AI in Finance: Unveiling Risks and Opportunities

The impact of artificial intelligence on the financial system unveiling potential risks is a topic that’s both exciting and concerning. As AI rapidly evolves, its influence on various sectors, including finance, is undeniable. The financial system, the backbone of modern economies, is undergoing a significant transformation as AI finds its way into everything from fraud detection to algorithmic trading.

While AI promises efficiency and accuracy, it also presents potential risks that need careful consideration.

From automating complex tasks to analyzing vast amounts of data, AI is changing the landscape of finance. AI-powered applications are already being used to detect fraudulent transactions, manage risk, optimize investment strategies, and even provide personalized financial advice. These applications have the potential to streamline processes, reduce human error, and enhance the customer experience.

However, the integration of AI into financial systems also brings with it a set of challenges and risks that we must address.

The Impact of Artificial Intelligence on the Financial System

The world is witnessing an unprecedented surge in the development and application of Artificial Intelligence (AI). From self-driving cars to personalized healthcare, AI is rapidly transforming various industries, and the financial sector is no exception. The financial system, as the backbone of modern economies, plays a crucial role in facilitating economic growth, managing risk, and allocating capital.

The integration of AI into this intricate system is generating both immense opportunities and potential risks that require careful consideration.

AI’s Influence on Financial Operations

The integration of AI into financial operations is reshaping the way institutions conduct business. Here’s a breakdown of key areas where AI is making its mark:

- Fraud Detection:AI algorithms can analyze vast amounts of data to identify patterns and anomalies that indicate fraudulent activity, helping banks and financial institutions prevent financial losses and protect customers. For example, AI-powered systems can detect unusual spending patterns, identify fake identities, and flag suspicious transactions in real-time, enhancing security measures.

- Risk Management:AI can assist in assessing and managing financial risks more effectively. By analyzing historical data and market trends, AI algorithms can identify potential risks, predict market volatility, and develop strategies to mitigate these risks. This allows financial institutions to make informed decisions about investments, lending, and trading.

- Personalized Financial Services:AI-powered chatbots and virtual assistants are revolutionizing customer service in the financial sector. These intelligent systems can provide personalized financial advice, answer customer queries, and automate routine tasks, improving efficiency and customer satisfaction.

- Automated Trading:AI-powered algorithms can analyze market data and execute trades at lightning speed, making them ideal for high-frequency trading. This allows financial institutions to capitalize on market opportunities and optimize returns.

- Investment Management:AI is transforming the way investment decisions are made. AI-powered algorithms can analyze vast amounts of data, including financial statements, market trends, and news articles, to identify investment opportunities and manage portfolios.

AI Applications in Finance

Artificial intelligence (AI) is rapidly transforming the financial industry, bringing about significant changes in how financial institutions operate and interact with their customers. From fraud detection to investment strategies, AI is being leveraged across various aspects of finance, offering the potential for enhanced efficiency, accuracy, and customer experience.

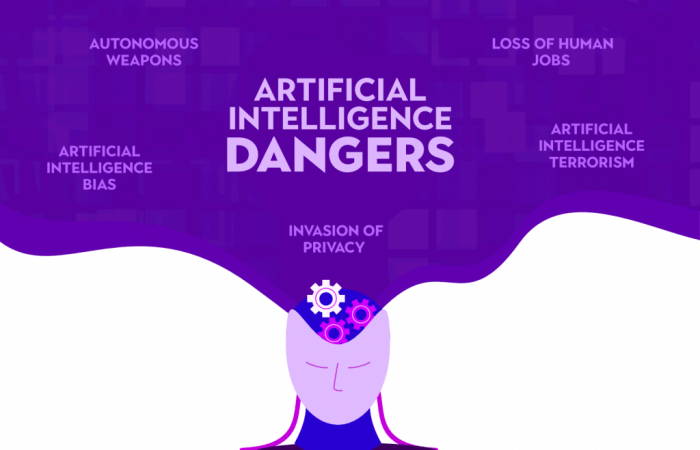

The rapid evolution of artificial intelligence (AI) is reshaping the financial landscape, offering both exciting possibilities and unsettling risks. While AI can automate tasks, improve efficiency, and enhance risk management, its integration also raises concerns about algorithmic bias, cybersecurity vulnerabilities, and the potential for market manipulation.

As we witness the US dollar holding steady amidst Fed rate hike expectations and debt ceiling optimism , it’s crucial to remember that these macro-economic shifts will be further influenced by the ever-evolving impact of AI on financial systems.

Understanding and mitigating the risks associated with AI adoption is essential to ensure a stable and secure financial future.

Fraud Detection, The impact of artificial intelligence on the financial system unveiling potential risks

AI algorithms are adept at identifying patterns and anomalies in large datasets, making them highly effective in detecting fraudulent activities. By analyzing historical data and real-time transactions, AI systems can flag suspicious behaviors and transactions that may indicate fraud. This allows financial institutions to proactively prevent fraudulent activities, minimize losses, and protect their customers.

- Real-time transaction monitoring:AI algorithms can analyze transaction data in real-time, identifying unusual patterns or deviations from normal spending habits that may indicate fraudulent activity. This enables financial institutions to take immediate action to prevent unauthorized transactions.

- Identity verification:AI-powered systems can verify the identity of customers by analyzing various data points, such as facial recognition, voice authentication, and document verification. This helps prevent identity theft and ensure that transactions are conducted by legitimate individuals.

- Anti-money laundering (AML) compliance:AI can assist financial institutions in complying with AML regulations by analyzing transactions for suspicious activities related to money laundering. AI algorithms can identify patterns and connections that may indicate money laundering, enabling financial institutions to take appropriate action.

Risk Management

AI is revolutionizing risk management in finance by enabling more sophisticated and data-driven approaches. AI algorithms can analyze vast amounts of data, including market trends, economic indicators, and customer behavior, to identify and assess potential risks. This allows financial institutions to make more informed decisions about risk mitigation strategies, portfolio allocation, and credit scoring.

- Credit risk assessment:AI algorithms can analyze a wide range of data, including credit history, income, and spending patterns, to assess the creditworthiness of borrowers. This enables financial institutions to make more accurate lending decisions and reduce the risk of loan defaults.

Artificial intelligence is transforming the financial system, automating tasks and offering new opportunities. But alongside this progress, we need to consider the potential risks. One area of concern is the impact of AI on financial stability, especially in the context of decentralized finance.

The rise of cryptocurrencies like Bitcoin, explored in detail in this insightful article bitcoins impact on the global economy dissecting the influence of cryptocurrency , has introduced new complexities to the financial landscape. Understanding these complexities is crucial as we navigate the evolving relationship between AI and finance, ensuring responsible development and mitigating potential vulnerabilities.

- Market risk analysis:AI can analyze market data, such as historical prices, news sentiment, and economic indicators, to identify potential market risks and forecast future market movements. This allows financial institutions to adjust their investment strategies and hedge against potential losses.

- Operational risk management:AI can help identify and mitigate operational risks, such as system failures, human errors, and cyberattacks. By analyzing data from various sources, AI algorithms can identify potential vulnerabilities and recommend preventive measures.

Algorithmic Trading

AI-powered algorithms are increasingly used in algorithmic trading, where computers execute trades based on pre-defined rules and strategies. These algorithms can analyze vast amounts of market data, identify trading opportunities, and execute trades at high speeds, potentially outperforming human traders in certain scenarios.

- High-frequency trading:AI algorithms can execute trades at extremely high speeds, taking advantage of small price fluctuations in the market. This allows traders to profit from short-term price movements that may be difficult for humans to detect and react to.

- Automated portfolio management:AI algorithms can manage investment portfolios based on predefined risk tolerance and investment goals. These algorithms can adjust portfolio allocations automatically based on market conditions and individual investor preferences.

- Predictive analytics:AI algorithms can analyze historical market data and other relevant factors to predict future market movements. This allows traders to make more informed investment decisions and potentially generate higher returns.

Customer Service

AI is transforming the way financial institutions interact with their customers. AI-powered chatbots and virtual assistants can provide personalized customer support, answer frequently asked questions, and resolve simple issues without the need for human intervention. This improves customer satisfaction, reduces wait times, and allows human customer service representatives to focus on more complex issues.

- Personalized recommendations:AI algorithms can analyze customer data, such as transaction history and preferences, to provide personalized financial recommendations, such as investment advice or product suggestions.

- Automated customer support:AI-powered chatbots and virtual assistants can handle routine customer inquiries, such as account balance inquiries or password resets, freeing up human customer service representatives to focus on more complex issues.

- Fraud prevention:AI can help detect fraudulent activities and prevent unauthorized access to customer accounts. This helps protect customers from financial losses and enhances their trust in the financial institution.

Potential Risks of AI in Finance

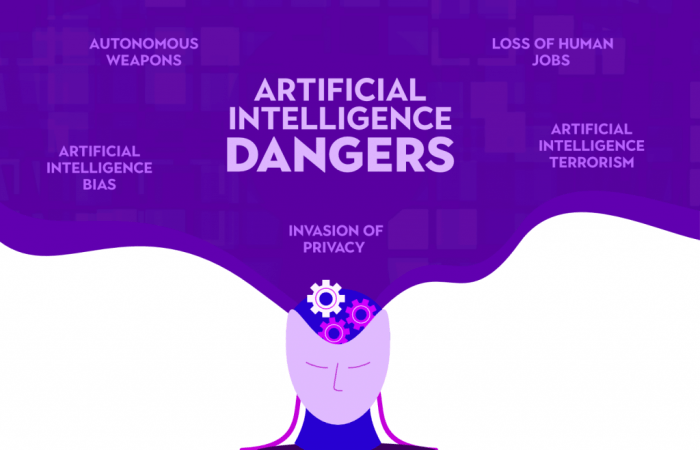

While AI promises to revolutionize the financial industry, it’s crucial to acknowledge the inherent risks associated with its integration. These risks stem from the complex nature of AI algorithms, the potential for biases, and the evolving cybersecurity landscape.

AI-Driven Biases

AI algorithms are trained on vast datasets, and if these datasets contain biases, the algorithms will inevitably reflect those biases. This can lead to discriminatory practices in lending, investment, and other financial services. For example, an AI-powered credit scoring system trained on historical data might perpetuate existing biases against certain demographics, leading to unfair lending decisions.

The rapid evolution of artificial intelligence is reshaping the financial landscape, bringing both exciting opportunities and concerning risks. As algorithms become increasingly sophisticated, they can automate tasks, enhance efficiency, and even predict market trends. However, this progress also raises questions about transparency, bias, and the potential for unforeseen consequences.

In a separate but related development, ark invest anticipates tesla cybertruck to achieve mainstream success comparable to model y , which could have a significant impact on the automotive industry. Ultimately, navigating the intersection of AI and finance requires a delicate balance between innovation and responsible implementation to ensure a stable and equitable future for all.

Algorithmic Errors

AI algorithms are complex and can be prone to errors. These errors can be caused by faulty data, flawed programming, or unforeseen interactions between different parts of the system. Algorithmic errors can lead to incorrect financial decisions, such as mispricing assets or making inaccurate predictions about market trends.

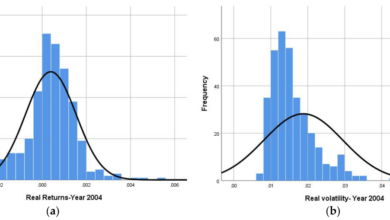

A notable example is the 2010 “Flash Crash” where algorithmic trading triggered a rapid decline in the stock market.

Cybersecurity Threats

AI systems are increasingly vulnerable to cybersecurity threats. Hackers can exploit vulnerabilities in AI algorithms to gain unauthorized access to financial data, manipulate financial markets, or disrupt financial operations. A recent example is the 2017 Equifax data breach, where hackers exploited a vulnerability in the company’s software to steal sensitive personal information, including credit card numbers and Social Security numbers.

Regulatory and Ethical Considerations: The Impact Of Artificial Intelligence On The Financial System Unveiling Potential Risks

The rapid advancement of artificial intelligence (AI) in the financial sector necessitates a comprehensive regulatory framework and a thorough examination of ethical implications. While AI offers significant potential for innovation and efficiency, it also poses unique challenges that require careful consideration.

Regulatory Landscape

The regulatory landscape surrounding AI in finance is evolving rapidly. Regulators worldwide are grappling with the complexities of AI, aiming to balance its potential benefits with the need to mitigate risks. The focus is on developing clear guidelines and oversight mechanisms to ensure responsible AI development and deployment.

- Transparency and Explainability: Regulators are increasingly emphasizing the need for transparency and explainability in AI algorithms. This involves understanding how AI systems arrive at their decisions, particularly in areas like credit scoring and risk assessment. This transparency fosters trust and accountability, allowing for effective oversight and responsible decision-making.

For instance, the European Union’s General Data Protection Regulation (GDPR) includes a “right to explanation” provision, requiring organizations to provide clear explanations for AI-driven decisions that significantly affect individuals.

- Data Privacy and Security: AI systems rely heavily on vast amounts of data. Regulators are focused on ensuring the secure collection, storage, and use of this data to protect individual privacy. This includes implementing robust data security measures, obtaining informed consent from individuals, and limiting data access to authorized personnel.

The GDPR and the California Consumer Privacy Act (CCPA) are examples of regulations addressing data privacy and security in the context of AI.

- Algorithmic Bias and Fairness: AI systems can inherit biases from the data they are trained on. Regulators are addressing concerns about algorithmic bias, ensuring fairness and non-discrimination in financial services. This involves identifying and mitigating potential biases in AI models, promoting equitable access to financial products and services, and ensuring that AI systems do not perpetuate existing social inequalities.

For instance, the U.S. Equal Credit Opportunity Act (ECOA) prohibits discrimination in lending based on protected characteristics, which is relevant to AI-powered credit scoring systems.

- Financial Stability and Risk Management: Regulators are examining the potential impact of AI on financial stability and risk management. This involves assessing the risks associated with AI-driven trading algorithms, automated decision-making, and the potential for systemic failures. Regulators are developing frameworks for managing these risks, ensuring that AI systems do not amplify financial instability or create new vulnerabilities.

Ethical Considerations

The use of AI in finance raises a number of ethical considerations that require careful attention. These considerations go beyond legal requirements and encompass the broader societal impact of AI.

- Job Displacement: AI automation has the potential to displace human workers in various roles within the financial sector. This raises concerns about unemployment, economic inequality, and the need for retraining and reskilling programs. For example, AI-powered chatbots and robo-advisors are already replacing some traditional customer service and financial advisory roles.

Ethical considerations include ensuring that AI-driven job displacement is managed responsibly, with adequate support for affected workers.

- Data Privacy and Security: The use of personal data in AI systems raises concerns about data privacy and security. It is crucial to ensure that data is collected, stored, and used ethically, respecting individual rights and minimizing the risk of data breaches. This includes obtaining informed consent from individuals, implementing robust data security measures, and limiting data access to authorized personnel.

- Algorithmic Transparency and Explainability: AI algorithms can be complex and opaque, making it challenging to understand how they arrive at their decisions. This lack of transparency raises concerns about accountability and the potential for bias or unfair treatment. Ethical considerations include promoting algorithmic transparency, providing explanations for AI-driven decisions, and ensuring that these decisions are fair and unbiased.

This transparency allows for greater trust and accountability in AI systems.

- Algorithmic Bias and Fairness: AI systems can inherit biases from the data they are trained on, potentially leading to unfair or discriminatory outcomes. Ethical considerations include identifying and mitigating biases in AI models, ensuring fairness and non-discrimination in financial services, and promoting equitable access to financial products and services.

This involves actively addressing bias in training data and developing AI systems that are fair and equitable.

Solutions and Best Practices

To mitigate risks and ensure responsible AI development and deployment, it is crucial to implement solutions and best practices that address both regulatory and ethical considerations.

- Collaboration and Partnerships: Collaboration between regulators, industry stakeholders, researchers, and ethicists is essential for developing effective guidelines and best practices for AI in finance. This collaboration can foster knowledge sharing, identify emerging risks, and develop solutions to address ethical challenges.

- Transparency and Explainability: Organizations should prioritize transparency and explainability in AI systems. This involves providing clear documentation of algorithms, data sources, and decision-making processes. It also includes developing methods for explaining AI-driven decisions to users and stakeholders, promoting trust and accountability. For example, providing explanations for credit scoring decisions can help users understand the factors that influence their creditworthiness.

- Data Privacy and Security: Organizations should implement robust data privacy and security measures to protect sensitive information. This includes obtaining informed consent from individuals, encrypting data, limiting access to authorized personnel, and conducting regular security audits. Organizations should also comply with relevant data privacy regulations, such as GDPR and CCPA.

- Algorithmic Bias Mitigation: Organizations should actively identify and mitigate biases in AI models. This involves using diverse and representative training data, employing bias detection tools, and conducting fairness audits. It is also important to develop AI systems that are transparent and explainable, allowing for the detection and correction of biases.

- Ethical Frameworks and Principles: Organizations should adopt ethical frameworks and principles for AI development and deployment. These frameworks can guide decision-making, ensure responsible use of AI, and promote ethical considerations throughout the AI lifecycle. Examples of ethical frameworks include the ACM Code of Ethics and the IEEE Global Initiative on Ethical Considerations in Artificial Intelligence and Autonomous Systems.

Future Trends and Implications

The rapid evolution of AI technologies promises to reshape the financial landscape in profound ways. Understanding these emerging trends is crucial for navigating the future of finance and its impact on individuals, institutions, and markets.

The Rise of Explainable AI (XAI)

The increasing complexity of AI models often leads to a lack of transparency in their decision-making processes. This opacity can be problematic in finance, where trust and accountability are paramount. Explainable AI (XAI) aims to address this challenge by developing AI systems that can provide clear and understandable explanations for their decisions.

XAI will be instrumental in building trust in AI-driven financial solutions and ensuring regulatory compliance.

The Growing Importance of Data Privacy and Security

As AI becomes more deeply integrated into the financial system, safeguarding data privacy and security becomes increasingly critical. The use of sensitive financial data by AI algorithms raises concerns about potential misuse, data breaches, and privacy violations. Effective data governance frameworks, robust security measures, and transparent data usage policies will be essential for mitigating these risks and maintaining public confidence in AI-powered finance.

The Potential for AI-Driven Financial Inclusion

AI has the potential to revolutionize financial inclusion by providing access to financial services for underserved populations. AI-powered platforms can automate loan applications, assess creditworthiness, and deliver financial products to individuals who may have been previously excluded from traditional banking systems.

This could have a transformative impact on economic development and social mobility.

The Evolving Relationship Between AI and Human Decision-Making in Finance

AI is not intended to replace human decision-making in finance but rather to augment it. The future of finance will likely involve a collaborative relationship between AI and humans, where AI provides data-driven insights and analysis, while humans retain the responsibility for strategic decision-making and ethical oversight.

This approach will leverage the strengths of both AI and human intelligence to create a more robust and responsible financial system.

The Long-Term Impact of AI on Financial Markets, Institutions, and Individuals

The long-term impact of AI on the financial system is multifaceted and complex. AI is likely to reshape financial markets by introducing new trading strategies, automating investment decisions, and potentially creating new financial products. Financial institutions will need to adapt to the changing landscape by investing in AI technologies, developing new business models, and retraining their workforce.

Individuals will have access to more personalized financial services, but they will also need to navigate the potential risks associated with AI, such as data privacy and job displacement.