The Fed Battles Inflation: Rate Cuts Considered

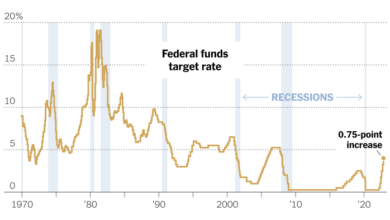

The federal reserves battle against inflation continues with rate cut considerations – The Federal Reserve’s battle against inflation continues with rate cut considerations, a move that could have profound implications for the economy. The Fed faces a delicate balancing act, attempting to tame rising prices without triggering a recession. This high-stakes game of economic chess is playing out against a backdrop of persistent inflation, fueled by factors like supply chain disruptions and strong consumer demand.

The Fed’s dual mandate – to maintain price stability and foster maximum employment – is at the heart of this challenge. As inflation erodes purchasing power and weighs on businesses, the Fed must carefully weigh the potential benefits of rate cuts against the risks of exacerbating inflation or weakening the economy.

Alternative Strategies for Addressing Inflation: The Federal Reserves Battle Against Inflation Continues With Rate Cut Considerations

The Federal Reserve’s primary tool for combating inflation is adjusting interest rates. However, in certain situations, rate cuts might not be the most effective or desirable approach. This necessitates exploring alternative strategies that the Federal Reserve could consider to address inflation.

Fiscal Policy Measures

Fiscal policy, which involves government spending and taxation, can play a significant role in managing inflation.

- Increased Taxes:Raising taxes can reduce disposable income, thereby curbing consumer spending and demand-pull inflation. For example, increasing taxes on luxury goods or high-income earners can help to reduce overall demand and cool down the economy.

- Reduced Government Spending:Decreasing government spending can have a similar effect to raising taxes, as it reduces the overall level of economic activity and demand. This could involve cutting back on non-essential government programs or delaying infrastructure projects.

Targeted Interventions

Targeted interventions focus on specific sectors or industries driving inflation.

- Price Controls:Implementing price controls on essential goods, such as food and energy, can directly limit inflation in those sectors. However, price controls can lead to shortages and distortions in the market.

- Supply Chain Interventions:Addressing supply chain bottlenecks, such as those experienced during the COVID-19 pandemic, can help alleviate inflationary pressures. This might involve providing incentives for increased production or streamlining logistical processes.

Potential Effectiveness and Risks, The federal reserves battle against inflation continues with rate cut considerations

The effectiveness and risks associated with alternative strategies vary depending on the specific measure and the underlying economic conditions.

- Fiscal Policy:Fiscal policy can be effective in managing inflation, but it can also be politically challenging to implement. Tax increases or spending cuts can be unpopular, and there is a risk of unintended consequences on economic growth.

- Targeted Interventions:Targeted interventions can be effective in addressing specific inflationary pressures, but they can also create distortions in the market and lead to unintended consequences. For example, price controls can lead to shortages and black markets.

Comparison of Policy Approaches

Comparing the potential outcomes of different policy approaches requires considering the specific context and the goals of the Federal Reserve.

- Rate Cuts vs. Fiscal Policy:Rate cuts can be more effective in stimulating economic growth, but they can also fuel inflation. Fiscal policy can be more effective in addressing specific inflationary pressures, but it can also be politically challenging to implement.

- Fiscal Policy vs. Targeted Interventions:Fiscal policy can have a broader impact on the economy, while targeted interventions can be more effective in addressing specific inflationary pressures.

The Impact on Businesses and Consumers

The Federal Reserve’s battle against inflation has far-reaching consequences for businesses and consumers alike. The Fed’s actions, particularly interest rate adjustments, influence borrowing costs, investment decisions, and pricing strategies for businesses. Meanwhile, consumers experience changes in purchasing power, savings rates, and housing affordability.

Understanding these impacts is crucial for navigating the economic landscape.

The Impact on Businesses

The Fed’s actions have a significant impact on businesses, primarily through changes in borrowing costs. When the Fed raises interest rates, it becomes more expensive for businesses to borrow money. This can discourage investment in new projects, equipment, or expansion, as the cost of financing becomes a significant factor.

Businesses may also be forced to cut back on spending, leading to slower economic growth.

- Higher Borrowing Costs:Increased interest rates make it more expensive for businesses to obtain loans, impacting their ability to invest in growth initiatives. This can lead to a decrease in capital expenditures and potentially slower economic expansion.

- Impact on Investment Decisions:Higher borrowing costs can deter businesses from investing in new projects or expanding operations. This can lead to a slowdown in economic growth and job creation.

- Pricing Strategies:Businesses may adjust their pricing strategies to offset higher borrowing costs or inflation. This can lead to higher prices for consumers, further contributing to inflation.

The Impact on Consumers

The Fed’s actions also have a significant impact on consumers, affecting their purchasing power, savings rates, and housing affordability. When interest rates rise, the cost of borrowing increases, impacting consumer spending on big-ticket items like cars and homes. Additionally, rising interest rates can lead to lower returns on savings accounts, impacting consumers’ ability to save for the future.

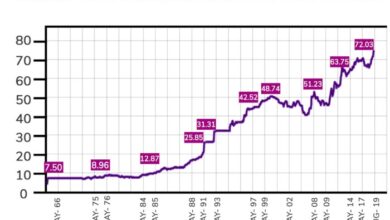

- Purchasing Power:Higher interest rates can lead to higher prices for goods and services, eroding consumer purchasing power. This can force consumers to cut back on spending, potentially leading to a slowdown in economic growth.

- Savings Rates:Rising interest rates can lead to lower returns on savings accounts, making it harder for consumers to save for retirement or other financial goals. This can discourage saving and potentially lead to higher levels of consumer debt.

- Housing Affordability:Higher interest rates can significantly impact housing affordability, making it more expensive to buy a home. This can discourage homeownership and potentially lead to a slowdown in the housing market.

The Federal Reserve’s battle against inflation continues, with rate cut considerations constantly being weighed against the potential for further economic slowdown. This delicate balancing act is further complicated by geopolitical tensions, as evidenced by China’s recent imposition of export controls on gallium and germanium , which could disrupt global semiconductor supply chains and exacerbate inflationary pressures.

The Fed’s decisions will undoubtedly be influenced by these global events, making the coming months crucial for navigating the path towards economic stability.

The Federal Reserve’s battle against inflation continues, with rate cut considerations a constant topic of discussion. While traditional markets grapple with uncertainty, the crypto world offers a potential hedge against inflation. For those looking to navigate this landscape, cryptocurrency investment strategies profitable guide for maximum returns provides valuable insights.

Understanding the potential of digital assets could be crucial as the Fed weighs its next move, impacting both traditional and crypto markets.

The Federal Reserve’s battle against inflation continues, with rate cut considerations looming. This fight against rising prices has become intertwined with the growing regulatory pressure on the cryptocurrency sector, as seen in the recent SEC lawsuit against Coinbase. This legal action highlights the increasing scrutiny of the crypto industry, which could potentially influence the Fed’s monetary policy decisions as they grapple with the complexities of inflation and the evolving digital financial landscape.