US Dollar Steady as Economic Data Eases Recession Worries, Australian Dollar Slides on Inflation Slowdown

Us dollar steady as resilient economic data eases recession worries australian dollar slides on inflation slowdown – The US dollar has been holding its ground recently, buoyed by positive economic data that has calmed recession fears. Meanwhile, the Australian dollar has been slipping, impacted by a slowdown in inflation. This divergence in currency performance highlights the complex interplay between economic fundamentals and market sentiment.

The US economy has shown surprising resilience, with strong job growth and consumer spending. This robust performance has bolstered investor confidence in the greenback, driving its value higher. Conversely, the Australian dollar has been pressured by a cooling inflation rate, which suggests that the Reserve Bank of Australia (RBA) may be nearing the end of its interest rate hiking cycle.

This potential shift in monetary policy has led to a weakening of the Aussie.

US Dollar Strength and Economic Resilience

The US dollar has recently displayed remarkable stability, bucking the trend of weakening global currencies. This strength can be attributed to a confluence of factors, including resilient economic data that has allayed recession fears. As investors seek safe havens amidst global economic uncertainties, the US dollar has emerged as a preferred asset, further bolstering its position.

Economic Indicators Supporting US Dollar Strength, Us dollar steady as resilient economic data eases recession worries australian dollar slides on inflation slowdown

Resilient economic data has played a crucial role in underpinning the US dollar’s strength and easing recession concerns. Several key economic indicators have painted a positive picture of the US economy, boosting investor confidence and supporting the greenback’s value.

- Strong Labor Market:The US labor market continues to demonstrate resilience, with low unemployment rates and robust job creation. The unemployment rate remains near historic lows, indicating a healthy economy with ample employment opportunities. This strong labor market is a significant driver of consumer spending, which is a major component of the US economy.

- Solid Consumer Spending:Consumer spending has remained surprisingly robust, defying expectations of a slowdown. This indicates that American consumers are still confident in the economy and are willing to spend. This sustained consumer spending is a key indicator of economic health and supports continued growth.

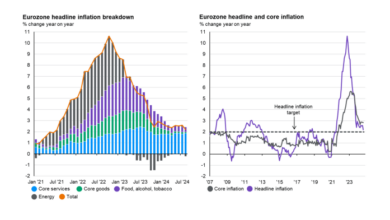

- Steady Inflation:While inflation remains elevated, it has shown signs of moderating, indicating that the Federal Reserve’s efforts to combat inflation are beginning to take effect. This easing of inflationary pressures has provided some relief to consumers and businesses, contributing to a more stable economic outlook.

- Strong Corporate Earnings:Corporate earnings have remained relatively strong, reflecting healthy business activity and robust profits. This positive earnings performance is a testament to the resilience of the US economy and provides further evidence of its underlying strength.

Impact on Investor Confidence and Market Sentiment

The positive economic data has significantly impacted investor confidence and market sentiment, bolstering the US dollar’s appeal. As investors seek stability and safety in their investments, the US dollar, backed by a resilient economy, has become a preferred asset. This increased demand for the US dollar has further strengthened its value, creating a positive feedback loop.

The US dollar’s strength reflects a resilient economy, easing recession fears, while the Australian dollar weakens as inflation slows. Amidst this global economic landscape, it’s worth exploring investment opportunities in luxury goods, a sector often considered a safe haven during economic uncertainty.

For insights on this sector, check out investing in luxury goods stocks billionaire ken fishers recommendations and top analyst favored companies , which delves into billionaire Ken Fisher’s recommendations and top analyst picks. While the economic picture continues to evolve, the potential for growth in luxury goods stocks remains an interesting consideration.

“The US dollar is often seen as a safe-haven currency during times of global economic uncertainty, and recent economic data has reinforced this perception.”

The combination of strong economic fundamentals and investor confidence has created a favorable environment for the US dollar, supporting its stability and resilience in the face of global economic headwinds.

Australian Dollar Weakness and Inflation Slowdown

The Australian dollar has been on a downward trajectory in recent months, driven by a combination of factors, including a slowing inflation rate and a more cautious outlook for the Australian economy. While the US dollar has strengthened on the back of resilient economic data, the Australian dollar’s decline reflects concerns about the country’s economic outlook.

Impact of Inflation Slowdown on the Australian Economy

A slowing inflation rate can have a mixed impact on an economy. While it can provide relief from rising prices and potentially boost consumer spending, it can also signal a weakening economy, which can lead to lower investment and job creation.

In Australia’s case, the Reserve Bank of Australia (RBA) has been raising interest rates to combat inflation, but the impact of these rate hikes on the economy is still unfolding. The RBA’s next move will be crucial for the Australian dollar’s direction.

Inflation Rate Comparison Between the US and Australia

The inflation rates in the US and Australia have been diverging in recent months. The US has seen a relatively steady decline in inflation, while Australia’s inflation rate has remained stubbornly high. The key differences in inflation rates can be attributed to several factors, including:

- Supply Chain Disruptions:While supply chain disruptions have eased in the US, they have persisted in Australia, contributing to higher prices for imported goods.

- Energy Prices:Australia has experienced higher energy prices due to its reliance on fossil fuels, while the US has benefited from lower oil prices.

- Monetary Policy:The US Federal Reserve has been more aggressive in raising interest rates than the RBA, which has contributed to a stronger US dollar and a weaker Australian dollar.

Potential Implications of Inflation Divergence on the AUD/USD Exchange Rate

The divergence in inflation rates between the US and Australia is likely to continue to weigh on the AUD/USD exchange rate. As the US economy continues to outperform and the Federal Reserve maintains its hawkish stance, the US dollar is expected to remain strong.

In contrast, the Australian dollar is likely to remain under pressure as the RBA grapples with high inflation and a slowing economy.

The US dollar held steady today as positive economic data helped ease recession worries, while the Australian dollar slipped on news of a slowdown in inflation. This fluctuating market highlights the importance of diversifying your portfolio, and exploring alternative investment opportunities.

One area to consider is the world of soft commodities, where you can find potential for growth in markets like coffee, cocoa, cotton, and sugar. Check out this insightful article on soft commodities trading to learn more about these opportunities.

Meanwhile, we’ll keep an eye on the US dollar and its performance as economic data continues to unfold.

The AUD/USD exchange rate is likely to remain volatile in the coming months, with the potential for further depreciation of the Australian dollar.

Global Economic Outlook and Currency Dynamics: Us Dollar Steady As Resilient Economic Data Eases Recession Worries Australian Dollar Slides On Inflation Slowdown

The global economic landscape is currently characterized by a complex interplay of factors, including persistent inflation, rising interest rates, and geopolitical uncertainties. These dynamics have a significant impact on the US and Australian economies, influencing currency exchange rates and investor sentiment.

The US dollar held steady today as resilient economic data eased recession worries, while the Australian dollar slipped on news of a slowdown in inflation. Amidst these financial shifts, HP CEO Enrique Lores predicts an AI-driven revolution in computers within the next two years , a development that could significantly impact global markets and the technology landscape.

It will be interesting to see how these economic trends and technological advancements play out in the coming months.

Global Economic Trends and Their Impact

The global economic outlook remains uncertain, with several key factors influencing the trajectory of growth and inflation.

- Persistent Inflation:Inflation remains a major concern in many economies, driven by supply chain disruptions, strong consumer demand, and rising energy prices. This has prompted central banks worldwide to raise interest rates to curb inflation, which could potentially slow economic growth.

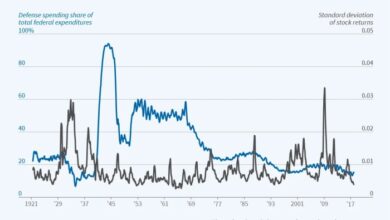

- Rising Interest Rates:Central banks in major economies, including the US Federal Reserve and the Reserve Bank of Australia, have been aggressively raising interest rates to combat inflation. This has increased borrowing costs for businesses and consumers, potentially impacting economic activity.

- Geopolitical Uncertainties:The ongoing war in Ukraine, heightened tensions between the US and China, and other geopolitical events contribute to global economic uncertainty. These factors can disrupt trade flows, increase commodity prices, and impact investor confidence.

Currency Exchange Rate Dynamics

Global economic trends significantly influence currency exchange rates.

- US Dollar Strength:The US dollar has been strengthening against other major currencies, driven by the Federal Reserve’s aggressive rate hikes and the perception of the US economy as a safe haven asset. This has made it more expensive for other countries to import goods and services from the US.

- Australian Dollar Weakness:The Australian dollar has weakened against the US dollar, primarily due to the Reserve Bank of Australia’s less aggressive rate hike cycle and concerns about slowing economic growth in China, Australia’s largest trading partner. This has made Australian exports cheaper for foreign buyers but also increased the cost of imports from the US.

Key Economic Indicators and Their Impact

The following table Artikels key economic indicators and their potential impact on the US dollar and Australian dollar:

| Indicator | US Dollar | Australian Dollar |

|---|---|---|

| Inflation Rate | Higher inflation could lead to further rate hikes, strengthening the US dollar. | Higher inflation could weaken the Australian dollar as it increases pressure on the Reserve Bank of Australia to raise rates. |

| Interest Rate Differentials | Higher US interest rates relative to other economies tend to attract foreign investment, boosting the US dollar. | Lower interest rates in Australia compared to the US can weaken the Australian dollar. |

| Economic Growth | Strong economic growth in the US can strengthen the US dollar as it indicates a healthy economy. | Slower economic growth in Australia can weaken the Australian dollar as it reduces investor confidence. |

| Commodity Prices | Rising commodity prices can benefit the US dollar as the US is a major producer of commodities. | Higher commodity prices can benefit the Australian dollar as Australia is a major commodity exporter. |

| Geopolitical Events | Geopolitical uncertainty can increase demand for the US dollar as a safe haven asset, strengthening the currency. | Geopolitical events, particularly those affecting China, can impact the Australian dollar due to Australia’s close trade ties with China. |

Investor Sentiment and Market Volatility

Investor sentiment, a key driver of market trends, is currently mixed regarding the US and Australian economies. While positive economic data in the US has eased recession fears, leading to a strengthening US dollar, concerns about slowing inflation and potential interest rate hikes in Australia are weighing on the Australian dollar.

Impact of Investor Sentiment on Currency Trading

Investor sentiment significantly influences currency trading activity. When investors are optimistic about a country’s economic prospects, they tend to buy its currency, driving its value up. Conversely, negative sentiment leads to selling pressure, causing the currency to depreciate. In the current scenario, the US dollar is benefiting from strong investor confidence fueled by resilient economic data, while the Australian dollar is facing pressure due to concerns about inflation and potential interest rate hikes.

Factors Contributing to Market Volatility

Several factors can contribute to increased market volatility in the near future.

- Geopolitical Tensions:Ongoing geopolitical tensions, such as the war in Ukraine and the US-China trade war, can create uncertainty and trigger sharp movements in currency markets.

- Central Bank Policy Decisions:Central bank decisions on interest rates and other monetary policies can significantly impact currency valuations. Unexpected changes in policy can lead to market volatility.

- Economic Data Releases:Unexpectedly strong or weak economic data releases can trigger market reactions, influencing investor sentiment and currency movements.

- Global Economic Slowdown:Concerns about a global economic slowdown can lead to risk aversion among investors, driving capital flows towards safe-haven currencies like the US dollar, further increasing volatility.

Factors Influencing Investor Sentiment and Currency Exchange Rates

| Factor | Impact on Investor Sentiment | Impact on Currency Exchange Rate |

|---|---|---|

| Strong Economic Growth | Positive | Appreciation |

| Low Inflation | Positive | Appreciation |

| Stable Political Environment | Positive | Appreciation |

| Favorable Interest Rate Differentials | Positive | Appreciation |

| High Government Debt | Negative | Depreciation |

| Weak Economic Growth | Negative | Depreciation |

| High Inflation | Negative | Depreciation |

| Political Instability | Negative | Depreciation |

Implications for Businesses and Consumers

A strong US dollar and a weak Australian dollar have significant implications for businesses operating in both countries and for consumers. Currency fluctuations affect the cost of imports and exports, impacting business profitability and consumer spending power.

Impact on Businesses

Currency fluctuations can create both opportunities and challenges for businesses. For instance, a strong US dollar makes US exports more expensive for Australian consumers, potentially reducing demand. Conversely, it makes Australian exports cheaper for US consumers, potentially boosting demand.

- Exporting Businesses:Businesses exporting from Australia to the US benefit from a weaker Australian dollar as their goods become more competitive in the US market. However, a stronger US dollar makes it more expensive for them to import raw materials or components from the US.

- Importing Businesses:Businesses importing goods from the US to Australia face higher costs due to a strong US dollar. This can lead to higher prices for consumers or reduced profit margins for businesses.

- Businesses with International Operations:Businesses with operations in both the US and Australia need to carefully manage their currency exposure. They can use hedging strategies to mitigate the risks associated with currency fluctuations.

Impact on Consumers

Currency fluctuations directly impact consumer spending power. A stronger US dollar makes US goods and services more expensive for Australian consumers, potentially reducing their purchasing power. Conversely, a weaker Australian dollar makes Australian goods and services more affordable for US consumers.

- Travel and Tourism:A strong US dollar makes travel to the US more expensive for Australian consumers, while a weak Australian dollar makes it more affordable for US consumers to travel to Australia.

- Imported Goods:A strong US dollar increases the cost of imported goods from the US, impacting consumer spending on electronics, clothing, and other goods.

- Purchasing Power:A weak Australian dollar reduces the purchasing power of Australian consumers, as they need to spend more Australian dollars to buy the same amount of goods and services.

Mitigating Currency Volatility

Businesses can employ various strategies to mitigate the risks associated with currency volatility.

- Hedging:Businesses can use hedging strategies to lock in exchange rates for future transactions, reducing the impact of currency fluctuations on their profits.

- Diversification:Businesses can diversify their operations to reduce their exposure to any single currency.

- Currency Management:Businesses can implement effective currency management strategies to track exchange rates and make informed decisions about their operations.

Impact on Different Business Sectors and Consumers

The table below Artikels the potential impacts of currency fluctuations on various business sectors and consumers: