UPIs Rise: From India to the World, Driving the Cashless Revolution

The rise of upi from india to the world how upi is driving the cashless revolution – UPI’s Rise: From India to the World, Driving the Cashless Revolution, is a story of innovation, inclusivity, and transformative impact. Imagine a world where you can send money to anyone, anywhere, instantly and with just a few taps on your phone.

This is the reality that UPI has created in India, and its influence is now spreading globally. UPI, or Unified Payments Interface, has revolutionized digital payments in India, transforming the way people shop, pay bills, and manage their finances.

This unique system, developed by the National Payments Corporation of India (NPCI), has made digital transactions accessible to millions, even those without traditional bank accounts.

But UPI’s journey is far from over. Its success in India has sparked interest around the world, with countries looking to adapt its principles to their own payment systems. This begs the question, could UPI become the dominant global payment system, driving a truly cashless future?

Let’s explore the remarkable rise of UPI and its potential to reshape the financial landscape worldwide.

Understanding UPI

UPI, or Unified Payments Interface, is a game-changing mobile-based payments system developed by the National Payments Corporation of India (NPCI). It has revolutionized digital payments in India, making it easier and faster for individuals and businesses to send and receive money.

UPI’s Core Principles and Functionalities

UPI operates on a real-time, peer-to-peer (P2P) payment system, allowing users to transfer money instantly between bank accounts linked to their mobile devices. This eliminates the need for physical cash or card-based transactions. UPI leverages the Immediate Payment Service (IMPS) infrastructure and incorporates unique features that have made it a highly successful system.

- Virtual Payment Addresses (VPAs):UPI uses unique mobile-friendly identifiers like “yourname@yourbank” for easy identification and transactions. These VPAs replace traditional bank account details, simplifying the payment process.

- Multiple Bank Accounts:Users can link multiple bank accounts to their UPI apps, allowing them to choose the account they want to use for each transaction.

- Scan and Pay:UPI enables QR code scanning for payments, further simplifying the process. Merchants can display QR codes for customers to scan and pay directly from their UPI apps.

- Push and Pull Payments:Users can initiate both push (sending money) and pull (requesting money) payments through UPI apps.

- Multiple Payment Options:UPI supports various payment options, including bank account transfers, debit card payments, and prepaid wallets.

UPI’s Impact on Digital Payments in India

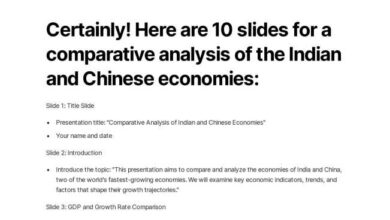

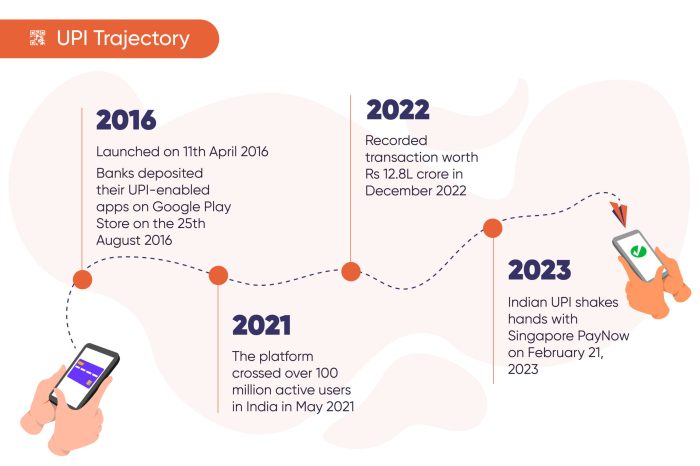

UPI has significantly impacted digital payments in India, contributing to a dramatic shift towards a cashless economy. Here are some key statistics:

- High Adoption Rate:UPI has witnessed rapid adoption, with over 260 million active users and over 3.5 billion transactions per month as of June 2023. This demonstrates the system’s widespread acceptance and popularity among Indian consumers.

- Increased Financial Inclusion:UPI has played a crucial role in financial inclusion by enabling millions of unbanked and underbanked individuals to access digital payment services.

- Boost to Small Businesses:UPI has empowered small businesses by providing them with a simple and affordable platform to accept digital payments.

- Reduced Cash Dependency:UPI has significantly reduced cash dependency in India, leading to greater efficiency and transparency in financial transactions.

Comparing UPI with Other Payment Systems

UPI stands out from other payment systems globally due to its unique features and advantages:

- Ease of Use:UPI is highly user-friendly, with a simple interface and minimal technical requirements. This has contributed to its widespread adoption, especially among first-time digital payment users.

- Cost-Effectiveness:UPI transactions are generally free or have very low fees compared to other payment systems, making it an attractive option for both individuals and businesses.

- Real-time Transactions:UPI enables instant payments, eliminating the delays associated with traditional banking systems. This real-time nature enhances convenience and efficiency.

- Interoperability:UPI allows for seamless transactions between different banks and payment apps, providing users with greater flexibility and choice.

The Rise of UPI

UPI, India’s homegrown mobile-based payments system, has become a global phenomenon, transforming the way people transact and paving the way for a cashless future. Its journey from a nascent concept to a revolutionary force is a testament to innovation, collaboration, and a commitment to financial inclusion.

Timeline of UPI’s Development

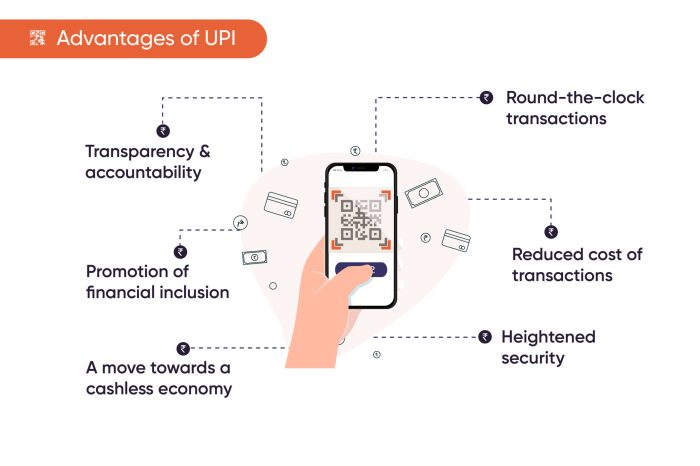

The development of UPI has been a gradual process, marked by significant milestones and innovations.

- 2016:UPI was launched by the National Payments Corporation of India (NPCI), a not-for-profit organization that operates retail payments and settlement systems in India.

- 2017:The adoption of UPI began to accelerate, with the launch of BHIM app, a government-backed mobile payments app that simplified UPI transactions.

- 2018:The introduction of UPI-powered QR codes further enhanced the ease of transactions.

- 2019:UPI transactions crossed the billion mark, demonstrating its widespread acceptance.

- 2020:The COVID-19 pandemic accelerated the adoption of digital payments, leading to a surge in UPI transactions.

- 2021:UPI saw its highest-ever growth, with the number of transactions crossing the 4 billion mark.

- 2022:UPI continued its upward trajectory, becoming a vital part of India’s digital economy.

Role of NPCI in Driving UPI Adoption

The National Payments Corporation of India (NPCI) played a pivotal role in driving the adoption of UPI.

- Creating a Unified Platform:NPCI developed a unified platform that enabled interoperability between various banks and financial institutions, allowing users to transfer money seamlessly across different accounts.

- Promoting Financial Inclusion:NPCI’s focus on financial inclusion ensured that UPI was accessible to all, regardless of their financial background or location.

- Supporting Innovation:NPCI encouraged innovation by allowing third-party app developers to build on the UPI platform, leading to a diverse ecosystem of apps.

- Advocating for UPI:NPCI actively promoted UPI through various campaigns and initiatives, raising awareness and encouraging its use.

Factors Contributing to UPI’s Growth

UPI’s rapid growth and widespread acceptance in India can be attributed to several factors.

The rise of UPI in India is a testament to how innovative technology can drive a cashless revolution. It’s fascinating to see how the world is taking notice, and even influential figures like Vitalik Buterin, the co-founder of Ethereum, have weighed in on its potential.

In a recent interview on Bloomberg Studio 10, Vitalik Buterin discussed the implications of UPI for the future of finance. It’s clear that UPI’s success in India is paving the way for a more inclusive and efficient financial system globally.

- Ease of Use:UPI’s user-friendly interface and simple process made it accessible to even first-time users.

- Security:UPI transactions are secure and protected by multi-factor authentication, providing users with peace of mind.

- Interoperability:UPI’s interoperability feature allowed users to transfer money across different banks and financial institutions, eliminating the need for multiple accounts.

- Low Transaction Costs:UPI transactions are typically free of charge, making it an attractive alternative to traditional payment methods.

- Government Support:The Indian government actively promoted UPI, encouraging its adoption and providing regulatory support.

- Mobile Penetration:India’s high mobile penetration rate provided a fertile ground for the adoption of a mobile-based payment system like UPI.

- Growing Digital Literacy:Increasing digital literacy among Indians facilitated the adoption of digital payment methods like UPI.

- Cashless Initiatives:The government’s initiatives to promote a cashless economy, such as demonetization in 2016, further boosted the adoption of UPI.

UPI’s Impact on the Indian Economy

UPI, with its ease of use and widespread adoption, has significantly impacted the Indian economy, transforming financial inclusion and driving digital empowerment. This has led to increased financial literacy, boosted business growth, and spurred economic development.

Financial Inclusion and Access to Financial Services, The rise of upi from india to the world how upi is driving the cashless revolution

UPI has played a pivotal role in promoting financial inclusion by making financial services accessible to a larger population, particularly in rural areas. Prior to UPI, accessing financial services often required physical presence at banks or financial institutions, posing a significant barrier for many, especially those residing in remote regions.

UPI’s rise in India has shown the world the power of a truly seamless, accessible, and cashless payment system. This success is prompting global interest in similar solutions, and even prompting strategic moves in the blockchain space, like the one spearheaded by Gavin Wood with his focus on chain mergers and acquisitions, as seen in this article.

Whether it’s blockchain or traditional finance, the future seems to be heading towards more interconnected and efficient systems, and UPI’s success in India serves as a powerful example of what’s possible.

- UPI has enabled individuals without bank accounts to access financial services through mobile wallets and payment banks, fostering financial inclusion and empowering them to participate in the formal economy.

- The ability to make and receive payments using a mobile phone has significantly reduced the dependence on cash, enabling individuals to engage in financial transactions conveniently and securely.

- UPI has facilitated the adoption of digital payments for various services, including utility bill payments, insurance premiums, and government subsidies, making these services more accessible to a wider population.

Financial Literacy and Digital Empowerment

UPI’s user-friendly interface and ease of use have contributed to a significant increase in financial literacy and digital empowerment among Indian citizens.

- The widespread adoption of UPI has encouraged individuals to embrace digital transactions, leading to an increased understanding of financial concepts and digital tools.

- UPI has fostered a culture of cashless transactions, reducing the reliance on physical cash and promoting financial transparency and accountability.

- The ability to track transactions and manage finances through mobile apps has empowered individuals to make informed financial decisions, contributing to improved financial well-being.

Impact on Businesses and the Indian Economy

UPI has significantly impacted businesses, particularly small and medium enterprises (SMEs), by facilitating seamless and cost-effective transactions.

The rise of UPI in India has been truly remarkable, transforming the way people make payments. This innovation is now spreading globally, with other countries looking to replicate its success. It’s interesting to see how technology can change entire industries, much like the shift towards electric vehicles, which is another major trend reshaping our world.

If you’re wondering about the pros and cons of gas vs electric vehicles, I recommend checking out this article: gas vs electric vehicles which is a better deal know the experts suggestions. Back to UPI, its ease of use and accessibility have played a major role in driving the cashless revolution in India, and it’s exciting to see its potential to change the financial landscape worldwide.

- UPI has reduced the need for physical cash handling, lowering transaction costs and increasing efficiency for businesses.

- The ability to accept payments through UPI has enabled businesses to expand their customer base and reach a wider market, particularly in rural areas.

- UPI has facilitated the adoption of digital payment solutions for various business activities, such as supply chain management, inventory tracking, and customer relationship management, improving operational efficiency and reducing fraud.

According to a report by the National Payments Corporation of India (NPCI), the total value of UPI transactions in India reached over ₹125 trillion (USD 1.6 trillion) in FY2023, reflecting the significant role of UPI in driving economic growth and digital transformation.

UPI: A Global Trendsetter

The success of UPI in India has not gone unnoticed globally. Many countries are exploring similar digital payment systems, recognizing the potential of UPI to revolutionize their own financial landscapes.

UPI’s Global Appeal

UPI’s appeal lies in its simplicity, efficiency, and affordability. Its interoperability, allowing users to seamlessly transfer funds between different banks, is particularly attractive. The low transaction fees and accessibility for even the most basic mobile phones make it a compelling option for developing countries.

Examples of UPI-like Systems Around the World

- BHIM UPI (India):This is the flagship UPI system, providing a foundation for the widespread adoption of digital payments in India.

- PayNow (Singapore):A real-time mobile payment system that enables peer-to-peer (P2P) transfers and QR code payments, similar to UPI.

- PromptPay (Thailand):Thailand’s national e-payment system, facilitating real-time fund transfers and bill payments through mobile banking.

- DuitNow (Malaysia):Malaysia’s national real-time payment system, enabling instant fund transfers between different banks and financial institutions.

- Fast Payment System (FPS) (United Kingdom):A real-time payment system that allows instant transfers between banks and financial institutions.

Challenges and Opportunities for UPI’s Expansion

While UPI’s global potential is evident, there are challenges to its expansion:

- Regulatory Framework:Implementing a UPI-like system requires a robust regulatory framework to ensure security, stability, and consumer protection.

- Interoperability:Ensuring interoperability between different banks and financial institutions is crucial for the success of any digital payment system.

- Infrastructure:A strong digital infrastructure, including reliable internet connectivity and mobile phone penetration, is essential for widespread adoption.

- Consumer Awareness and Trust:Educating the public about the benefits and security of digital payments is vital to foster adoption and build trust.

Despite these challenges, UPI’s global expansion presents significant opportunities:

- Financial Inclusion:UPI can empower individuals and businesses, particularly in developing countries, by providing access to financial services.

- Economic Growth:Increased digital transactions can boost economic activity, reduce cash handling costs, and promote financial transparency.

- Innovation:UPI’s success can inspire further innovation in digital payments, leading to new and improved systems.

UPI: The Future of Cashless Transactions: The Rise Of Upi From India To The World How Upi Is Driving The Cashless Revolution

The phenomenal success of UPI in India has ignited a global conversation about the future of cashless transactions. With its simplicity, speed, and cost-effectiveness, UPI has the potential to become a dominant global payment system, reshaping the financial landscape.

UPI’s Global Expansion

The potential for UPI to become a global standard is significant, given its inherent advantages and the growing demand for seamless and secure digital payment solutions.

- Adoption by other countries:Several countries, including Nepal, Bhutan, and the UAE, are exploring the adoption of UPI or similar models. This signifies the global recognition of UPI’s effectiveness and its potential to revolutionize payment systems in emerging economies.

- Collaboration with international payment networks:UPI’s integration with global payment networks like Mastercard and Visa would facilitate cross-border transactions and further expand its reach. This would enable users to make payments to merchants and individuals across borders, creating a truly global payment ecosystem.

- Strategic partnerships:Partnerships with leading technology companies and financial institutions would accelerate UPI’s global expansion. By leveraging existing infrastructure and expertise, UPI can tap into new markets and gain access to a wider user base.

Emerging Trends and Technologies

UPI’s capabilities are constantly evolving with the integration of emerging trends and technologies.

- Artificial intelligence (AI):AI-powered solutions can enhance UPI’s security, fraud detection, and user experience. For example, AI algorithms can analyze transaction patterns to identify suspicious activities and prevent fraud.

- Blockchain technology:Blockchain can introduce greater transparency and security to UPI transactions, making them more secure and immutable. This technology can also facilitate cross-border payments and simplify the process of sending and receiving money internationally.

- Internet of Things (IoT):The integration of UPI with IoT devices will enable seamless payments for a wide range of services, including transportation, utilities, and healthcare. This will further drive the adoption of UPI in various sectors and create new opportunities for businesses.

Impact on Financial Services and the Cashless Revolution

UPI’s global expansion will have a profound impact on the future of financial services and the cashless revolution.

- Financial inclusion:UPI’s accessibility and low transaction costs will facilitate financial inclusion by enabling individuals without access to traditional banking services to participate in the digital economy.

- Innovation in financial services:UPI’s success has encouraged innovation in financial services, leading to the development of new products and services that cater to the evolving needs of consumers.

- Economic growth:The widespread adoption of UPI will stimulate economic growth by increasing financial transactions, reducing cash dependency, and fostering a more efficient and transparent financial ecosystem.