Tesla Reports 27% Sales Growth in Q3, but Misses Analyst Expectations

Tesla reports 27 percent increase in 3q sales but falls short of analyst expectations – Tesla Reports 27% Sales Growth in Q3, but Misses Analyst Expectations sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Tesla, the electric vehicle giant, reported a 27% increase in sales for the third quarter, a significant jump compared to the previous quarter.

However, the company’s performance fell short of analyst expectations, raising questions about its future trajectory. This news comes amidst a period of intense competition in the EV market, with established automakers ramping up their own electric vehicle offerings.

Despite the impressive sales growth, Tesla’s stock price took a hit following the announcement. Investors were clearly disappointed by the shortfall in meeting analyst expectations, which suggests that the company may face challenges in maintaining its rapid growth pace in the coming quarters.

The company’s reliance on China, which is facing economic headwinds, is another factor that could weigh on Tesla’s future performance.

Analyst Expectations and Shortfall: Tesla Reports 27 Percent Increase In 3q Sales But Falls Short Of Analyst Expectations

While Tesla reported a 27% increase in sales for the third quarter, it fell short of analyst expectations, raising concerns about the company’s future financial performance.

Tesla’s 27% increase in 3Q sales, while impressive, fell short of analyst expectations. This news comes amidst a wave of AI-powered innovation, with Apple’s latest iPhone 15 and Series 9 watches getting a significant AI boost, as detailed in this article.

Whether these advancements will be enough to sway consumers away from Tesla’s electric vehicles remains to be seen, but it’s clear that the tech landscape is rapidly evolving, and AI is at the forefront of this change.

Analysts had anticipated a more significant jump in sales, with estimates ranging from 30% to 40%. This expectation was fueled by the company’s strong previous quarter performance and the ongoing global demand for electric vehicles. However, Tesla’s actual sales growth fell short of these projections, leading to a decline in the company’s stock price.

Tesla’s 27 percent increase in third-quarter sales, while impressive, fell short of analyst expectations. It seems like even the electric car giant isn’t immune to global economic headwinds. Meanwhile, Canada’s July trade deficit was smaller than anticipated, likely due to the impact of the recent port strike, as reported here.

The impact of these events on Tesla’s future performance remains to be seen, but it’s clear that the company faces a complex landscape.

Reasons for Shortfall

Several factors contributed to the shortfall in meeting analyst expectations.

- Supply Chain Challenges:Tesla, like many other manufacturers, continues to face supply chain disruptions, particularly in procuring key components like semiconductors. These challenges have hampered the company’s production capacity, limiting its ability to meet the growing demand for its vehicles.

- Increased Competition:The electric vehicle market is becoming increasingly competitive, with established automakers like Ford and General Motors making significant investments in EV production. This intensified competition has put pressure on Tesla to maintain its market share and sales growth.

- Economic Headwinds:Global economic uncertainty, including rising inflation and interest rates, has impacted consumer spending, potentially affecting demand for high-priced vehicles like Teslas.

Potential Implications for Tesla’s Future Financial Performance, Tesla reports 27 percent increase in 3q sales but falls short of analyst expectations

The shortfall in meeting analyst expectations raises questions about Tesla’s future financial performance.

Tesla’s 27% increase in third-quarter sales, while impressive, fell short of analyst expectations. This news comes as Argentina faces critical IMF talks to resolve its looming debt crisis, a situation that could have significant global repercussions. It’s a reminder that even with impressive growth, Tesla, like many global companies, is susceptible to the economic and political headwinds facing various countries around the world.

- Impact on Stock Price:The company’s stock price has been volatile in recent months, and the shortfall in sales growth could further exacerbate this volatility. Investors may become more cautious about Tesla’s future prospects, leading to a decline in stock value.

- Pressure on Profitability:To maintain its growth trajectory, Tesla may need to adjust its pricing strategy or increase production efficiency. This could potentially impact the company’s profitability margins, particularly in a challenging economic environment.

- Increased Competition:The shortfall in sales growth could embolden Tesla’s competitors, who may be more aggressive in their marketing and pricing strategies. This could put further pressure on Tesla to maintain its market share and profitability.

Key Factors Influencing Sales

Tesla’s 27% increase in third-quarter sales, although falling short of analyst expectations, reflects a complex interplay of factors. While the electric vehicle market is booming, Tesla faces challenges like supply chain disruptions and rising costs, all while navigating a competitive landscape.

This analysis delves into the key factors driving Tesla’s sales growth, exploring the impact of external pressures and the company’s strategic response.

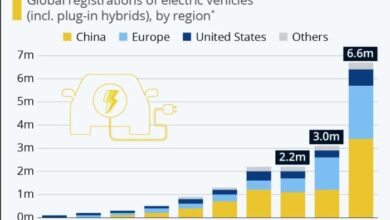

The Electric Vehicle Market Trend

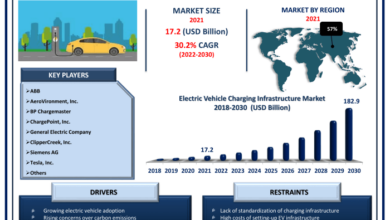

The global electric vehicle market is experiencing rapid growth, driven by increasing consumer awareness of environmental concerns, government incentives, and technological advancements. Tesla, a pioneer in the electric vehicle sector, benefits from this trend, as consumers increasingly opt for sustainable transportation solutions.

The company’s early entry and established brand recognition have positioned it as a leader in the market, attracting a loyal customer base.

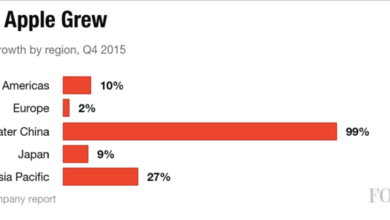

Regional Sales Performance

Tesla’s sales growth in the third quarter was not uniform across all regions. While the company experienced strong growth in some markets, others saw more modest gains. This regional variation highlights the diverse market dynamics that Tesla operates within.

Sales Performance by Region

The regional breakdown of Tesla’s sales performance reveals significant disparities.

- United States:Tesla’s largest market, the United States, saw a 24% increase in sales, contributing significantly to the overall growth. This growth can be attributed to strong demand for Tesla’s electric vehicles, particularly the Model Y, which continues to be a popular choice among American consumers.

The company’s ongoing expansion of its Supercharger network and its commitment to local manufacturing have also played a role in boosting sales in the US.

- China:Tesla’s second-largest market, China, experienced a more modest 3% growth in sales. This slower growth can be attributed to several factors, including increased competition from local electric vehicle manufacturers, ongoing supply chain challenges, and a challenging economic environment. Despite these headwinds, Tesla’s sales in China remain strong, reflecting the country’s growing demand for electric vehicles.

- Europe:Tesla’s European sales surged by 45% in the third quarter. This impressive growth can be attributed to several factors, including the region’s strong commitment to electric vehicle adoption, the growing popularity of Tesla’s vehicles in Europe, and the company’s successful expansion of its Supercharger network across the continent.

Factors Influencing Regional Sales Performance

Several factors influence regional sales performance, including:

- Government incentives:Governments around the world are offering incentives to encourage the adoption of electric vehicles. These incentives can vary significantly from country to country, impacting Tesla’s sales performance. For example, the US government offers tax credits for electric vehicle purchases, while China has implemented a quota system requiring automakers to sell a certain percentage of electric vehicles.

- Consumer preferences:Consumer preferences for electric vehicles vary significantly across regions. In some markets, like Norway, electric vehicles are already mainstream, while in other markets, they are still a niche product. Tesla’s sales performance is directly impacted by the level of consumer adoption in each region.

- Competition:Tesla faces intense competition from both established automakers and new entrants in the electric vehicle market. The level of competition varies significantly from region to region, impacting Tesla’s sales performance. For example, Tesla faces stiff competition from local electric vehicle manufacturers in China, while its competition is more limited in the United States.

- Infrastructure:The availability of charging infrastructure is a critical factor for electric vehicle adoption. Tesla has invested heavily in its Supercharger network, which gives it a competitive advantage in markets with limited public charging infrastructure. However, the availability of charging infrastructure varies significantly across regions, impacting Tesla’s sales performance.