Money, Mind, and Finance: Exploring Behavioral Finance for Insight

The power of money and the mind exploring behavioral finance for financial insight – Money, Mind, and Finance: Exploring Behavioral Finance for Insight delves into the fascinating intersection of psychology and finance. It’s a journey that unveils how our thoughts, emotions, and biases shape our financial decisions, often leading us to make choices that are not in our best interest.

By understanding the principles of behavioral finance, we can gain valuable insights into our own financial behavior and make more informed decisions.

This exploration will cover topics like cognitive biases, loss aversion, the impact of wealth on happiness, and practical strategies for improving financial literacy. It’s not just about the numbers; it’s about understanding the human element that drives our financial choices.

The Mind’s Influence on Money

Our minds are not always rational when it comes to money. Cognitive biases, emotional responses, and mental shortcuts can lead us to make financial decisions that are not in our best interest. Understanding how these psychological factors influence our financial behavior is crucial for making informed and sound decisions.

Cognitive Biases and Financial Decision-Making

Cognitive biases are systematic errors in thinking that can affect our judgment and decision-making. These biases often stem from our brains’ tendency to simplify complex information and make quick decisions, even if they are not always the most logical.

- Confirmation Bias:We tend to seek out information that confirms our existing beliefs, even if it is inaccurate or incomplete. This can lead us to ignore evidence that contradicts our investment choices and hold onto losing investments for too long.

- Availability Bias:We tend to overestimate the likelihood of events that are easily recalled or vivid in our minds. This can lead us to make decisions based on anecdotal evidence or sensational news stories, rather than on sound financial analysis.

- Loss Aversion:We feel the pain of a loss more strongly than the pleasure of an equivalent gain. This can lead us to hold onto losing investments for too long, hoping to recoup our losses, or to avoid taking risks that could lead to potential gains.

Understanding the power of money and the mind is crucial in navigating the financial landscape. Behavioral finance teaches us that emotions can drive irrational decisions, leading to costly mistakes. The recent federal reserve report on SVB collapse highlights mismanagement and supervisory failures , highlighting the role of risk appetite and poor decision-making, reinforces this point.

By studying behavioral finance, we can gain valuable insights into how to manage our own financial behavior and make informed decisions, avoiding costly pitfalls.

- Overconfidence Bias:We tend to overestimate our abilities and knowledge, leading to excessive risk-taking or poor investment choices. This bias can be particularly dangerous in the financial markets, where it can lead to overtrading or making decisions based on incomplete information.

The Role of Emotions in Investment Choices, The power of money and the mind exploring behavioral finance for financial insight

Emotions play a significant role in our financial decisions. Fear, greed, and anxiety can cloud our judgment and lead us to make impulsive or irrational choices.

- Fear:Fear can lead us to sell investments during market downturns, even if the underlying fundamentals remain strong. This can result in losses and missed opportunities for long-term growth.

- Greed:Greed can lead us to chase high returns, taking on excessive risk or investing in speculative assets. This can lead to significant losses if the market turns sour.

- Anxiety:Anxiety can lead to indecisiveness and procrastination, delaying important financial decisions. This can result in missed opportunities or a lack of preparedness for future financial needs.

Framing Effects and Anchoring Bias

The way information is presented can significantly influence our decisions. Framing effects and anchoring bias are two common psychological phenomena that can impact our financial behavior.

- Framing Effects:The way in which information is framed or presented can influence our choices, even if the underlying information is the same. For example, a 20% discount on a product may seem more appealing than a $20 discount, even though they are financially equivalent.

- Anchoring Bias:We tend to rely too heavily on the first piece of information we receive, even if it is irrelevant or inaccurate. This can lead us to set unrealistic financial goals or make investment decisions based on outdated information.

Cognitive Biases and Their Effects on Financial Behavior

| Cognitive Bias | Effect on Financial Behavior | Example |

|---|---|---|

| Confirmation Bias | Ignoring evidence that contradicts existing beliefs, leading to holding onto losing investments | An investor who believes a particular stock will rise continues to invest in it despite negative news, hoping to prove their initial belief correct. |

| Availability Bias | Overestimating the likelihood of events that are easily recalled, leading to impulsive decisions | An investor invests in a company based on a recent news story about its success, without considering the company’s long-term prospects. |

| Loss Aversion | Holding onto losing investments for too long, hoping to recoup losses | An investor refuses to sell a stock that has lost value, hoping to regain their initial investment, even though it may be a better decision to cut their losses. |

| Overconfidence Bias | Overestimating abilities and knowledge, leading to excessive risk-taking | A trader believes they can consistently outperform the market and takes on excessive leverage, risking significant losses. |

| Framing Effects | Making decisions based on the way information is presented, even if the underlying information is the same | An investor is more likely to invest in a fund that is described as having a “high potential for growth” than one described as having a “high risk of loss,” even though the underlying investments are the same. |

| Anchoring Bias | Relying too heavily on the first piece of information received, even if it is irrelevant | An investor sets an investment goal based on their initial investment amount, even though their financial situation has changed. |

The Power of Money and Its Impact on Behavior

Money, a ubiquitous element in modern society, exerts a profound influence on our behavior, shaping our perceptions, decisions, and even our well-being. Its presence, or lack thereof, can alter our view of value, trigger emotional responses, and impact our overall happiness.

The Influence of Money on Perception of Value

Money acts as a universal measure of value, allowing us to compare and quantify the worth of different goods and services. However, its influence can distort our perception of true value, leading to biases in our decision-making. For example, the price of a product can be interpreted as a proxy for its quality, even though this correlation may not always hold true.

Understanding the power of money and the mind is crucial for navigating the financial world. Behavioral finance helps us uncover the psychological biases that can influence our investment decisions, reminding us that markets are driven by human emotions. The recent news that Dow futures dipped as Disney reported losses and inflation data loomed highlights the impact of investor sentiment on market movements.

By understanding these psychological forces, we can make more informed and rational choices, ultimately achieving our financial goals.

We may be more likely to perceive an expensive product as being of higher quality than a cheaper alternative, even if their actual quality is comparable. This phenomenon, known as the “price-quality heuristic,” can lead us to overvalue expensive items and undervalue cheaper ones.

Understanding the power of money and the mind through behavioral finance can help us make smarter financial decisions. It’s fascinating how our emotions and biases can influence our choices, and how companies like Netflix have mastered the art of navigating these waters.

Take a look at this insightful article on Netflix’s success in adapting to social and political issues , which offers valuable insights from a corporate board veteran. Learning from these examples can empower us to make more informed choices about our own financial well-being, whether it’s investing, saving, or simply managing our daily spending.

Loss Aversion and Its Implications for Financial Choices

Loss aversion, a fundamental principle in behavioral finance, highlights our tendency to feel the pain of a loss more acutely than the pleasure of an equivalent gain. This psychological bias can have significant implications for our financial choices. For instance, we may be more likely to hold onto a losing investment, hoping for a recovery, rather than selling it and accepting the loss.

This reluctance to cut our losses can lead to further financial losses.

The Relationship Between Money and Happiness

While money can provide a sense of security and freedom, its relationship with happiness is complex and multifaceted. The concept of diminishing marginal utility of wealth suggests that the increase in happiness derived from each additional unit of wealth diminishes as our wealth increases.

This means that the first few dollars we earn bring us a greater sense of happiness than subsequent dollars. While money can certainly contribute to well-being, research suggests that beyond a certain threshold, its impact on happiness plateaus.

Psychological Consequences of Wealth and Poverty

The presence or absence of wealth can have profound psychological consequences, influencing our self-esteem, social interactions, and overall well-being. | Psychological Consequences | Wealth | Poverty ||—|—|—|| Self-Esteem| Increased confidence and self-worth | Decreased self-worth and feelings of inadequacy || Social Interactions| Greater social acceptance and opportunities for networking | Social isolation and limited opportunities for social mobility || Stress and Anxiety| Increased stress related to managing wealth and investments | Increased stress related to financial insecurity and lack of resources || Happiness and Well-being| Greater overall happiness and well-being (up to a certain threshold) | Decreased overall happiness and well-being || Health| Improved physical and mental health | Increased risk of physical and mental health problems |

Behavioral Finance and Financial Insight

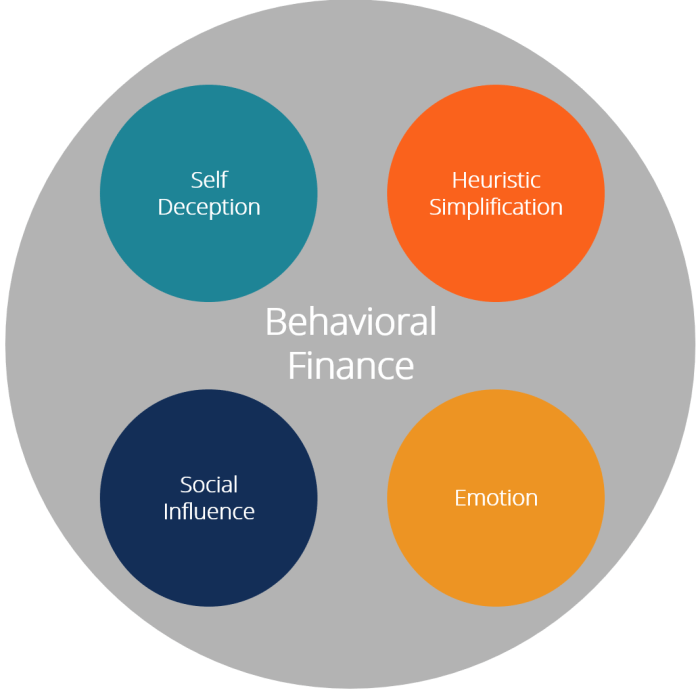

Behavioral finance is a field that combines psychology and economics to understand how people make financial decisions. It acknowledges that human beings are not always rational and that emotions, biases, and heuristics can significantly influence our choices. By recognizing these cognitive biases, we can gain valuable financial insights and make more informed decisions.

Key Principles of Behavioral Finance

Behavioral finance highlights several key principles that can improve financial decision-making. Understanding these principles can help us make more rational choices and avoid common pitfalls.

- Loss Aversion: We tend to feel the pain of a loss more strongly than the pleasure of an equivalent gain. This can lead to holding onto losing investments for too long, hoping for a recovery, or avoiding taking risks that could potentially lead to higher returns.

- Overconfidence: We often overestimate our abilities and knowledge, leading to poor investment choices. We might think we can predict market trends or pick winning stocks better than professionals, which can result in risky decisions and financial losses.

- Herding: We tend to follow the crowd, even if it means going against our own judgment. This can lead to investing in assets that are already overvalued or selling assets that are undervalued, simply because others are doing the same.

- Framing Effects: The way information is presented can influence our choices. For example, a loss of 5% might seem less significant than a gain of 5%, even though the financial impact is the same.

Applying Behavioral Finance to Financial Decisions

Behavioral finance provides valuable insights that can be applied to various aspects of financial decision-making, including investing, saving, and spending.

- Investing: By understanding our biases, we can avoid making impulsive decisions based on emotions or market hype. We can also diversify our portfolios to mitigate risk and avoid over-concentration in specific assets. For example, recognizing our tendency to overestimate our abilities, we can choose to invest in a diversified index fund rather than trying to pick individual stocks.

- Saving: Behavioral finance can help us develop effective saving strategies. By automating our savings, we can avoid procrastination and ensure that we are regularly putting money aside for our financial goals. We can also use techniques like mental accounting to make saving more appealing, such as setting aside money for specific purposes, like a down payment on a house or a future vacation.

- Spending: Behavioral finance can help us manage our spending habits. By understanding our triggers for impulsive purchases, we can develop strategies to resist them. For example, we can use budgeting tools to track our spending and identify areas where we can cut back.

We can also use techniques like pre-commitment, such as signing up for a gym membership or a meal delivery service, to make it harder to deviate from our goals.

Financial Education and Mitigating Cognitive Biases

Financial education plays a crucial role in mitigating the negative impacts of cognitive biases. By understanding how our minds work and the common pitfalls we face, we can make more informed and rational financial decisions.

- Financial Literacy: Learning about basic financial concepts, such as budgeting, saving, investing, and debt management, can equip us with the knowledge to make informed choices. This knowledge can help us recognize and avoid common biases, such as overconfidence or loss aversion.

- Understanding Risk: Financial education can help us understand the different types of risk involved in financial decisions. This understanding can help us make more informed choices about how much risk we are willing to take, based on our individual circumstances and financial goals.

- Developing a Long-Term Perspective: Financial education can help us develop a long-term perspective on our finances. This can help us avoid making impulsive decisions based on short-term market fluctuations or emotional reactions. We can focus on building a solid financial foundation for the future, rather than chasing quick profits.

Strategies for Overcoming Behavioral Obstacles

While cognitive biases can be challenging to overcome, several strategies can help us manage their influence on our financial decisions.

- Seek Professional Advice: Consulting with a financial advisor can provide an objective perspective and help us make more informed decisions. A financial advisor can help us develop a financial plan, assess our risk tolerance, and choose appropriate investments.

- Use Behavioral Finance Tools: There are various tools and resources available to help us manage our biases. These tools can provide insights into our spending habits, track our investments, and help us develop more effective financial plans.

- Practice Mindfulness: Being mindful of our emotions and biases can help us make more rational decisions. We can take time to reflect on our choices, consider the potential consequences, and avoid making impulsive decisions based on fear or greed.

Applications of Behavioral Finance: The Power Of Money And The Mind Exploring Behavioral Finance For Financial Insight

Behavioral finance is a field that combines psychology and economics to understand how human emotions and cognitive biases influence financial decision-making. This understanding can be applied to various areas, from designing financial products to improving financial education and marketing.

Designing Financial Products and Services

Behavioral finance principles can be used to design financial products and services that are more appealing and effective for consumers. By understanding the common biases that influence financial decisions, financial institutions can create products that are more likely to meet the needs and preferences of their target market.

- Default Options:Offering a default option that is aligned with the long-term financial goals of consumers, such as automatically enrolling employees in a retirement savings plan with a default contribution rate, can increase participation and savings.

- Framing Effects:Presenting information in a way that highlights the positive aspects of a product or service, such as emphasizing the potential returns of an investment rather than the risks, can make it more appealing to consumers.

- Loss Aversion:Consumers are more sensitive to losses than gains. Therefore, financial products that emphasize the potential for losses can be more effective in motivating consumers to take action, such as paying down debt or saving for retirement.

Improving Financial Literacy and Education

Behavioral finance can be used to improve financial literacy and education by addressing the cognitive biases that hinder financial decision-making.

- Overconfidence Bias:People often overestimate their abilities and knowledge, leading to poor financial decisions. Education programs can help people to understand their limitations and to make more informed choices.

- Availability Heuristic:People tend to overestimate the likelihood of events that are easily recalled or vivid in their minds. Education programs can help people to recognize the influence of this bias and to make decisions based on objective data.

- Anchoring Bias:People tend to rely too heavily on the first piece of information they receive, even if it is irrelevant. Education programs can help people to be more critical of the information they receive and to consider multiple perspectives.

Ethical Implications of Using Behavioral Finance in Financial Marketing

While behavioral finance can be used to create more effective financial products and services, it is important to consider the ethical implications of using these techniques in financial marketing.

- Transparency:It is important to be transparent about the use of behavioral finance techniques in marketing materials. Consumers should be informed about how these techniques are being used to influence their decisions.

- Fairness:Financial institutions should use behavioral finance techniques in a way that is fair and equitable. They should avoid exploiting consumers’ biases or creating products that are harmful to their financial well-being.

- Consumer Protection:Financial institutions should prioritize consumer protection and ensure that their products and services are designed to meet the needs of their target market.

Case Study: Behavioral Finance in Retirement Planning

A study by the Center for Retirement Research at Boston College found that individuals who are automatically enrolled in a retirement savings plan with a default contribution rate are more likely to save for retirement. This is because automatic enrollment takes advantage of the status quo bias, which is the tendency for people to stick with the default option.

The study also found that individuals who are presented with a choice architecturethat makes it easy to save for retirement, such as offering a variety of investment options and providing clear and concise information about the benefits of saving, are more likely to participate in retirement savings plans.