The Rise of Cryptocurrency: Facts, Tips, and Market Trends

The rise of cryptocurrency facts tips and market trends – The rise of cryptocurrency: facts, tips, and market trends – it’s a topic that’s been buzzing for years, and for good reason. This digital revolution is transforming the financial landscape, offering new ways to invest, pay, and even raise funds.

But with this exciting new world comes a lot of questions: What is cryptocurrency, how does it work, and is it a good investment? This article dives into the core of this fascinating world, exploring its evolution, benefits, and the market forces shaping its future.

We’ll examine the fundamentals of blockchain technology, the diverse types of cryptocurrencies, and the factors that influence their value. We’ll also delve into the risks and rewards of investing in crypto, providing practical tips for securing your assets and navigating the often-volatile market.

From understanding market capitalization to exploring real-world case studies, we’ll equip you with the knowledge and insights you need to make informed decisions in this exciting and ever-evolving space.

The Evolution of Cryptocurrency

Cryptocurrency, a digital form of money, has revolutionized the financial landscape, offering a decentralized and secure alternative to traditional systems. Its journey, marked by innovation and challenges, is a testament to the power of technology and the human desire for financial freedom.

The Birth of Bitcoin

Bitcoin, the first and most prominent cryptocurrency, emerged in 2008 with the publication of a whitepaper by an anonymous individual or group known as Satoshi Nakamoto. This groundbreaking document Artikeld the concept of a decentralized digital currency, leveraging blockchain technology to secure transactions and prevent double-spending.

Bitcoin’s introduction marked the beginning of a new era in finance, paving the way for the development of numerous other cryptocurrencies.

The Role of Blockchain Technology

Blockchain technology is the cornerstone of cryptocurrency, providing a secure and transparent system for recording and verifying transactions. It is essentially a distributed ledger, a chain of blocks containing transaction data, that is replicated across multiple computers in a decentralized network.

Each block is cryptographically linked to the previous one, creating an immutable record of transactions that is resistant to tampering. This decentralized and secure nature of blockchain technology makes it an ideal platform for cryptocurrency, eliminating the need for intermediaries and enhancing trust.

The Evolution of Cryptocurrency Types

The cryptocurrency landscape has expanded beyond Bitcoin, encompassing a diverse range of cryptocurrencies with unique features and functionalities.

Ethereum and Smart Contracts

Ethereum, launched in 2015, introduced the concept of smart contracts, self-executing agreements written in code and stored on the blockchain. These contracts automate transactions and agreements, eliminating the need for intermediaries and reducing the risk of fraud. Ethereum’s platform also allows for the creation of decentralized applications (dApps), which can run on the blockchain without relying on centralized servers.

Stablecoins and Price Stability

Stablecoins are cryptocurrencies designed to maintain a stable price, typically pegged to a fiat currency like the US dollar. They aim to address the volatility inherent in traditional cryptocurrencies, making them suitable for payments and other applications where price stability is crucial.

Examples of stablecoins include Tether (USDT) and USD Coin (USDC).

Key Features and Benefits of Cryptocurrency

Cryptocurrency is a digital form of money that uses cryptography for security. It operates independently of central banks and governments, offering a decentralized and transparent financial system. This unique structure provides several benefits that traditional financial systems often lack.

Decentralization and its Implications

Decentralization is a core feature of cryptocurrency, meaning it’s not controlled by any single entity. Transactions are recorded on a public ledger, known as a blockchain, accessible to anyone. This distributed network ensures transparency and eliminates the need for intermediaries, such as banks, making it more resistant to censorship and manipulation.

Security, Transparency, and Accessibility

Cryptocurrency offers enhanced security due to its cryptographic nature. Transactions are encrypted and verified through complex mathematical algorithms, making them highly resistant to fraud and tampering. The public ledger provides complete transparency, allowing anyone to track transactions and verify their authenticity.

Additionally, cryptocurrency is accessible to anyone with an internet connection, breaking down geographical barriers and promoting financial inclusion.

Use Cases of Cryptocurrency

Cryptocurrency has a wide range of potential applications beyond traditional financial transactions.

Payments

Cryptocurrency can facilitate fast and low-cost international payments, bypassing traditional banking systems and their associated fees.

Investments

Cryptocurrency can be considered an alternative investment asset, offering potential for growth and diversification of portfolios.

Fundraising

Cryptocurrency-based fundraising platforms, known as Initial Coin Offerings (ICOs), allow projects to raise capital directly from investors, bypassing traditional financial institutions.

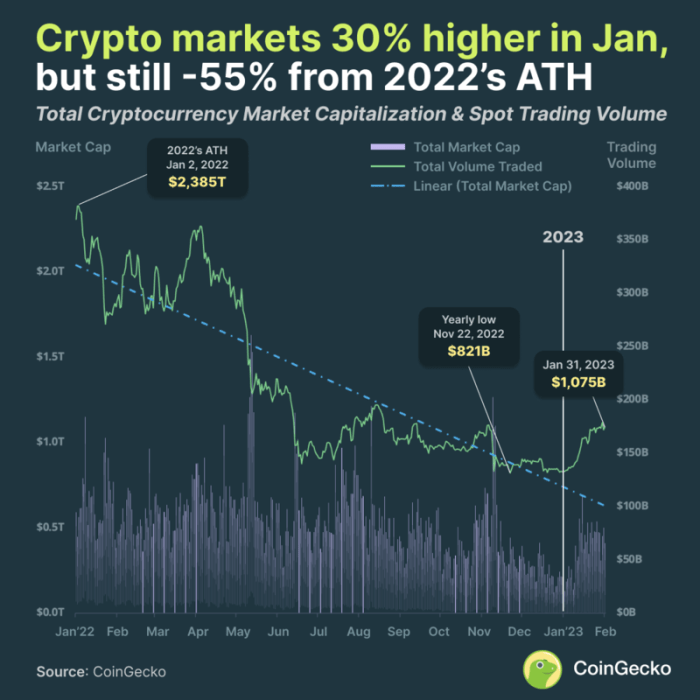

Understanding the Cryptocurrency Market

The cryptocurrency market is a dynamic and volatile space, influenced by a complex interplay of factors. Understanding these factors is crucial for navigating this exciting but unpredictable world.

Factors Influencing Cryptocurrency Prices

Cryptocurrency prices are influenced by a variety of factors, both internal and external.

- Supply and Demand:Like traditional assets, the price of a cryptocurrency is determined by the forces of supply and demand. When demand exceeds supply, prices rise, and vice versa.

- Market Sentiment:The overall sentiment of the market plays a significant role in price fluctuations. Positive news, regulatory clarity, or technological advancements can boost investor confidence and drive prices up. Conversely, negative news, regulatory uncertainty, or security breaches can lead to price drops.

- Adoption and Use Cases:The wider adoption of cryptocurrency for payments, investments, or other applications can increase demand and push prices higher.

- Technological Developments:Advancements in blockchain technology, such as improved scalability or security features, can impact the value of cryptocurrencies.

- Regulatory Environment:Government regulations and policies can significantly impact the cryptocurrency market. Clear and favorable regulations can boost investor confidence, while restrictive or uncertain regulations can dampen enthusiasm.

- Macroeconomic Factors:Global economic events, such as interest rate changes, inflation, or geopolitical tensions, can also influence cryptocurrency prices.

Market Volatility

The cryptocurrency market is known for its high volatility, characterized by rapid and significant price swings. This volatility stems from several factors:

- Decentralized Nature:Cryptocurrencies are decentralized, meaning they are not subject to the control of any central authority. This lack of regulation can lead to rapid price fluctuations.

- Limited Liquidity:Compared to traditional markets, the cryptocurrency market has limited liquidity, meaning there are fewer buyers and sellers. This can lead to large price swings in response to relatively small trading volumes.

- Speculative Trading:A significant portion of cryptocurrency trading is driven by speculation, with investors hoping to profit from short-term price movements. This can create bubbles and crashes.

- News and Events:News and events, both positive and negative, can have a dramatic impact on cryptocurrency prices, leading to sudden and sharp price swings.

Cryptocurrency Exchanges

Cryptocurrency exchanges are platforms that facilitate the buying, selling, and trading of cryptocurrencies. Different types of exchanges cater to various user needs and preferences.

- Centralized Exchanges (CEXs):These exchanges act as intermediaries between buyers and sellers, holding user funds in their custody. CEXs typically offer a wide range of cryptocurrencies, high trading volumes, and advanced trading features. Examples include Binance, Coinbase, and Kraken.

- Decentralized Exchanges (DEXs):DEXs operate on a decentralized network, eliminating the need for a central authority. Users directly interact with each other through smart contracts, offering greater privacy and control over their funds. Examples include Uniswap, PancakeSwap, and SushiSwap.

Market Capitalization

Market capitalization (market cap) is a measure of the total value of a cryptocurrency in circulation. It is calculated by multiplying the current price of a cryptocurrency by its circulating supply.

Market Cap = Price x Circulating Supply

Market cap is a key indicator of a cryptocurrency’s overall value and popularity. A higher market cap generally indicates a larger and more established cryptocurrency. However, it’s important to note that market cap alone is not a definitive measure of a cryptocurrency’s potential or value.

Investing in Cryptocurrency

Investing in cryptocurrency can be a lucrative opportunity, but it comes with significant risks. It’s crucial to understand the potential rewards and risks before making any investment decisions.

Risks and Rewards of Cryptocurrency Investments

Cryptocurrency investments are known for their volatility, which can lead to substantial profits or losses. The value of cryptocurrencies can fluctuate drastically within short periods due to various factors, including market sentiment, regulatory changes, and technological advancements.

- High Volatility:Cryptocurrency markets are highly volatile, with prices often experiencing sharp swings. This can lead to significant gains but also substantial losses in a short period.

- Market Manipulation:The relatively small size of some cryptocurrency markets can make them susceptible to manipulation, where individuals or groups can influence prices artificially.

- Security Risks:Cryptocurrencies are vulnerable to hacking and theft, as they are stored in digital wallets that can be compromised.

- Regulatory Uncertainty:The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations can impact the value of investments.

- Lack of Intrinsic Value:Unlike traditional assets like stocks or bonds, cryptocurrencies have no inherent value, and their value is solely based on market demand and speculation.

Despite these risks, cryptocurrency investments offer potential rewards:

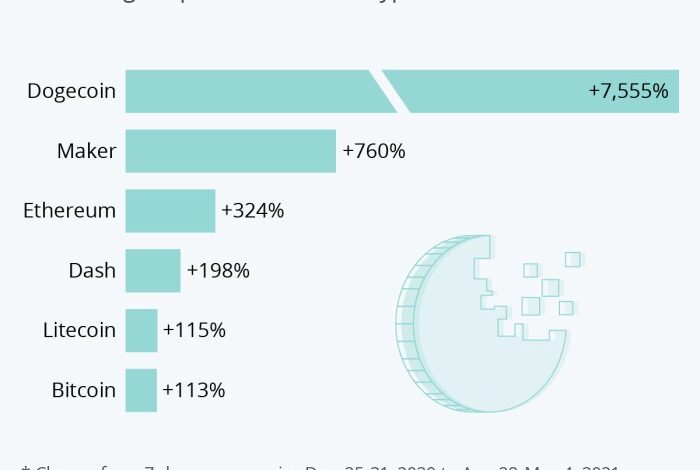

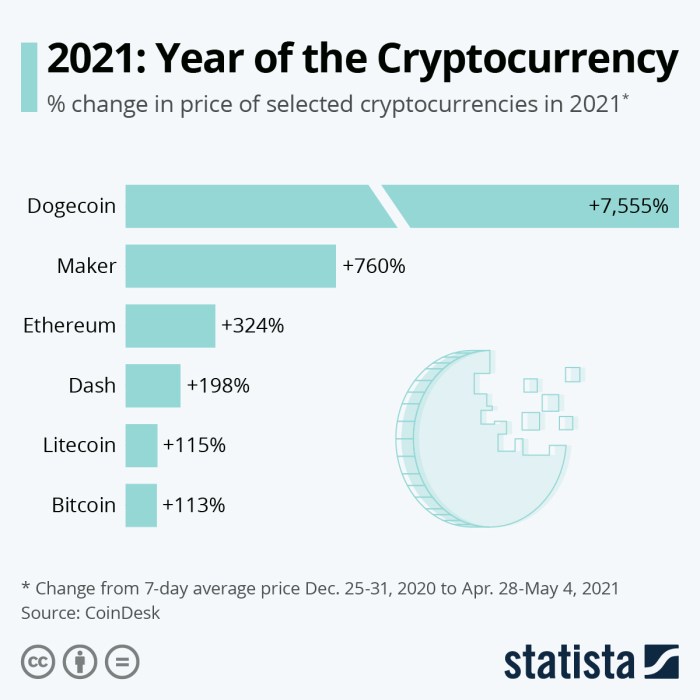

- High Potential Returns:The potential for high returns is a major attraction for investors. The value of some cryptocurrencies has skyrocketed in recent years, offering significant gains to early investors.

- Decentralization:Cryptocurrencies are decentralized, meaning they are not controlled by any central authority, which can be seen as a benefit by some investors.

- Accessibility:Investing in cryptocurrencies is relatively accessible, with many platforms allowing individuals to buy and sell cryptocurrencies with ease.

- Innovation:The cryptocurrency industry is constantly evolving, with new technologies and applications emerging regularly. This innovation can create opportunities for investors.

Investment Strategies for Cryptocurrency

There are various investment strategies for cryptocurrencies, each with its own risk profile and potential returns:

Buying and Holding

Buying and holding, also known as “hodling,” involves purchasing cryptocurrencies and holding them for the long term, regardless of short-term price fluctuations. This strategy is based on the belief that the value of cryptocurrencies will appreciate over time.

“Buy low, sell high”

The cryptocurrency market is constantly evolving, with new trends and opportunities emerging daily. Understanding the basics of crypto, like blockchain technology and how to invest safely, is essential for navigating this exciting space. But as you dive deeper, remember the importance of protecting your privacy.

A privacy policy, as explained in this article, what is a privacy policy and why is it important , is crucial for safeguarding your personal information, especially when dealing with decentralized finance platforms. With a solid understanding of both cryptocurrency trends and privacy practices, you can navigate the world of crypto confidently and securely.

Trading

Cryptocurrency trading involves buying and selling cryptocurrencies frequently to capitalize on short-term price fluctuations. This strategy requires a high level of technical analysis and market knowledge.

- Day Trading:This involves buying and selling cryptocurrencies within the same day, aiming to profit from small price movements.

- Swing Trading:This involves holding cryptocurrencies for a few days or weeks, aiming to profit from larger price swings.

- Scalping:This involves making numerous small trades, aiming to profit from very small price differences.

Staking

Staking is a process of holding cryptocurrencies in a digital wallet to support the network and earn rewards. This is similar to earning interest on a savings account.

The world of cryptocurrency is constantly evolving, with new trends emerging and market forces shifting daily. It’s important to stay informed about the latest developments, including potential risks, as we’ve seen with the recent rise of scams and fraud.

This cautionary note applies to other markets as well, such as the real estate market, where experts warn homebuyers of red flags beyond climbing interest rates. By understanding the potential pitfalls in both crypto and real estate, we can make more informed decisions and navigate these complex markets with greater confidence.

- Proof-of-Stake (PoS) Consensus:Staking is often used in cryptocurrencies that employ a Proof-of-Stake (PoS) consensus mechanism, where users who hold a certain amount of cryptocurrency can validate transactions and earn rewards.

- Staking Rewards:Staking rewards can vary depending on the cryptocurrency and the amount staked.

Diversification and Risk Management

Diversification and risk management are crucial in cryptocurrency portfolios. Diversifying your portfolio across different cryptocurrencies and asset classes can help mitigate the risks associated with individual assets.

- Diversify Across Cryptocurrencies:Invest in a variety of cryptocurrencies with different market capitalizations, use cases, and technologies.

- Consider Other Asset Classes:Diversify your portfolio beyond cryptocurrencies by including traditional assets like stocks, bonds, and real estate.

- Risk Tolerance:Determine your risk tolerance and invest accordingly. High-risk investments can offer higher potential returns but also carry a greater risk of loss.

- Dollar-Cost Averaging:This involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy helps reduce the impact of volatility and can potentially lower the average purchase price.

The Future of Cryptocurrency

The cryptocurrency landscape is constantly evolving, with new technologies and trends emerging regularly. Predicting the future of this dynamic space is challenging, but understanding the potential drivers of change can provide insights into the likely trajectory of cryptocurrency.

Regulatory Frameworks and Government Policies

Government policies and regulations play a significant role in shaping the future of cryptocurrency. Regulatory clarity can boost investor confidence and encourage innovation within the industry. Conversely, overly restrictive regulations could stifle growth and hinder mainstream adoption.

The cryptocurrency market is constantly evolving, with new trends emerging daily. Understanding the factors driving these trends, like the potential impact of Gavin Wood’s chain mergers and acquisitions , is crucial for navigating this exciting space. Whether you’re a seasoned investor or just starting your crypto journey, staying informed about market dynamics is essential for making smart decisions.

- Increased Regulation:Many governments worldwide are actively developing regulatory frameworks for cryptocurrency, aiming to balance innovation with consumer protection and financial stability. This includes establishing licensing requirements for exchanges, implementing anti-money laundering (AML) and know-your-customer (KYC) rules, and clarifying tax regulations.

- Central Bank Digital Currencies (CBDCs):Several central banks are exploring the development of their own digital currencies, which could potentially impact the cryptocurrency ecosystem. CBDCs could offer advantages such as faster and cheaper transactions, improved financial inclusion, and greater control over monetary policy.

- International Cooperation:As cryptocurrency becomes increasingly global, international cooperation on regulatory frameworks is crucial. This includes coordinating AML/KYC standards, addressing cross-border transactions, and promoting interoperability between different cryptocurrencies.

Disruption of Traditional Financial Systems

Cryptocurrency has the potential to disrupt traditional financial systems by offering alternative solutions for payments, investments, and financial services.

- Decentralized Finance (DeFi):DeFi platforms built on blockchain technology enable users to access financial services like lending, borrowing, and trading without intermediaries. This has the potential to democratize access to finance and reduce reliance on traditional institutions.

- Cross-Border Payments:Cryptocurrency can facilitate faster and cheaper cross-border payments compared to traditional methods. This could benefit businesses and individuals by reducing transaction fees and processing times.

- Investment Opportunities:Cryptocurrency offers new investment opportunities beyond traditional asset classes like stocks and bonds. However, it’s important to note that cryptocurrency investments carry significant risks due to its volatility and lack of regulation in some jurisdictions.

Cryptocurrency Facts and Statistics

The world of cryptocurrency is constantly evolving, with new technologies, trends, and adoption rates emerging all the time. To understand the current state of this dynamic industry, it’s essential to delve into some key facts and statistics. These figures offer insights into the growing adoption of cryptocurrency, the size of the market, and the ways people are using digital assets.

Key Facts and Statistics

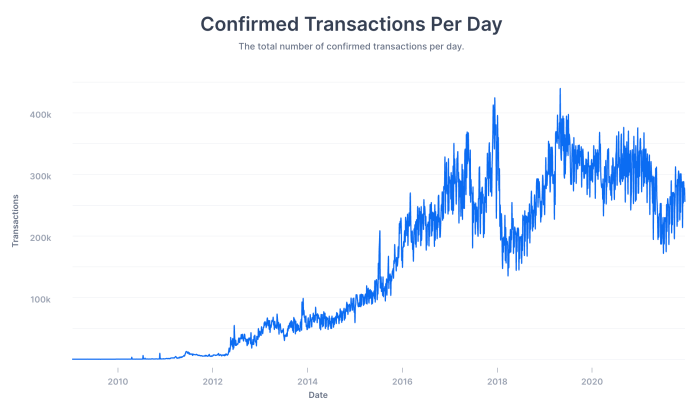

The cryptocurrency market is rapidly expanding, with a growing number of users and transactions worldwide. Here’s a table highlighting some of the key facts and statistics:

| Metric | Value |

|---|---|

| Global Cryptocurrency Market Size (2023) | $1.2 trillion |

| Number of Cryptocurrency Users Worldwide | Over 400 million |

| Average Daily Cryptocurrency Trading Volume | $100 billion |

| Percentage of Global Population Owning Cryptocurrency | Over 5% |

Top Ten Cryptocurrencies by Market Capitalization, The rise of cryptocurrency facts tips and market trends

Understanding the top ten cryptocurrencies by market capitalization provides a snapshot of the leading players in the market and their key features and use cases.

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin is often referred to as “digital gold” due to its limited supply and decentralized nature. Its primary use case is as a store of value and a means of payment.

- Ethereum (ETH): Ethereum is a platform that enables the development and execution of smart contracts and decentralized applications (dApps). It’s widely used for DeFi (Decentralized Finance) applications, NFTs (Non-Fungible Tokens), and other blockchain-based solutions.

- Tether (USDT): Tether is a stablecoin pegged to the US dollar, offering price stability and a convenient way to transact in fiat currency. It’s widely used for trading and as a bridge between fiat and cryptocurrencies.

- BNB (BNB): Binance Coin is the native token of the Binance exchange, used for trading fees, staking, and accessing exclusive features on the platform.

- USD Coin (USDC): Another stablecoin pegged to the US dollar, USD Coin is popular for its transparency and stability. It’s used for trading, payments, and as a store of value.

- XRP (XRP): XRP is designed for fast and low-cost cross-border payments, targeting financial institutions and businesses.

- Cardano (ADA): Cardano focuses on scalability and sustainability, offering a platform for smart contracts and dApps. It’s known for its rigorous development process and academic research.

- Solana (SOL): Solana is a high-performance blockchain platform known for its speed and scalability. It’s used for DeFi, NFTs, and other dApps.

- Dogecoin (DOGE): Dogecoin is a meme-inspired cryptocurrency known for its friendly community and accessibility. It’s primarily used for online payments and tipping.

- Polygon (MATIC): Polygon is a scaling solution for Ethereum, offering faster and cheaper transactions. It’s used for dApps, NFTs, and other blockchain-based projects.

Growth of Cryptocurrency Adoption

The adoption of cryptocurrency has been steadily increasing over the years, driven by factors like technological advancements, growing awareness, and increased accessibility.

[Image of a chart or graph illustrating the growth of cryptocurrency adoption over time]

The chart illustrates the increasing adoption of cryptocurrency over time. This growth is evident in the rising number of users, transactions, and overall market capitalization. The continued development of new technologies, improved user experience, and broader acceptance by businesses and institutions are expected to further drive adoption in the future.

Tips for Cryptocurrency Users

The world of cryptocurrency can be exciting and potentially lucrative, but it also comes with its share of risks. Navigating this space effectively requires a combination of knowledge, caution, and responsible practices. Here are some key tips to help you stay safe and secure while exploring the cryptocurrency landscape.

Securing Cryptocurrency Wallets

Securely storing your cryptocurrency is paramount. This involves safeguarding your wallet from unauthorized access and protecting it against potential threats.

- Choose a Strong Password and Enable Two-Factor Authentication:Use a complex password that combines upper and lowercase letters, numbers, and symbols. Enable two-factor authentication (2FA) for an extra layer of security, requiring a code from your phone or email in addition to your password.

- Store Your Private Keys Offline:Never share your private keys with anyone. Keep them in a secure offline location, ideally on a hardware wallet, which is a physical device designed to store cryptocurrency offline.

- Be Wary of Phishing Scams:Phishing attacks attempt to trick you into revealing your private keys. Be cautious of suspicious emails, links, or messages asking for your wallet information.

- Use Reputable Wallets:Choose a well-established and reputable cryptocurrency wallet provider with a proven track record of security.

Choosing and Using Cryptocurrency Exchanges

Cryptocurrency exchanges facilitate the buying, selling, and trading of digital assets. Selecting the right exchange is crucial for a smooth and secure experience.

- Research and Compare Exchanges:Look for exchanges with a good reputation, strong security features, and a user-friendly interface.

- Consider Fees and Trading Volume:Compare trading fees, withdrawal fees, and the volume of trading activity on the exchange. Higher trading volume typically indicates a more liquid market.

- Verify Exchange Security Measures:Check if the exchange has measures in place to protect user funds, such as cold storage, multi-signature wallets, and insurance.

- Enable Two-Factor Authentication:Always enable two-factor authentication on your exchange account for an extra layer of security.

Understanding the Risks Associated with Cryptocurrency Trading

The cryptocurrency market is highly volatile, and prices can fluctuate significantly. It’s essential to be aware of the risks involved before investing.

- Market Volatility:Cryptocurrency prices can rise and fall rapidly, leading to potential losses.

- Security Risks:There are inherent security risks associated with storing and trading cryptocurrency, such as hacking and theft.

- Regulatory Uncertainty:The regulatory landscape for cryptocurrency is still evolving, which can create uncertainty for investors.

- Scams and Fraud:Be wary of scams and fraudulent schemes targeting cryptocurrency investors.

- Investment Risk:Investing in cryptocurrency is a high-risk venture.

Case Studies of Cryptocurrency Adoption: The Rise Of Cryptocurrency Facts Tips And Market Trends

The world of cryptocurrency is no longer a niche concept; it’s rapidly gaining traction in various sectors, transforming how businesses operate and consumers interact with the digital economy. This section delves into real-world examples of how businesses and organizations are embracing cryptocurrency, highlighting its impact on different industries.

Adoption in the Retail Sector

The retail sector is witnessing a significant shift towards cryptocurrency adoption. Businesses are increasingly accepting cryptocurrency as a form of payment, offering customers a convenient and secure alternative to traditional payment methods.

- Starbucks:The coffee giant partnered with Bakkt, a cryptocurrency platform, to allow customers to pay for their purchases using Bitcoin. This move marked a significant step towards mainstream adoption of cryptocurrency in the retail sector.

- Microsoft:The tech giant initially accepted Bitcoin as a payment method for its digital products and services. While it later discontinued this option, it demonstrated the growing acceptance of cryptocurrency within the tech industry.

- Overstock.com:This online retailer was one of the early adopters of Bitcoin, accepting it as payment for its products. Overstock’s pioneering approach helped pave the way for other retailers to embrace cryptocurrency.

Cryptocurrency’s Impact on the Financial Sector

The financial sector is undergoing a dramatic transformation as cryptocurrency adoption gains momentum. Blockchain technology, the underlying framework for cryptocurrencies, is revolutionizing traditional financial systems, offering greater transparency, security, and efficiency.

- Ripple:This blockchain network focuses on facilitating cross-border payments, enabling faster and more cost-effective transactions compared to traditional banking systems. Ripple’s technology has been adopted by several financial institutions, including banks and money transfer companies.

- Ethereum:Ethereum’s blockchain platform allows for the development of decentralized applications (dApps), including financial applications such as lending platforms and decentralized exchanges. These dApps offer alternative financial services with greater accessibility and transparency.

- Bitcoin:Bitcoin’s decentralized nature and limited supply have made it a store of value, attracting investors seeking to diversify their portfolios. The increasing adoption of Bitcoin as a digital asset has contributed to its growing market capitalization.

Cryptocurrency’s Potential to Revolutionize the Gaming Industry

The gaming industry is on the cusp of a revolution as cryptocurrency adoption gains traction. Blockchain technology is empowering developers to create innovative gaming experiences, offering players new ways to interact with games and earn rewards.

- Axie Infinity:This blockchain-based game allows players to earn cryptocurrency by battling their digital pets, known as Axies. The game’s popularity has demonstrated the potential for cryptocurrency to create new economic models within the gaming industry.

- Decentraland:This virtual reality platform allows users to create, experience, and monetize virtual worlds using cryptocurrency. Decentraland’s metaverse offers a glimpse into the future of gaming and digital ownership.

- The Sandbox:Similar to Decentraland, The Sandbox is a metaverse platform that allows users to create and monetize their own virtual experiences using cryptocurrency. The platform’s focus on user-generated content has attracted a growing community of developers and creators.

Cryptocurrency Adoption in the Supply Chain

The supply chain is another area where cryptocurrency adoption is making a significant impact. Blockchain technology can enhance transparency, security, and efficiency in supply chain operations.

- Walmart:The retail giant has implemented blockchain technology to track its food supply chain, ensuring the safety and authenticity of its products. This initiative demonstrates the potential for cryptocurrency to improve transparency and traceability in supply chain management.

- Maersk:The shipping giant has partnered with IBM to develop a blockchain platform for tracking cargo shipments. This platform allows for real-time tracking of goods, reducing the risk of fraud and improving efficiency.

- Everledger:This company utilizes blockchain technology to track the provenance of diamonds, combating counterfeit products and ensuring ethical sourcing.