Swift Partners with Chainlink for Cross-Crypto Transfers

Swift partners with chainlink in cross crypto transfer – Swift Partners with Chainlink for Cross-Crypto Transfers, a game-changing collaboration that’s poised to revolutionize the way we move crypto assets across borders. This partnership marks a significant step towards bridging the gap between traditional finance and the decentralized world of blockchain technology.

Imagine a future where sending crypto from one platform to another is as seamless as sending money through your bank. This is the vision that Swift and Chainlink are working towards, leveraging their respective strengths to create a more efficient and accessible global financial system.

Swift and Chainlink Partnership: A Game Changer for Cross-Crypto Transfers

The partnership between Swift, the global financial messaging system, and Chainlink, a leading decentralized oracle network, marks a significant step in the evolution of the cryptocurrency landscape. This collaboration aims to bridge the gap between traditional finance and the decentralized world of crypto, paving the way for seamless and secure cross-border crypto transfers.

Swift partnering with Chainlink for cross-crypto transfers is a huge step towards mainstream adoption. It brings the security and reliability of traditional finance into the decentralized world. This move echoes the ideas of Gavin Wood, who envisions a future where blockchain mergers and acquisitions Gavin Wood: Chain Mergers & become commonplace, creating more robust and interconnected ecosystems.

By bridging the gap between traditional finance and crypto, Swift and Chainlink are paving the way for a future where blockchain technology is truly integrated into our everyday lives.

Addressing Key Challenges

This partnership addresses several key challenges that have hindered the widespread adoption of cryptocurrencies for cross-border transactions.

- Interoperability:The fragmented nature of the cryptocurrency ecosystem, with numerous blockchains and protocols, has created significant challenges for interoperability. Swift and Chainlink aim to address this by providing a standardized and secure framework for cross-chain communication.

- Security and Trust:Traditional financial institutions have been hesitant to embrace cryptocurrencies due to concerns about security and trust. The partnership leverages Chainlink’s secure and reliable oracle network to provide verifiable data and enhance the security of cross-crypto transfers.

- Regulatory Compliance:The lack of clear regulatory frameworks for cryptocurrencies has posed a significant obstacle for institutions. This collaboration aims to facilitate regulatory compliance by integrating with existing financial systems and adhering to established regulatory standards.

Revolutionizing Cross-Border Crypto Transfers

The Swift and Chainlink partnership has the potential to revolutionize cross-border crypto transfers by offering several key benefits:

- Faster and More Efficient Transfers:By leveraging the combined strengths of Swift and Chainlink, cross-border crypto transfers can be executed more efficiently and at a lower cost, reducing settlement times and improving transaction speeds.

- Enhanced Security and Transparency:The use of Chainlink’s decentralized oracle network provides a higher level of security and transparency for cross-crypto transfers, ensuring the integrity and authenticity of data used in transactions.

- Increased Accessibility:This partnership makes cryptocurrencies more accessible to a wider range of users, including traditional financial institutions and individuals who may not have previously had access to these technologies.

- Improved Interoperability:The partnership promotes interoperability between different blockchain networks, enabling seamless transfer of digital assets across various platforms.

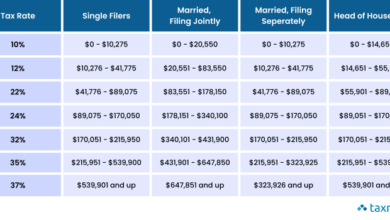

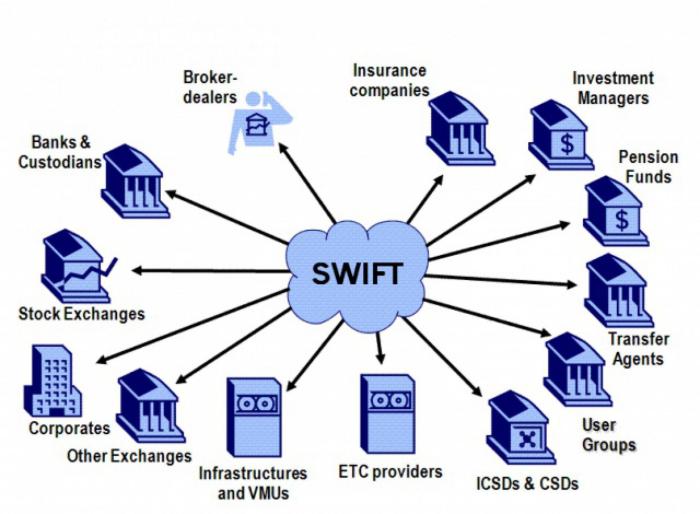

Understanding Swift’s Role in Traditional Finance

Swift, or the Society for Worldwide Interbank Financial Telecommunication, plays a crucial role in facilitating cross-border payments and financial transactions globally. It acts as a network that connects banks and financial institutions worldwide, enabling them to communicate securely and efficiently for international transactions.

Swift’s Core Functions and Impact

Swift’s core function is to provide a standardized messaging system for financial institutions to exchange payment instructions and other financial data securely and reliably. This network is essential for facilitating international trade, foreign exchange transactions, and other cross-border financial activities.

The news of SWIFT partnering with Chainlink for cross-crypto transfers is exciting, as it signifies a potential shift in the way traditional financial institutions interact with the decentralized world. This move reminds me of Gavin Wood’s insightful piece on Polkadot’s governance, Gavin Wood: A Walkthrough of Polkadot’s Governance , where he discusses the crucial role of on-chain governance in facilitating the growth of a decentralized ecosystem.

Just like Polkadot’s governance model, the integration of Chainlink’s oracles into SWIFT’s infrastructure could be a pivotal step towards greater interoperability and trust within the global financial landscape.

Swift’s impact on the global financial system is profound. It enables seamless and secure communication between financial institutions, contributing to:

- Increased efficiency:Swift’s standardized messaging system streamlines the process of international payments, reducing processing times and costs.

- Enhanced security:Swift’s network employs robust security measures to protect sensitive financial data, ensuring the integrity and confidentiality of transactions.

- Global reach:Swift’s network connects over 11,000 financial institutions in more than 200 countries and territories, facilitating cross-border transactions worldwide.

- Reduced risk:Swift’s network helps mitigate risks associated with international payments, such as fraud and settlement delays, by providing a secure and reliable platform for transactions.

Swift’s Existing Infrastructure and Limitations in Handling Cryptocurrency Transactions

Swift’s existing infrastructure, based on traditional financial systems, is not inherently designed to handle cryptocurrency transactions. The limitations include:

- Lack of native support:Swift’s messaging system is not built to process transactions on blockchain networks, making it incompatible with cryptocurrencies.

- Centralized control:Swift’s network operates under a centralized model, which contrasts with the decentralized nature of blockchain technology.

- Slow transaction speeds:Traditional payment systems, including Swift, often have slower transaction speeds compared to blockchain-based transactions.

- High transaction fees:Swift transactions can involve significant fees, particularly for international payments, which can be a deterrent for crypto transactions.

Potential Benefits of Integrating Blockchain Technology into Swift’s Existing Framework, Swift partners with chainlink in cross crypto transfer

Integrating blockchain technology into Swift’s existing framework has the potential to revolutionize cross-border payments and financial transactions. The potential benefits include:

- Faster and cheaper transactions:Blockchain technology can enable faster and more cost-effective cross-border payments, reducing processing times and transaction fees.

- Enhanced security and transparency:Blockchain’s decentralized and immutable nature can enhance security and transparency in financial transactions, reducing the risk of fraud and errors.

- Improved accessibility:Blockchain technology can facilitate access to financial services for underserved populations, including those in developing countries.

- Increased efficiency and automation:Blockchain can automate various aspects of financial transactions, streamlining processes and reducing manual intervention.

Chainlink’s Contribution to Cross-Crypto Transfers

Chainlink plays a crucial role in facilitating secure and reliable cross-crypto transfers by providing real-world data to smart contracts, bridging the gap between traditional finance and blockchain technology.

Chainlink’s Role in Providing Secure and Reliable Data Feeds

Chainlink’s decentralized oracle network provides a vital link between blockchain networks and external data sources. These oracles act as trusted intermediaries, fetching real-time data from various sources and delivering it to smart contracts on the blockchain. This data can include anything from market prices and exchange rates to regulatory information and identity verification.

The news of SWIFT partnering with Chainlink for cross-crypto transfers is a significant step in bridging the gap between traditional finance and the decentralized world. This partnership aims to streamline cross-border payments and enhance the accessibility of cryptocurrencies for a wider audience.

This development echoes the vision of interoperability that Gavin Wood has championed with Polkadot, which aims to connect different blockchains together. You can read more about Gavin Wood’s vision and Polkadot’s launch process in this insightful article: Gavin Wood Explains Polkadots Launch Process.

Both SWIFT and Chainlink’s efforts towards interoperability are paving the way for a more connected and efficient future of finance.

Chainlink’s decentralized oracle network ensures data integrity and reliability by using a network of independent nodes, eliminating single points of failure and mitigating the risk of manipulation.

Chainlink’s Decentralized Oracle Network and Its Importance in Bridging the Gap Between Traditional Finance and Blockchain

Chainlink’s decentralized oracle network is crucial in bridging the gap between traditional finance and blockchain technology. This network allows smart contracts to access real-world data, enabling them to execute complex transactions based on external events and conditions. This functionality is essential for facilitating cross-crypto transfers, as it allows for the seamless exchange of value between different blockchains.

Chainlink’s Technology in Facilitating Seamless Cross-Crypto Transfers within the Swift Network

Chainlink’s technology can facilitate seamless cross-crypto transfers within the Swift network by providing a secure and reliable mechanism for exchanging data between blockchains and traditional financial institutions. By integrating Chainlink oracles into the Swift network, financial institutions can access real-time information about crypto asset prices, exchange rates, and regulatory compliance, enabling them to execute cross-crypto transfers with confidence.

For example, a bank could use a Chainlink oracle to verify the identity of a user making a cross-crypto transfer, ensuring compliance with anti-money laundering regulations.

Benefits of Cross-Crypto Transfers for Users and Businesses: Swift Partners With Chainlink In Cross Crypto Transfer

The integration of Swift and Chainlink promises a revolutionary shift in cross-crypto transfers, offering significant advantages for both individuals and businesses. This partnership allows for faster, cheaper, and more accessible transactions, potentially reshaping the landscape of digital asset movement.

Benefits for Individuals

The seamless integration of traditional finance and blockchain technology through Swift and Chainlink creates a more user-friendly environment for individuals to engage with cryptocurrencies. This is achieved through faster transaction speeds, lower fees, and increased accessibility.

- Faster Transaction Speeds:Cross-crypto transfers facilitated by Swift and Chainlink are significantly faster than traditional methods. This is because blockchain technology enables near-instantaneous transactions, eliminating the delays associated with traditional banking systems. For example, a cross-border transfer that could take several days with traditional methods can be completed within minutes using Swift and Chainlink.

- Lower Fees:The fees associated with cross-crypto transfers are generally lower than traditional transfer fees. This is due to the decentralized nature of blockchain technology, which eliminates the need for intermediaries and their associated fees. For instance, a cross-border transfer using traditional methods might incur significant fees from multiple intermediaries, while a Swift and Chainlink-powered transfer would involve minimal fees.

- Increased Accessibility:The integration of Swift and Chainlink makes it easier for individuals to access and use cryptocurrencies. This is because Swift’s global network provides a familiar and trusted platform for users to send and receive digital assets. As a result, individuals who were previously hesitant to engage with cryptocurrencies due to complexity or lack of accessibility now have a simpler and more familiar gateway.

Benefits for Businesses

The advantages of cross-crypto transfers extend to businesses, enabling improved efficiency, reduced costs, and expanded market reach.

- Improved Efficiency:Businesses can streamline their operations and improve efficiency by utilizing cross-crypto transfers. Faster transaction speeds and lower fees reduce processing times and minimize costs, allowing businesses to operate more effectively. For instance, a business can receive payments from international clients in cryptocurrencies quickly and efficiently, eliminating the need for lengthy and costly traditional transfer processes.

- Reduced Costs:Cross-crypto transfers offer businesses significant cost savings. Lower transaction fees and reduced processing times translate into lower operating expenses. For example, a business can save substantial amounts on international payments by utilizing Swift and Chainlink’s cross-crypto transfer capabilities, freeing up capital for investment and growth.

- Expanded Market Reach:Businesses can tap into new markets and customer segments by accepting cryptocurrencies. Cross-crypto transfers allow businesses to receive payments from a wider range of customers, including those who prefer to use digital assets. This can significantly expand a business’s market reach and generate new revenue streams.

Comparison of Traditional and Cross-Crypto Transfers

| Feature | Traditional Transfers | Cross-Crypto Transfers |

|---|---|---|

| Transaction Speed | Slow (Days or Weeks) | Fast (Minutes or Seconds) |

| Fees | High (Multiple Intermediaries) | Low (Decentralized Network) |

| Accessibility | Limited (Complex Procedures) | Wide (Familiar and Trusted Platforms) |

| Security | Vulnerable (Intermediary Risks) | Secure (Blockchain Technology) |

| Transparency | Opaque (Lack of Real-Time Tracking) | Transparent (Blockchain Records) |

Technical Aspects of the Integration

The integration of Swift and Chainlink is a complex endeavor, requiring a deep understanding of both systems and their respective functionalities. The aim is to create a seamless bridge between traditional finance and the decentralized world of cryptocurrencies, facilitating secure and efficient cross-crypto transfers.The integration will involve a combination of technologies and protocols to ensure secure and reliable communication between the two systems.

This involves using Chainlink’s oracle network to provide real-time price data and other crucial information to Swift’s network, enabling accurate and transparent cross-crypto transactions.

Technical Challenges

Several technical challenges must be overcome for a successful implementation of the Swift and Chainlink integration.

- Interoperability:One of the primary challenges is ensuring seamless interoperability between Swift’s traditional financial messaging system and Chainlink’s decentralized oracle network. This requires careful consideration of data formats, communication protocols, and security standards.

- Security:Security is paramount in any financial system, and this integration is no exception. Ensuring the integrity and confidentiality of data exchanged between Swift and Chainlink is crucial to prevent fraud and manipulation. This involves implementing robust security measures, including encryption, authentication, and access control mechanisms.

- Scalability:The integration must be able to handle a significant volume of transactions without compromising speed or efficiency. This requires careful planning and optimization of the underlying infrastructure, including the use of distributed ledger technology (DLT) and other scalable solutions.

- Regulatory Compliance:The integration must comply with relevant regulations and legal frameworks in both the traditional finance and cryptocurrency sectors. This involves working closely with regulatory authorities and ensuring that the integration adheres to all applicable rules and standards.

Impact on Blockchain Technology and Adoption

The integration of Swift and Chainlink has the potential to significantly impact the development and adoption of blockchain technology in the financial sector.

- Increased Trust and Adoption:By integrating with Swift, a widely trusted and established financial network, Chainlink gains credibility and legitimacy in the eyes of traditional financial institutions. This could lead to increased trust and adoption of blockchain technology for cross-crypto transfers and other financial applications.

- Interoperability and Standardization:The integration could foster interoperability and standardization within the blockchain ecosystem. This could lead to the development of common standards and protocols, facilitating seamless communication and data exchange between different blockchain networks.

- New Financial Products and Services:The integration could pave the way for the development of new financial products and services that leverage the benefits of blockchain technology, such as cross-border payments, asset tokenization, and decentralized finance (DeFi).

Implications for the Future of Finance

The partnership between Swift and Chainlink marks a significant turning point in the evolution of global finance, potentially reshaping the landscape of cross-border payments and accelerating the adoption of cryptocurrency and blockchain technology within the traditional financial system. This integration holds immense promise for a more efficient, secure, and accessible financial future.

Impact on Cross-Border Payments

The integration of Swift and Chainlink has the potential to revolutionize cross-border payments by streamlining processes, reducing costs, and increasing speed. This will be achieved through:* Faster Transaction Times:Chainlink’s decentralized oracle network can provide real-time data and price feeds, enabling faster settlement times for cross-border payments compared to traditional methods.

Reduced Costs By eliminating intermediaries and streamlining processes, the integration can significantly reduce the costs associated with cross-border payments, making it more affordable for individuals and businesses.

Increased Security Chainlink’s decentralized nature enhances security by eliminating single points of failure and reducing the risk of fraud.

Improved Transparency The integration provides greater transparency into cross-border payments, enabling users to track their transactions in real-time.

Implications for Cryptocurrency Adoption

The Swift-Chainlink partnership can accelerate the adoption of cryptocurrency and blockchain technology in the global financial system by:* Increased Trust and Legitimacy:The integration of blockchain technology into the traditional financial system, through the partnership of Swift and Chainlink, lends legitimacy to cryptocurrency and blockchain technology, increasing trust and acceptance among financial institutions.

Bridging the Gap Between Traditional Finance and Decentralized Finance (DeFi) This integration acts as a bridge between traditional finance and DeFi, allowing for seamless interaction between the two worlds and enabling wider access to DeFi services for a broader audience.

Enhanced Interoperability The partnership promotes interoperability between different blockchain networks and traditional financial systems, facilitating smoother cross-chain transactions.

Timeline for Integration

While a definitive timeline for the complete integration of Swift and Chainlink is yet to be established, potential milestones and key developments include:

- Phase 1:Pilot projects and initial integrations with select financial institutions to test the feasibility and effectiveness of the integration.

- Phase 2:Gradual rollout of the integration to a wider range of financial institutions, accompanied by regulatory approvals and compliance measures.

- Phase 3:Full-scale implementation of the integration across the global financial system, with widespread adoption by financial institutions and businesses.