Nvidias New US Rules Impact AI Chip Exports

Nvidia new us rules impact ai chip exports – Nvidia’s new US rules impact AI chip exports, setting off a chain reaction across the global tech landscape. The US government’s recent restrictions on the export of advanced AI chips, specifically targeting Nvidia’s A100 and H100 processors, have sent shockwaves through the industry.

This move, driven by concerns over national security and the potential misuse of AI technology, has far-reaching implications for both the development and accessibility of artificial intelligence.

The US government’s rationale behind these rules centers around preventing the use of advanced AI chips in sensitive applications, particularly in China, where concerns exist about potential military applications. These restrictions are not just impacting Nvidia, but also other chip manufacturers and AI developers who rely on these powerful processors.

The potential impact on the global AI chip market, particularly in China, is significant, forcing companies to adapt and find alternative solutions.

Background of the New US Rules

The US government has implemented new rules regarding the export of advanced artificial intelligence (AI) chips, specifically targeting Nvidia’s high-performance chips used in supercomputers and other critical infrastructure. These rules aim to restrict the flow of these chips to certain countries, primarily China, citing concerns about potential misuse for military applications and national security threats.

The rationale behind these new rules is rooted in the growing awareness of the strategic importance of AI technology and the potential risks associated with its proliferation. The US government believes that advanced AI chips could be used to develop autonomous weapons systems, enhance cyberwarfare capabilities, or facilitate surveillance activities that could undermine global security.

The new US rules impacting AI chip exports from NVIDIA are certainly a hot topic, and it’s fascinating to see how these developments intersect with the broader economic landscape. While the tech world grapples with these restrictions, the housing market continues to feel the heat as mortgage rates rise for the sixth consecutive week, hitting 7.63 percent according to this report.

It’s a reminder that these global shifts are interconnected, and the ripple effects can be felt across various sectors. It’ll be interesting to see how the evolving AI chip landscape plays out, and whether it impacts the housing market in any significant way.

Restrictions Imposed on Nvidia’s AI Chip Exports

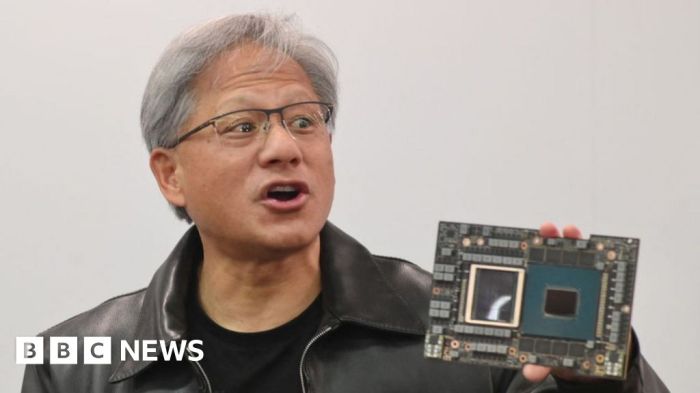

The new US rules impose specific restrictions on Nvidia’s export of its high-performance AI chips, primarily the A100 and H100 models. These chips are designed for demanding AI applications such as machine learning, deep learning, and scientific computing. The restrictions focus on limiting the export of these chips to China, specifically targeting companies involved in supercomputing, military research, and other sensitive sectors.

The US government’s new rules on AI chip exports are creating a ripple effect across the global tech landscape. This comes at a time when global economic uncertainty is already high, with factors like the ongoing war in Ukraine and the Federal Reserve’s plans for rate hikes impacting markets.

The latest news on crude oil prices, which are holding steady near $94 amid these pressures, crude oil prices hold steady near 94 amid feds rate hike plans and russian export ban , only adds to the complexity of the situation.

Nvidia’s AI chip exports are facing new scrutiny, and the broader implications of these rules on technological advancement and global competition remain to be seen.

- License Requirements:Companies seeking to export Nvidia’s A100 and H100 chips to China must now obtain a license from the US government. This process involves a thorough review of the intended use of the chips and the recipient company’s activities.

The US government will scrutinize applications to ensure that the chips are not being used for purposes that could pose a threat to national security.

- Limited Access:The US government has also imposed restrictions on the access to Nvidia’s A100 and H100 chips for certain Chinese companies. These restrictions are designed to prevent the acquisition of these chips by entities deemed to be involved in activities that could undermine US national security interests.

Implications for the Global AI Chip Market

The new US rules have significant implications for the global AI chip market. These rules could potentially:

- Impact China’s AI Development:The restrictions on Nvidia’s AI chip exports to China could hinder the development of China’s AI industry, particularly in areas such as supercomputing and military applications. This could slow down China’s progress in areas where AI technology plays a critical role.

- Shift in Global AI Chip Supply Chain:The new rules could lead to a shift in the global AI chip supply chain. Companies may seek alternative sources for high-performance AI chips, potentially leading to the emergence of new players in the market. This could create new opportunities for other chip manufacturers, particularly those based outside of the US.

- Geopolitical Tensions:The new rules could exacerbate geopolitical tensions between the US and China, particularly in the realm of technology. These tensions could lead to further restrictions and trade disputes, potentially impacting the global economy and technological innovation.

Nvidia’s Response to the New Rules

Nvidia, a leading manufacturer of AI chips, has faced significant challenges due to the new US export restrictions. These rules aim to limit the flow of advanced semiconductor technology to China and other countries, potentially impacting Nvidia’s revenue streams and future growth prospects.

The new US rules on AI chip exports to China are certainly a big deal for Nvidia, and it’s likely to impact the company’s bottom line. While it’s too early to say exactly how much, the market is definitely feeling the uncertainty, and as wall street anticipates a soft start as rate uncertainties persist , it’s clear that the situation is adding another layer of complexity.

It will be interesting to see how Nvidia navigates these challenges and how the broader market reacts in the coming months.

Nvidia’s Official Statement

Nvidia has publicly acknowledged the new US export restrictions and their potential impact on the company’s business. In a statement released in October 2022, Nvidia expressed its commitment to complying with all applicable laws and regulations. The company also emphasized its dedication to serving its global customer base while navigating the evolving regulatory landscape.

Potential Strategies to Mitigate the Impact, Nvidia new us rules impact ai chip exports

Nvidia is actively exploring various strategies to mitigate the impact of the export restrictions. These strategies include:

- Diversifying its customer base:Nvidia is seeking to expand its customer base beyond China by focusing on other key markets, such as Europe and Southeast Asia. This strategy aims to reduce reliance on the Chinese market and ensure a more balanced revenue stream.

- Developing alternative products:Nvidia is working on developing new products and technologies that are not subject to the export restrictions. This could involve designing chips with lower performance levels or focusing on specific applications that are not considered sensitive.

- Collaborating with partners:Nvidia is actively collaborating with partners in various countries to develop and manufacture chips that comply with the new rules. This approach allows Nvidia to leverage the expertise and resources of its partners while navigating the complex regulatory environment.

Potential Financial and Operational Consequences

The new US export restrictions have the potential to significantly impact Nvidia’s financial performance and operational efficiency. These consequences include:

- Reduced revenue:The restrictions could lead to a decline in Nvidia’s revenue, particularly in the Chinese market. This is due to the reduced availability of its high-performance chips for use in AI applications.

- Increased costs:Nvidia may need to invest in developing alternative products or technologies that comply with the export restrictions. This could result in higher manufacturing costs and potentially affect profit margins.

- Supply chain disruptions:The restrictions could disrupt Nvidia’s supply chain, particularly in the procurement of components from suppliers in China. This could lead to delays in production and potentially impact the company’s ability to meet customer demand.

- Competitive disadvantage:Nvidia’s competitors, such as Intel and AMD, may be less affected by the export restrictions. This could create a competitive disadvantage for Nvidia in the global semiconductor market.

Impact on AI Development and Research: Nvidia New Us Rules Impact Ai Chip Exports

The new US rules restricting the export of advanced AI chips, primarily targeting Nvidia’s A100 and H100, have significant implications for AI development and research worldwide. These regulations aim to limit access to cutting-edge technology, particularly for countries perceived as potential adversaries.

The impact on AI development and research will vary depending on the region and the specific research focus.

Potential Impact on AI Development and Research in Various Countries

The new US rules will likely have a more pronounced impact on countries heavily reliant on Nvidia’s chips for their AI research and development. These countries may face challenges in accessing the necessary hardware for training large language models, developing advanced computer vision algorithms, and conducting other cutting-edge AI research.

For example, China, which heavily utilizes Nvidia chips for its AI ambitions, might see a slowdown in its AI development due to the restrictions.

Potential for Alternative Chip Suppliers to Fill the Gap

While Nvidia currently dominates the high-performance computing market, other chip manufacturers are stepping up to fill the void created by the new US rules. Companies like Intel, AMD, and even Chinese companies like Huawei are actively developing their own AI chips.

However, it is crucial to acknowledge that these alternatives might not yet match Nvidia’s performance or capabilities. Moreover, the US government may also implement restrictions on these alternative chip suppliers in the future, further complicating the situation.

Potential for the New Rules to Accelerate the Development of Domestic AI Chip Industries

The new US rules might inadvertently accelerate the development of domestic AI chip industries in countries facing restrictions. This is because the limitations on accessing advanced chips could incentivize these countries to invest heavily in research and development of their own AI chip technology.

China, for instance, has already been making significant strides in developing its own AI chips, and the new US rules could further motivate these efforts.

Geopolitical Implications

The new US rules on AI chip exports have significant geopolitical implications, potentially reshaping the global technology landscape and influencing international relations, particularly between the US and China. The restrictions could trigger a wave of protectionist measures in other countries, leading to a more fragmented and competitive global tech ecosystem.

Impact on US-China Relations

The new rules are likely to further strain US-China relations, which have already been tense due to trade disputes and ideological differences. The restrictions on AI chip exports could be perceived by China as a deliberate attempt to hinder its technological development and economic growth.

This could lead to retaliatory measures from China, such as imposing restrictions on US technology companies or limiting access to its domestic market.

Potential for Protectionist Measures

The US rules could set a precedent for other countries to implement similar export controls on advanced technologies, potentially leading to a global wave of protectionism. This could fragment the global tech ecosystem, making it more difficult for companies to access essential components and technologies.

The new US rules could trigger a domino effect, leading to a more fragmented and less collaborative global tech landscape.

Impact on Global Technology Landscape

The new rules could have a significant impact on the global technology landscape, potentially slowing down the pace of innovation and development. The restrictions on AI chip exports could hinder the progress of research and development in AI, particularly in countries that rely heavily on US technology.

The US rules could stifle global innovation by limiting access to critical technologies, potentially slowing down the progress of AI research and development.

Future Outlook

The new US export rules on AI chips are a significant development with far-reaching implications for the global AI landscape. This section explores the potential future of AI chip exports, the likelihood of rule modifications, and the influence of emerging technologies on the AI chip market.

Potential for Rule Modifications

The new US rules are likely to be subject to ongoing review and potential modifications. The US government may consider adjusting the rules based on various factors, including:

- International Cooperation:The US government may seek greater cooperation with other countries to establish a more unified approach to AI chip exports. This could involve harmonizing regulations or developing joint initiatives to address security concerns while fostering innovation.

- Technological Advancements:As AI chip technology continues to evolve, the US government may need to update its export rules to reflect the latest developments. This could involve adjusting the scope of the rules to encompass newer chip architectures or specific applications.

- Industry Feedback:The US government may engage with industry stakeholders to gather feedback on the impact of the rules and identify areas for improvement. This could involve consulting with chip manufacturers, AI researchers, and other relevant parties.

Impact of Emerging Technologies

The AI chip market is a rapidly evolving landscape, with new technologies and developments emerging regularly. These advancements have the potential to significantly impact the future of AI chip exports:

- Quantum Computing:Quantum computing is a promising area of research with the potential to revolutionize AI. If quantum computers become commercially viable, they could significantly impact the demand for traditional AI chips. The US government may need to consider how to regulate the export of quantum computing technologies.

- Neuromorphic Computing:Neuromorphic computing aims to mimic the structure and function of the human brain. These chips could offer significant advantages in terms of energy efficiency and processing power. If neuromorphic computing gains traction, it could influence the future of AI chip exports.

- Edge AI:Edge AI involves deploying AI models on devices at the edge of the network, such as smartphones and IoT devices. This trend is driving demand for smaller, more efficient AI chips. The US government may need to consider the implications of edge AI for export controls.