Tesla Offers Year-End Incentives to Boost EV Sales

Tesla offers year end incentives to drive sales in tight ev market – Tesla Offers Year-End Incentives to Boost EV Sales in a Tight Market. The electric vehicle (EV) market is heating up, with competition intensifying and consumers becoming increasingly price-sensitive. In response, Tesla, the leading EV manufacturer, has announced a series of year-end incentives designed to drive sales and maintain its market share.

These incentives, which include price reductions, extended warranties, and financing options, are aimed at attracting both new and existing customers. This move comes at a time when Tesla is facing increasing pressure from established automakers like Ford and General Motors, as well as newer EV startups like Rivian and Lucid Motors.

These incentives are not just about boosting short-term sales. They are also a strategic move to solidify Tesla’s position as the dominant player in the EV market. By offering attractive deals, Tesla hopes to win over customers and create brand loyalty, making it harder for competitors to gain ground.

But the question remains, will these incentives be enough to sway consumers in a crowded and increasingly competitive market?

Tesla’s Year-End Incentives: Tesla Offers Year End Incentives To Drive Sales In Tight Ev Market

Tesla, known for its premium electric vehicles (EVs), has joined the ranks of other automakers in offering year-end incentives to boost sales in a tightening EV market. These incentives aim to attract buyers and maintain Tesla’s market share, especially as competition from other EV manufacturers intensifies.

Tesla’s year-end incentives are a clear sign of the pressure the EV market is facing, with competition heating up and consumer spending becoming more cautious. It’s interesting to note that this comes at a time when Moody’s has signaled potential credit downgrades for six major US banks , which could further impact consumer confidence and spending.

With economic uncertainty looming, it will be fascinating to see how Tesla’s aggressive sales push plays out in the coming months.

Incentive Details and Target Audience

Tesla’s year-end incentives are designed to appeal to a wide range of potential buyers, including those who might be on the fence about purchasing an EV or those seeking a more affordable option. The incentives vary depending on the model and the buyer’s location.

Some examples include:

- Price reductions:Tesla has reduced the prices of its Model 3 and Model Y vehicles by a significant amount, making them more accessible to a broader audience.

- Free Supercharger miles:Tesla is offering a limited number of free Supercharger miles with the purchase of certain models, which can significantly reduce the cost of long-distance travel for EV owners.

- Financing incentives:Tesla is offering special financing rates and extended loan terms to make its vehicles more affordable.

These incentives are particularly attractive to buyers who prioritize affordability, long-term cost savings, and the convenience of a comprehensive charging network.

Comparison to Previous Years

Tesla’s year-end incentives are more substantial than those offered in previous years. In the past, Tesla has primarily relied on price reductions and limited-time offers, but the current incentives are more comprehensive and targeted towards a broader audience. This shift suggests that Tesla is facing increased competition and is actively seeking to maintain its market share.

Impact on Tesla’s Sales and Market Share

The impact of Tesla’s year-end incentives on its sales and market share is yet to be fully realized. However, early indications suggest that these incentives are driving increased demand. Tesla’s sales figures in the final quarter of the year are expected to be significantly higher than in previous years, reflecting the effectiveness of the incentives.

This surge in sales could help Tesla maintain its position as the leading EV manufacturer, even as other companies ramp up their EV production.

The Competitive EV Market

The electric vehicle (EV) market is rapidly evolving, with numerous players vying for market share. This intense competition has led to aggressive pricing strategies, technological advancements, and a focus on expanding the charging infrastructure. Tesla, a pioneer in the EV space, has faced growing competition from established automakers and new entrants.

Major Competitors and Strategies

The EV market is characterized by a diverse range of competitors, each with its unique approach and strategies. Some key players include:

- General Motors (GM):GM has made significant investments in EVs, with models like the Chevrolet Bolt EV and the Cadillac Lyriq. They are focusing on expanding their EV portfolio across different segments and leveraging their existing dealer network for sales and service.

- Ford:Ford is aggressively pursuing the EV market with models like the Mustang Mach-E and the F-150 Lightning. They are aiming to capture a large share of the pickup truck segment, a crucial market for traditional automakers.

- Volkswagen:Volkswagen is committed to electrifying its entire model lineup, with a wide range of EVs under its various brands, including Audi, Porsche, and Skoda. They are investing heavily in battery technology and charging infrastructure.

- Hyundai and Kia:These South Korean automakers have gained significant traction in the EV market with models like the Hyundai Kona Electric and the Kia EV6. They are known for their affordability and advanced technology.

- Rivian:This relatively new EV startup has made a splash with its electric pickup truck, the R1T, and SUV, the R1S. They are focusing on premium features and off-road capabilities.

- Lucid Motors:Lucid is a luxury EV brand known for its high-performance sedan, the Air. They are competing with Tesla in the premium EV segment.

Current State of the EV Market

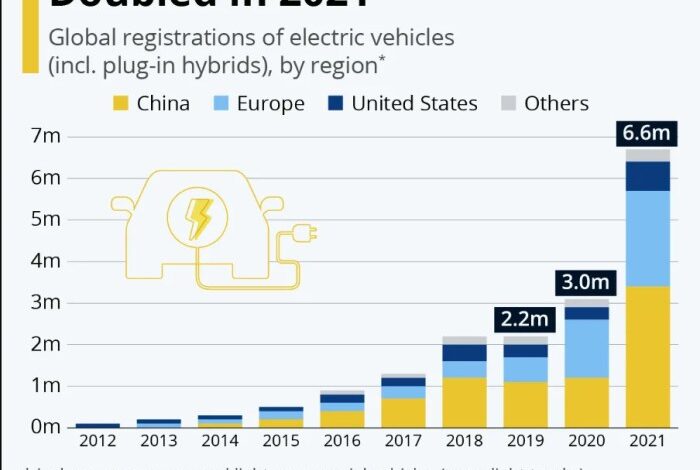

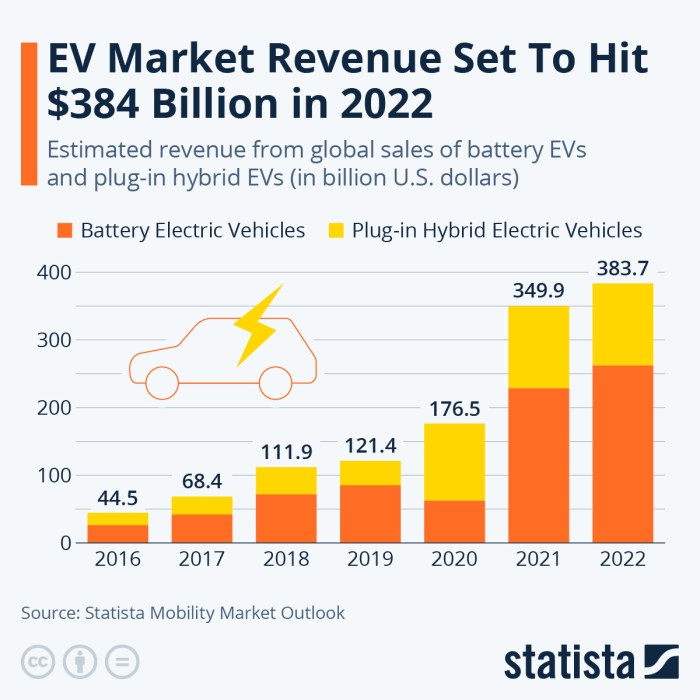

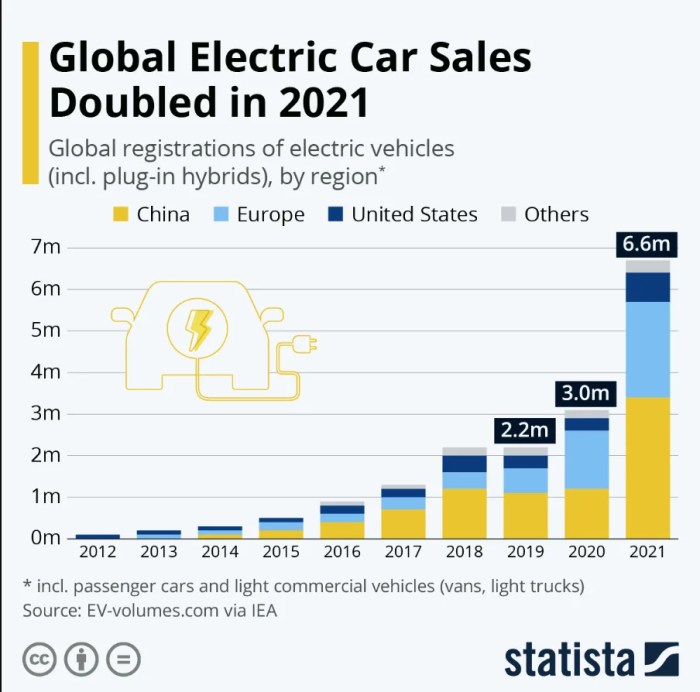

The global EV market is experiencing rapid growth, driven by several factors:

- Government incentives:Many countries are offering subsidies and tax breaks to encourage EV adoption. This reduces the upfront cost of EVs and makes them more attractive to consumers.

- Environmental concerns:Growing awareness of climate change and air pollution is driving demand for EVs, which produce zero tailpipe emissions.

- Technological advancements:Battery technology is improving rapidly, leading to longer driving ranges and faster charging times. This addresses range anxiety, a major concern for potential EV buyers.

- Falling battery costs:Battery prices have been declining steadily, making EVs more affordable. This trend is expected to continue in the coming years.

However, the EV market also faces some challenges:

- Limited charging infrastructure:The availability of charging stations remains a concern in many regions, especially for long-distance travel. This is hindering EV adoption, particularly in rural areas.

- High initial cost:EVs are still generally more expensive than comparable gasoline-powered vehicles, despite declining battery costs. This remains a barrier for many consumers.

- Limited model availability:While the number of EV models is increasing, the selection is still relatively limited compared to gasoline-powered vehicles. This can limit consumer choice and make it difficult to find an EV that meets specific needs.

Impact of Tesla’s Incentives on the Competitive Landscape

Tesla’s year-end incentives have a significant impact on the competitive landscape, forcing other EV makers to respond with similar offers. This price war can benefit consumers by lowering the cost of EVs, but it also puts pressure on manufacturers’ margins.

The long-term implications of these incentives remain to be seen, but they are likely to accelerate the adoption of EVs and drive innovation in the market.

Consumer Response to Incentives

Tesla’s year-end incentives have generated a buzz among potential EV buyers. These incentives, designed to boost sales in a competitive market, have sparked a range of reactions from consumers. Some see it as an opportunity to finally get behind the wheel of a Tesla, while others remain skeptical, questioning the long-term impact of these promotions.

Consumer Reactions to Tesla’s Incentives

The introduction of these incentives has led to a wave of both excitement and scrutiny. Some consumers have expressed their delight at the prospect of acquiring a Tesla at a more affordable price. Online forums and social media platforms have been flooded with discussions about the incentives, with many users sharing their experiences and opinions.

For instance, a recent post on a popular automotive forum discussed the impact of the incentives on the waitlist for the Model Y. The post highlighted that many users who had been on the waitlist for months saw their delivery dates significantly expedited after Tesla announced its incentives.

This suggests that the incentives have indeed stimulated demand, attracting both new and existing customers.However, not all consumers are swayed by the incentives. Some remain hesitant, citing concerns about the long-term sustainability of these promotions and the potential for future price fluctuations.

For example, a recent article in a leading automotive publication highlighted concerns from some consumers who feared that the incentives might be a temporary tactic to boost sales, and that prices could rise again in the future. These concerns are not unfounded, as Tesla has a history of fluctuating prices, which has sometimes led to customer dissatisfaction.

Tesla’s year-end incentives are a smart move in a tightening EV market, but it reminds me of a recent story about a father and son in Massachusetts who tried to pull off a 20 million dollar lottery scam. They thought they could outsmart the system, but ended up behind bars – read about their downfall here.

It’s a good reminder that even with the best intentions, sometimes things just don’t go as planned. Hopefully, Tesla’s incentives will help them achieve their sales goals, but they’ll need to stay vigilant and avoid any shady tactics.

Effectiveness of Incentives in Driving Demand

The effectiveness of Tesla’s incentives in driving demand is evident in the surge in sales figures. Tesla reported a significant increase in deliveries during the final quarter of the year, exceeding analysts’ expectations. This suggests that the incentives have been successful in attracting new customers and enticing existing customers to make a purchase.However, it is crucial to note that the effectiveness of these incentives may vary depending on factors such as regional market conditions and consumer preferences.

In some regions, the incentives may have a more pronounced impact on demand than in others.

Long-Term Impact of Incentives on Consumer Behavior

The long-term impact of these incentives on consumer behavior remains to be seen. Some argue that these promotions could lead to a shift in consumer preferences, with more people considering Tesla as a viable option due to its affordability. Others believe that the impact will be temporary, with consumers returning to their original preferences once the incentives are withdrawn.

The long-term impact will likely depend on various factors, including the duration of the incentives, the competitive landscape, and consumer perceptions of Tesla’s brand.For example, if Tesla continues to offer similar incentives on a regular basis, it could potentially create a sense of expectation among consumers, leading to a reliance on promotions and a reluctance to purchase at full price.

Tesla’s year-end incentives are a clear sign that the electric vehicle market is getting competitive. As automakers fight for market share, it’s more important than ever to understand what is a privacy policy and why is it important.

After all, a company’s privacy practices can influence consumer trust and loyalty, which are key factors in a buyer’s decision, especially in a rapidly evolving market like electric vehicles.

Conversely, if the incentives are discontinued abruptly, it could lead to a decline in demand, as consumers may be unwilling to pay the higher price.The long-term impact of Tesla’s incentives on consumer behavior will ultimately be shaped by the company’s pricing strategies, its ability to maintain its brand image, and the overall evolution of the EV market.

Strategic Implications for Tesla

Tesla’s year-end incentives represent a strategic shift in the company’s approach to sales, driven by the increasingly competitive electric vehicle (EV) market. This move reflects a need to adapt to changing market dynamics and maintain its market share in a rapidly evolving landscape.

Strategic Goals Behind Tesla’s Year-End Incentives

Tesla’s year-end incentives aim to achieve several strategic goals, including:

- Boosting sales: The primary objective is to increase sales volume, particularly during the final quarter of the year, a period traditionally marked by a surge in consumer spending.

- Clearing inventory: Tesla might be seeking to reduce its inventory of unsold vehicles, particularly those with older model years or specific configurations. This can free up production capacity for newer models.

- Attracting new customers: The incentives can entice potential buyers who were previously hesitant due to the high price point of Tesla vehicles. This can broaden the company’s customer base and introduce its brand to a wider audience.

- Maintaining market share: The EV market is becoming increasingly crowded with new entrants and established automakers launching competitive models. Incentives help Tesla stay competitive and maintain its leading position in the market.

Potential Risks and Benefits of Tesla’s Strategy, Tesla offers year end incentives to drive sales in tight ev market

Tesla’s strategy of offering year-end incentives carries both potential risks and benefits:

Potential Risks

- Erosion of brand image: Offering discounts might be perceived as a sign of weakness or desperation, potentially harming Tesla’s premium brand image. This could lead to a long-term impact on pricing power and consumer perception.

- Short-term focus: Focusing solely on short-term sales gains might distract from long-term goals, such as product development and innovation. This could potentially hinder the company’s future growth and competitiveness.

- Customer expectations: Repeated incentives could create expectations among customers for ongoing discounts, making it difficult to raise prices in the future. This could limit Tesla’s pricing flexibility and profitability.

- Impact on profitability: While incentives might boost sales, they can also reduce profit margins. This is particularly relevant in the current economic climate, where rising costs and supply chain disruptions are already impacting profitability.

Potential Benefits

- Increased sales volume: Incentives can drive immediate sales growth, providing a much-needed boost to Tesla’s revenue and market share.

- Improved cash flow: Higher sales can translate into improved cash flow, allowing Tesla to invest in future projects and strengthen its financial position.

- Market share dominance: By maintaining a strong market presence, Tesla can further solidify its leadership position in the EV market, creating a competitive advantage for future growth.

- Customer loyalty: Offering attractive incentives can create a positive experience for customers, potentially leading to repeat purchases and increased brand loyalty.

Impact of Incentives on Tesla’s Financial Performance

The impact of Tesla’s year-end incentives on its financial performance can be analyzed through various metrics:

| Metric | Potential Impact | Example |

|---|---|---|

| Revenue | Increase | A 5% discount on Model 3 could lead to a 10% increase in sales, resulting in higher revenue. |

| Gross Profit Margin | Decrease | The discount reduces the profit margin on each vehicle sold, potentially impacting overall profitability. |

| Operating Income | Mixed | Increased sales can boost operating income, but the impact on profit margin might offset this gain. |

| Earnings per Share (EPS) | Mixed | Higher sales can lead to higher EPS, but lower profit margins can have a negative impact. |

The Future of Tesla’s Sales Strategy

Tesla’s recent year-end incentives highlight the evolving dynamics of the electric vehicle (EV) market. While Tesla has historically relied on its brand image and technological edge, the growing competition from established automakers and new EV startups necessitates a more nuanced sales approach.

The Impact of Market Dynamics on Tesla’s Incentives

The EV market is rapidly evolving, with increasing competition from established automakers like Ford, General Motors, and Volkswagen, as well as new EV startups like Rivian and Lucid. This competition is putting pressure on Tesla to maintain its market share and sales momentum.

Tesla’s future success hinges on its ability to adapt its sales strategy to the changing market landscape.

- Increased competition:As more players enter the EV market, Tesla will face increased pressure to offer competitive pricing and incentives. This will likely lead to more frequent and potentially larger incentives to attract customers.

- Consumer demand:While Tesla’s brand remains strong, consumer demand for EVs is increasingly driven by factors such as affordability, range, and charging infrastructure. Tesla will need to adjust its pricing and incentives to meet these evolving consumer needs.

- Government incentives:Government incentives for EVs are playing a crucial role in driving adoption. Tesla will need to monitor and adapt to changes in these policies, as they can significantly impact consumer demand and purchase decisions.

Potential Market Share Growth for Tesla

While the EV market is becoming increasingly competitive, Tesla still enjoys a strong brand image and a loyal customer base.

Tesla’s innovative technology and robust charging infrastructure network provide a competitive advantage.

- Continued innovation:Tesla’s commitment to continuous innovation, including advancements in battery technology, autonomous driving, and software updates, will continue to drive demand for its vehicles.

- Expansion into new markets:Tesla is expanding its global footprint, entering new markets like India and Southeast Asia. This expansion will provide significant growth opportunities.

- Scaling production:Tesla is aggressively scaling up production to meet the growing demand for its vehicles. Increased production capacity will allow Tesla to offer more competitive pricing and reach a wider customer base.