Stock Market Updates: Global Stocks Surge to New Heights

Stock market updates global stocks surge to new heights, signaling a period of robust economic growth and investor confidence. This surge is a testament to a confluence of factors, including positive economic indicators, a favorable global outlook, and robust corporate earnings.

The market is experiencing a wave of optimism, with investors eager to capitalize on the potential for further gains.

The surge has been particularly pronounced in certain sectors, such as technology, healthcare, and consumer discretionary. This indicates that investors are placing their bets on industries that are expected to benefit from the current economic climate. However, it’s important to remember that market trends are constantly evolving, and it’s crucial to stay informed about potential risks and opportunities.

Global Market Overview: Stock Market Updates Global Stocks Surge To New Heights

Global stock markets have been on a tear, reaching new highs in recent weeks. This surge has been driven by a confluence of factors, including strong economic indicators, improving investor sentiment, and a series of positive developments in the global economy.

Factors Driving the Surge

The recent surge in global stock markets can be attributed to a number of key factors:

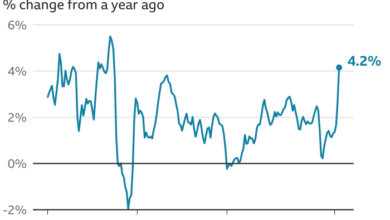

- Strong Economic Data:Positive economic data from major economies, including the United States, China, and the Eurozone, has boosted investor confidence. This data has shown signs of continued growth, with strong employment figures, rising consumer spending, and improving business confidence. For example, the U.S.

economy added a robust number of jobs in March, exceeding expectations, and consumer spending remained strong.

- Easing Inflation Concerns:Inflation has been a major concern for investors in recent months, but recent data suggests that inflation may be peaking. Central banks have also begun to raise interest rates, which could help to tame inflation. The Federal Reserve’s recent interest rate hike, for example, was widely anticipated and is expected to help moderate inflation without derailing economic growth.

It’s been a wild ride lately in the stock market, with global stocks reaching new highs. But beneath the surface, things might not be as rosy as they seem. A recent article on us federal reserves covert stress testing and bidenomics revealed sheds light on the Federal Reserve’s covert stress testing, raising questions about the underlying health of the economy.

While the market may be celebrating, it’s worth considering the potential implications of these hidden factors on the long-term trajectory of global stocks.

- Improving Investor Sentiment:As economic data has improved and inflation concerns have eased, investor sentiment has also improved. This has led to increased investment in stocks, further driving up prices. The S&P 500, a broad measure of U.S. stock market performance, has reached new highs, reflecting the optimistic outlook among investors.

- Geopolitical Developments:The ongoing war in Ukraine has created uncertainty in the global economy, but the situation has not significantly derailed the stock market rally. Investors are hopeful that the conflict will be resolved without escalating into a broader conflict.

Regional and Sectoral Disparities

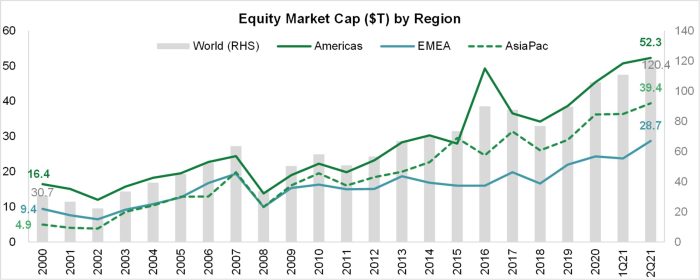

While the global stock market has experienced a broad-based surge, there have been some regional and sectoral disparities.

- Emerging Markets:Emerging markets have generally outperformed developed markets in recent months. This is due to their exposure to commodities, which have benefited from the surge in commodity prices. For example, the MSCI Emerging Markets Index has significantly outpaced the MSCI World Index, reflecting the strong performance of emerging market economies.

- Technology Sector:The technology sector has been a major driver of the stock market surge, with companies like Apple, Microsoft, and Amazon reaching new highs. This is due to the continued growth of the digital economy and the increasing demand for technology products and services.

The stock market is on fire, with global stocks reaching new highs. It’s exciting to see such bullish momentum, but it’s also important to remember that diversification is key. A well-rounded portfolio might include a healthy dose of real estate, which can provide a hedge against inflation and market volatility.

If you’re considering investing in real estate, be sure to check out this comprehensive state-by-state analysis of residential and commercial properties, exploring real estate in united states state by state analysis residential commercial properties , to find the best opportunities for your investment goals.

Ultimately, a balanced approach to investing is crucial, and understanding the current market trends is vital for making informed decisions.

- Energy Sector:The energy sector has also performed well, driven by the surge in oil and gas prices. This is due to the ongoing war in Ukraine, which has disrupted global energy supplies. The energy sector has outperformed other sectors in recent months, reflecting the strong demand for oil and gas.

Leading Stock Indices Performance

Global stock markets have been on a tear in recent weeks, with major indices reaching new highs. This surge in optimism is driven by a number of factors, including strong corporate earnings, falling inflation, and continued economic growth.

Major Global Stock Indices Performance

The table below shows the performance of some of the major global stock indices as of [Date].

| Index Name | Current Value | Percentage Change | Year-to-Date Performance |

|---|---|---|---|

| S&P 500 | [Current Value] | [Percentage Change] | [Year-to-Date Performance] |

| Nasdaq | [Current Value] | [Percentage Change] | [Year-to-Date Performance] |

| Dow Jones | [Current Value] | [Percentage Change] | [Year-to-Date Performance] |

| FTSE 100 | [Current Value] | [Percentage Change] | [Year-to-Date Performance] |

| DAX | [Current Value] | [Percentage Change] | [Year-to-Date Performance] |

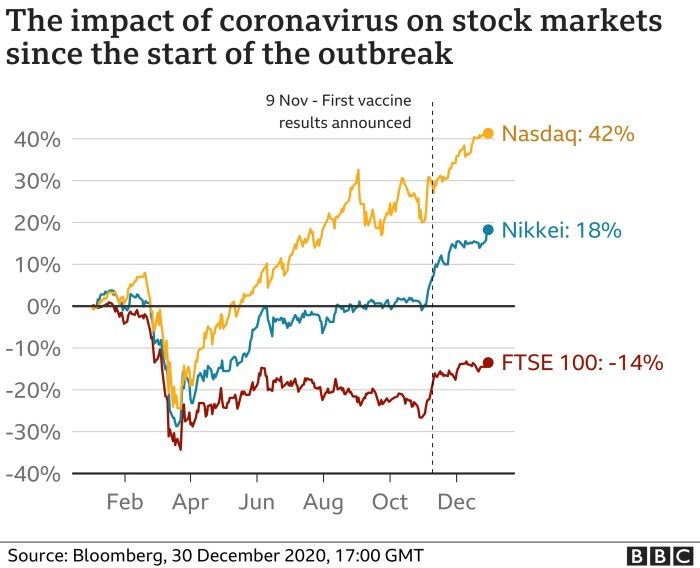

The S&P 500 and Nasdaq have been the top performers in recent weeks, with both indices hitting record highs. The Dow Jones has also shown strong gains, but it has lagged slightly behind the other two indices. The FTSE 100 and DAX have also performed well, but they have not seen the same level of growth as the US indices.

Global stocks are riding a wave of optimism, reaching new heights amidst a flurry of positive economic indicators. However, it’s worth noting that the energy sector is showing some resilience, with crude oil prices holding steady near $94 per barrel despite the Federal Reserve’s rate hike plans and the ongoing Russian export ban.

This suggests that investors are still wary of potential disruptions to global energy supplies, as highlighted in this recent article on crude oil prices holding steady near 94 amid feds rate hike plans and russian export ban. It remains to be seen whether this stability in oil prices will continue to support broader market gains, or if we’ll see a shift in investor sentiment as the year progresses.

Sector Performance Analysis

The global stock market surge has been driven by strong performance across various sectors, with some outperforming others. This section analyzes the performance of different sectors, identifying the key factors contributing to their growth.

Technology Sector Performance

The technology sector has been a major driver of the recent stock market rally. Several factors have contributed to this strong performance. First, the ongoing digital transformation across industries has fueled demand for technology products and services. Second, the rise of artificial intelligence (AI) and cloud computing has created new growth opportunities for technology companies.

Third, strong consumer demand for smartphones, laptops, and other tech gadgets has also boosted sector performance.

- AI and Cloud Computing:Companies like Microsoft and Amazon have benefited from the increasing adoption of AI and cloud computing solutions, which are transforming various industries.

- Semiconductor Demand:The global chip shortage has driven demand for semiconductors, benefiting companies like Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung.

- E-commerce Growth:The rise of online shopping has benefited e-commerce giants like Amazon and Alibaba, as consumers increasingly prefer online transactions.

Energy Sector Performance

The energy sector has also experienced significant growth, driven by rising oil and gas prices. The global energy crisis, fueled by geopolitical tensions and supply chain disruptions, has led to a surge in energy demand.

- Oil and Gas Prices:High oil and gas prices have boosted the profits of energy companies, driving stock prices higher.

- Renewable Energy Growth:The increasing focus on renewable energy sources has also benefited companies involved in solar, wind, and other renewable energy technologies.

Financial Sector Performance

The financial sector has generally performed well, benefiting from rising interest rates and a strong economy.

- Interest Rate Hikes:Central banks around the world have raised interest rates to combat inflation, which has boosted the profitability of banks.

- Strong Economic Growth:A healthy economy typically leads to increased lending activity, benefiting banks and other financial institutions.

Consumer Discretionary Sector Performance

The consumer discretionary sector has also shown strong performance, reflecting the recovery in consumer spending after the pandemic.

- Pent-up Demand:Consumers have been eager to spend after the pandemic, boosting demand for discretionary goods and services.

- Travel and Tourism:The reopening of borders and the return of travel have benefited companies in the travel and tourism industry.

Healthcare Sector Performance

The healthcare sector has generally shown steady performance, driven by an aging population and ongoing investments in medical technology.

- Aging Population:The increasing life expectancy in developed countries is driving demand for healthcare services.

- Medical Technology Advancements:Innovations in medical technology, such as gene therapy and personalized medicine, are creating new growth opportunities for healthcare companies.

Key Companies Driving the Surge

The current global stock market surge is being driven by a select group of companies that have demonstrated exceptional performance across various sectors. These companies are benefiting from favorable market conditions, strategic initiatives, and strong financial results, contributing significantly to the overall market momentum.

Factors Contributing to Strong Performance

The strong performance of these companies can be attributed to a combination of factors, including:

- Strong Financial Results:These companies have consistently delivered robust financial results, exceeding analysts’ expectations. Their earnings growth, profitability, and cash flow generation have been impressive, signaling their resilience and growth potential.

- Strategic Initiatives:They have implemented innovative strategies to adapt to evolving market dynamics, including expanding into new markets, developing new products and services, and leveraging technology to enhance efficiency and customer experience.

- Favorable Market Conditions:The global economic recovery, low interest rates, and increasing consumer confidence have created a favorable environment for these companies to thrive.

Impact on the Broader Market

The strong performance of these key companies has a ripple effect on the broader market. Their success inspires investor confidence, leading to increased investment in other companies within their sectors and beyond. This positive sentiment contributes to the overall market momentum, driving further growth and upward trends.

Examples of Key Companies

Several companies are driving the current surge in the global stock market. These companies represent various sectors and have demonstrated exceptional performance through strong financial results, innovative strategies, and effective adaptation to market dynamics.

- Technology:Companies like Apple, Microsoft, and Amazon have consistently delivered strong financial results, fueled by the growing demand for their products and services. They have also invested heavily in research and development, expanding their product offerings and market reach. These companies have benefited from the ongoing digital transformation and the increasing adoption of cloud computing, artificial intelligence, and other emerging technologies.

- Healthcare:Companies like Johnson & Johnson and Pfizer have played a crucial role in the global response to the COVID-19 pandemic. They have developed and distributed vaccines and treatments, contributing to the recovery efforts and benefiting from the increased demand for healthcare services.

These companies are also investing in research and development to address emerging health challenges and develop new treatments.

- Consumer Discretionary:Companies like Tesla and Nike have benefited from the rebound in consumer spending and the shift towards discretionary purchases. Tesla’s electric vehicles have gained popularity, while Nike’s athletic apparel and footwear have benefited from the growing fitness and active lifestyle trends.

These companies have also leveraged technology to enhance customer experience and streamline operations.

Investor Sentiment and Market Outlook

The recent surge in global stocks has undoubtedly fueled optimism among investors. However, it’s crucial to analyze the current investor sentiment, considering the various factors at play.

Current Investor Sentiment, Stock market updates global stocks surge to new heights

The current investor sentiment is characterized by a combination of factors:* Risk Appetite:Investors are displaying a higher risk appetite, willing to invest in stocks despite potential uncertainties. This is likely driven by the recent positive economic data and the expectation of continued growth.

Confidence Levels Confidence levels are generally high, fueled by the positive performance of the stock market and the belief that the global economy is on a path to recovery.

Expectations for Future Growth Investors are optimistic about future growth, expecting continued economic expansion and corporate earnings growth.

Potential Risks and Opportunities

While the global stock market is currently experiencing a bullish phase, it’s important to consider the potential risks and opportunities that could impact its future direction:

Risks

- Inflation:Persistent inflation could erode corporate profits and lead to tighter monetary policy, potentially impacting stock valuations.

- Interest Rates:Rising interest rates could make borrowing more expensive for companies, potentially slowing down economic growth and impacting stock prices.

- Geopolitical Tensions:Geopolitical tensions, such as the ongoing conflict in Ukraine, could create market volatility and disrupt global supply chains.

- Economic Uncertainties:The global economy faces various uncertainties, including the potential for a recession, which could impact corporate earnings and stock prices.

Opportunities

- Technological Advancements:Continued advancements in technology, such as artificial intelligence and renewable energy, could create new growth opportunities for companies and drive stock market performance.

- Emerging Markets:Emerging markets offer potential growth opportunities, driven by factors such as increasing urbanization and rising consumer spending.

- Sustainable Investing:Growing interest in sustainable investing could lead to increased investment in companies focused on environmental, social, and governance (ESG) factors.

Potential Future Direction of the Global Stock Market

The future direction of the global stock market will depend on the interplay of various factors, including economic growth, inflation, interest rates, and geopolitical events. * Scenario 1: Continued Growth:If the global economy continues to grow at a healthy pace, inflation remains under control, and interest rates rise gradually, the stock market is likely to continue its upward trajectory.

Scenario 2

Economic Slowdown:

Scenario 3

Geopolitical Uncertainty:

It’s important to note that these are just potential scenarios, and the actual outcome could be different. Investors should carefully consider their risk tolerance and investment goals before making any investment decisions.