Stock Market Update: Wall Street Eyes Fed Decision with Modest Gains

Stock market update wall street eyes fed decision with modest gains – Stock Market Update: Wall Street Eyes Fed Decision with Modest Gains sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Wall Street is currently holding its breath, waiting for the Federal Reserve’s interest rate decision, which is expected to significantly impact the stock market’s trajectory.

While modest gains have been observed in recent days, the market’s overall sentiment remains cautiously optimistic, with investors keenly aware of the potential for volatility.

The Fed’s decision will likely be the most significant event influencing market movements in the coming weeks. The anticipation is palpable, as analysts and investors alike grapple with the potential implications of a rate hike. Will the Fed adopt a more hawkish stance, signaling a continued fight against inflation, or will they take a more dovish approach, acknowledging the potential economic slowdown?

The answer to this question will shape the market’s direction, impacting everything from individual stock prices to the overall performance of major indices.

Wall Street’s Current State

Wall Street is cautiously optimistic as investors await the Federal Reserve’s interest rate decision. The market is experiencing modest gains, driven by hopes that the Fed might signal a pause in its rate-hiking cycle, potentially easing pressure on the economy.

Market Performance

The major market indices are reflecting this cautious optimism. The Dow Jones Industrial Average is up slightly, while the Nasdaq Composite and the S&P 500 are also trading in positive territory. This indicates a general sense of confidence among investors, though the gains are relatively modest, suggesting a degree of uncertainty surrounding the Fed’s decision.

Key Sectors Driving Gains

The technology sector is leading the charge, with several tech giants reporting strong earnings recently. This has boosted investor sentiment and contributed to the Nasdaq’s gains. The energy sector is also performing well, benefiting from rising oil prices. This positive performance is a result of a combination of factors, including increased global demand and supply constraints.

Focus on the Fed Decision

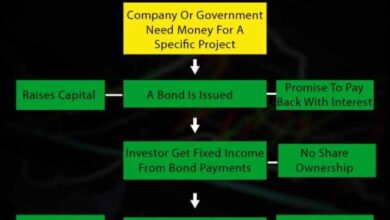

The Federal Reserve’s interest rate decision is a major event for the stock market, as it can significantly impact investor sentiment and market direction. The Fed’s actions influence borrowing costs, economic growth, and inflation, all of which play a crucial role in shaping stock valuations.The market is keenly anticipating the Fed’s decision, particularly in light of recent economic data and the ongoing battle against inflation.

Investors are closely analyzing the potential interest rate hike, the accompanying statement, and any hints about future policy moves.

Potential Scenarios Based on Interest Rate Hikes

The Fed’s decision to raise interest rates, lower rates, or maintain them at the current level will have a significant impact on the stock market. Here are some potential scenarios based on different interest rate hike possibilities:* A Larger-Than-Expected Rate Hike:A more aggressive rate hike could signal that the Fed is concerned about inflation and is determined to bring it under control.

This could lead to a sell-off in the stock market, as investors may anticipate slower economic growth and higher borrowing costs. For instance, in June 2022, the Fed raised interest rates by 75 basis points, leading to a sharp decline in the stock market.

A Smaller-Than-Expected Rate Hike A smaller rate hike could suggest that the Fed is becoming more cautious about the potential impact of its tightening policy on the economy. This could be seen as a positive sign by investors, potentially leading to a rally in the stock market.

However, a smaller rate hike might also indicate that the Fed is not fully committed to controlling inflation, which could lead to concerns about future price pressures.

No Rate Hike The Fed may choose to hold interest rates steady if it believes that inflation is cooling down and the economy is showing signs of weakness. This could be interpreted as a dovish stance, which could be positive for the stock market.

However, it could also lead to concerns about the Fed’s ability to control inflation in the long term.

Implications of the Fed’s Messaging and Future Policy Outlook

Beyond the actual rate decision, the Fed’s accompanying statement and any hints about future policy moves are equally important. The Fed’s messaging can provide valuable insights into its overall economic outlook, its inflation targets, and its commitment to controlling price pressures.* Hawkish Messaging:If the Fed’s statement suggests a continued focus on fighting inflation and a willingness to raise rates further, it could be seen as hawkish.

This could weigh on the stock market, as it suggests that interest rates will remain elevated for a longer period, potentially dampening economic growth.

Wall Street is on edge, watching closely as the Federal Reserve prepares to make its decision on interest rates. The market saw modest gains today, but the mood remains cautious. The news of genesis crypto lending filing for bankruptcy protection has added to the uncertainty, as it highlights the ongoing fragility in the crypto market.

Investors are likely to keep a close eye on how the Fed’s decision impacts both the traditional and digital financial landscapes.

Dovish Messaging A more dovish statement, suggesting that the Fed is becoming more cautious about raising rates and is willing to consider other factors, could be positive for the stock market. This indicates that the Fed is less concerned about inflation and is more focused on supporting economic growth.

Data Dependency

Wall Street is watching the Fed’s decision closely, with the market showing modest gains as investors anticipate the central bank’s next move. This cautious optimism is fueled by the expectation that the Fed might signal a pause in interest rate hikes, as outlined in this recent article, markets anticipate federal reserve decision stocks on the rise.

While the market is hoping for a more dovish stance, the Fed’s decision will ultimately determine the trajectory of the stock market in the coming weeks.

Key Economic Indicators

The recent economic data releases provide insights into the health of the US economy and its implications for the stock market. Investors are closely watching these indicators to gauge the trajectory of inflation, interest rates, and overall economic growth.

Inflation and Its Impact on Investor Sentiment

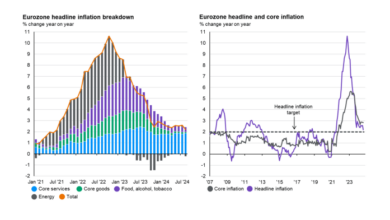

Inflation remains a key concern for investors. The latest Consumer Price Index (CPI) report showed a slight moderation in inflation, but it is still significantly higher than the Federal Reserve’s target of 2%. This persistent inflation has led to increased volatility in the stock market, as investors worry about the Fed’s response and its potential impact on corporate profits.

“The Fed’s commitment to bringing inflation down to its 2% target is a key factor driving investor sentiment.”

Interest Rates and Their Relationship with Inflation and Stock Market Performance

The Federal Reserve has been aggressively raising interest rates to combat inflation. Higher interest rates make it more expensive for businesses to borrow money, which can slow down economic growth and potentially impact corporate earnings. This has led to a correlation between interest rate hikes and stock market declines.

“The relationship between interest rates, inflation, and stock market performance is complex and can vary depending on the specific economic environment.”

- For example, in 2022, the Fed’s aggressive rate hikes led to a significant decline in the stock market, as investors anticipated a slowdown in economic growth and corporate earnings.

- However, the stock market has shown some resilience in 2023, as investors have become more optimistic about the Fed’s ability to manage inflation without triggering a recession.

Latest Economic Data Releases, Stock market update wall street eyes fed decision with modest gains

The latest economic data releases have provided mixed signals about the state of the US economy. While some indicators suggest a slowdown in growth, others point to continued resilience.

- The recent GDP report showed a slight contraction in the first quarter of 2023, but economists expect growth to rebound in the coming quarters.

- The labor market remains strong, with low unemployment and robust job creation, but wage growth has moderated, indicating that inflation is starting to ease.

- Consumer spending has remained steady, but there are concerns about slowing demand due to higher inflation and rising interest rates.

Investor Behavior and Sentiment

The current mood among investors is one of cautious optimism, with a delicate balance between risk appetite and risk aversion. The recent modest gains in the stock market suggest that investors are cautiously optimistic about the future, but the ongoing uncertainty surrounding inflation, interest rates, and the global economic outlook is keeping them on edge.The Fed’s decision on interest rates is a key factor driving investor sentiment.

If the Fed raises rates aggressively, it could lead to a slowdown in economic growth and a correction in the stock market. However, if the Fed signals a more dovish stance, it could boost investor confidence and lead to further gains.

Wall Street is on edge, watching closely as the Fed prepares to make its interest rate decision. While the market has seen modest gains, investors are looking for a clear signal about the future direction of monetary policy. For those seeking more control over their financial future, exploring profitable low investment business ideas unlocking high returns might be a worthwhile avenue.

After all, building a solid financial foundation can offer a sense of security regardless of the market’s ups and downs.

The Influence of Speculation and Market Psychology

Speculation and market psychology play a significant role in shaping the stock market trajectory. Investors often react emotionally to news events, which can lead to herd behavior and price bubbles. For example, the recent surge in meme stocks was driven by retail investors who were influenced by social media and online forums.

“The market is driven by sentiment, not fundamentals.”

Warren Buffett

Another example is the recent rise in the price of Bitcoin, which has been driven by speculation and the belief that it is a safe haven asset. However, the lack of regulation and the volatility of the cryptocurrency market have made it a risky investment.The current market environment is characterized by a high degree of uncertainty, which makes it difficult to predict future market movements.

Investors should be aware of the risks involved and make investment decisions based on a thorough understanding of the market and their own financial goals.

Key Companies and Sectors

The Fed’s decision will have a significant impact on various companies and sectors, especially those sensitive to interest rate changes. This section will analyze the potential impact of the Fed’s decision on different industries and delve into the stock market outlook for specific sectors like technology, healthcare, and energy.

Technology Sector

The technology sector is often viewed as sensitive to interest rate changes. Higher interest rates can impact the valuations of growth-oriented tech companies, which rely on future earnings expectations.

- Growth-oriented Tech Companies:Companies like Meta (META), Amazon (AMZN), and Tesla (TSLA)have seen their stock prices fluctuate significantly in response to interest rate hikes. These companies have high valuations based on future growth expectations, which can be impacted by rising interest rates.

- Software-as-a-Service (SaaS) Companies:Companies like Salesforce (CRM), Adobe (ADBE), and Microsoft (MSFT)rely on recurring revenue models, which can be affected by economic slowdowns. Higher interest rates can lead to a slowdown in business spending, potentially impacting SaaS companies’ growth prospects.

Healthcare Sector

The healthcare sector is generally considered less volatile than other sectors, but it can still be influenced by economic conditions. Higher interest rates can impact healthcare companies’ ability to finance expansion and acquisitions.

- Pharmaceutical Companies:Companies like Pfizer (PFE)and Johnson & Johnson (JNJ)are less sensitive to interest rate changes than other sectors. They generate consistent revenue streams from essential drugs and medical devices. However, higher interest rates could impact their ability to finance research and development, which is crucial for innovation.

- Healthcare Providers:Hospitals and other healthcare providers are sensitive to economic conditions, as patient volume can be impacted by job losses and reduced access to healthcare. Higher interest rates can also impact their borrowing costs for expansion and modernization projects.

Energy Sector

The energy sector is often influenced by global economic conditions and geopolitical events. Higher interest rates can impact oil and gas companies’ ability to invest in exploration and production.

- Oil and Gas Companies:Companies like ExxonMobil (XOM)and Chevron (CVX)have benefited from higher oil prices in recent years. However, higher interest rates could impact their ability to finance new projects and expand production.

- Renewable Energy Companies:Companies like NextEra Energy (NEE)and First Solar (FSLR)are less directly impacted by interest rate changes. However, higher interest rates can make it more expensive to finance renewable energy projects, which could slow down the transition to clean energy.

Potential Market Volatility: Stock Market Update Wall Street Eyes Fed Decision With Modest Gains

The Fed’s decision on interest rates could trigger significant market volatility, as investors react to the implications for economic growth, inflation, and corporate earnings. The potential for market swings is heightened by the current economic landscape, characterized by elevated inflation, rising interest rates, and geopolitical uncertainty.

Factors Contributing to Market Volatility

The Fed’s decision could spark market volatility due to several factors.

- Interest Rate Expectations:Investors closely monitor the Fed’s policy decisions, anticipating their impact on borrowing costs and economic growth. A more hawkish stance, with larger rate hikes or a faster pace of tightening, could lead to a sell-off in equities as investors become more risk-averse.

Conversely, a dovish stance, with smaller rate hikes or a pause in tightening, could trigger a rally in stocks as investors become more optimistic about economic prospects.

- Inflation Outlook:The Fed’s assessment of inflation plays a crucial role in determining the trajectory of interest rates. If the Fed signals concerns about persistent inflation, it could lead to a more aggressive tightening cycle, potentially triggering a market sell-off. Conversely, if the Fed indicates that inflation is moderating, it could lead to a less aggressive tightening cycle, potentially boosting market sentiment.

- Economic Growth Prospects:The Fed’s assessment of the economic outlook is another key factor influencing market volatility. If the Fed expresses concerns about a weakening economy, it could lead to a market sell-off as investors become more risk-averse. Conversely, if the Fed indicates a strong economic outlook, it could lead to a market rally as investors become more optimistic about corporate earnings and growth prospects.

Potential Market Reactions to Fed Decisions

The market’s reaction to the Fed’s decision will depend on the specific outcome and the accompanying messaging. The following table Artikels potential market reactions to different Fed decision outcomes: