Target Earnings, S&P 500, Dow, & Fed Meeting Minutes

Target earnings sp500 dow fed meeting minutes – Target earnings, S&P 500, Dow, & Fed meeting minutes: these are the key ingredients shaping the current market landscape. Understanding the interplay of these factors is crucial for investors seeking to navigate the complexities of today’s economic environment.

This week, the Federal Reserve released its latest meeting minutes, providing insights into its plans for managing inflation and interest rates. Simultaneously, earnings season is in full swing, with companies reporting their quarterly results and revealing their outlook for the future.

The performance of the S&P 500 and Dow Jones Industrial Average, two of the most closely watched market indices, offers a window into the overall health of the stock market.

Target Earnings

Earnings expectations for the S&P 500 and Dow Jones Industrial Average are closely watched by investors as they provide insights into the overall health of the U.S. economy and corporate profitability. These expectations are influenced by various factors, including economic conditions, inflation, and corporate profitability.

The market’s reaction to the latest Fed meeting minutes, where the central bank hinted at continued rate hikes, was fascinating. While the Dow and S&P 500 initially dipped, they quickly rebounded, likely fueled by a recent analysis of mixed jobs data that suggested a potential slowdown in economic growth.

This dynamic, as explored in this insightful article , could indicate that investors are cautiously optimistic about the Fed’s ability to manage inflation without causing a significant economic downturn. Ultimately, the focus remains on how these developments will impact corporate earnings and the future direction of the market.

Historical Earnings Growth Trends

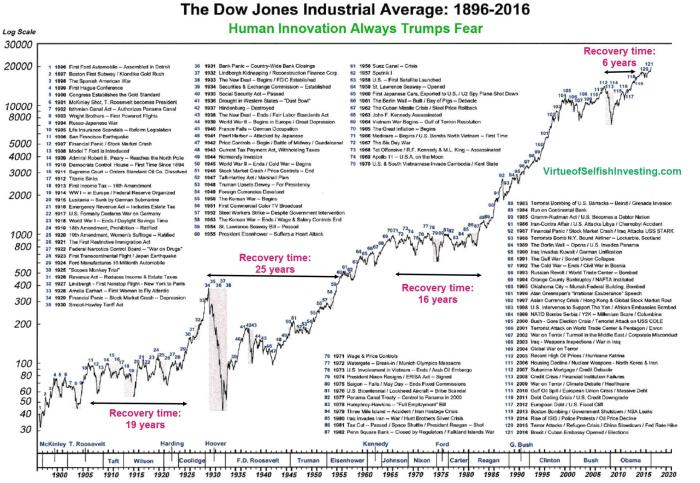

Historical analysis of earnings growth trends for the S&P 500 and Dow Jones Industrial Average reveals cyclical patterns. The indices typically experience periods of robust earnings growth followed by periods of slower growth or even declines. For instance, during the economic expansion of the late 1990s, both indices witnessed significant earnings growth, fueled by technological advancements and strong consumer spending.

However, the dot-com bubble burst in the early 2000s led to a sharp decline in earnings. Similarly, the global financial crisis of 2008-2009 resulted in a substantial drop in earnings for both indices.

Key Factors Driving Earnings Expectations

Several key factors drive current earnings expectations, including:

- Economic Conditions:Economic growth, unemployment rates, and consumer confidence play a significant role in shaping earnings expectations. A robust economy typically translates into higher demand for goods and services, leading to increased corporate revenues and profits. Conversely, a weak economy can dampen demand and hurt corporate earnings.

The Fed’s meeting minutes are out, and the market is reacting with a bit of a shrug. Earnings season is in full swing, with the S&P 500 and Dow both showing modest gains. It’s interesting to see how the Indian markets are responding, with the Nifty crossing 17,650, and the focus shifting to HCL Tech and Tata Motors.

Check out the latest updates on the share market movement here for a more in-depth look at the current trends. The next few weeks will be interesting to see how the markets respond to the Fed’s guidance on interest rates and the overall economic outlook.

- Inflation:Rising inflation can erode corporate profit margins by increasing input costs, such as raw materials and labor. However, companies can sometimes pass on these costs to consumers through higher prices. The impact of inflation on earnings expectations depends on the industry and the company’s ability to manage costs and pricing.

- Corporate Profitability:Corporate profitability is a key driver of earnings expectations. Factors that influence profitability include cost management, efficiency, and innovation. Companies that are able to effectively control costs and generate revenue growth are more likely to deliver strong earnings.

Earnings Expectations for Different Sectors

Earnings expectations can vary significantly across different sectors within the S&P 500. For example, the technology sector is typically characterized by high growth and innovation, leading to strong earnings expectations. However, the energy sector is more susceptible to fluctuations in oil prices and global demand, which can impact earnings.

Impact of Earnings Revisions on Market Sentiment, Target earnings sp500 dow fed meeting minutes

Earnings revisions can have a significant impact on market sentiment and stock prices. Positive earnings revisions, where companies exceed analysts’ expectations, tend to boost market sentiment and drive stock prices higher. Conversely, negative earnings revisions, where companies fall short of expectations, can lead to a decline in market sentiment and stock prices.

The markets are on edge this week, with investors closely watching target earnings, the S&P 500, and the Dow, all while anticipating the Fed’s meeting minutes. This comes as Wall Street faces mixed earnings reports and anticipates the Fed’s rate decision, which you can follow in real-time with live news coverage.

The Fed’s decision will likely have a significant impact on market direction, so it’s crucial to stay informed about the latest developments and how they might influence the target earnings, S&P 500, and Dow.

S&P 500 and Dow Jones Performance: Target Earnings Sp500 Dow Fed Meeting Minutes

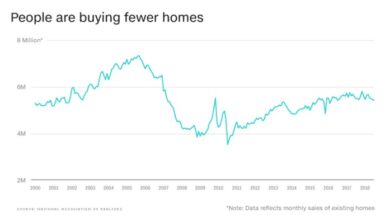

The S&P 500 and Dow Jones Industrial Average are two of the most widely followed stock market indices in the world. These indices provide a broad snapshot of the performance of the US stock market. In recent months, both indices have experienced volatility, reflecting the complex interplay of economic factors and investor sentiment.

Recent Performance

The recent performance of the S&P 500 and Dow Jones Industrial Average has been influenced by several factors, including interest rate hikes, inflation, and economic growth. The Federal Reserve’s aggressive interest rate increases have weighed on the stock market, as investors have become more cautious about valuations.

Inflation has also been a major concern, as it erodes corporate profits and consumer spending. However, the US economy has shown resilience, with strong job growth and consumer spending.

Factors Contributing to Performance

- Interest Rates:The Federal Reserve’s monetary policy tightening has been a significant factor influencing stock market performance. Rising interest rates increase the cost of borrowing for businesses and can slow economic growth, which can impact corporate earnings.

- Inflation:High inflation erodes purchasing power and can lead to higher input costs for businesses. This can squeeze profit margins and make investors more cautious about stock valuations.

- Economic Growth:The health of the US economy is a key driver of stock market performance. Strong economic growth can boost corporate earnings and investor confidence, while a weakening economy can lead to stock market declines.

Comparison with Other Market Benchmarks

The performance of the S&P 500 and Dow Jones Industrial Average can be compared to other major market benchmarks, such as the Nasdaq Composite and the Russell 2000. The Nasdaq Composite, which is heavily weighted towards technology stocks, has experienced greater volatility than the S&P 500 and Dow Jones Industrial Average.

The Russell 2000, which tracks the performance of small-cap stocks, has generally outperformed the broader market in recent years.

Potential Catalysts for Future Performance

The future performance of the S&P 500 and Dow Jones Industrial Average will depend on several factors, including:

- Earnings Reports:Corporate earnings reports can provide insights into the health of the economy and the outlook for future growth. Strong earnings reports can boost investor confidence and support stock prices, while weak earnings can lead to declines.

- Economic Data:Key economic data releases, such as inflation reports, employment data, and GDP growth figures, can provide insights into the direction of the economy and influence stock market performance.

- Geopolitical Events:Geopolitical events, such as wars, trade disputes, and political instability, can create uncertainty and volatility in the stock market.

Key Performance Metrics

| Metric | S&P 500 | Dow Jones Industrial Average |

|---|---|---|

| Current Value | [Current Value] | [Current Value] |

| Year-to-Date Performance | [Year-to-Date Performance] | [Year-to-Date Performance] |

| 1-Year Performance | [1-Year Performance] | [1-Year Performance] |

| 5-Year Performance | [5-Year Performance] | [5-Year Performance] |

Federal Reserve Meeting Minutes

The latest Federal Reserve meeting minutes, released on [date], provided insights into the central bank’s current thinking on the economy and monetary policy. The minutes revealed a cautious but determined stance, with policymakers recognizing the ongoing challenges posed by inflation and the need to balance economic growth with price stability.

Inflation and Economic Growth

The minutes acknowledged that inflation has moderated somewhat in recent months, but it remains elevated. The Fed attributed this moderation to a combination of factors, including easing supply chain pressures and declining energy prices. However, the minutes also emphasized that core inflation, which excludes volatile food and energy prices, has remained stubbornly high, indicating that inflationary pressures are still embedded in the economy.The Fed’s outlook on economic growth was more mixed.

While the economy has proven resilient, the minutes acknowledged that the recent rise in interest rates and tighter financial conditions are likely to weigh on economic activity in the coming months. The Fed also expressed concern about the potential for further economic shocks, such as the ongoing war in Ukraine and geopolitical tensions.

Interest Rates

The minutes reiterated the Fed’s commitment to bringing inflation down to its 2% target. To achieve this, policymakers are prepared to continue raising interest rates in the near term. The minutes also highlighted the importance of keeping interest rates at a restrictive level for a sufficient period to ensure that inflation is under control.The Fed’s current stance on interest rates is a continuation of its previous actions.

Since March 2022, the Fed has raised interest rates by a total of 5.25 percentage points, the fastest pace of tightening in decades. However, the minutes suggest that the Fed is now more focused on the pace of future rate hikes, rather than the overall level of interest rates.

This indicates that the Fed is monitoring economic data closely and is prepared to adjust its policy stance as needed.

Implications for the Stock Market

The Fed’s policy decisions have significant implications for the stock market. The minutes suggest that the Fed is likely to continue raising interest rates in the coming months, which could put downward pressure on stock prices. This is because higher interest rates make it more expensive for companies to borrow money, which can slow down economic growth and reduce corporate profits.However, the Fed’s commitment to bringing inflation down to its target could also be viewed positively by investors.

If the Fed succeeds in curbing inflation, it could boost confidence in the economy and lead to higher stock prices in the long run.

Key Messages and Potential Market Implications

The following table summarizes the Fed’s key messages from the latest meeting minutes and their potential implications for the stock market: