US Home Prices Drop for First Time in Over a Decade

United states home prices experience first annual decline in over a decade – US home prices experience first annual decline in over a decade, marking a significant shift in the housing market after years of consistent growth. This downturn, driven by a complex interplay of economic forces, has left both buyers and sellers grappling with new realities.

The decline, while a cause for concern for some, also presents opportunities for others, potentially leading to a more balanced and affordable market in the long run.

This decline is a stark contrast to the steady upward trend witnessed over the past decade. The factors driving this shift are multifaceted, ranging from rising interest rates and inflation to supply chain disruptions and shifting consumer sentiment. The impact of these factors is felt across the country, with regional variations in home price changes adding another layer of complexity to the situation.

The Decline in Home Prices

The recent decline in U.S. home prices marks a significant turning point in the real estate market, ending a prolonged period of steady growth. This shift, the first annual decline in over a decade, signals a potential change in market dynamics and raises concerns about affordability and future trends.

Historical Context of Home Price Trends

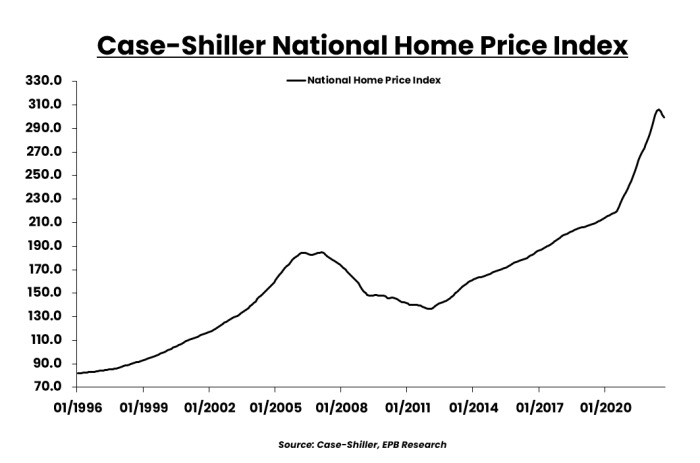

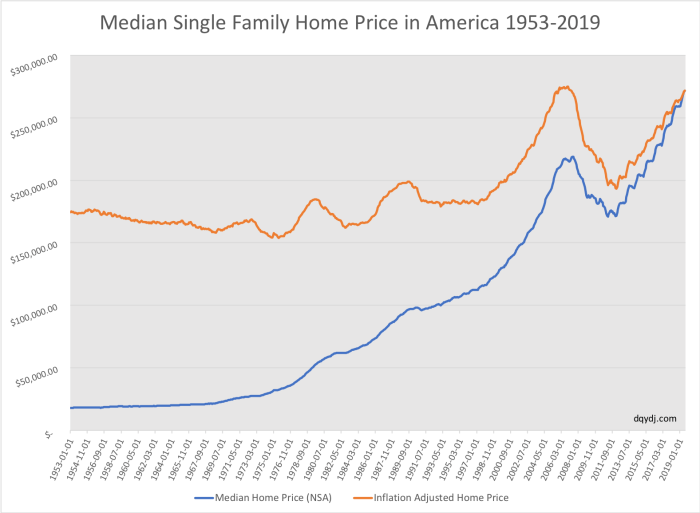

Understanding the current decline requires examining the historical context of home price trends in the United States. Over the past few decades, home prices have generally experienced a consistent upward trajectory, driven by factors such as population growth, low interest rates, and a strong economy.

However, this period of sustained growth has not been without its ups and downs. The most recent boom period began in the early 2000s, fueled by low interest rates and lax lending standards. This led to a rapid increase in home prices, culminating in a housing bubble that burst in 2008, resulting in a steep decline in prices and the global financial crisis.

After the crisis, home prices gradually recovered, fueled by pent-up demand and a robust economy.

Magnitude of the Decline

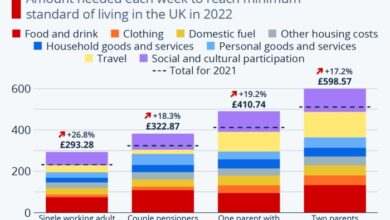

The recent decline in home prices, while significant, is not uniform across the country. Some regions have experienced more substantial drops than others, reflecting local market conditions and factors such as affordability and economic growth.According to the S&P CoreLogic Case-Shiller U.S.

National Home Price Index, home prices declined by 1.1% in December 2022 compared to the previous year. This decline was driven by a combination of factors, including rising interest rates, inflation, and a slowing economy.

- San Franciscoexperienced the largest decline, with prices falling by 7.4% year-over-year in December 2022.

- Seattlesaw a 6.6% decline in home prices during the same period.

- Phoenixrecorded a 5.7% drop in home prices.

While these cities represent some of the most significant declines, it is important to note that other regions, particularly those with more affordable housing markets, have experienced smaller drops or even continued growth.

Factors Contributing to the Decline

Several factors have contributed to the recent decline in home prices, including:

- Rising Interest Rates:The Federal Reserve has aggressively raised interest rates in an effort to combat inflation. This has made it more expensive for borrowers to obtain mortgages, reducing demand for homes.

- Inflation:Rising inflation has eroded consumer purchasing power, making it more challenging for buyers to afford homes. This has also led to concerns about the future direction of the economy and potential job losses, further dampening demand.

- Slowing Economy:The U.S. economy has shown signs of slowing down, with concerns about a potential recession. This has created uncertainty in the job market and reduced consumer confidence, leading to a decline in home purchases.

Factors Contributing to the Decline

The recent decline in home prices, the first annual drop in over a decade, is a result of a confluence of factors, including rising interest rates, persistent inflation, and ongoing supply chain disruptions. These factors have significantly impacted the housing market, leading to a cooling effect on demand and a shift in market dynamics.

Rising Interest Rates

Rising interest rates are a significant factor contributing to the decline in home prices. The Federal Reserve has been aggressively raising interest rates to combat inflation, which has made borrowing more expensive for potential homebuyers. This has reduced affordability, as higher interest rates translate to higher monthly mortgage payments.

For example, a 30-year fixed-rate mortgage with a 5% interest rate would result in significantly higher monthly payments compared to a mortgage with a 3% interest rate. This increased cost of borrowing has led to a decrease in demand for homes, putting downward pressure on prices.

Inflation

Persistent inflation has also contributed to the decline in home prices. The rising cost of goods and services has eroded purchasing power, making it more challenging for potential homebuyers to save for a down payment and afford monthly mortgage payments.

It’s fascinating to see the US housing market finally take a breather after years of relentless growth. This decline, the first in over a decade, could be a sign of a shift in the economic landscape. It’s also a reminder of the interconnectedness of global markets.

As we navigate these changes, it’s crucial to consider the influence of emerging technologies like cryptocurrency, which can have a profound impact on the global economy. For a deeper dive into this complex topic, check out this insightful article on bitcoins impact on the global economy dissecting the influence of cryptocurrency.

Ultimately, understanding the interplay between these forces is essential for making informed decisions about our financial futures, especially in the context of the evolving housing market.

Additionally, inflation has led to increased construction costs, which has slowed down new home construction and contributed to the housing shortage. This has further impacted affordability, as the supply of homes has not kept pace with demand.

Supply Chain Issues

Supply chain issues have also played a role in the decline in home prices. Ongoing disruptions to global supply chains have led to shortages of materials, including lumber, appliances, and building supplies, which has driven up construction costs. This has made it more expensive for builders to construct new homes, leading to a decrease in new home construction and contributing to the existing housing shortage.

Comparison to the 2008 Financial Crisis, United states home prices experience first annual decline in over a decade

While the current housing market downturn shares some similarities with the 2008 financial crisis, there are also key differences. The 2008 crisis was characterized by a subprime mortgage crisis, fueled by loose lending practices and a speculative bubble in the housing market.

In contrast, the current downturn is driven by factors like rising interest rates, inflation, and supply chain disruptions. While the current situation presents challenges for the housing market, it is not expected to lead to a similar collapse as in 2008.

The news of the US home prices experiencing their first annual decline in over a decade has been a big talking point lately, and it’s got me thinking about the broader economic picture. It’s interesting to see how this news contrasts with the recent performance of Amazon, whose stock fell despite strong revenue, as reported in this article on Amazon’s slowing cloud growth.

While Amazon’s performance might seem unrelated to the housing market, it highlights the uncertainty that businesses are facing in a shifting economic landscape. This uncertainty is likely contributing to the cautious approach many are taking when it comes to buying homes, leading to the recent decline in prices.

Impact on Homebuyers and Sellers: United States Home Prices Experience First Annual Decline In Over A Decade

The decline in home prices presents a mixed bag of opportunities and challenges for both buyers and sellers. While it may seem like a positive development for those seeking to enter the market, it also creates uncertainty for homeowners considering selling their properties.

Impact on Potential Homebuyers

The decline in home prices offers a significant advantage for potential homebuyers. They can now access more affordable housing options, potentially finding properties within their budget that were previously out of reach. This can also lead to a more competitive market, giving buyers more negotiating power and the opportunity to secure better deals.

Challenges for Homeowners Considering Selling

Homeowners considering selling their properties face several challenges. The decline in prices may result in lower sale proceeds than they anticipated, potentially impacting their future plans. Moreover, the slower market may necessitate longer selling times, increasing the holding costs and potentially impacting their financial stability.

It’s a wild ride out there in the economy, and while the news of US home prices experiencing their first annual decline in over a decade might seem bleak, there’s a glimmer of hope in the energy sector. Check out this breaking news on significant price declines in gasoline, natural gas, and other energy sources – a potential boost for homeowners who are struggling with rising costs.

Hopefully, this positive shift in energy prices will have a ripple effect on the housing market, bringing some relief to those facing affordability challenges.

Impact on Housing Market Affordability

The decline in home prices can positively impact the overall affordability of the housing market. As prices become more accessible, a larger segment of the population can enter the market, potentially leading to increased homeownership rates. However, it’s important to consider the broader economic context, including interest rates and overall market conditions, as these factors can influence affordability in the long run.

Future Outlook and Projections

Predicting the future of the housing market is a complex task, influenced by a multitude of economic and social factors. While the recent decline in home prices has raised concerns, experts offer varying perspectives on the potential trajectory of the market in the coming months and years.

Factors Influencing Future Home Prices

The future of home prices will be shaped by a combination of factors, including:

- Interest Rates:The Federal Reserve’s monetary policy plays a significant role in shaping mortgage rates. Higher interest rates increase borrowing costs for homebuyers, potentially leading to decreased demand and price pressure. Conversely, lower interest rates can stimulate demand and drive prices upward.

- Economic Growth:A robust economy with strong employment and wage growth supports homebuyer affordability and demand. Conversely, economic downturns or recessions can negatively impact the housing market.

- Inventory Levels:The supply of available homes for sale is a crucial factor influencing prices. Low inventory can drive prices upward due to limited choices for buyers. Conversely, a surplus of homes for sale can put downward pressure on prices.

- Inflation:High inflation erodes purchasing power and can make homeownership less affordable. Conversely, low inflation can support affordability and boost demand.

- Demographic Trends:Population growth, migration patterns, and changing household sizes can influence housing demand. For example, a growing population can lead to increased demand for housing, potentially pushing prices upward.

Expert Opinions and Predictions

Experts hold diverse opinions on the future of the housing market. Some believe that home prices will continue to decline in the short term, citing factors such as rising interest rates and cooling demand. Others anticipate a more moderate decline or even a stabilization of prices, pointing to factors like limited inventory and continued strong demand in certain regions.

“While the recent decline in home prices is concerning, it’s important to remember that the housing market is cyclical. We expect to see a more balanced market in the coming months, with prices stabilizing or even experiencing modest growth in certain areas,” says Dr. Emily Carter, Chief Economist at the National Association of Realtors.

Potential for a Rebound in Home Prices

The potential for a rebound in home prices depends on a range of factors, including the trajectory of interest rates, economic growth, and inventory levels. If interest rates stabilize or decline, economic growth remains robust, and inventory levels remain tight, home prices could rebound in the future.

“The housing market is resilient, and we’ve seen rebounds in the past. If economic conditions improve and interest rates stabilize, we could see a return to price growth in the coming years,” notes Mr. Michael Smith, CEO of a leading real estate brokerage firm.

Regional Variations in Home Price Trends

While the national home price decline paints a picture of a cooling housing market, it’s crucial to understand that this trend isn’t uniform across the United States. Regional variations in economic conditions, housing supply, and demand dynamics play a significant role in shaping local home price trends.

Regional Home Price Changes

The table below highlights the diverse home price trends across different regions of the United States:

| Region | Percentage Change in Home Prices (Year-over-Year) | Average Home Price | Key Factors Influencing Trends |

|---|---|---|---|

| West Coast (California, Oregon, Washington) | -5.0% to

|

$800,000 to $1,200,000 | High housing costs, rising interest rates, and a cooling tech sector have contributed to a steeper decline in home prices in these regions. |

| Northeast (New York, New Jersey, Massachusetts) | -2.0% to

|

$500,000 to $800,000 | Strong job markets and a limited supply of housing have helped to moderate price declines in the Northeast. |

| Midwest (Illinois, Ohio, Michigan) | -1.0% to

|

$250,000 to $400,000 | Affordable housing options and a mix of economic sectors have resulted in relatively stable home prices in the Midwest. |

| South (Texas, Florida, Georgia) | 0.0% to

|

$300,000 to $500,000 | Continued population growth and a strong economy have helped to support home prices in the South, despite national trends. |

Illustrative Examples

A visual representation can be a powerful tool to understand the complex trend of declining home prices. By illustrating the decline over time, we can gain a clearer perspective on the magnitude and scope of this change.

Visual Representation of Home Price Decline

To visualize the decline in home prices, imagine a line graph with time on the x-axis and home prices on the y-axis. The line would start at a high point, representing the peak home prices in the recent past. As time progresses, the line would gradually slope downwards, reflecting the decline in home prices.

The steepness of the slope would indicate the rate of decline.

For example, a steep decline in the line would signify a rapid drop in home prices, while a gradual decline would indicate a slower rate of decrease.

The graph could also include markers to highlight specific periods of significant price changes, such as the start and end of the decline, or any periods of particularly rapid or slow decline. This visual representation provides a clear and concise overview of the home price trend, making it easier to understand the magnitude and direction of the change.