Stock Market Shows Resilience Amid PPI Surge

Stock market shows resilience in the face of ppi surge – Stock Market Shows Resilience Amid PPI Surge, defying expectations in a surprising turn of events. Despite the recent surge in the Producer Price Index (PPI), a key indicator of inflation, the stock market has remained surprisingly resilient. This unexpected strength in the face of economic headwinds raises questions about the current state of the market and the factors driving its performance.

The PPI surge, a reflection of rising input costs for businesses, typically signals inflationary pressures and potential economic slowdown. However, the stock market’s ability to withstand this pressure suggests a complex interplay of factors at play. This resilience could be attributed to a number of factors, including robust corporate earnings, investor optimism, and accommodative monetary policy.

PPI Surge and its Impact: Stock Market Shows Resilience In The Face Of Ppi Surge

The Producer Price Index (PPI) measures the average change over time in the selling prices received by domestic producers for their output. A surge in the PPI, like the one we’ve seen recently, indicates that businesses are facing higher costs for their inputs, which they may pass on to consumers in the form of higher prices.

This can have a significant impact on the broader economy, affecting both businesses and consumers.

The stock market’s resilience in the face of the PPI surge is a testament to its ability to adapt to changing economic conditions. While rising inflation might cause some concern, remember that even in a high-interest rate environment, there are ways to save big on your home loan.

Check out these three easy tips on high mortgage rates no problem 3 easy tips to save big on your home loan to keep your finances on track. With a bit of planning and strategic adjustments, you can weather any storm and continue to invest in your future.

Impact on Businesses

A surge in the PPI can have a number of consequences for businesses. First, it can lead to higher input costs, which can eat into profits. Second, it can make it more difficult for businesses to compete, especially if their competitors are not facing the same cost pressures.

The stock market’s resilience in the face of the PPI surge is a testament to its ability to adapt to changing economic conditions. While some investors might be tempted to panic, others are looking for ways to capitalize on the situation.

Perhaps a more relaxed approach, like exploring some of the 10 relaxing jobs for seniors to enjoy retirement , could provide a different perspective on navigating the market. After all, a calm mind often makes for better investment decisions.

The stock market, much like life itself, is full of ups and downs, and those who can weather the storms are often rewarded in the long run.

Third, it can lead to a decrease in demand for goods and services, as consumers become more price-sensitive.

For example, if the price of raw materials used to produce cars increases significantly, car manufacturers may have to raise the prices of their vehicles. This could lead to a decrease in demand for cars, as consumers become less willing to pay higher prices.

Impact on Consumers

A surge in the PPI can also have a number of consequences for consumers. First, it can lead to higher prices for goods and services. Second, it can reduce the purchasing power of consumers, as their incomes do not keep pace with rising prices.

It’s fascinating to see how the stock market continues to show resilience despite the recent PPI surge. It seems like investors are weathering the storm, perhaps buoyed by the newfound energy in the cryptocurrency market. Bitcoin’s volatility is surging , which is certainly attracting attention and could be a contributing factor to the stock market’s continued strength.

While the economic outlook remains uncertain, it’s encouraging to see both traditional and digital assets exhibiting a degree of stability.

Third, it can lead to inflation, which can erode the value of savings.

For example, if the price of gasoline increases significantly, consumers may have to spend more of their income on transportation. This could lead to a decrease in spending on other goods and services, such as food, clothing, and entertainment.

Historical Trends and Anomalies

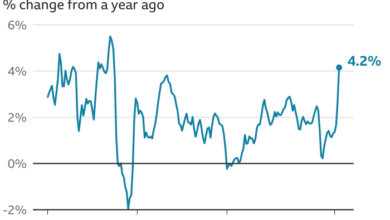

The current PPI surge is significant compared to historical data. The PPI has been rising steadily in recent months, reaching its highest level in decades. This is due to a number of factors, including supply chain disruptions, rising energy prices, and strong consumer demand.

The PPI surged by 11.2% in March 2022, the largest increase in over 40 years. This surge was driven by a number of factors, including the war in Ukraine, which disrupted global supply chains and led to higher energy prices.

The current PPI surge is a cause for concern, as it could lead to a period of sustained inflation. However, it is important to note that the economy is resilient, and there are a number of factors that could help to mitigate the impact of the PPI surge.

Factors Contributing to Market Resilience

Despite the recent surge in the Producer Price Index (PPI), the stock market has shown remarkable resilience. This unexpected strength suggests underlying factors are at play, mitigating the potential negative impact of inflation.

Monetary Policy and Central Bank Actions

The Federal Reserve’s (Fed) monetary policy plays a significant role in shaping market sentiment. The Fed’s commitment to controlling inflation, even at the cost of slowing economic growth, has instilled a degree of confidence among investors. The Fed’s actions, including interest rate hikes and quantitative tightening, aim to curb inflation, potentially contributing to market resilience.

Impact of Corporate Earnings and Economic Growth Projections, Stock market shows resilience in the face of ppi surge

Strong corporate earnings and positive economic growth projections have been a key driver of market resilience. Companies have been able to navigate inflationary pressures, demonstrating resilience in their earnings. Positive economic growth projections, even amidst rising inflation, suggest a healthy underlying economy, further bolstering investor confidence.

Potential Risks and Opportunities

While the stock market’s resilience in the face of the PPI surge is encouraging, it’s crucial to acknowledge potential risks and identify opportunities that may arise in this environment.

Potential Risks

The stock market’s current performance, while positive, is not without its risks. It’s essential to be aware of these potential threats to make informed investment decisions.

- Inflationary Pressures:Persistent inflation can erode corporate profits and consumer spending, potentially impacting stock valuations. The recent PPI surge suggests that inflationary pressures are not easing as quickly as expected, potentially impacting future economic growth and corporate earnings.

- Interest Rate Hikes:The Federal Reserve’s aggressive interest rate hikes aim to curb inflation, but they can also slow economic growth and impact corporate borrowing costs. Higher interest rates can make it more expensive for companies to finance operations, potentially leading to reduced investment and slower earnings growth.

- Geopolitical Uncertainty:The ongoing war in Ukraine and heightened geopolitical tensions in other regions can create volatility in global markets. These uncertainties can impact supply chains, energy prices, and investor sentiment, leading to market fluctuations.

- Recession Fears:The possibility of a recession is a looming concern, as economic growth slows and inflation remains high. A recession could significantly impact corporate earnings and stock prices, leading to a market downturn.

Investment Opportunities

Despite the potential risks, the current market environment presents opportunities for investors who are willing to navigate the challenges.

- Value Stocks:With inflation potentially impacting growth stocks, value stocks, which are often undervalued by the market, may offer attractive investment opportunities. These companies typically have strong fundamentals, stable earnings, and lower valuations compared to growth stocks, making them more resilient to economic downturns.

- Energy Sector:The ongoing energy crisis has driven up energy prices, making the energy sector a potential investment opportunity. Companies involved in oil and gas production, refining, and renewable energy are likely to benefit from the increased demand and higher prices.

- Defensive Sectors:Sectors like consumer staples and healthcare are considered defensive, as they tend to be less affected by economic downturns. These sectors offer stability and potential for steady returns, making them attractive investment options during periods of market volatility.

- Short-Term Opportunities:The current market volatility can create opportunities for short-term traders who are adept at identifying and capitalizing on market trends. Short-term trading strategies can involve exploiting price fluctuations and taking advantage of market momentum.

Hypothetical Portfolio Strategy

A hypothetical portfolio strategy in this environment might consider a balanced approach, incorporating both growth and value stocks, as well as defensive sectors.

- Growth Stocks (30%):Invest in high-growth companies with strong potential for future earnings growth. Consider sectors like technology, healthcare, and consumer discretionary.

- Value Stocks (30%):Focus on undervalued companies with strong fundamentals and stable earnings. Look for sectors like financials, industrials, and energy.

- Defensive Sectors (20%):Allocate a portion of the portfolio to sectors like consumer staples and healthcare, which offer stability and potential for steady returns.

- Fixed Income (20%):Include a portion of fixed income investments, such as bonds, to provide diversification and reduce portfolio volatility. Consider investing in high-quality bonds with varying maturities to manage interest rate risk.

This is a hypothetical portfolio strategy and should not be considered investment advice. It is essential to consult with a financial advisor before making any investment decisions.

Looking Ahead

The recent surge in the PPI, while a cause for concern, has not sent the market into a tailspin. This resilience suggests a degree of confidence in the underlying economic fundamentals. However, the future remains uncertain, and the PPI surge could have lasting implications.

Potential Market Trends and Volatility

The PPI surge, combined with other macroeconomic factors, could influence market trends and volatility in the near future. The extent of this impact will depend on several factors, including the Federal Reserve’s monetary policy response, consumer spending patterns, and global economic conditions.

The market could experience increased volatility as investors grapple with the implications of rising inflation and the Fed’s tightening monetary policy.

Investors should be prepared for a period of heightened market volatility as the economy navigates the path toward a more stable inflation environment.

Impact on Future Economic Policies

The PPI surge will likely prompt the Federal Reserve to continue its aggressive monetary tightening. This could involve further interest rate hikes and a reduction in the Fed’s balance sheet. The aim is to curb inflation by slowing down economic growth.

The Fed’s actions will be crucial in determining the trajectory of the economy and the stock market in the coming months.

Key Economic Indicators to Monitor

To navigate the market effectively, investors need to closely monitor key economic indicators. These indicators can provide insights into the health of the economy and the potential impact of the PPI surge on future economic policies.Here are some key economic indicators to watch:

- Consumer Price Index (CPI):This measures the change in prices paid by urban consumers for a basket of consumer goods and services. A sustained rise in CPI indicates inflation is not easing.

- Personal Consumption Expenditures (PCE):This is a measure of consumer spending, which is a key driver of economic growth. A slowdown in PCE growth could signal a weakening economy.

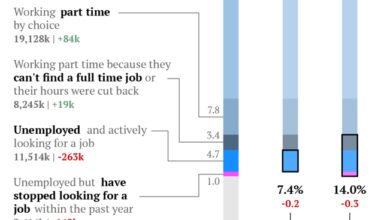

- Nonfarm Payrolls:This measures the number of new jobs created in the nonfarm sector. A decline in job growth could indicate a slowing economy.

- Manufacturing Purchasing Managers’ Index (PMI):This gauge of manufacturing activity can provide insights into the health of the industrial sector. A decline in the PMI could signal weakening demand.

- Federal Reserve Interest Rate Decisions:The Fed’s interest rate decisions are a key indicator of monetary policy. Investors will be closely watching for signs of a shift in the Fed’s stance on inflation.