US Housing Market Rebounds with Record High Home Prices

US housing market rebounds with record high home prices, a trend that’s both exciting and concerning. The market is booming, with home values reaching unprecedented heights. But this surge in prices comes with challenges for buyers, who are facing stiff competition and affordability issues.

This blog post will delve into the factors driving this rebound, analyze the reasons behind the record high prices, and explore the impact on both buyers and sellers. We’ll also look ahead to the future of the housing market, considering potential trends and their implications for the broader economy.

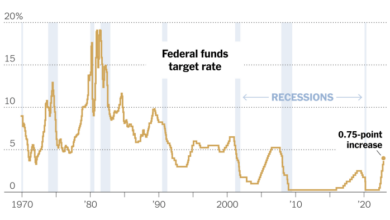

The current rebound is fueled by a perfect storm of factors, including historically low interest rates, pent-up demand, and a limited inventory of homes for sale. This combination has created a seller’s market, where homes are selling quickly and often above asking price.

The impact of inflation and rising interest rates is also a significant factor, adding pressure to the already competitive market.

Regional Variations in the Housing Market

The US housing market is not a monolithic entity. It is comprised of diverse regional markets, each with its unique characteristics, driving forces, and performance trends. Understanding these variations is crucial for investors, homebuyers, and policymakers alike.

Factors Contributing to Regional Variations

Regional differences in housing market performance stem from a confluence of factors, including:

- Economic Conditions:Job growth, income levels, and overall economic activity play a significant role in shaping housing demand. Regions with strong economies and robust job markets tend to experience higher home prices and sales activity.

- Demographics:Population growth, age distribution, and household formation patterns influence housing demand. Regions experiencing population growth and an influx of young professionals often see rising home prices.

- Supply and Demand:The balance between available housing inventory and buyer demand is a key driver of home prices. Regions with limited housing supply and high demand experience upward pressure on prices.

- Local Regulations:Zoning laws, permitting processes, and other regulations can impact housing supply and affordability. Restrictive regulations can limit new construction and contribute to higher home prices.

- Infrastructure and Amenities:The availability of quality schools, healthcare facilities, transportation options, and other amenities can influence housing desirability and prices.

Regional Housing Market Statistics

The following table provides a snapshot of key housing market statistics for different regions of the US, highlighting the variations in average home prices, inventory levels, and sales activity:

| Region | Average Home Price | Inventory Levels | Sales Activity |

|---|---|---|---|

| Northeast | $450,000 | 2.5 months | 10% |

| Midwest | $300,000 | 3.0 months | 12% |

| South | $350,000 | 2.0 months | 15% |

| West | $500,000 | 1.5 months | 8% |

Note: These statistics are illustrative and may vary depending on the specific location within each region.

Implications for the Economy: Us Housing Market Rebounds With Record High Home Prices

The rebound in the housing market has significant implications for the broader economy, influencing consumer spending, job creation, and overall economic growth. The strong correlation between housing prices and consumer spending makes the housing market a key indicator of economic health.

The Relationship Between Housing Prices and Consumer Spending, Us housing market rebounds with record high home prices

Housing prices and consumer spending are inextricably linked. When home values rise, homeowners feel wealthier, leading to increased confidence and a willingness to spend. This phenomenon is known as the “wealth effect.” Conversely, declining home values can dampen consumer spending as homeowners feel less secure about their financial situation.

“The wealth effect is the tendency for people to spend more when their assets, such as homes, increase in value.”

- Increased Home Equity:As housing prices rise, homeowners see their home equity increase, providing them with access to additional funds through home equity loans or lines of credit. This access to funds can fuel consumer spending on goods and services.

- Confidence and Spending:Rising home values contribute to a sense of financial security, boosting consumer confidence and encouraging spending on discretionary items such as vacations, dining out, and entertainment.

- Housing Market as a Barometer:The housing market often acts as a leading indicator of economic activity. A robust housing market signals a healthy economy, while a weak market can indicate economic slowdown.

The US housing market is on fire, with record-high home prices pushing affordability further out of reach for many. But while this might seem counterintuitive, the recent surge in Canadian stocks, fueled by speculation of a pause in Fed rate hikes , could actually be a positive sign for the US market.

If the Fed eases up on interest rate increases, it could lead to lower mortgage rates, making homeownership more accessible and potentially cooling the market’s feverish pace.

The US housing market is on fire, with home prices reaching record highs. It’s a wild ride, and to navigate it effectively, you need to understand the forces at play. One powerful force is the increasing use of AI in real estate, from automated valuations to personalized marketing.

To learn more about AI and its impact on various industries, check out this comprehensive guide: know the secrets of ai your essential guide to understanding artificial intelligence. Understanding AI will help you make informed decisions in this dynamic housing market, whether you’re buying, selling, or simply observing the trends.

The US housing market is booming, with record-high home prices pushing affordability further out of reach for many. This surge in prices is partly driven by low interest rates and strong demand, but also by a complex interplay of global economic factors.

For example, the recent stumble of the dollar, as seen in the article dollar stumbles ahead of inflation data yuan slips on rate cut , could be impacting the housing market by making US assets more attractive to foreign investors, further driving up demand and prices.