US Debt Deal Bolsters Asian Stocks, Markets Gain Momentum

Us debt deal bolsters asian stocks markets gain momentum – US Debt Deal Bolsters Asian Stocks, Markets Gain Momentum: The recent agreement to raise the US debt ceiling has sent a wave of optimism through global financial markets, particularly in Asia. This deal, aimed at averting a catastrophic default, has injected a much-needed dose of confidence into investors, leading to a surge in stock prices across the region.

Asian markets, already experiencing a period of robust growth, have further benefited from the deal’s positive implications for the global economy. The agreement signals a return to stability and predictability in the US financial system, which is a major boost for global trade and investment.

This has spurred a surge in demand for Asian assets, as investors seek to capitalize on the region’s strong economic fundamentals and growth prospects.

The US Debt Deal and its Impact on Global Markets

The US debt deal, reached after intense negotiations, has provided much-needed relief to global markets. This agreement averted a catastrophic default on US debt obligations, a scenario that could have had severe repercussions for the global financial system. This blog post will explore the key provisions of the deal, its potential implications for US economic growth and stability, and its impact on global investor sentiment and risk appetite.

Key Provisions of the US Debt Deal

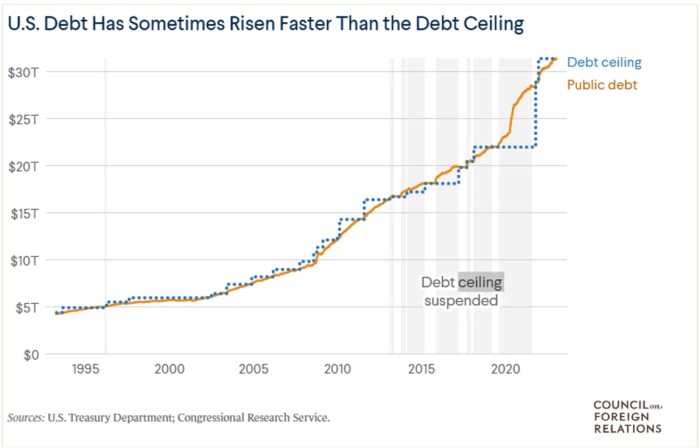

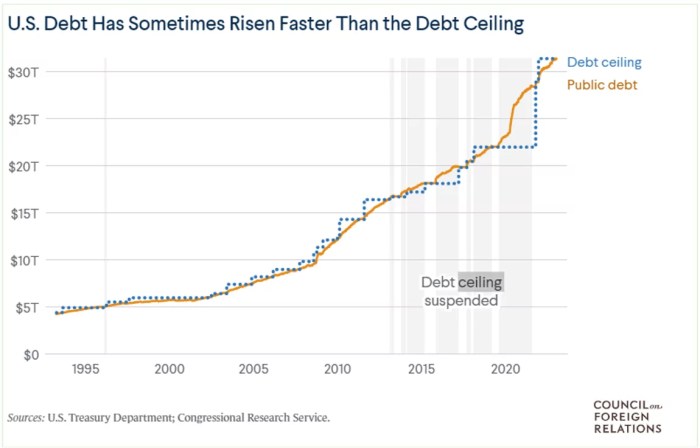

The debt deal, signed into law by President Biden, suspends the debt ceiling until January 2025. This suspension prevents the US from defaulting on its financial obligations during this period. The deal also includes provisions aimed at reducing federal spending, although the exact details are subject to further negotiations.

The agreement has been widely hailed as a temporary solution, providing some breathing room for the US government to address its long-term fiscal challenges.

Implications for US Economic Growth and Stability

The debt deal has had a positive impact on US economic growth and stability. The immediate relief from the threat of default has boosted investor confidence, leading to a surge in stock markets. However, the deal’s long-term implications for US economic growth remain uncertain.

The spending cuts included in the deal could potentially slow economic growth if they are implemented too aggressively. Furthermore, the deal does not address the underlying fiscal challenges facing the US government, such as rising healthcare costs and social security obligations.

The US debt deal news has definitely injected some positive energy into the Asian stock markets, driving a wave of optimism. While the markets are buzzing, it’s a good reminder to keep our own financial health in check, just like we do with our physical health.

Check out this great article on balancing your finances and health top tips for achieving both , it’s full of practical tips! Back to the markets, it’ll be interesting to see how the US debt deal plays out in the long run, but for now, it’s definitely a positive sign for global investors.

Impact on Global Investor Sentiment and Risk Appetite

The US debt deal has had a significant impact on global investor sentiment and risk appetite. The agreement has reassured investors that the US government is committed to fulfilling its financial obligations, reducing concerns about a potential global financial crisis.

This renewed confidence has led to increased investment in riskier assets, such as stocks and emerging market bonds. However, the long-term impact on global investor sentiment remains uncertain. The potential for future debt ceiling negotiations and the unresolved fiscal challenges facing the US government could lead to renewed volatility in global markets.

Asian Stock Markets’ Response to the US Debt Deal

The US debt deal announcement was met with a wave of optimism in Asian stock markets, as investors breathed a sigh of relief at the avoidance of a potential economic catastrophe. The deal, which averted a US default, provided much-needed certainty for global markets, leading to a surge in investor sentiment.

Immediate Reaction of Asian Stock Markets

Asian stock markets reacted positively to the US debt deal announcement, with most major indices experiencing gains. For instance, Japan’s Nikkei 225 surged by over 2%, while South Korea’s KOSPI gained over 1%. Similarly, Hong Kong’s Hang Seng Index rose by more than 1%, indicating a widespread positive sentiment across the region.

This immediate upward trend reflected investors’ confidence in the US economy’s continued stability and the positive implications for global growth.

Performance of Asian Stock Market Indices

The positive momentum in Asian stock markets continued in the days following the US debt deal announcement. A comparative analysis of the performance of key Asian stock market indices reveals a consistent upward trend.

- The Shanghai Composite Index, a key indicator of China’s stock market, rose by over 2% in the days following the deal, reflecting investor optimism about the US economy’s impact on China’s growth prospects.

- India’s Sensex, another prominent Asian stock market index, also experienced a significant gain of over 1%, demonstrating the broader positive sentiment across the region.

- The Taiwan Weighted Index, a measure of the Taiwanese stock market, gained over 1% in the days following the deal, signaling a positive outlook for Taiwanese companies.

Factors Driving Positive Momentum

Several factors contributed to the positive momentum in Asian markets following the US debt deal announcement.

- The deal’s avoidance of a US default, a scenario that could have had severe consequences for global markets, provided a sense of stability and certainty, encouraging investors to take on more risk.

- The deal also signaled a commitment to fiscal responsibility, potentially leading to improved US economic performance and increased global demand for Asian exports.

- The positive sentiment in the US markets, driven by the debt deal, also spilled over to Asian markets, creating a domino effect of optimism and encouraging investment.

Economic Fundamentals Driving Asian Market Gains

The recent surge in Asian stock markets, fueled by the US debt deal, is also underpinned by a confluence of positive economic fundamentals. Key Asian economies are exhibiting signs of resilience, navigating global challenges with a mix of strategic policies and robust domestic demand.

Economic Growth and Inflation in Key Asian Economies

The economic outlook for Asia remains positive, with several key economies experiencing robust growth. China, the region’s economic powerhouse, is expected to maintain its growth trajectory, supported by government stimulus measures and a gradual recovery in consumer spending. India, another major player, is benefiting from strong domestic demand and a favorable demographic profile.

Southeast Asian economies, particularly Vietnam and Indonesia, are also experiencing healthy growth, driven by export-oriented manufacturing and rising domestic consumption. However, inflation remains a concern in many Asian economies. Rising energy prices and supply chain disruptions have contributed to inflationary pressures.

The US debt deal has breathed life into Asian stock markets, with investors feeling optimistic about global economic stability. However, the positive sentiment is tempered by the ongoing economic crisis in Pakistan, a country grappling with a crippling debt burden and dwindling foreign reserves.

Understanding the intricacies of Pakistan’s economic crisis and charting a path towards financial stability is crucial, as highlighted in this insightful article pakistans economic crisis analyzing challenges and charting a path to financial stability. While the US debt deal offers a glimmer of hope, the global economic landscape remains fragile, and the challenges faced by Pakistan serve as a stark reminder of the vulnerabilities that persist.

Central banks in the region are carefully navigating the delicate balance between controlling inflation and supporting economic growth. Some countries, like South Korea and Thailand, have already raised interest rates to curb inflation, while others are adopting a more cautious approach.

Impact of Global Supply Chain Disruptions and Geopolitical Tensions on Asian Businesses

Global supply chain disruptions, exacerbated by the ongoing Russia-Ukraine conflict, have presented significant challenges for Asian businesses. The dependence on global trade routes has made many companies vulnerable to disruptions, leading to higher input costs and production delays. Geopolitical tensions, particularly in the Taiwan Strait, have also added to the uncertainty surrounding global trade and investment.Despite these challenges, Asian businesses are demonstrating remarkable resilience.

The US debt deal has injected a dose of optimism into global markets, with Asian stocks experiencing a surge in momentum. This positive sentiment highlights the importance of financial security, especially in times of economic uncertainty. A recent Gallup survey sheds light on the growing concern over financial security, emphasizing the need for proactive measures to protect our assets.

Bank account security tips protecting finances recent survey of gallup provides valuable insights and practical steps to safeguard our finances. With a solid financial foundation, we can confidently navigate the evolving economic landscape and benefit from opportunities like the current bullish market trend.

Many companies are diversifying their supply chains, exploring alternative sourcing options, and investing in automation and digital technologies to enhance efficiency and reduce reliance on global networks. This proactive approach is helping them mitigate the impact of disruptions and position themselves for future growth.

Asian Companies Navigating the Current Economic Landscape

Asian companies are employing a variety of strategies to navigate the current economic landscape. These include:

- Investing in innovation and technology:Companies are embracing digital transformation to enhance productivity, improve efficiency, and develop new products and services. This includes investing in artificial intelligence, cloud computing, and e-commerce platforms.

- Expanding into new markets:Many companies are seeking growth opportunities in emerging markets, particularly in Southeast Asia and Africa, to diversify their revenue streams and reduce dependence on mature markets.

- Building strategic partnerships:Collaboration with other companies, including those in developed economies, is becoming increasingly important for Asian businesses. These partnerships can provide access to new technologies, markets, and expertise.

- Focusing on sustainability:Environmental, social, and governance (ESG) factors are becoming increasingly important for investors. Companies are incorporating sustainability into their operations and supply chains to attract investors and enhance their reputation.

Sector-Specific Performance and Opportunities: Us Debt Deal Bolsters Asian Stocks Markets Gain Momentum

The US debt deal has injected a dose of optimism into global markets, particularly in Asia, where stock markets have responded positively. This positive sentiment has not been uniformly distributed across all sectors, however. Certain sectors are poised to benefit more than others from the improved economic outlook.

Sector-Specific Performance Following the Debt Deal

The debt deal has led to a surge in investor confidence, which has translated into strong performance across various sectors in Asian stock markets. However, some sectors have outperformed others.

- Technology: The tech sector has been a standout performer, driven by the expectation of continued digital transformation and increased investment in artificial intelligence (AI). The sector has also benefited from the easing of global trade tensions and the revival of demand for tech products and services.

- Consumer Discretionary: This sector has also witnessed strong gains, fueled by pent-up consumer demand and improving consumer confidence. The easing of inflation and rising disposable incomes are expected to further boost spending on discretionary items like automobiles, electronics, and travel.

- Financials: The financial sector has seen a positive response to the debt deal, driven by expectations of higher interest rates and increased lending activity. Banks and other financial institutions are expected to benefit from the improved economic outlook and the resumption of normal economic activity.

- Energy: The energy sector has also shown resilience, supported by the ongoing recovery in global oil demand and the geopolitical tensions in the region. However, the sector’s performance may be subject to volatility due to fluctuating oil prices.

Sectors Poised to Benefit from the Improved Global Economic Outlook

The positive economic outlook resulting from the debt deal is likely to favor sectors that are sensitive to global economic growth and consumer spending.

- Tourism and Hospitality: With the easing of travel restrictions and increased consumer confidence, the tourism and hospitality sector is expected to experience a strong rebound. This sector stands to benefit significantly from the pent-up demand for travel and leisure activities.

- Infrastructure: The debt deal’s focus on infrastructure spending is expected to create opportunities for companies involved in construction, engineering, and related sectors. Increased infrastructure investment is likely to stimulate economic growth and create jobs.

- Healthcare: The healthcare sector is expected to benefit from the aging population and the growing demand for healthcare services. The sector is also likely to benefit from technological advancements in areas such as medical devices and pharmaceuticals.

Hypothetical Portfolio of Asian Stocks

Based on the expected growth potential of various sectors, a hypothetical portfolio of Asian stocks could be constructed as follows:

- Technology:

– Samsung Electronics (South Korea)

– Taiwan Semiconductor Manufacturing Company (Taiwan)

– Alibaba Group Holding (China)

- Consumer Discretionary:

– Toyota Motor (Japan)

– LVMH (France)

– JD.com (China)

- Financials:

– HSBC Holdings (UK)

– Mitsubishi UFJ Financial Group (Japan)

– ICBC (China)

- Tourism and Hospitality:

– Marriott International (US)

– AirAsia (Malaysia)

– Trip.com Group (China)

- Infrastructure:

– Larsen & Toubro (India)

– China State Construction Engineering Corporation (China)

– Shimizu Corporation (Japan)

Long-Term Implications for Asian Markets

The US debt deal, while providing immediate relief, has significant long-term implications for Asian markets. It’s crucial to analyze how this agreement might influence economic growth, investor sentiment, and overall market performance in the region.

The Impact of the US Debt Deal on Long-Term Economic Growth in Asia, Us debt deal bolsters asian stocks markets gain momentum

The US debt deal, by preventing a default, helps maintain global financial stability and confidence. This stability can positively impact Asian economies in several ways. Firstly, it reduces the risk of a global recession, which would have severely impacted Asian export-oriented economies.

Secondly, it allows for continued investment flows from the US into Asian markets, fueling economic growth and development.

The Role of Asian Economies in the Global Economic Recovery

Asian economies are increasingly playing a vital role in the global economic recovery. Their robust growth, driven by strong domestic demand and structural reforms, makes them attractive destinations for investment. The US debt deal further strengthens this trend, as it provides a more stable global economic environment, allowing Asian economies to continue their growth trajectory.

Opportunities and Challenges for Investors in Asian Markets

The US debt deal creates both opportunities and challenges for investors in Asian markets. On the one hand, the deal fosters a more stable global economic landscape, reducing risk and encouraging investment. On the other hand, investors need to carefully consider the specific risks and opportunities within each Asian market.

For example, China’s economic slowdown and its impact on regional trade present a challenge, while India’s robust growth and expanding consumer market present an opportunity.