US Mortgage Rates Rise Sixth Week, Up 7.63%

US mortgage rates rise sixth week 7 63 percent sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The recent surge in mortgage rates, marking the sixth consecutive week of increases, has sent ripples through the housing market, impacting both buyers and sellers alike.

This upward trend has reached a point where the average 30-year fixed mortgage rate has climbed to a level not seen in over two decades, leaving many wondering what this means for the future of homeownership.

This unprecedented rise in mortgage rates is a direct consequence of the Federal Reserve’s ongoing efforts to combat inflation. The Fed’s aggressive monetary policy, characterized by increased interest rates, aims to curb consumer spending and cool down the economy.

However, this strategy has unintended consequences for the housing market, making it more expensive to borrow money for a mortgage. The implications of this shift are far-reaching, affecting not only affordability for prospective homebuyers but also the overall health of the real estate sector.

Mortgage Rate Trends

The recent surge in mortgage rates, marking the sixth consecutive week of increases, has sent ripples through the housing market. This sustained upward trend has raised concerns among prospective homebuyers and homeowners alike, prompting questions about the future trajectory of rates and their impact on affordability.

Historical Context of the Current Rate Rise

Understanding the current rate rise requires looking back at historical trends. Mortgage rates have historically fluctuated in response to various economic factors, including inflation, monetary policy, and investor sentiment. The recent surge in rates is primarily attributed to the Federal Reserve’s aggressive monetary policy tightening aimed at curbing inflation.

The Fed has raised interest rates several times this year, making borrowing more expensive across the board, including mortgages.

Average 30-Year Fixed Mortgage Rate

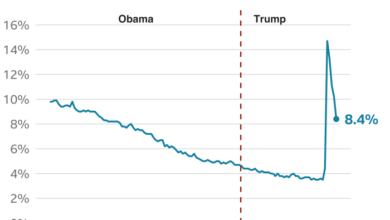

The average 30-year fixed mortgage rate has witnessed a significant increase over the past year. According to Freddie Mac, the average rate stood at 2.65% in January 2022, but has since climbed to over 7%. This sharp rise reflects the impact of the Fed’s rate hikes and heightened inflation.

Comparison to the Average Rate Over the Past Decade

The current mortgage rate environment is markedly different from the average rates observed over the past decade. From 2012 to 2021, the average 30-year fixed mortgage rate hovered around 4%, with periods of both higher and lower rates. The current rate is significantly higher than the average for this period, making it a more expensive time to borrow for homeownership.

Impact on Homebuyers

Rising mortgage rates have a significant impact on the affordability of homeownership for potential buyers. As rates increase, the cost of borrowing money to finance a mortgage goes up, leading to higher monthly payments and a reduced purchasing power for homebuyers.

The Impact of Rate Increases on Monthly Payments

Higher mortgage rates directly translate into increased monthly payments. The amount of the increase depends on the size of the loan, the loan term, and the difference in interest rates. For example, a $300,000 mortgage with a 30-year term at a 4% interest rate would have a monthly payment of approximately $1,432.

However, if the interest rate rises to 6%, the monthly payment would jump to $1,798, an increase of $366 per month.

Strategies for Homebuyers to Navigate Rising Rates

Navigating a rising rate environment requires careful planning and consideration of various strategies.

- Increase Down Payment:A larger down payment reduces the amount of money borrowed, resulting in lower monthly payments and a smaller impact from rising rates.

- Shop for the Best Rates:Comparing rates from multiple lenders can help secure the most favorable terms and potentially lower monthly payments.

- Consider a Shorter Loan Term:Opting for a 15-year mortgage instead of a 30-year mortgage can result in lower interest rates and significantly reduce the overall cost of the loan, even with higher monthly payments.

- Explore Adjustable-Rate Mortgages (ARMs):ARMs offer lower initial interest rates compared to fixed-rate mortgages, but the rates can adjust periodically. This option can be advantageous for those who plan to sell or refinance the property before the rate adjustments kick in.

- Improve Credit Score:A higher credit score often qualifies for lower interest rates. Improving credit scores before applying for a mortgage can help secure more favorable terms.

Impact on the Housing Market

Rising mortgage rates can have a cooling effect on the housing market.

- Reduced Demand:Higher rates can deter some buyers, leading to a decrease in demand and a slowdown in home sales.

- Price Adjustments:As demand cools, sellers may need to adjust their asking prices to attract buyers, potentially leading to price stabilization or even declines.

- Increased Competition:With fewer buyers, those who remain in the market may face less competition and have more leverage to negotiate favorable terms.

Economic Factors: Us Mortgage Rates Rise Sixth Week 7 63 Percent

The recent surge in mortgage rates is not an isolated event; it is a reflection of broader economic forces at play. Understanding these factors is crucial for navigating the current housing market and making informed financial decisions.

It’s a tough time to be a homebuyer with mortgage rates climbing for the sixth straight week, reaching 7.63 percent. But amidst this financial crunch, a ray of hope emerges with the news that HP’s CEO forecasts an AI-driven revolution in computers within two years.

Perhaps this technological leap will bring about new efficiencies and affordability in the housing market, providing some relief for those looking to purchase a home.

Inflation and the Federal Reserve’s Monetary Policy

The Federal Reserve (Fed), the central bank of the United States, plays a significant role in influencing mortgage rates. The Fed’s primary mandate is to maintain price stability and full employment. To achieve this, it utilizes various monetary policy tools, including adjusting interest rates.

When inflation rises, the Fed typically raises interest rates to cool down the economy and curb price increases.

Higher interest rates make borrowing more expensive, which can slow down economic activity and reduce inflationary pressures.

The rising cost of borrowing is certainly a concern for many, with US mortgage rates rising for the sixth straight week to 7.63%. This comes at a time when the Biden administration is expressing worries about the dominance of tech giants in the stock market, which is explored in this article biden administration raises concerns over tech giant dominance in stock market.

While these two issues seem unrelated at first glance, they both contribute to the overall economic climate, which can ultimately impact individual financial decisions like buying a home.

The current inflationary environment, driven by factors such as supply chain disruptions and strong consumer demand, has prompted the Fed to implement a series of interest rate hikes. These hikes have directly impacted mortgage rates, as lenders often base their rates on the Fed’s benchmark interest rates.

Relationship Between Mortgage Rates and Economic Growth, Us mortgage rates rise sixth week 7 63 percent

Mortgage rates and economic growth are intricately intertwined. When mortgage rates are low, borrowing becomes more affordable, leading to increased housing demand and construction activity. This stimulates economic growth by creating jobs and boosting consumer spending.

However, when rates rise, borrowing becomes more expensive, which can dampen housing demand and slow down economic growth.

The news of US mortgage rates rising for the sixth consecutive week, reaching 7.63%, is a significant development, particularly with the current economic climate. It’s no surprise that Wall Street is bracing for the Fed’s meeting news today, as seen in the mixed performance of stocks.

This fluctuating market reflects the uncertainty surrounding interest rate decisions, which directly impact the affordability of mortgages and ultimately, the housing market.

The impact of rising mortgage rates on economic growth is complex and can vary depending on other factors, such as consumer confidence, job market conditions, and government policies.

Forecast for Future Rate Movements

Predicting future mortgage rate movements is inherently challenging, as it depends on a multitude of economic factors. However, analysts generally anticipate that the Fed will continue to raise interest rates in the coming months, albeit at a slower pace, to combat inflation.

This suggests that mortgage rates may continue to rise in the near term, although the pace of increases could moderate.

The future path of rates will ultimately depend on how inflation evolves, the strength of the economy, and the Fed’s response to these developments.

Market Dynamics

The current rate environment, characterized by rising mortgage rates, has a significant impact on the supply and demand dynamics of the housing market. This impacts housing inventory, home prices, and presents both opportunities and challenges for real estate investors.

Impact on Housing Inventory and Home Prices

Rising mortgage rates make it more expensive for potential buyers to finance a home, leading to a decrease in demand. This reduced demand can cause a slowdown in home sales and, in some cases, a buildup of unsold inventory. As a result, sellers may find themselves needing to adjust their asking prices to attract buyers.

Opportunities and Challenges for Real Estate Investors

For real estate investors, rising rates present a mixed bag.

Opportunities

- Potential for Lower Prices:The reduced demand and potential for inventory buildup can create opportunities for investors to acquire properties at lower prices than they might have been able to in a more robust market.

- Increased Rental Demand:As homeownership becomes less affordable for some, rental demand may increase, providing opportunities for investors to capitalize on the growing rental market.

Challenges

- Higher Financing Costs:Investors, like homeowners, also face higher borrowing costs, making it more expensive to finance their acquisitions.

- Reduced Returns:The combination of higher financing costs and potentially lower rental yields can lead to reduced returns on investment.

Impact on the Overall Housing Market

The impact of rising rates on the overall housing market can be complex and multifaceted.

Potential Outcomes

- Slowdown in Growth:Rising rates can slow down the pace of home price appreciation and potentially lead to a period of market stabilization or even a slight decline in prices in certain areas.

- Increased Affordability Challenges:The affordability challenges created by higher rates can impact first-time homebuyers, potentially leading to a decrease in homeownership rates.

- Shift in Buyer Preferences:As affordability becomes a greater concern, buyers may shift their preferences towards smaller or less expensive homes, potentially impacting the demand for certain types of properties.

Financial Considerations

The recent surge in mortgage rates has significant implications for homeowners with existing mortgages, potential homebuyers, and the overall housing market. Understanding these financial considerations is crucial for navigating the current landscape and making informed decisions.

Impact on Existing Mortgage Holders

Rising interest rates can impact homeowners with existing mortgages in several ways. The most immediate effect is on those with adjustable-rate mortgages (ARMs), as their interest rates are tied to a benchmark that has been rising. This can lead to higher monthly payments, putting pressure on household budgets.

Even for those with fixed-rate mortgages, rising rates can affect their ability to refinance to lower their interest rates or access home equity loans.

Strategies for Refinancing

While refinancing may seem less appealing in a rising rate environment, it’s still possible to find favorable terms, especially if you have a mortgage with a significantly higher interest rate.

- Shop around for the best rates:Compare rates from multiple lenders to ensure you’re getting the most competitive offer.

- Consider a shorter loan term:A shorter loan term, such as a 15-year mortgage, will result in higher monthly payments but could save you significant interest over the life of the loan.

- Explore a cash-out refinance:If you have equity in your home, a cash-out refinance can allow you to access some of that equity for other financial needs.

Impact on the Housing Market

Rising mortgage rates can have a significant impact on the housing market. As borrowing costs increase, home affordability decreases, potentially leading to:

- Reduced demand:Higher mortgage rates can deter some potential buyers, leading to a decrease in demand for homes.

- Slower price growth:With reduced demand, home prices may experience slower growth or even a slight decline.

- Increased inventory:If fewer buyers are active, unsold homes may accumulate, leading to an increase in inventory.

Role of Financial Planning

In this dynamic market, financial planning plays a crucial role in navigating the challenges and opportunities presented by rising rates.

- Review your budget:Assess your current financial situation and determine your affordability for a mortgage in the current market.

- Consider your long-term goals:Align your housing decisions with your overall financial goals, such as retirement planning or saving for your children’s education.

- Seek professional advice:Consult with a financial advisor to develop a personalized financial plan that considers your specific circumstances and goals.