Tech Earnings and Jobs Report Drive Stocks to New Highs

Unstoppable market surge tech earnings and jobs report propel stocks to new highs – The unstoppable market surge, fueled by robust tech earnings and a positive jobs report, has propelled stocks to new highs, creating a wave of optimism among investors. This upward momentum reflects a confluence of factors, including strong corporate performance, a resilient economy, and a growing sense of confidence in the future.

The recent surge in tech earnings, driven by innovation and robust consumer demand, has been a major catalyst for the market’s upward trajectory. This performance, coupled with a positive jobs report indicating a healthy labor market, has further bolstered investor sentiment.

The combination of these factors has created a powerful tailwind, propelling the market to record levels.

Investment Strategies

The recent market surge, fueled by strong tech earnings and a robust jobs report, has pushed stocks to new highs. While this bullish sentiment is encouraging, it’s crucial for investors to approach the market with a well-defined investment strategy. A carefully crafted portfolio can help navigate the potential ups and downs of the market and maximize long-term returns.

Hypothetical Investment Portfolio

A balanced portfolio, diversified across different asset classes, is essential to mitigate risk and achieve long-term growth. Here’s a hypothetical investment portfolio that could be considered in the current market environment:

- Large-Cap U.S. Stocks (30%):These stocks represent established companies with a significant market capitalization, offering stability and potential growth. Examples include Apple, Microsoft, and Amazon.

- Small-Cap U.S. Stocks (20%):These stocks represent smaller companies with the potential for higher growth but also higher risk. Examples include Tesla and Zoom.

- International Stocks (15%):Diversifying into international markets can provide exposure to different economic cycles and growth opportunities. Examples include Samsung and Nestle.

- Bonds (20%):Bonds provide income and a degree of stability to a portfolio. They are less volatile than stocks and can help mitigate risk during market downturns.

- Real Estate (10%):Real estate can provide diversification and potential appreciation. This could include residential or commercial properties, or REITs (Real Estate Investment Trusts).

- Commodities (5%):Commodities like gold and oil can serve as an inflation hedge and offer diversification benefits.

Investment Strategies and Their Potential Risks and Rewards

| Strategy | Potential Risks | Potential Rewards |

|---|---|---|

| Growth Investing | High volatility, potential for losses, focus on long-term growth, may not provide immediate returns. | High potential returns, exposure to innovative and rapidly growing companies. |

| Value Investing | May miss out on growth opportunities, requires in-depth research, companies may be undervalued for a reason. | Potential for significant returns if undervalued companies are identified correctly. |

| Index Investing | Limited control over portfolio, may not outperform the market, may not capture specific sector growth. | Low-cost and passive, diversified exposure to a broad market, suitable for long-term investors. |

| Active Investing | Requires significant time and expertise, may underperform the market, higher fees. | Potential to outperform the market, tailored portfolio based on individual goals and risk tolerance. |

Key Considerations for Investors, Unstoppable market surge tech earnings and jobs report propel stocks to new highs

- Risk Tolerance:Understand your risk tolerance and invest accordingly. A higher risk tolerance may lead to investments in growth stocks, while a lower risk tolerance may favor bonds or real estate.

- Investment Horizon:Consider your investment horizon. Long-term investors may be able to ride out market fluctuations, while short-term investors may need to be more cautious.

- Diversification:Diversify your portfolio across different asset classes, sectors, and geographies to mitigate risk.

“Don’t put all your eggs in one basket”

- Market Research:Stay informed about current market conditions, economic indicators, and company performance to make informed investment decisions.

- Professional Advice:Consult with a financial advisor to develop a personalized investment strategy that aligns with your financial goals and risk tolerance.

Market Volatility: Unstoppable Market Surge Tech Earnings And Jobs Report Propel Stocks To New Highs

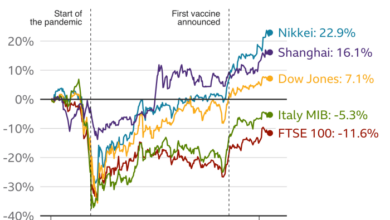

While the recent surge in the stock market is encouraging, it’s crucial to acknowledge that markets are inherently volatile. This means that periods of significant gains can be followed by periods of decline, and vice versa. Understanding the potential for market fluctuations is essential for investors to make informed decisions and manage their portfolios effectively.

Factors Contributing to Market Volatility

The stock market is influenced by a multitude of factors, both economic and geopolitical. These factors can create periods of heightened volatility, leading to rapid price fluctuations.

- Economic Data:Key economic indicators, such as inflation, interest rates, and unemployment, can significantly impact investor sentiment and market direction. For example, a surprise increase in inflation could lead to concerns about the Federal Reserve raising interest rates, which could negatively impact corporate earnings and stock prices.

- Geopolitical Events:International conflicts, political instability, and global trade tensions can create uncertainty and volatility in the market. For instance, the ongoing war in Ukraine has led to increased energy prices and supply chain disruptions, impacting global economic growth and investor confidence.

- Company-Specific News:Positive or negative news about individual companies can also drive stock price fluctuations. Earnings reports, product launches, and regulatory changes can all impact a company’s valuation and stock performance.

- Market Sentiment:Investor psychology plays a significant role in market movements. Periods of optimism and exuberance can lead to market rallies, while fear and pessimism can drive sell-offs. This sentiment can be influenced by news events, economic data, and overall market conditions.

Managing Volatility

Navigating market volatility requires a proactive approach to risk management and portfolio construction. Investors can consider several strategies to mitigate the impact of market fluctuations:

- Diversification:Spreading investments across different asset classes, sectors, and geographies can help reduce overall portfolio risk. For example, investing in a mix of stocks, bonds, and real estate can help offset potential losses in any one asset class.

- Long-Term Perspective:Market fluctuations are a normal part of the investment cycle. Focusing on a long-term investment horizon can help investors ride out short-term volatility and benefit from the long-term growth potential of the market.

- Rebalancing:Regularly adjusting portfolio allocations to maintain desired asset class weights can help manage risk and ensure that investments are aligned with long-term goals. For instance, if stocks outperform bonds, rebalancing could involve selling some stocks and buying more bonds to restore the original allocation.

- Dollar-Cost Averaging:Investing a fixed amount of money at regular intervals, regardless of market conditions, can help reduce the impact of volatility. This strategy averages out the purchase price over time, potentially reducing the average cost of investment.

The market is soaring, driven by strong tech earnings and a positive jobs report, pushing stocks to new highs. It’s a time of celebration for investors, but amidst the financial euphoria, we mourn the loss of a talented actor. Ray Stevenson, known for his roles in films like “Punisher: War Zone” and “RRR,” passed away at the age of 58, leaving a void in the entertainment industry.

His untimely passing is a reminder that life is fleeting, even as the market continues its upward climb.

The market’s on fire, fueled by strong tech earnings and a robust jobs report, sending stocks soaring to new highs. Amazon’s latest move, investing $120 million in a satellite processing hub at NASA’s Kennedy Space Center in Florida , underscores the company’s commitment to innovation and expansion, adding to the bullish sentiment driving the market’s upward trajectory.

The market’s on fire, fueled by strong tech earnings and a stellar jobs report, pushing stocks to new highs. But amidst the bullish momentum, there’s a new twist: exclusive elon musk confirms upcoming twitter video app for smart tvs which could signal a shift in how we consume content.

Whether this will further boost the market or create a new wave of investor excitement remains to be seen, but it’s definitely a move worth watching in the tech space.