Market Watch: Stocks Down, Oil Up, Central Banks Decide

Market watch stocks downturn as central banks prepare for rate decisions oil prices surge – Market Watch: Stocks Down, Oil Up, Central Banks Decide – these are the headlines dominating the financial news as central banks prepare for crucial rate decisions. With stocks struggling, oil prices surging, and inflation still a concern, investors are navigating a complex and uncertain landscape.

The upcoming rate decisions from major central banks will be a pivotal moment, potentially impacting everything from interest rates and economic growth to consumer spending and business investment.

The stock market has been on a roller coaster ride in recent months, driven by a confluence of factors. Rising inflation, the potential for further rate hikes, and concerns about a global economic slowdown have all contributed to the volatility.

Meanwhile, oil prices have soared, fueled by supply constraints, geopolitical tensions, and strong demand. The impact of these trends on the economy and the financial markets is significant, making it crucial to understand the interplay between central bank policy, oil prices, and stock market performance.

Market Watch and Stock Downturn

The stock market is currently navigating a challenging landscape, with a confluence of factors weighing on investor sentiment and driving market volatility. While the recent decline in major indices like the S&P 500 and Nasdaq has garnered significant attention, a deeper analysis reveals a complex interplay of economic indicators, central bank policies, and geopolitical events.

Central Bank Rate Decisions and Stock Market Performance

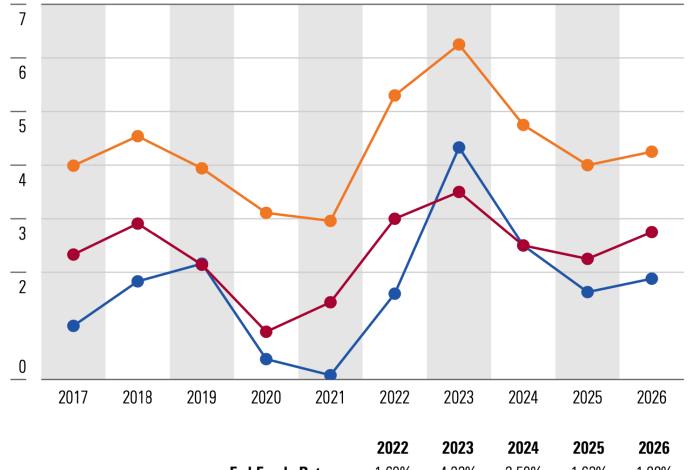

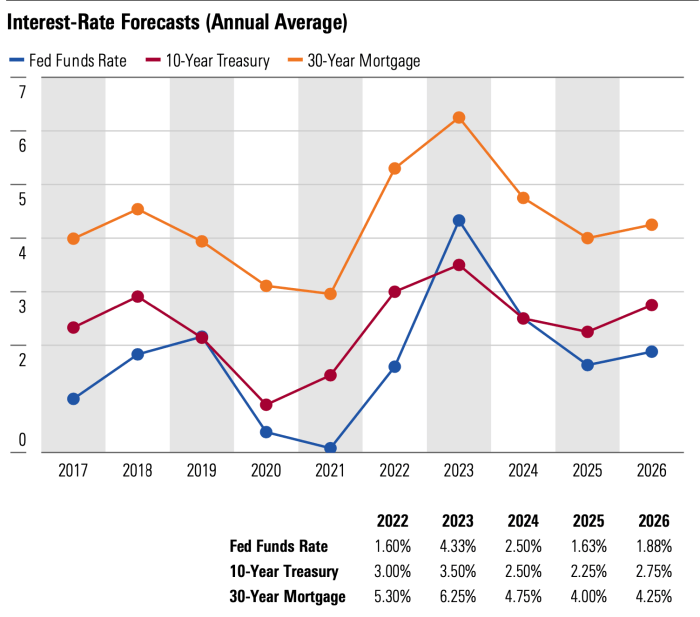

Central bank interest rate decisions have a profound impact on stock market performance. When central banks raise interest rates, it becomes more expensive for companies to borrow money, potentially slowing economic growth and dampening corporate earnings. Conversely, lower interest rates stimulate borrowing and investment, often leading to a more buoyant stock market.

Recent decisions by the Federal Reserve and other major central banks to raise interest rates have contributed to the current stock market downturn.

The market’s been a rollercoaster lately, with stocks dipping as central banks prepare for their rate decisions and oil prices skyrocketing. It’s a reminder that the global economy is a complex beast, constantly shifting and surprising us. But amidst the financial chaos, there’s a bright spot: the Indian Premier League (IPL), which has become a financial juggernaut, proving that sports can be a powerful engine for economic growth.

This article dives deep into the money game of Indian cricket, exploring how the IPL has become a financial powerhouse. While the global markets are in a state of flux, the IPL’s success is a testament to the enduring power of entertainment and the potential for sports to drive economic growth, even in uncertain times.

Oil Prices and Stock Market Fluctuations

The correlation between oil prices and stock market fluctuations is complex and multifaceted. Rising oil prices can have a negative impact on corporate earnings, as businesses face higher costs for transportation and production. However, oil prices also serve as an indicator of economic activity, and a surge in prices can sometimes signal a robust global economy, which can benefit stock market performance.

The recent surge in oil prices, driven by factors such as geopolitical tensions and supply constraints, has contributed to market uncertainty and volatility.

Investor Sentiment and Market Volatility

Investor sentiment is a key driver of market volatility. In times of economic uncertainty, investors tend to become more risk-averse, leading to sell-offs and market declines. Conversely, periods of economic optimism and strong corporate earnings often lead to a more bullish sentiment and stock market gains.

The current downturn has been characterized by heightened investor anxiety, driven by concerns about inflation, rising interest rates, and geopolitical risks.

The market’s been a roller coaster lately, with stocks taking a downturn as central banks gear up for crucial rate decisions and oil prices soar. It’s a wild ride, and the news is reflecting the volatility. For a live look at Wall Street’s current state, check out this article: live news coverage wall street faces mixed earnings reports and anticipates fed rate decision.

It’s a mix of earnings reports and anticipation for the Fed’s announcement, adding another layer of uncertainty to the already volatile market. With all these factors at play, investors are bracing for a bumpy ride in the coming weeks.

Central Bank Rate Decisions: Market Watch Stocks Downturn As Central Banks Prepare For Rate Decisions Oil Prices Surge

Central banks around the world are preparing to make crucial interest rate decisions in the coming weeks, with implications for global financial markets, economic growth, and inflation. These decisions are being made against a backdrop of persistent inflation, slowing economic growth, and geopolitical uncertainty.

While the market watches stocks downturn as central banks prepare for rate decisions and oil prices surge, a different kind of storm is brewing in the political arena. The Senate’s most prominent advocate for cryptocurrency, known as the “Crypto Queen,” has unveiled a far-reaching new bill focused on Bitcoin, which could have a significant impact on the future of the digital currency.

This move comes at a time when the traditional financial markets are in a state of flux, leaving investors wondering if the rise of crypto will be a boon or a bust.

Factors Influencing Central Bank Decisions

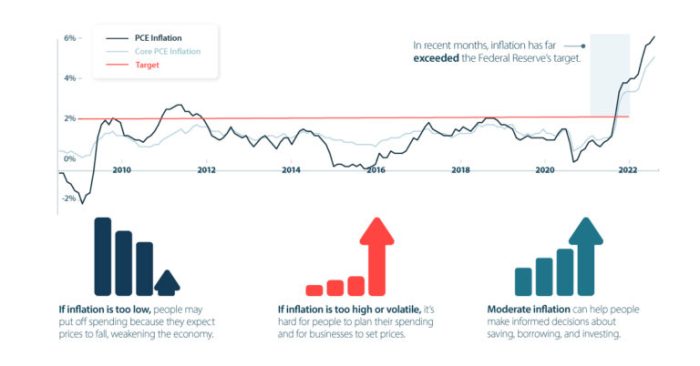

Central bank policy decisions are primarily driven by two key macroeconomic indicators: inflation and unemployment.

- Inflation: Central banks aim to maintain price stability by keeping inflation at a target level, typically around 2%. When inflation is high, central banks often raise interest rates to cool down the economy and curb price increases.

- Unemployment: Central banks also consider the level of unemployment when setting interest rates. A low unemployment rate can signal a strong economy, but it can also lead to higher inflation. In such cases, central banks might raise interest rates to prevent the economy from overheating.

Potential Impact of Rate Decisions, Market watch stocks downturn as central banks prepare for rate decisions oil prices surge

The upcoming rate decisions by major central banks are likely to have a significant impact on interest rates and economic growth.

- Interest Rates: If central banks raise interest rates, it will become more expensive for businesses and consumers to borrow money. This can lead to a slowdown in economic activity, as businesses may invest less and consumers may spend less.

- Economic Growth: Rate hikes can also have a dampening effect on economic growth. By making borrowing more expensive, central banks can slow down investment and consumer spending, leading to slower economic expansion.

Implications for Businesses and Consumers

Rate hikes can have both positive and negative implications for businesses and consumers.

- Businesses: Higher interest rates can make it more expensive for businesses to borrow money for investments, expansion, or working capital. However, they can also lead to a stronger currency, which can benefit businesses that export goods and services.

- Consumers: Higher interest rates can make it more expensive for consumers to borrow money for mortgages, auto loans, and credit cards. This can reduce consumer spending and slow down economic growth. However, higher interest rates can also lead to higher returns on savings accounts, which can benefit savers.

Oil Price Surge

The recent surge in oil prices has sent shockwaves through global markets, impacting everything from inflation and consumer spending to energy-dependent industries and global economies. Understanding the factors driving this price surge is crucial for navigating the current economic landscape.

Supply and Demand Dynamics

The recent surge in oil prices is primarily driven by a complex interplay of supply and demand factors.

- Supply Constraints:The ongoing conflict in Ukraine has disrupted global energy supplies, particularly from Russia, a major oil and gas exporter. The conflict has led to sanctions on Russian energy exports, reducing global supply and putting upward pressure on prices.

- Reduced Investment:The COVID-19 pandemic led to a significant decline in oil demand, prompting energy companies to reduce investments in new exploration and production projects. This reduced investment capacity has limited the ability to quickly increase supply to meet rising demand.

- Rebound in Demand:As economies recover from the pandemic, demand for oil has rebounded, particularly in China, a major oil importer. This surge in demand, combined with limited supply, has driven prices higher.

- OPEC+ Production Cuts:The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) have maintained production cuts, further limiting supply and contributing to higher prices. This strategy aims to balance supply and demand and support oil prices.

Impact on Inflation and Consumer Spending

The surge in oil prices has a significant impact on inflation and consumer spending.

- Inflationary Pressure:Higher oil prices increase the cost of transportation, manufacturing, and other goods and services, contributing to overall inflation. This can erode purchasing power and reduce consumer spending.

- Reduced Consumer Spending:Rising fuel prices directly impact consumer budgets, leaving less disposable income for other goods and services. This can lead to a decline in consumer spending, impacting economic growth.

- Impact on Energy-Intensive Industries:Industries that heavily rely on energy, such as transportation, manufacturing, and agriculture, are particularly vulnerable to higher oil prices. Increased energy costs can reduce profitability and competitiveness, potentially leading to job losses or reduced investment.

Implications for Energy-Dependent Industries and Global Economies

The oil price surge has far-reaching implications for energy-dependent industries and global economies.

- Energy-Dependent Industries:Industries heavily reliant on energy, such as airlines, shipping, and manufacturing, face significant challenges due to higher fuel costs. These industries may need to adjust their pricing strategies, reduce production, or seek alternative energy sources to mitigate the impact of higher oil prices.

- Global Economic Growth:The oil price surge can slow global economic growth by increasing input costs, reducing consumer spending, and impacting investment decisions. This can particularly affect emerging markets heavily reliant on energy imports.

- Geopolitical Tensions:High oil prices can exacerbate geopolitical tensions, as countries compete for limited energy resources. This can lead to increased instability and uncertainty in global markets.

Strategies for Mitigating the Impact of High Oil Prices

Mitigating the impact of high oil prices requires a multi-faceted approach, involving both government and private sector actions.

- Energy Efficiency:Promoting energy efficiency measures in homes, businesses, and transportation can reduce demand for oil and mitigate the impact of price increases. This can involve investing in energy-efficient technologies, improving building insulation, and promoting public transportation.

- Renewable Energy:Investing in renewable energy sources, such as solar, wind, and hydropower, can reduce dependence on fossil fuels and provide a more sustainable energy future. This can involve providing incentives for renewable energy projects, developing smart grids, and promoting energy storage technologies.

- Strategic Reserves:Governments can utilize strategic oil reserves to stabilize markets and mitigate price spikes. This involves releasing oil from reserves during periods of supply disruptions or high prices.

- Price Controls:Governments may consider implementing price controls on fuel to protect consumers from excessive price increases. However, price controls can create shortages and distort markets, requiring careful consideration and implementation.

Market Outlook and Strategies

The current market environment is characterized by heightened volatility, driven by factors such as central bank rate decisions, rising oil prices, and lingering concerns about inflation and economic growth. Navigating this complex landscape requires a nuanced approach to investment strategies.

Short-Term Outlook

The short-term outlook for the stock market remains uncertain. While recent market declines have been influenced by rising interest rates and inflation, potential catalysts for a rebound include a potential easing of monetary policy by central banks, signs of slowing inflation, and positive corporate earnings reports.

However, the risk of further market declines remains, particularly if economic growth slows significantly or geopolitical tensions escalate.

Long-Term Outlook

The long-term outlook for the stock market remains positive, driven by factors such as technological innovation, a growing global economy, and a rising middle class in emerging markets. However, investors should be prepared for periods of volatility and market corrections.

Potential Investment Opportunities and Risks

In the current market environment, investors should consider both opportunities and risks:

Opportunities

- Value stocks: Companies with strong fundamentals and undervalued assets may offer attractive returns as investors seek value in a volatile market. Examples include energy companies, which have benefited from rising oil prices, and financial institutions, which stand to gain from higher interest rates.

- Defensive sectors: Sectors such as healthcare and consumer staples tend to be less sensitive to economic fluctuations, providing a degree of stability in a volatile market.

- Emerging markets: Emerging markets may offer attractive growth potential, driven by a rising middle class and expanding economies. However, investors should be aware of the risks associated with emerging markets, including political instability and currency fluctuations.

Risks

- Inflation: Persistent inflation can erode the value of investments and lead to higher interest rates, which can negatively impact stock valuations.

- Recession: A recession could significantly impact corporate earnings and lead to a decline in stock prices.

- Geopolitical risks: Geopolitical tensions, such as the war in Ukraine, can create market volatility and impact global economic growth.

Strategies for Managing Risk and Maximizing Returns

To navigate a volatile market effectively, investors should consider the following strategies:

Diversification

Diversifying investments across different asset classes, sectors, and geographies can help reduce overall portfolio risk.

“Don’t put all your eggs in one basket.”

Warren Buffett

Long-Term Investing

Focusing on long-term investment goals and avoiding short-term market fluctuations can help investors weather market volatility and achieve their financial objectives.

“The stock market is a device for transferring money from the impatient to the patient.”

Warren Buffett

Dollar-Cost Averaging

Investing a fixed amount of money at regular intervals, regardless of market conditions, can help reduce the impact of market volatility and potentially increase returns over the long term.

Active Management

Active portfolio management involves regularly reviewing and adjusting investments based on market conditions and individual risk tolerance.

Passive Management

Passive portfolio management involves investing in low-cost index funds or exchange-traded funds (ETFs) that track a specific market index, such as the S&P 500.

Importance of Diversification and Long-Term Investing

Diversification and long-term investing are crucial for managing risk and maximizing returns in a volatile market. Diversification helps spread risk across different asset classes and sectors, reducing the impact of any single investment on overall portfolio performance. Long-term investing allows investors to ride out market fluctuations and benefit from the long-term growth potential of the stock market.