US Dollar Struggles as Unemployment Claims Surge, Market Anticipates Feds Next Move

Us dollar struggles as unemployment claims surge market anticipates feds next move – The US dollar is facing headwinds as unemployment claims surge, signaling a potential economic slowdown. This comes at a time when the market is eagerly anticipating the Federal Reserve’s next move on interest rates. The recent increase in jobless claims has fueled concerns about the strength of the US economy, leading to a weakening of the greenback.

The Federal Reserve is caught in a delicate balancing act, trying to tame inflation without triggering a recession. The outcome of their decision will have a significant impact on the US dollar, inflation, and the overall economic outlook.

The US dollar’s recent decline is attributed to several factors, including rising inflation, a widening trade deficit, and the Federal Reserve’s shift towards a more accommodative monetary policy. The rising unemployment claims further exacerbate the situation, indicating a potential slowdown in economic activity.

This scenario presents a challenging environment for the US dollar, which could potentially weaken further if the economic outlook deteriorates.

US Dollar Weakness

The US dollar has been experiencing a period of weakness in recent months, with the dollar index falling to its lowest level in over two years. This decline has raised concerns among investors and economists, prompting discussions about the potential implications for the global economy.

The US dollar is facing headwinds as unemployment claims surge, leaving the market anxiously awaiting the Fed’s next move. While the US grapples with economic uncertainty, the IMF predicts resilient economic growth for India in FY23, as reported by The Venom Blog.

This divergence highlights the global economic landscape’s complexities, as the US dollar’s weakness could influence global markets and further complicate the Fed’s decision-making process.

Factors Contributing to Dollar Weakness

Several factors have contributed to the recent decline in the US dollar’s value. These include:

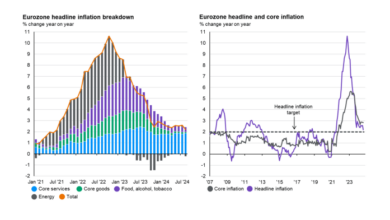

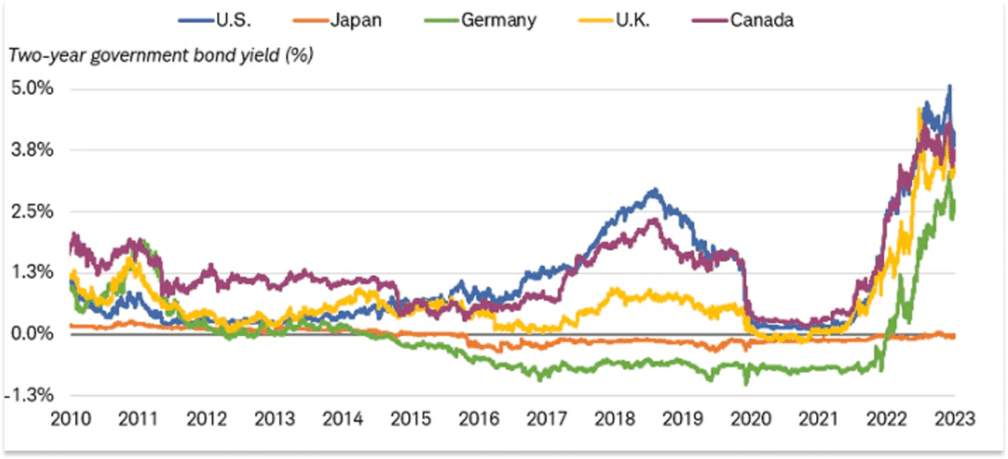

- Rising Inflation:The US Federal Reserve has been aggressively raising interest rates to combat high inflation, which has led to concerns about a potential recession. As investors anticipate a slower economic growth, they have been selling US dollar assets, leading to a depreciation in the currency.

- Interest Rate Differentials:The US Federal Reserve’s interest rate hikes have narrowed the gap between US and other major economies’ interest rates. This has made the US dollar less attractive to foreign investors, further contributing to its decline.

- Safe-Haven Demand:During times of global uncertainty, investors often seek safe-haven assets like the US dollar. However, the recent geopolitical tensions and economic instability have weakened the US dollar’s appeal as a safe haven.

- Energy Prices:The surge in energy prices, driven by the war in Ukraine, has put pressure on the US economy and contributed to the decline in the dollar’s value.

Comparison to Previous Periods of Dollar Weakness

The current period of dollar weakness is reminiscent of previous episodes, such as the 1970s and the early 2000s. During those periods, the US dollar experienced significant declines due to factors like rising inflation, trade deficits, and geopolitical instability. However, the current situation is unique in that it is unfolding against the backdrop of a global economic slowdown and heightened geopolitical risks.

The US dollar is struggling as unemployment claims surge, and the market anxiously awaits the Fed’s next move. This uncertainty mirrors the challenges faced by emerging economies like Pakistan, which is grappling with its own economic crisis. Understanding the intricacies of Pakistan’s situation, as outlined in this insightful article on Pakistan’s economic crisis analyzing challenges and charting a path to financial stability , can provide valuable insights into the broader global economic landscape.

With the US economy facing its own headwinds, the Fed’s actions will have a ripple effect, impacting countries like Pakistan and influencing the trajectory of the global financial system.

Relationship Between the US Dollar and Global Economic Conditions

The US dollar plays a crucial role in the global economy, serving as the world’s primary reserve currency. Its value has a significant impact on global trade, investment, and financial markets. When the US dollar weakens, it can lead to:

- Increased Inflation:Imported goods become more expensive, putting upward pressure on inflation. This can also lead to higher prices for domestically produced goods, as businesses pass on the increased costs to consumers.

- Higher Borrowing Costs:As the dollar weakens, the cost of borrowing for US companies and individuals can increase. This can hinder economic growth and investment.

- Increased Volatility:A weak US dollar can lead to increased volatility in global financial markets, as investors adjust their portfolios to reflect the changing currency landscape.

Rising Unemployment Claims

The recent surge in unemployment claims has sent shockwaves through the market, raising concerns about the health of the US economy. This unexpected rise is a significant indicator of potential economic weakness, and its implications for consumer spending and overall economic growth warrant careful analysis.

Causes of Rising Unemployment Claims

The increase in unemployment claims can be attributed to a confluence of factors, including:

- Layoffs:As companies grapple with economic uncertainty and slowing demand, some have resorted to layoffs to cut costs and streamline operations. This is particularly evident in sectors like technology, where recent mass layoffs have made headlines.

- Seasonal Fluctuations:Certain industries, like retail and hospitality, experience seasonal fluctuations in employment.

The post-holiday period often sees a decline in hiring, contributing to a rise in unemployment claims.

- Economic Uncertainty:The ongoing economic challenges, including high inflation and rising interest rates, have created a climate of uncertainty that is causing businesses to become more cautious about hiring and expansion plans.

The US dollar has been struggling lately as unemployment claims surge, leaving the market anxiously anticipating the Fed’s next move. However, a glimmer of hope emerged with the recent May jobs report, which exceeded expectations by adding 339,000 jobs and boosting the US economy.

This positive news could potentially influence the Fed’s decision, but the market remains cautious as inflation remains a concern, and the dollar’s future trajectory is still uncertain.

Impact on Consumer Spending and Economic Growth

Rising unemployment claims have a direct impact on consumer spending, which is a key driver of economic growth. When individuals lose their jobs, they have less disposable income to spend on goods and services. This decline in consumer spending can lead to a slowdown in economic activity, creating a vicious cycle where businesses cut back on hiring and investment, further impacting employment.

“A rise in unemployment claims is a warning sign that the economy may be losing steam. It signals that businesses are less confident about the future and are cutting back on hiring. This can lead to a decline in consumer spending, which can further weaken the economy.”

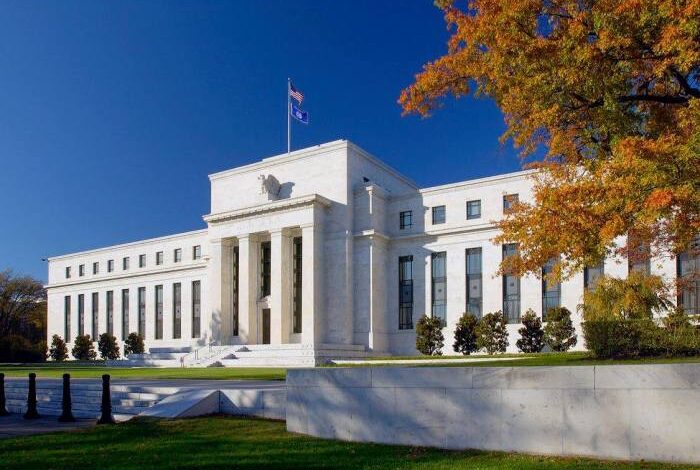

Federal Reserve’s Next Move: Us Dollar Struggles As Unemployment Claims Surge Market Anticipates Feds Next Move

The Federal Reserve, the central bank of the United States, is facing a delicate balancing act as it navigates the current economic landscape. With inflation still stubbornly high and the labor market showing signs of weakness, the Fed must carefully weigh the risks of further interest rate hikes against the potential for a recession.

The Fed’s Policy Options

The Fed’s primary tool for influencing the economy is its control over short-term interest rates. By raising rates, the Fed makes it more expensive for businesses and consumers to borrow money, which can slow economic growth. Conversely, lowering rates can stimulate borrowing and economic activity.

The Fed also has other policy tools at its disposal, such as adjusting the amount of money in circulation through open market operations.The Fed’s next move will depend on a variety of factors, including the trajectory of inflation, the strength of the labor market, and the overall health of the economy.

Potential Scenarios for the Fed’s Next Move

- Maintain Current Interest Rates:The Fed could choose to hold interest rates steady at their current level, allowing the economy to continue to adjust to previous rate hikes. This would be a cautious approach, but it could also be seen as a sign that the Fed is not confident about the economic outlook.

- Raise Interest Rates:The Fed could choose to raise interest rates further, in an effort to bring inflation down to its target level of 2%. This would likely slow economic growth and potentially increase the risk of a recession, but it could also help to stabilize prices in the long run.

- Lower Interest Rates:The Fed could choose to lower interest rates if the economy shows signs of weakness or if inflation begins to fall more rapidly than expected. This would stimulate borrowing and economic activity, but it could also lead to higher inflation.

Consequences of Different Policy Options, Us dollar struggles as unemployment claims surge market anticipates feds next move

- Raising Interest Rates:Higher interest rates would likely lead to a stronger US dollar, as investors seek higher returns in the United States. This would make US exports more expensive and imports cheaper, potentially hurting US businesses and consumers. Higher interest rates would also likely slow economic growth, potentially leading to a recession.

- Lowering Interest Rates:Lower interest rates would likely weaken the US dollar, as investors seek higher returns in other countries. This would make US exports cheaper and imports more expensive, potentially benefiting US businesses and consumers. Lower interest rates would also likely stimulate economic growth, but it could also lead to higher inflation.

- Maintaining Current Interest Rates:Maintaining current interest rates would likely have a relatively neutral impact on the US dollar, inflation, and economic growth. This would be a cautious approach, but it could also be seen as a sign that the Fed is uncertain about the economic outlook.

Examples of the Fed’s Impact on the US Economy

The Fed’s decisions have a significant impact on the US economy. For example, during the 2008 financial crisis, the Fed lowered interest rates and injected liquidity into the financial system to prevent a collapse of the banking system. This helped to stabilize the economy and prevent a deeper recession.

However, the Fed’s policies can also have unintended consequences. For example, the Fed’s quantitative easing program, which involved buying large amounts of US Treasury bonds and mortgage-backed securities, was intended to stimulate the economy. However, it also contributed to a rise in asset prices and inequality.

Market Reactions and Outlook

The recent surge in unemployment claims and the weakening US dollar have sent shockwaves through financial markets, prompting investors and analysts to reassess their outlook on the US economy. The Federal Reserve’s upcoming policy decisions are now under intense scrutiny, with investors closely monitoring any hints about potential interest rate adjustments.

Market Sentiment and Volatility

The prevailing sentiment among investors is one of caution and uncertainty. The stock market has experienced increased volatility, with major indices fluctuating in response to economic data releases and Fed pronouncements. Many investors are adopting a wait-and-see approach, seeking clarity on the Fed’s future actions and the trajectory of the US economy.

“The market is currently in a state of flux, with investors grappling with conflicting signals,” notes [Name of a reputable financial analyst], a leading market strategist. “The recent economic data has raised concerns about the strength of the US economy, but the Fed’s stance remains unclear.”

Impact on Asset Classes

The current economic situation has a significant impact on various asset classes, with varying degrees of influence:

- Stocks: The stock market has shown signs of weakness, particularly in sectors sensitive to economic growth, such as consumer discretionary and industrials. However, some investors believe that the market may be oversold and poised for a rebound, particularly if the Fed adopts a more dovish stance.

- Bonds: The bond market has generally benefited from the recent economic uncertainty, with investors seeking safe haven assets. Bond yields have declined, reflecting a lower risk appetite among investors. However, the potential for inflation could put upward pressure on bond yields in the future.

- Commodities: The price of commodities, such as oil and gold, has been volatile in recent weeks. Oil prices have been influenced by global supply and demand dynamics, while gold has served as a safe haven asset amid market uncertainty. The outlook for commodities will likely depend on the trajectory of economic growth and inflation.