Surging Mortgage Rates Compound Housing Crisis for Buyers

Surging mortgage rates compound housing crisis posing challenges for home buyers, a perfect storm brewing in the real estate market. The recent surge in mortgage rates, driven by inflation, Federal Reserve policies, and market conditions, has significantly impacted affordability.

This rise, coupled with existing housing market challenges like limited inventory and high demand, creates a formidable obstacle for prospective homebuyers.

The housing crisis is impacting various segments of the population, particularly first-time homebuyers, families, and low-income households. The combination of rising mortgage rates and the housing crisis has made it even more challenging for individuals to achieve the dream of homeownership.

The Rise of Mortgage Rates

The recent surge in mortgage rates has significantly impacted the housing market, making homeownership less affordable for many. This increase has driven a wedge between buyers and sellers, adding to the already complex challenges of the housing crisis.

Factors Contributing to the Rise in Mortgage Rates

The recent surge in mortgage rates is a result of a confluence of factors, including:

- Inflation:The Federal Reserve’s aggressive interest rate hikes are a direct response to high inflation, which has been fueled by supply chain disruptions, strong consumer demand, and government stimulus measures. As the Fed raises interest rates, borrowing costs increase across the board, including mortgage rates.

- Federal Reserve Policies:The Federal Reserve’s monetary policy tightening is a key driver of rising mortgage rates. The Fed has raised its benchmark interest rate several times in recent months to combat inflation, and these increases have a direct impact on mortgage rates.

The surging mortgage rates are compounding the housing crisis, making it increasingly difficult for first-time buyers to enter the market. It’s a complex issue with multiple contributing factors, and understanding the intricacies of decentralized finance, like the difference between Bitcoin and Ethereum, how Ethereum is different from Bitcoin , can help us explore potential solutions.

While the housing crisis is a pressing concern, it’s crucial to acknowledge the potential of blockchain technology and its applications in addressing such issues.

- Market Conditions:The bond market plays a significant role in determining mortgage rates. When investors anticipate higher inflation or economic uncertainty, they demand higher returns on their investments, leading to higher bond yields. This, in turn, pushes mortgage rates higher.

Comparison to Historical Averages

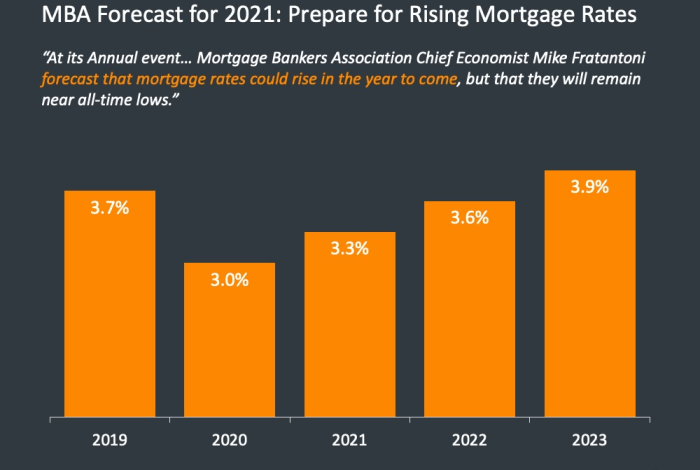

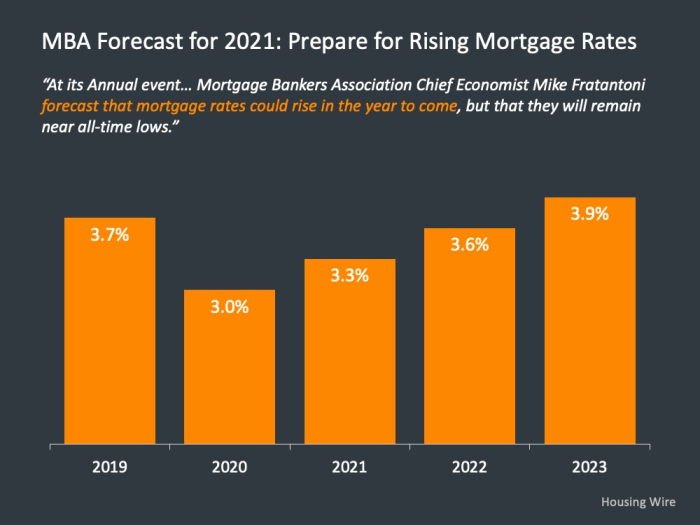

Current mortgage rates are significantly higher than historical averages. For instance, the average 30-year fixed-rate mortgage was around 3.5% in 2020, but it has now risen to over 7%. This sharp increase has made it much more expensive for buyers to finance a home.

Potential Future Trends

Predicting future mortgage rate trends is a complex task. However, several factors suggest that rates could remain elevated in the near term. Continued inflation, ongoing Fed tightening, and economic uncertainty could all contribute to higher borrowing costs. However, if inflation begins to cool down and the Fed signals a shift towards a more accommodative monetary policy, mortgage rates could potentially decline in the future.

The surging mortgage rates are compounding the existing housing crisis, making it increasingly difficult for buyers to enter the market. It’s a tough time for everyone, and it’s a stark reminder that life can be unpredictable. Sadly, the world recently lost a talented actor, Ray Stevenson, known for his roles in films like “The Punisher: War Zone” and “RRR,” as reported by The Venom Blog.

His passing is a loss to the entertainment industry, but the challenges faced by homebuyers continue, demanding a more stable and accessible housing market for everyone.

The Housing Crisis: Surging Mortgage Rates Compound Housing Crisis Posing Challenges For Home Buyers

The current state of the housing market is characterized by a perfect storm of challenges, creating a significant crisis for many seeking to buy a home. This crisis is not merely a temporary blip; it represents a complex interplay of factors that have converged to make homeownership increasingly unattainable for a large segment of the population.

The State of the Housing Market

The housing market is currently facing a severe imbalance between supply and demand. Limited inventory, fueled by a combination of factors like slow construction rates, aging homeowners reluctant to sell, and investors snapping up properties, has created a highly competitive environment.

The surging mortgage rates are compounding the housing crisis, making it increasingly difficult for homebuyers to enter the market. While navigating this financial hurdle, it’s also important to understand the complex world of investments, especially with the rise of cryptocurrencies.

Decoding crypto prices and understanding how cryptocurrencies are valued can help investors make informed decisions, just as understanding mortgage rates is crucial for homebuyers. With both housing and investments facing challenges, it’s a time for careful planning and strategic decision-making.

This limited supply, coupled with strong demand driven by factors like low interest rates (prior to the recent surge) and a robust economy, has led to a significant increase in home prices. This price surge, combined with the recent rise in mortgage rates, has made homeownership a distant dream for many.

Impact on Different Segments of the Population

The housing crisis is not affecting all segments of the population equally. First-time homebuyers, who often rely on tight budgets and face a challenging entry point into the market, are disproportionately impacted. The current situation makes it even harder for them to save for a down payment, navigate the competitive bidding wars, and ultimately secure a mortgage.

Families, especially those with growing needs for space, are also facing significant pressure. The affordability crisis makes it difficult for them to find suitable homes within their budget, forcing them to consider smaller properties or locations further from their desired areas.

Low-income households are particularly vulnerable, often facing a lack of affordable housing options and limited access to resources.

The Relationship Between Rising Mortgage Rates and the Housing Crisis

The recent surge in mortgage rates has significantly exacerbated the existing housing crisis. As interest rates rise, the monthly mortgage payments increase, making homeownership more expensive. This further reduces affordability for potential buyers, pushing them out of the market.

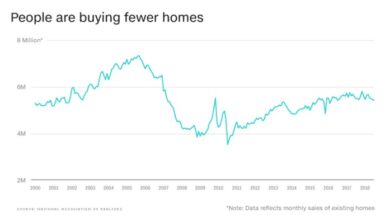

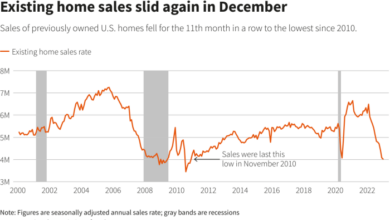

The rising rates have also led to a slowdown in home sales, as buyers become more hesitant to commit to a mortgage at higher interest rates. This slowdown in sales can further exacerbate the inventory shortage, as fewer sellers are willing to put their homes on the market.

This creates a vicious cycle where rising mortgage rates further fuel the housing crisis.

Challenges for Homebuyers

The current housing market presents a formidable landscape for homebuyers, characterized by affordability constraints, intense competition, and lingering uncertainty. The confluence of rising mortgage rates, soaring home prices, and limited inventory has created a perfect storm, making the dream of homeownership a daunting prospect for many.

Impact of Rising Mortgage Rates on Affordability

Rising mortgage rates have a significant impact on the affordability of homes. Higher rates translate into higher monthly payments, putting a strain on household budgets. For example, a 1% increase in the mortgage rate can increase monthly payments by hundreds of dollars, depending on the loan amount and term.

This reduction in purchasing power limits the pool of homes that buyers can afford, making it more challenging to find a suitable property within their budget.

Potential Solutions and Mitigation Strategies

The current housing crisis, fueled by surging mortgage rates, demands innovative solutions to stabilize the market and alleviate the challenges faced by homebuyers. Addressing this complex issue requires a multi-pronged approach, encompassing policy interventions, increased housing supply, and financial assistance programs.

Increasing Housing Supply

Addressing the housing shortage is paramount to stabilizing the market and making homeownership more attainable.

- Streamlining Zoning Regulations:Restrictive zoning regulations often hinder the development of new housing units, particularly affordable options. Relaxing these regulations and promoting mixed-use development can increase housing supply and cater to diverse needs.

- Incentivizing Housing Construction:Governments can incentivize developers to build more affordable housing by offering tax breaks, subsidies, or expedited permitting processes. These incentives can encourage the construction of rental units, townhouses, and other housing options that are more affordable than single-family homes.

- Investing in Public Housing:Expanding public housing programs and investing in infrastructure can provide safe and affordable housing options for low-income families. This can alleviate the pressure on the private market and create a more balanced housing ecosystem.

Providing Affordable Housing Options

A significant portion of the population struggles to afford housing, particularly in high-demand areas. Addressing this affordability gap requires a multifaceted approach.

- Expanding Housing Choice Voucher Programs:These programs provide rental assistance to low-income families, enabling them to access affordable housing options in the private market. Expanding these programs can have a direct impact on housing affordability and reduce homelessness.

- Developing Community Land Trusts:Community Land Trusts (CLTs) are non-profit organizations that acquire land and develop affordable housing units. They offer long-term affordability by separating ownership of the land from the dwelling, ensuring that housing remains affordable for future generations.

- Creating Shared Equity Programs:These programs allow homebuyers to purchase a portion of a home and share ownership with a non-profit or government entity. This reduces the upfront costs of homeownership and makes it more accessible to individuals and families with limited financial resources.

Offering Financial Assistance to Homebuyers, Surging mortgage rates compound housing crisis posing challenges for home buyers

Financial assistance programs can bridge the gap between affordability and homeownership, particularly for first-time buyers and low-income families.

- Down Payment Assistance Programs:These programs provide grants or loans to help homebuyers cover the down payment, reducing the financial barrier to entry. These programs can be targeted towards specific demographics, such as first-time buyers, veterans, or families in underserved communities.

- Mortgage Interest Rate Subsidies:Governments can offer interest rate subsidies to reduce the overall cost of homeownership. This can make mortgages more affordable and encourage homeownership, particularly for individuals with lower credit scores or limited income.

- Expanding Access to Affordable Mortgages:Programs that provide affordable mortgages with lower interest rates and relaxed credit requirements can make homeownership more accessible to a wider range of borrowers. This can be particularly beneficial for first-time buyers, low-income families, and individuals with limited credit history.

Stabilizing the Housing Market

In addition to addressing affordability and supply, policy interventions can help stabilize the housing market and prevent excessive price fluctuations.

- Regulating Speculative Investing:Speculative investing, where investors purchase properties solely for profit, can drive up prices and make it harder for genuine homebuyers to compete. Implementing regulations to curb speculative investing can help stabilize the market and ensure that housing is primarily used for residential purposes.

- Encouraging Long-Term Ownership:Policies that encourage long-term homeownership, such as property tax abatements or incentives for home improvements, can help stabilize the market and prevent excessive turnover. This can foster community development and create more stable housing environments.

- Addressing Foreclosure Crisis:Addressing foreclosure crisis and offering support to homeowners facing financial hardship can help prevent a cascade of foreclosures that can further destabilize the housing market. This can involve programs that provide counseling, mortgage modification, or temporary forbearance to help homeowners stay in their homes.