Stock Market Basics: Tips for Beginners

Tips for beginners to invest in the stock market learn the basics of stock market – Ready to dive into the world of investing? “Stock Market Basics: Tips for Beginners” is your guide to navigating this exciting but sometimes intimidating landscape. Whether you’re intrigued by the potential for growth or simply curious about how the stock market works, this guide provides a solid foundation for your investment journey.

We’ll demystify the jargon, explore essential concepts, and equip you with the knowledge you need to make informed decisions.

Investing in the stock market can be a rewarding experience, offering the chance to build wealth over time. But it’s crucial to approach it with a well-defined strategy and a clear understanding of the risks involved. This guide will cover everything from setting up your first brokerage account to understanding different investment strategies and managing your portfolio for success.

Understanding the Basics

The stock market can seem daunting at first, but understanding its core concepts is crucial for making informed investment decisions. This section will demystify the fundamentals of the stock market, including stocks, bonds, and mutual funds, and explain how stock prices fluctuate.

Types of Securities

The stock market is a marketplace where securities are traded. Securities represent ownership or debt obligations. The three main types of securities are:

- Stocks:Represent ownership in a company. When you buy a stock, you become a shareholder and are entitled to a portion of the company’s profits and assets. Stock prices fluctuate based on factors like company performance, market sentiment, and investor demand.

- Bonds:Represent debt obligations. When you buy a bond, you are essentially lending money to a company or government entity. In return, you receive regular interest payments and the principal amount at maturity. Bond prices are inversely related to interest rates.

When interest rates rise, bond prices fall, and vice versa.

- Mutual Funds:Pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Mutual funds provide diversification and professional management, making them suitable for investors with limited time or expertise.

Stock Market Types

Different stock markets exist, each with its own characteristics and trading rules. Some notable types include:

- New York Stock Exchange (NYSE):The world’s largest stock exchange by market capitalization, known for its physical trading floor and high-profile listings.

- Nasdaq:A technology-heavy exchange, known for its focus on electronic trading and listings of many tech companies.

- London Stock Exchange (LSE):One of the oldest and largest stock exchanges in Europe, known for its global reach and diverse listings.

How Stock Prices Fluctuate

Imagine a bustling marketplace where buyers and sellers negotiate prices for various goods. The stock market operates similarly, with buyers (investors) and sellers (investors looking to sell their shares) determining the price of a stock.

Starting your journey in the stock market can be exciting, but it’s crucial to understand the fundamentals before diving in. Even giants like Amazon, who recently reported strong revenue, saw their stock fall due to slower cloud growth, as reported in this article.

This highlights the importance of analyzing company performance beyond just revenue, which is a key aspect of learning the basics of investing.

Stock prices fluctuate based on the forces of supply and demand.

When more buyers are interested in a stock than sellers, the demand increases, pushing the price higher. Conversely, if more sellers are looking to sell than buyers, the supply increases, driving the price down. This dynamic interplay of supply and demand drives the constant fluctuations in stock prices.

Setting Up Your Investment Account

To begin your journey in the stock market, you need to open a brokerage account. This account serves as your gateway to buying and selling stocks, ETFs, and other investments.

Types of Brokerage Accounts

Brokerage accounts come in various forms, each with its own set of features and benefits. Here are some of the most common types:

- Cash Accounts:These accounts require you to settle trades with funds already in your account. You can only buy securities if you have the necessary funds available.

- Margin Accounts:Margin accounts allow you to borrow money from your broker to purchase securities. This can amplify both potential gains and losses. However, margin accounts come with interest charges and risks associated with borrowing.

- Retirement Accounts:Retirement accounts, such as IRAs (Individual Retirement Accounts) and 401(k)s, offer tax advantages for long-term savings. These accounts are often subject to specific contribution limits and withdrawal rules.

- Robo-Advisors:Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios based on your risk tolerance and financial goals. These platforms often have lower minimum investment requirements and fees compared to traditional brokerage accounts.

Choosing a Reputable Broker

Selecting the right broker is crucial for a smooth and successful investment experience. Here are some factors to consider:

- Fees and Commissions:Compare different brokers’ fees for trading, account maintenance, and other services. Some brokers offer commission-free trading, while others charge fees based on the trade size or account balance.

- Investment Options:Ensure the broker offers access to the investments you want to buy, such as stocks, ETFs, mutual funds, and options.

- Research Tools and Resources:Look for brokers that provide comprehensive research tools, including market data, company information, and analyst reports. This can help you make informed investment decisions.

- Customer Support:Choose a broker with responsive and reliable customer support. You should be able to easily reach out to them for assistance with account issues or investment questions.

- Security and Reliability:Prioritize brokers with strong security measures to protect your personal and financial information. Consider brokers regulated by reputable financial authorities.

Opening a Brokerage Account

Once you’ve chosen a broker, opening an account is typically a straightforward process:

- Visit the Broker’s Website:Go to the broker’s website and click on the “Open an Account” or “Sign Up” button.

- Provide Personal Information:Fill out an application form with your personal details, including your name, address, Social Security number, and date of birth.

- Choose an Account Type:Select the type of account that best suits your needs, such as a cash account, margin account, or retirement account.

- Fund Your Account:Deposit funds into your account to begin trading. You can typically fund your account through bank transfers, wire transfers, or debit card payments.

- Complete the Application:Review the terms and conditions and complete the application process. The broker may require you to provide additional documentation, such as proof of identity or income verification.

Additional Tips

- Start Small:Begin with a small investment amount to gain experience and reduce potential losses.

- Diversify Your Portfolio:Spread your investments across different asset classes, sectors, and companies to mitigate risk.

- Invest for the Long Term:Focus on long-term growth rather than short-term gains. The stock market can be volatile, and it’s essential to have a long-term perspective.

Researching Stocks

Before you invest in any company, it’s crucial to do your homework. Researching stocks is about understanding the company’s fundamentals, its industry, and its potential for growth. This process helps you make informed decisions and minimize risks.

Key Financial Metrics

Evaluating a company’s financial health is essential. These metrics provide insights into its profitability, efficiency, and financial stability. Here are some key financial metrics to consider:

| Metric | Description |

|---|---|

| Earnings Per Share (EPS) | Profit generated per share of outstanding stock. A higher EPS indicates a more profitable company. |

| Price-to-Earnings Ratio (P/E Ratio) | The ratio of a company’s stock price to its earnings per share. A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, indicating potential growth expectations. |

| Return on Equity (ROE) | A measure of how effectively a company uses its shareholders’ equity to generate profits. A higher ROE indicates better profitability. |

| Debt-to-Equity Ratio | The ratio of a company’s total debt to its total equity. A higher ratio indicates a higher level of financial risk. |

| Current Ratio | A measure of a company’s ability to meet its short-term financial obligations. A higher ratio indicates a stronger ability to pay its bills. |

| Free Cash Flow (FCF) | The cash flow available to a company after paying for its operating expenses and capital expenditures. A positive FCF indicates a healthy cash position. |

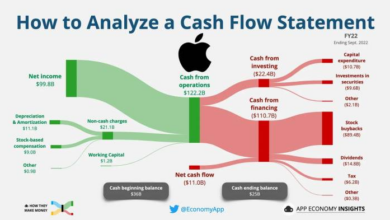

Analyzing Financial Statements

Financial statements provide a detailed snapshot of a company’s financial performance. Understanding how to analyze these statements is crucial for evaluating a stock.* Income Statement:Shows a company’s revenue, expenses, and net income over a specific period.

Balance Sheet Shows a company’s assets, liabilities, and equity at a specific point in time.

Cash Flow Statement Shows a company’s cash inflows and outflows over a specific period.

Getting started with the stock market can seem daunting, but it’s all about taking those first steps. Understanding the basics of investing, like diversification and risk management, is crucial. But it’s also important to be aware of the broader economic picture, especially with inflation impacting everything from grocery bills to gas prices.

To navigate this, I highly recommend checking out the inflation guide tips to understand and manage rising prices on The Venom Blog. This knowledge will empower you to make informed investment decisions, even in a fluctuating market.

Tip:Use ratios like the P/E ratio and ROE to compare different companies within the same industry.

Resources and Tools

There are numerous resources available to help you research stocks.* Financial News Websites:Websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes, financial news, and company information.

Brokerage Platforms

Learning the basics of the stock market is a great way to gain financial independence, but it’s important to remember that investing always involves some risk. Recent events like the bank turmoil resulting in a 72 billion loss of deposits for First Republic highlight the importance of understanding how market fluctuations can impact your investments.

Diversifying your portfolio, researching companies thoroughly, and seeking professional advice are crucial steps for beginners to navigate the stock market effectively.

Most online brokerage platforms offer research tools, including stock analysis, financial data, and market news.Company Websites Visit the company’s website to learn about its business model, products, and services.

SEC Filings The Securities and Exchange Commission (SEC) requires companies to file public documents, including annual reports (10-K), quarterly reports (10-Q), and prospectuses. These filings provide valuable information about a company’s financial performance, management, and risks.

Investment Research Firms Firms like Morningstar and S&P Global Market Intelligence offer in-depth research reports on companies and industries.

Financial Books and Articles Books and articles by renowned investors and financial experts can provide valuable insights into stock market investing.

Investing Strategies for Beginners

Now that you understand the basics of the stock market and have set up your investment account, it’s time to explore different investment strategies. Choosing the right strategy is crucial for achieving your financial goals. This section will compare and contrast various strategies suitable for beginners, including dollar-cost averaging and index fund investing.

Dollar-Cost Averaging, Tips for beginners to invest in the stock market learn the basics of stock market

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the stock price. This helps to mitigate the risk of buying high and selling low, a common pitfall for new investors. For example, you might invest $100 every month in a particular stock.

During periods of market volatility, you will buy more shares when the price is low and fewer shares when the price is high. Over time, this can help to lower your average purchase price.

Index Fund Investing

Index funds are mutual funds or exchange-traded funds (ETFs) that track a specific market index, such as the S&P 500. Investing in index funds provides broad market exposure, making it a simple and low-cost way to diversify your portfolio. Index funds typically have lower expense ratios than actively managed funds, meaning you pay less in fees.

By investing in a diversified index fund, you can gain exposure to a wide range of companies without having to pick individual stocks.

Diversification

Diversification is a key principle in investing that involves spreading your investments across different asset classes. This helps to reduce risk by minimizing the impact of any single investment performing poorly. Examples of asset classes include stocks, bonds, real estate, and commodities.

A diversified portfolio might include a mix of:

- Stocks:Equities representing ownership in companies, offering the potential for higher returns but also higher risk.

- Bonds:Debt securities issued by companies or governments, providing a stream of income and lower risk compared to stocks.

- Real Estate:Tangible assets like homes, apartments, or commercial properties, offering potential for rental income and appreciation.

- Commodities:Raw materials like gold, oil, or agricultural products, offering diversification and potential inflation protection.

Long-Term Investing

Long-term investing is a strategy that emphasizes holding investments for extended periods, typically years or even decades. This approach allows time for investments to grow and compound, potentially leading to significant returns.

“Time in the market beats timing the market.”

This saying highlights the importance of long-term investing. While market fluctuations are inevitable, the long-term trend of the stock market has historically been upward.

Potential Risks

While long-term investing offers the potential for significant returns, it also comes with risks:

- Market Volatility:Stock prices can fluctuate significantly in the short term, potentially leading to losses.

- Inflation:Rising inflation can erode the purchasing power of your investments.

- Interest Rate Changes:Increases in interest rates can negatively impact bond prices.

- Recessions:Economic downturns can lead to stock market declines.

Managing Your Investments: Tips For Beginners To Invest In The Stock Market Learn The Basics Of Stock Market

Investing in the stock market is a long-term game, and it requires active management to ensure your portfolio grows and remains aligned with your financial goals. Just like any other skill, mastering investment management takes time, effort, and a willingness to learn.

This section explores how to monitor your investments, manage risk, and stay informed about market trends.

Monitoring Your Portfolio

Regularly reviewing your portfolio is crucial to track its performance and identify areas for improvement.

- Track your investments:Use online platforms or investment apps to monitor your portfolio’s performance. Pay attention to the growth or decline of individual stocks and your overall portfolio value.

- Review your asset allocation:Assess whether your current asset allocation (the proportion of your portfolio invested in different asset classes) still aligns with your risk tolerance and financial goals. Consider rebalancing your portfolio if needed.

- Analyze your performance:Evaluate your investment decisions, noting any successful strategies and areas for improvement. Learn from your mistakes and adjust your approach accordingly.

Managing Risk

Risk management is a critical aspect of investing. It involves taking steps to protect your investments from potential losses.

- Diversify your portfolio:Invest in a variety of assets, such as stocks, bonds, real estate, and commodities, to reduce the impact of any single investment’s performance on your overall portfolio.

- Set stop-loss orders:Stop-loss orders automatically sell your stocks when they reach a predetermined price, limiting potential losses. This can help protect your portfolio from significant declines.

- Avoid emotional investing:Don’t let fear or greed drive your investment decisions. Stay rational and stick to your investment plan, even when the market is volatile.

Staying Informed

Staying informed about market trends and economic indicators is essential for making informed investment decisions.

- Follow financial news:Read reputable financial news sources, such as The Wall Street Journal, Bloomberg, and Reuters, to stay updated on market movements, economic data, and company news.

- Understand economic indicators:Pay attention to key economic indicators, such as inflation, interest rates, and unemployment rates, as they can influence stock prices and overall market performance.

- Research industry trends:Stay informed about industry trends and technological advancements that could impact your investments. Consider investing in companies with strong growth potential in emerging sectors.