Tech Giants Q3 Earnings Impact Markets: Nasdaq & Alphabet

Tech giants Q3 earnings impact markets nasdaq alphabet takes center stage, revealing a fascinating story of growth, challenges, and market volatility. This quarter saw a mixed bag of results from major players like Alphabet and Microsoft, sending ripples through the tech sector and the broader market.

As investors dissect the numbers, we’ll explore the key drivers of earnings performance, the impact on the Nasdaq Composite Index, and what these results mean for the future of these tech giants.

From the robust growth of cloud computing to the ever-evolving landscape of digital advertising, these earnings reports provide a glimpse into the trends shaping the tech industry. We’ll delve into the factors influencing earnings performance, analyzing the challenges and opportunities faced by these companies, and exploring their outlook for future growth.

Tech Giants Q3 Earnings Overview

The third quarter of 2023 saw mixed results from major tech companies, with some exceeding expectations while others struggled to maintain momentum. Here’s a breakdown of key financial results and the overall market sentiment.

The recent Q3 earnings reports from tech giants like Alphabet have sent ripples through the market, particularly the Nasdaq. Investors are closely watching how these companies are navigating a challenging economic landscape. While the tech sector is in flux, it’s a good time to remember the importance of investing in tangible assets like precious metals.

If you’re considering adding gold or silver to your portfolio, be sure to check out this guide on how to spot fake gold and silver a simple guide to authenticating precious metals. Understanding how to authenticate precious metals is crucial to protect your investment, especially during times of market volatility.

Key Financial Results

The third quarter earnings reports provided insights into the financial health and growth trajectory of leading tech giants. Here are some highlights:

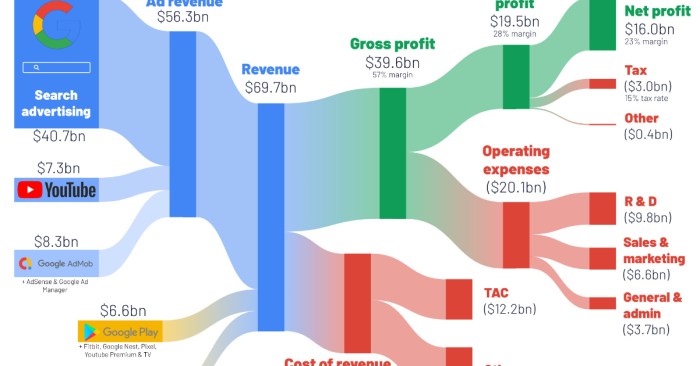

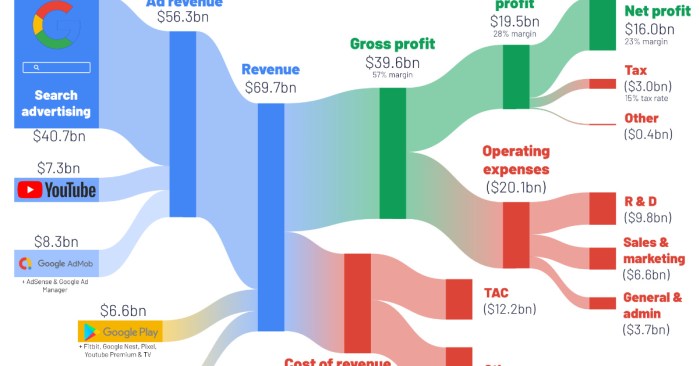

Alphabet

- Revenue: $76.05 billion, representing a 7.6% increase year-over-year.

- Net Income: $16.00 billion, down 23% from the previous year.

- Key Performance Indicators (KPIs): Google Cloud revenue grew 28% year-over-year, demonstrating continued strength in the cloud computing market. However, YouTube advertising revenue growth slowed down, indicating potential challenges in the digital advertising landscape.

Microsoft

- Revenue: $52.75 billion, representing a 18% increase year-over-year.

- Net Income: $18.5 billion, up 19% from the previous year.

- Key Performance Indicators (KPIs): Azure cloud computing revenue grew 31% year-over-year, indicating strong demand for Microsoft’s cloud services. The company also saw strong growth in its gaming and enterprise segments.

Amazon

- Revenue: $143.25 billion, representing a 15% increase year-over-year.

- Net Income: $2.7 billion, down 92% from the previous year.

- Key Performance Indicators (KPIs): Amazon Web Services (AWS) revenue grew 27% year-over-year, demonstrating its continued dominance in the cloud computing market. However, the company faced challenges in its retail business due to rising inflation and consumer spending shifts.

Analyst and Investor Sentiment, Tech giants q3 earnings impact markets nasdaq alphabet

The overall sentiment surrounding these earnings reports was mixed. While some analysts expressed optimism about the long-term growth prospects of these companies, others expressed concerns about slowing revenue growth and rising costs. Investors reacted cautiously, with stock prices generally fluctuating in the days following the earnings announcements.

Impact on Nasdaq Performance

The Q3 earnings reports of tech giants significantly impacted the performance of the Nasdaq Composite Index. The index, which is heavily weighted towards technology stocks, experienced both gains and losses in the wake of these reports.

Performance Fluctuations

The Nasdaq Composite Index displayed notable fluctuations in the period following the release of Q3 earnings reports. This volatility was driven by the individual performance of major tech companies, investor sentiment, and broader market conditions.

- Positive Earnings:When companies like Alphabet, Microsoft, and Apple exceeded earnings expectations, the Nasdaq generally experienced positive momentum. These strong results fueled investor confidence and encouraged buying activity, pushing the index higher.

- Disappointing Earnings:Conversely, companies that missed earnings estimates or provided weak guidance often saw their stock prices decline. This, in turn, exerted downward pressure on the Nasdaq. For instance, Meta Platforms’ (formerly Facebook) disappointing earnings in Q3 2022 led to a significant drop in its stock price, contributing to the Nasdaq’s overall decline.

- Market Sentiment:The overall market sentiment also played a crucial role. During periods of heightened economic uncertainty, investors tend to become more risk-averse, which can lead to selling pressure on tech stocks. This can negatively impact the Nasdaq even if individual companies report strong earnings.

Key Drivers of Earnings Performance: Tech Giants Q3 Earnings Impact Markets Nasdaq Alphabet

The Q3 earnings of Alphabet and other tech giants were driven by a complex interplay of factors, reflecting both the enduring strength of the digital economy and the evolving landscape of the tech industry.

Cloud Computing Growth

Cloud computing remains a key growth driver for many tech giants, with Alphabet’s Google Cloud Platform (GCP) experiencing significant revenue growth.

- Increased Adoption:Businesses continue to adopt cloud services for their scalability, flexibility, and cost-effectiveness.

- Expanding Services:Tech giants are expanding their cloud offerings to include a wider range of services, such as artificial intelligence (AI), data analytics, and cybersecurity.

- Competition:Competition in the cloud computing market remains intense, with companies like Amazon Web Services (AWS) and Microsoft Azure aggressively vying for market share.

Advertising Revenue Performance

Advertising revenue remains a crucial revenue stream for tech giants, although growth rates have slowed in recent quarters.

- Economic Uncertainty:Global economic uncertainty and concerns about inflation have impacted advertising spending, particularly in areas like retail and travel.

- Privacy Regulations:Changes in privacy regulations, such as Apple’s App Tracking Transparency (ATT) framework, have impacted targeted advertising and reduced advertising revenue for some companies.

- Shifting Consumer Behavior:Consumer behavior is evolving, with more users shifting towards platforms that prioritize privacy and user experience.

Other Business Segments

Other business segments, such as hardware, software, and subscription services, also contributed to the overall earnings performance of tech giants.

- Hardware Sales:Sales of devices like smartphones, laptops, and smart home devices have been impacted by supply chain disruptions and global economic headwinds.

- Software Subscriptions:Subscription-based software services, such as Google Workspace and Microsoft 365, continue to see strong growth, driven by the increasing adoption of cloud-based solutions.

Tech giants’ Q3 earnings have sent shockwaves through the markets, particularly impacting the Nasdaq and Alphabet. The performance of these companies often reflects the broader tech landscape, and investors are eagerly watching for signs of growth and stability. While these earnings reports dominate headlines, it’s crucial to remember the long-term implications of innovations like Neuralink, a company unveiling the future of mind-controlled computers.

These breakthroughs have the potential to reshape the tech industry and influence the trajectory of the markets in the years to come.

Tech giants like Alphabet are facing a tough Q3 earnings season, with investors closely watching how inflation and the broader economic landscape impact their performance. The recent surge in consumer prices, as documented in the annual consumer price hikes accelerating in July to a record 32% rise , is adding another layer of complexity.

This inflation is driving up costs for tech companies, potentially impacting their margins and ultimately affecting their stock prices on the NASDAQ.