Stock Market Anticipates Rise: Inflation Data and Earnings Season Take Center Stage

Stock market anticipates rise as inflation data and earnings season take center stage, setting the stage for a potentially volatile period for investors. The market is currently buzzing with optimism, fueled by a combination of factors. The recent performance of key market indices, such as the S&P 500 and the Nasdaq, has been encouraging, suggesting a positive trajectory.

Analysts are also cautiously optimistic, pointing to a number of factors that could drive further growth in the coming months. However, it’s crucial to acknowledge the potential risks and challenges that could impact the market’s upward trajectory.

Inflation data remains a key indicator that investors are closely watching. The Federal Reserve’s monetary policy decisions will be heavily influenced by the latest inflation figures. Earnings season, which is currently underway, is another critical factor shaping investor expectations.

Companies are releasing their quarterly earnings reports, providing valuable insights into their performance and future prospects. The performance of different sectors will be closely scrutinized, as investors seek to identify potential investment opportunities.

Market Outlook: Stock Market Anticipates Rise As Inflation Data And Earnings Season Take Center Stage

The stock market is currently exhibiting a bullish sentiment, with investors anticipating a rise in the coming months. This optimism is driven by a confluence of factors, including the recent easing of inflation, strong corporate earnings, and the Federal Reserve’s potential pivot towards a less aggressive monetary policy.

Recent Market Performance

The recent performance of key market indices provides further evidence of the bullish sentiment. The S&P 500, a broad measure of the US stock market, has gained over 15% since its October 2022 lows. Similarly, the tech-heavy Nasdaq Composite has surged over 30% during the same period.

With the stock market anticipating a rise as inflation data and earnings season take center stage, investors are seeking out sectors with strong growth potential. One area attracting attention is luxury goods, with analysts pointing to continued consumer demand for high-end products.

For those looking to capitalize on this trend, it’s worth exploring investing in luxury goods stocks billionaire ken fishers recommendations and top analyst favored companies , including those favored by billionaire investor Ken Fisher. As the market navigates these key economic indicators, savvy investors will be looking for sectors that can weather the storm and offer consistent returns.

These gains are significantly higher than the historical average returns for these indices, suggesting a strong upward momentum.

The S&P 500 has historically averaged annual returns of around 10%, while the Nasdaq Composite has averaged around 12%.

Analyst Opinions and Forecasts

Prominent financial analysts are largely optimistic about the market’s prospects for the coming months. Many believe that the recent decline in inflation and the potential for a less aggressive Fed will create a favorable environment for stocks. Some analysts even predict that the S&P 500 could reach new all-time highs by the end of the year.

“We believe that the market is poised for further gains in the coming months, driven by a combination of easing inflation, strong corporate earnings, and a more accommodative Fed,” said [Name of Analyst], Chief Investment Strategist at [Name of Financial Institution].

Inflation Data

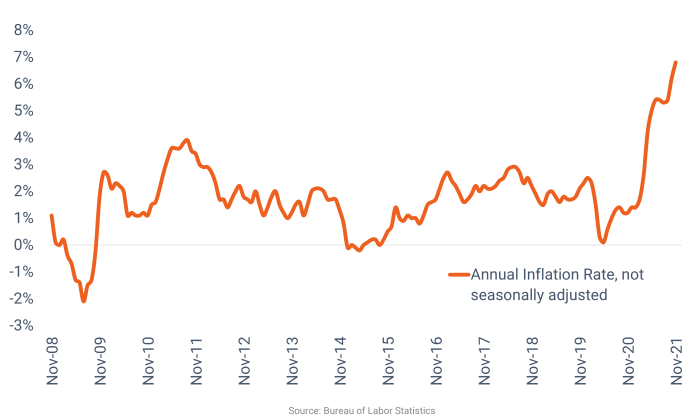

Inflation data is a crucial economic indicator that closely influences market sentiment and investor behavior. It provides valuable insights into the overall health of the economy, particularly concerning consumer spending, business activity, and the purchasing power of money.

Latest Inflation Figures and Comparison

The latest inflation figures provide a snapshot of price changes across a broad range of goods and services within a specific period. Comparing these figures to previous releases helps gauge the pace of inflation and whether it’s accelerating, decelerating, or remaining stable.

For instance, the Consumer Price Index (CPI), a widely followed inflation measure, can be compared to previous months or years to determine if inflation is rising or falling.

The stock market is bracing for a potential surge as investors anxiously await inflation data and the start of earnings season. Understanding the forces at play in the market can be a challenge, but it’s even more critical to grasp the impact of emerging technologies like artificial intelligence, which is rapidly transforming every sector.

If you’re looking to gain a deeper understanding of AI and its implications, check out know the secrets of ai your essential guide to understanding artificial intelligence. With AI playing an increasingly significant role in the economy, staying informed about its advancements and potential applications is essential for navigating the market’s future trajectory.

Impact on Federal Reserve’s Monetary Policy

Inflation data plays a significant role in shaping the Federal Reserve’s monetary policy decisions. The Fed closely monitors inflation trends to determine the appropriate course of action for interest rates.

When inflation is high and persistent, the Fed typically raises interest rates to cool down the economy and curb price increases. Conversely, if inflation is low or falling, the Fed may lower interest rates to stimulate economic growth.

Earnings Season

Earnings season is a crucial period for investors as it provides insights into the financial health and future prospects of publicly traded companies. During this time, companies release their quarterly or annual earnings reports, which reveal their revenue, profits, and other key performance indicators.

While Wall Street eyes inflation data and earnings season for clues on the market’s trajectory, a bizarre trend on TikTok is capturing attention. The McDonald’s Grimace Shake has sparked a viral trend of users faking their “death” after consuming the purple drink, adding a layer of unexpected absurdity to the economic landscape.

Meanwhile, investors await the economic indicators that will ultimately determine the market’s direction.

These reports offer valuable information that can influence investor sentiment and stock prices.

Key Companies and Expected Impact

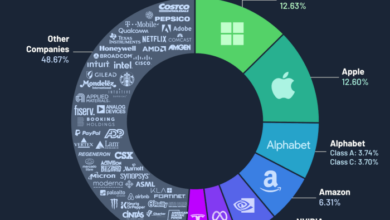

Earnings reports from major companies can have a significant impact on the overall market. Investors closely watch the performance of large-cap companies, particularly those in influential sectors such as technology, healthcare, and finance. For instance, the earnings reports of Apple, Amazon, and Microsoft are closely scrutinized for their potential to move the broader market.

The performance of these companies can provide a gauge of the overall health of the economy and the consumer spending environment.

- Technology Sector:The technology sector is expected to face challenges due to slowing economic growth and increased competition. However, companies with strong growth prospects and a focus on artificial intelligence and cloud computing may outperform.

- Healthcare Sector:The healthcare sector is expected to benefit from an aging population and rising healthcare costs.

Pharmaceutical companies and medical device manufacturers are likely to see continued growth.

- Finance Sector:The finance sector is expected to benefit from rising interest rates. Banks and other financial institutions are likely to see increased profits as they can charge higher interest rates on loans.

Market Volatility and Risk Factors

While the stock market anticipates a rise driven by positive inflation data and robust earnings season, it’s crucial to acknowledge the potential risks and challenges that could impact this anticipated trajectory. The market, by its nature, is inherently volatile and susceptible to various factors, both internal and external, that can influence its direction.

Geopolitical Landscape and Market Sentiment

The current geopolitical landscape remains a significant source of uncertainty and risk for the market. The ongoing conflict in Ukraine, heightened tensions between the US and China, and geopolitical instability in other regions can impact investor sentiment and market performance.

These events can lead to increased volatility, disrupt supply chains, and create uncertainty about global economic growth. For instance, the ongoing conflict in Ukraine has disrupted energy markets and commodity prices, leading to increased inflation and economic uncertainty.

Economic Indicators and Market Direction, Stock market anticipates rise as inflation data and earnings season take center stage

Several economic indicators can signal a shift in market direction. These indicators provide valuable insights into the health of the economy and can influence investor sentiment.

- Inflation:While recent data suggests inflation is cooling, continued high inflation could force the Federal Reserve to maintain or even increase interest rates, potentially slowing economic growth and impacting corporate earnings.

- Interest Rates:Rising interest rates can increase borrowing costs for businesses and consumers, potentially slowing economic activity. The Federal Reserve’s monetary policy decisions will be closely watched by investors.

- Consumer Spending:Consumer spending is a key driver of economic growth. A decline in consumer spending, potentially driven by inflation or rising interest rates, could signal a weakening economy and negatively impact corporate profits.

- Employment Data:Strong employment data can indicate a healthy economy, but a decline in job growth or an increase in unemployment could signal a weakening economy and impact investor sentiment.

Investor Strategies and Opportunities

The current market environment presents both challenges and opportunities for investors. With inflation still a concern, though showing signs of easing, and the Federal Reserve likely to maintain a hawkish stance, investors need to be selective and adopt strategies that can help them navigate volatility and potentially generate returns.

Sector Rotation and Growth Opportunities

Sector rotation is a key strategy for investors in this environment. As economic conditions evolve, different sectors may outperform others. Some sectors that could offer growth opportunities in the coming months include:

- Energy:Continued high energy prices and strong demand could benefit energy companies. However, investors should be aware of potential volatility in oil and gas prices.

- Financials:Rising interest rates typically benefit banks, as they can charge higher interest rates on loans. However, the potential for a recession could impact loan demand and profitability.

- Technology:While the technology sector has been under pressure in recent months, some companies with strong fundamentals and growth potential could outperform. Investors should focus on companies with recurring revenue streams and strong balance sheets.

- Healthcare:The healthcare sector is generally considered defensive, as demand for healthcare services tends to be relatively stable regardless of economic conditions. Investors may consider companies focused on pharmaceuticals, medical devices, and biotechnology.

Portfolio Allocation Strategies

A well-diversified portfolio is crucial for managing risk and maximizing returns. Here’s a hypothetical portfolio allocation strategy that could be considered:

| Asset Class | Allocation |

|---|---|

| Large-Cap U.S. Stocks | 25% |

| International Stocks | 15% |

| Small-Cap Stocks | 10% |

| Fixed Income | 30% |

| Alternatives | 10% |

This strategy emphasizes a balanced approach, with a significant allocation to stocks for growth potential and fixed income for diversification and income generation. The allocation to alternatives, such as real estate or commodities, can help further reduce portfolio volatility.

It is important to note that this is just a hypothetical allocation and investors should tailor their portfolios to their specific risk tolerance, time horizon, and financial goals. Consult with a financial advisor for personalized advice.