US Futures Stabilize as Shutdown Threat Eases, Chinas Growth in Focus

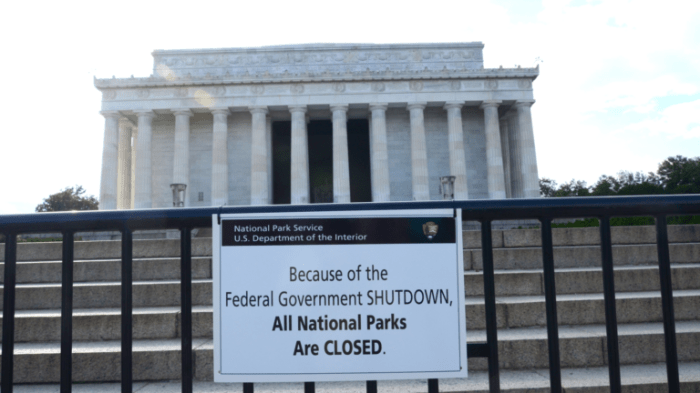

Us futures stabilize as shutdown threat eases chinas growth forecast in focus – US Futures Stabilize as Shutdown Threat Eases, China’s Growth in Focus: The US markets experienced a sigh of relief as the threat of a government shutdown receded, leading to a stabilization of futures. This calm, however, is overshadowed by the growing importance of China’s economic growth forecast, a factor that could significantly influence global markets.

The recent easing of political tensions in the US has boosted investor confidence, reflected in the stabilization of US futures. This positive sentiment is closely intertwined with the global economic landscape, particularly China’s economic trajectory. The world’s second-largest economy is facing a multitude of challenges, from slowing growth to geopolitical uncertainties, and its economic performance will have a ripple effect on global markets, including the US.

US Futures Stabilization

US futures markets experienced a period of stabilization, reflecting a positive shift in market sentiment. This stabilization was primarily driven by the easing of the government shutdown threat, which had previously cast a shadow over investor confidence.

The US futures market stabilized as the threat of a government shutdown eased, with investors now focused on China’s economic growth forecast. While this financial news plays out, the Biden administration is raising concerns about the dominance of tech giants in the stock market, exploring potential antitrust measures to address concerns about market manipulation and unfair competition.

This dual focus highlights the ongoing tension between economic stability and the need for regulatory oversight in a rapidly evolving digital landscape.

Impact of Eased Shutdown Threat

The easing of the shutdown threat significantly boosted market sentiment. Investors, relieved by the prospect of a resolution, regained their appetite for risk, leading to a surge in demand for US futures contracts. This positive shift in sentiment was reflected in the upward trajectory of key indices, indicating a renewed optimism among market participants.

With the US government shutdown threat easing, futures stabilized, and investors turned their attention to China’s growth forecast. Meanwhile, a US judge dismissed a lawsuit against Apple regarding CEO Tim Cook’s comments on China sales, ruling that his statements were not actionable.

This decision could have implications for future cases involving CEO statements and company performance, particularly in the context of global economic trends like China’s growth trajectory.

Economic Trends Reflected in Futures Stabilization

The stabilization of US futures reflects broader economic trends. The US economy, despite facing headwinds, continues to show resilience, with strong consumer spending and a robust labor market. These positive economic indicators contribute to a favorable environment for investment, driving demand for US futures contracts and contributing to their stabilization.

China’s Growth Forecast: Us Futures Stabilize As Shutdown Threat Eases Chinas Growth Forecast In Focus

China’s economic growth has been a key driver of global economic activity for decades. However, recent forecasts suggest that the country’s growth trajectory is shifting.

Recent Forecasts and Previous Projections

The International Monetary Fund (IMF) projects China’s GDP to grow by 5.2% in 2023, down from 3.0% in 2022. This is a significant decline from the double-digit growth rates China experienced in the early 2000s. The World Bank forecasts a similar growth rate of 5.1% for 2023.

These forecasts are lower than previous projections, which had anticipated a more robust recovery following the COVID-19 pandemic.

Factors Influencing China’s Growth Outlook

Several factors are influencing China’s growth outlook.

- Zero-COVID Policy:China’s strict zero-COVID policy has had a significant impact on economic activity. Lockdowns and travel restrictions have disrupted supply chains and reduced consumer spending. While China has recently eased its COVID-19 restrictions, the lingering effects of the policy are still being felt.

- Real Estate Crisis:China’s real estate sector has been struggling in recent years, with a number of high-profile developers defaulting on their debts. This has led to a slowdown in construction activity and a decline in property prices. The real estate sector is a significant contributor to China’s GDP, and its weakness is weighing on the overall economy.

- Global Economic Slowdown:The global economy is facing a number of challenges, including the war in Ukraine, rising inflation, and tighter monetary policy. These factors are reducing demand for Chinese exports and making it more difficult for China to maintain its growth momentum.

- Structural Challenges:China’s economy is also facing a number of structural challenges, including an aging population, rising labor costs, and environmental concerns. These challenges are making it more difficult for China to sustain its previous levels of growth.

Interplay of US and Chinese Economies

The US and Chinese economies are deeply intertwined, with each influencing the other in significant ways. This interconnectedness has led to a complex dynamic of cooperation and competition, shaping the global economic landscape.

Impact of US Futures on China’s Economic Growth, Us futures stabilize as shutdown threat eases chinas growth forecast in focus

The performance of US futures markets provides valuable insights into investor sentiment and expectations regarding the US economy. These expectations, in turn, can influence China’s economic growth. For example, if US futures indicate strong economic prospects, it can boost investor confidence in China, leading to increased investments and economic activity.

Conversely, weak US futures may signal uncertainty and caution, potentially dampening China’s growth prospects.

Impact of China’s Economic Growth on US Futures

China’s economic growth significantly impacts US futures markets through various channels. A robust Chinese economy can increase demand for US goods and services, benefiting US companies and boosting US stock prices. Additionally, strong Chinese growth can lead to higher commodity prices, impacting US futures markets for oil, metals, and agricultural products.

Conversely, a slowdown in China’s growth can negatively impact US futures markets, as it reduces demand for US exports and potentially leads to lower commodity prices.

Areas of Cooperation

The US and China have a significant potential for cooperation in various areas:

- Trade:Both countries can benefit from increased trade, particularly in areas where they have complementary strengths, such as technology and manufacturing.

- Climate Change:Addressing climate change requires global collaboration, and the US and China, as the world’s largest emitters, have a crucial role to play in reducing greenhouse gas emissions.

- Global Health:Cooperation on global health issues, such as pandemics and disease outbreaks, is essential to ensure the well-being of both populations.

Areas of Competition

The US and China also face competition in several areas:

- Technology:Both countries are vying for technological leadership in areas such as artificial intelligence, 5G, and quantum computing.

- Military Power:The US and China are engaged in a strategic rivalry, with each seeking to maintain its military dominance in the Asia-Pacific region.

- Economic Influence:Both countries are competing for global economic influence, seeking to shape trade agreements, investment flows, and international institutions.

The news that US futures are stabilizing as the government shutdown threat eases is certainly encouraging, but we can’t ignore the looming question of China’s economic growth forecast. While the global markets are trying to regain their footing, it’s a good time to think about building financial resilience with some profitable low investment business ideas unlocking high returns.

Even amidst economic uncertainty, there are opportunities to create passive income streams and diversify your portfolio. As we navigate the complex interplay of global economic forces, having a diversified strategy can be a real advantage.