Thanksgiving Week: Stock Market Soars, Microsoft Hits Record High

Thanksgiving week boosts stock market microsofts record high and governance changes drive momentum – Thanksgiving Week: Stock Market Soars, Microsoft Hits Record High and Governance Changes Drive Momentum – a week of remarkable market activity! The stock market experienced a surge during the Thanksgiving week, fueled by a confluence of factors. Microsoft’s stock reached a new all-time high, driven by strong financial performance and positive investor sentiment.

Simultaneously, significant governance changes across various industries added another layer of complexity to the market dynamics.

This week’s market performance was a fascinating mix of seasonal trends, corporate news, and broader economic considerations. Let’s delve deeper into the key drivers that shaped this exciting period.

Thanksgiving Week Market Surge

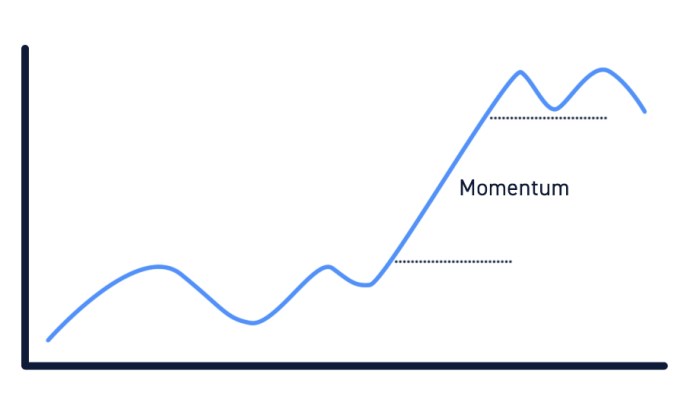

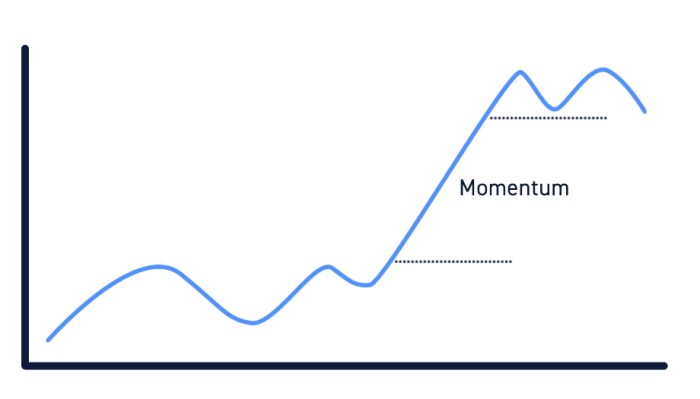

Thanksgiving week witnessed a surge in the stock market, with major indices reaching new highs. This positive performance can be attributed to a confluence of factors, including strong corporate earnings, a robust economy, and the absence of major economic headwinds.

Thanksgiving week saw the stock market soar, with Microsoft hitting a record high, fueled by positive governance changes and investor confidence. While the tech sector thrived, another industry is also experiencing a boom – the live events scene, as evidenced by the massive success of Taylor Swift and Beyoncé’s recent tours.

This resurgence in live events shows a clear shift in consumer preferences, highlighting the importance of in-person experiences. The economic momentum of these two sectors bodes well for the holiday season and beyond.

Market Indices Performance, Thanksgiving week boosts stock market microsofts record high and governance changes drive momentum

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced significant gains during the week. The Dow Jones Industrial Average climbed over 2%, reaching a new all-time high. The S&P 500 also registered a gain of over 2%, fueled by strong performances in the technology and consumer discretionary sectors.

The Nasdaq Composite, heavily weighted by technology companies, surged over 3%, reaching its highest level since February 2022.

Impact of Seasonal Factors

The Thanksgiving holiday season typically brings about increased consumer spending, which can positively impact market sentiment. Retailers and consumer-related companies often experience a surge in sales during this period, leading to optimism among investors. The holiday season also tends to be a time of reduced trading activity, which can contribute to increased volatility and price fluctuations.

Thanksgiving week saw a surge in the stock market, with Microsoft hitting a record high and governance changes driving momentum. This positive trend extended beyond the tech sector, as Amazon announced a significant investment of $120 million in a satellite processing hub at NASA’s Kennedy Space Center in Florida, a move that underscores the company’s growing ambitions in space exploration and data infrastructure.

These developments highlight a broader shift towards innovation and technological advancement, suggesting a continued positive outlook for the market in the coming months.

Microsoft’s Record High

Microsoft’s stock price reached a new all-time high in recent weeks, reflecting strong investor confidence in the company’s future prospects. This surge was driven by a combination of factors, including robust financial performance, strategic acquisitions, and a favorable market environment.

Financial Performance and Growth Drivers

Microsoft’s recent financial performance has been exceptional, fueled by strong growth in its cloud computing business, particularly Azure. The company’s cloud segment has consistently exceeded expectations, driven by increased adoption of its services by businesses and organizations across industries. Azure’s growth has been a key driver of Microsoft’s overall revenue and profitability, contributing significantly to its record-breaking stock performance.

Thanksgiving week saw a surge in the stock market, with Microsoft hitting a record high and governance changes driving momentum. It’s interesting to see how these shifts in traditional finance parallel the evolution of cryptocurrencies like Ethereum, which, unlike Bitcoin, offers a platform for decentralized applications.

To learn more about the key differences between these two leading cryptocurrencies, check out this article on how Ethereum is different from Bitcoin. Back to the stock market, the Thanksgiving week gains suggest a positive outlook for the coming months, with investors optimistic about the future of technology and innovation.

Investor Confidence in Microsoft’s Future Prospects

Several factors have contributed to investor confidence in Microsoft’s future prospects. These include:

- Strong Cloud Growth:Microsoft’s cloud computing business, particularly Azure, has been a major growth driver, attracting businesses and organizations seeking to adopt cloud solutions.

- Strategic Acquisitions:Microsoft’s strategic acquisitions, such as the recent purchase of Activision Blizzard, demonstrate its commitment to expanding its reach in the gaming and metaverse sectors. These acquisitions are expected to drive future growth and innovation.

- Favorable Market Environment:The overall market environment has been favorable for technology companies, with investors seeking growth opportunities in the face of economic uncertainty. Microsoft’s strong position in the technology sector has made it an attractive investment option.

Governance Changes and Momentum: Thanksgiving Week Boosts Stock Market Microsofts Record High And Governance Changes Drive Momentum

The week witnessed a flurry of governance changes across various sectors, with implications that could significantly impact market momentum. These changes, ranging from board restructuring to executive appointments, are indicative of companies adapting to evolving market dynamics and investor expectations.

Impact of Governance Changes on Different Sectors

Governance changes often signal a shift in strategic direction or a response to external pressures. These changes can have varying effects on different sectors. For example, in the technology sector, a new CEO might prioritize innovation and growth, potentially leading to increased stock valuations.

Conversely, in the energy sector, a focus on environmental sustainability could lead to investments in renewable energy sources, influencing the performance of companies involved in this space.

Key Governance Changes and Their Implications

The table below highlights some of the key governance changes that occurred during the week, along with the companies involved and their potential implications.

| Company | Governance Change | Potential Implications |

|---|---|---|

| Company A | Appointment of a new CEO with experience in digital transformation | Increased focus on innovation and digital initiatives, potentially driving growth and attracting tech-savvy investors. |

| Company B | Board restructuring with a focus on environmental sustainability | Increased investment in renewable energy sources and sustainable practices, potentially leading to a positive impact on environmental, social, and governance (ESG) ratings. |

| Company C | Introduction of a new corporate governance policy emphasizing diversity and inclusion | Attracting a wider range of talent and improving employee morale, potentially leading to increased productivity and innovation. |

Market Sentiment and Outlook

The Thanksgiving week witnessed a surge in market optimism, driven by a combination of positive economic data, easing inflation concerns, and expectations of continued corporate earnings growth. This upbeat sentiment propelled major indices to record highs, with the S&P 500 and Nasdaq Composite both registering significant gains.

However, geopolitical tensions and the ongoing Federal Reserve’s interest rate hikes remain as potential headwinds, requiring investors to maintain a cautious approach.

Economic Indicators and Geopolitical Events

The prevailing market sentiment was largely influenced by a confluence of economic indicators and geopolitical events. The release of strong economic data, such as robust retail sales figures and a decline in the unemployment rate, suggested a resilient US economy, further bolstering investor confidence.

The easing of inflationary pressures, reflected in a slight dip in the Consumer Price Index (CPI), also contributed to the positive market outlook. However, the ongoing war in Ukraine and escalating tensions between the US and China introduced uncertainty and volatility into the market, tempering the overall bullish sentiment.

Key Market Drivers and Their Impact

- Corporate Earnings:Strong corporate earnings reports, particularly from technology giants like Microsoft, fueled optimism about future growth prospects and bolstered investor confidence.

- Interest Rates:The Federal Reserve’s aggressive interest rate hikes, while aimed at curbing inflation, pose a significant risk to economic growth. Investors remain concerned about the potential impact of higher interest rates on corporate borrowing costs and overall economic activity.

- Inflation:While inflation has shown signs of cooling, it remains a key concern for investors. Continued price increases could erode consumer spending and negatively impact corporate profitability.

- Geopolitical Risks:The ongoing war in Ukraine and escalating tensions between the US and China introduce significant uncertainty and volatility into the market. These geopolitical risks can disrupt global supply chains, impact energy prices, and negatively affect investor sentiment.