US Regional Banks Downgraded Amidst Industry Challenges

US regional banks sp global downgrades amidst industry challenges sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The recent downgrades by S&P Global have sent shockwaves through the financial world, raising concerns about the health and stability of the US regional banking sector.

This move reflects the growing challenges facing these institutions, primarily driven by rising interest rates and a shifting economic landscape.

This blog delves into the heart of this matter, exploring the specific banks affected, the reasons behind the downgrades, and the potential consequences for the industry as a whole. We’ll examine the key challenges regional banks face, compare their struggles to those of larger national banks, and analyze the potential impact of these downgrades on regional bank operations, financial performance, and investor confidence.

Regional Bank Downgrades

The US regional banking sector has been facing a wave of downgrades from S&P Global, a leading credit rating agency. These downgrades reflect growing concerns about the financial health of these institutions, fueled by a confluence of factors including rising interest rates, economic uncertainty, and the lingering effects of the pandemic.

The recent downgrades of US regional banks by S&P Global reflect the broader challenges facing the industry. These challenges are compounded by the broader market decline witnessed on Wall Street, as highlighted in this article wall street bears witness to market decline amid labor data and rate hike concerns.

The combination of rising interest rates, persistent inflation, and a potential economic slowdown are creating a perfect storm for the banking sector, particularly for regional banks that are more exposed to local economic conditions.

S&P Global’s Rationale for Downgrades

S&P Global’s downgrades are driven by a combination of factors, including:

- Elevated Interest Rate Environment:Rising interest rates have put pressure on regional banks’ profitability, as they have to pay more to attract deposits while facing limited opportunities to increase loan yields.

- Economic Uncertainty:The current economic climate, marked by inflation and potential recessionary pressures, has heightened the risk of loan defaults, further impacting bank profitability.

- Deposit Outflows:Regional banks have experienced deposit outflows, driven by factors like higher interest rates offered by larger institutions and concerns about bank stability.

- Asset Quality Concerns:S&P Global has expressed concerns about the quality of assets held by some regional banks, particularly those with significant exposure to commercial real estate or energy sectors.

Industry Challenges: Us Regional Banks Sp Global Downgrades Amidst Industry Challenges

The US regional banking sector is facing a multitude of challenges, impacting their profitability and future prospects. These challenges are not isolated but interconnected, creating a complex environment for regional banks to navigate.

Impact of Rising Interest Rates

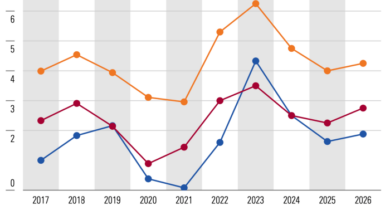

Rising interest rates have a significant impact on regional banks’ profitability and loan portfolios. As interest rates rise, the cost of borrowing for regional banks increases, squeezing their profit margins. This is especially challenging for regional banks that rely heavily on interest income from loans.

Moreover, rising rates can also lead to a decline in loan demand, further impacting their revenue streams.

The impact of rising interest rates on regional banks can be summarized as follows:

- Increased cost of borrowing, leading to lower profit margins

- Reduced loan demand, affecting revenue growth

Regional banks face a delicate balancing act in managing their loan portfolios during periods of rising interest rates. They need to balance the need to generate interest income with the risk of loan defaults as borrowers struggle to meet their repayment obligations.

Challenges Faced by Regional Banks Compared to National Banks

Regional banks face unique challenges compared to larger national banks. They typically have a smaller geographic footprint, a more concentrated customer base, and limited access to capital markets. These factors can make them more vulnerable to economic downturns and local market shocks.

- Smaller geographic footprint:Regional banks operate within a limited geographic area, making them more susceptible to local economic conditions. For instance, a decline in the real estate market in a specific region can significantly impact a regional bank’s loan portfolio.

- More concentrated customer base:Regional banks often serve a smaller number of customers, making them more susceptible to the financial health of those customers. A major economic downturn in a region could lead to a significant increase in loan defaults for regional banks.

- Limited access to capital markets:Regional banks have limited access to capital markets compared to larger national banks, making it more difficult for them to raise funds to meet their capital requirements or to weather economic downturns.

Regional banks often rely heavily on deposits from local businesses and individuals, making them more susceptible to economic downturns in their local markets.

The challenges faced by regional banks can be summarized as follows:

- Smaller geographic footprint, making them more susceptible to local economic conditions

- More concentrated customer base, making them more vulnerable to the financial health of their customers

- Limited access to capital markets, making it more difficult to raise funds

In contrast, national banks have a larger geographic footprint, a more diversified customer base, and greater access to capital markets, making them less vulnerable to local economic shocks.

Impact on Regional Banks

The recent downgrades by S&P Global have sent shockwaves through the regional banking sector, raising concerns about the potential implications for their operations and financial performance. These downgrades, driven by concerns about the economic outlook, rising interest rates, and potential for further loan losses, could have a significant impact on regional banks’ ability to attract capital, manage borrowing costs, and maintain investor confidence.

Impact on Access to Capital

The downgrades could make it more challenging for regional banks to access capital, particularly through debt issuance. A lower credit rating makes a bank appear riskier to investors, leading to higher borrowing costs and potentially making it harder to attract new investors.

This could limit their ability to fund loan growth and expand their operations.

Impact on Borrowing Costs

Lower credit ratings typically translate into higher borrowing costs for regional banks. This is because investors demand a higher return for taking on the perceived increased risk associated with a lower rating. Higher borrowing costs could put pressure on banks’ profitability and potentially lead to higher interest rates on loans for their customers.

Impact on Investor Confidence, Us regional banks sp global downgrades amidst industry challenges

The downgrades could erode investor confidence in regional banks, potentially leading to stock price declines and reduced investor interest in their securities. This could make it more difficult for banks to raise capital and may limit their ability to invest in growth opportunities.

Increased Regulatory Scrutiny

The downgrades could also lead to increased regulatory scrutiny of regional banks. Regulators may be more likely to examine their lending practices and capital adequacy, potentially leading to stricter requirements and increased compliance costs.

Stricter Lending Practices

In response to the downgrades, regional banks may adopt stricter lending practices to mitigate risk. This could involve increasing loan approval standards, requiring higher credit scores, and reducing loan sizes. While this could help to protect banks from future loan losses, it could also limit their ability to lend to small businesses and individuals who may need access to credit.

The recent S&P Global downgrades of US regional banks amidst industry challenges highlight the fragility of the financial landscape. These downgrades, coupled with the genesis crypto lending filing for bankruptcy protection , underscore the growing risks and uncertainties in the market.

While the crypto sector faces its own unique challenges, the ripple effects of these events are likely to impact traditional financial institutions as well, further intensifying the pressure on regional banks to adapt and navigate these turbulent times.

The recent downgrades of US regional banks by S&P Global highlight the challenges facing the industry, including the impact of rising interest rates and inflation. Navigating these turbulent waters requires a clear understanding of inflation and its implications for businesses, which is why I highly recommend checking out the inflation guide tips to understand and manage rising prices.

Armed with this knowledge, regional banks can better assess their risk exposures and implement strategies to mitigate the negative effects of inflation on their operations and customer base.