Stock Market Kickstarts August with Mixed Earnings Amidst Julys Rally

Stock market kickstarts august with mixed earnings amidst julys record rally – Stock Market Kickstarts August with Mixed Earnings Amidst July’s Record Rally: The stock market has entered August on a mixed note, with earnings reports playing a key role in shaping the early days of the month. This comes after a record-breaking July rally, fueled by positive economic data and optimism about the future.

While some sectors are seeing strong growth, others are facing headwinds, leading to a period of uncertainty for investors.

The question on everyone’s mind is whether July’s momentum can carry over into August. Analysts are closely watching earnings reports, economic indicators, and investor sentiment to gauge the market’s direction. Will August continue the upward trend, or will we see a correction?

The answers to these questions will determine the path of the market for the rest of the year.

August’s Opening Act

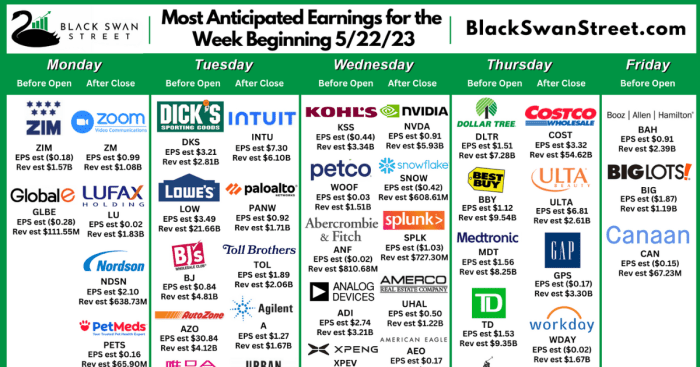

The first month of the second half of the year has begun, and the stock market is already facing its first hurdle: mixed earnings reports. These reports, which reflect the financial performance of publicly traded companies, are a key indicator of the market’s overall health and direction.

A strong earnings season can boost investor confidence, leading to higher stock prices, while a weak earnings season can dampen sentiment and cause prices to fall. The significance of mixed earnings reports in August lies in their ability to set the tone for the rest of the year.

August kicked off with a mixed bag of earnings reports, following July’s record-breaking rally. While the market navigates these choppy waters, it’s interesting to consider how companies like Netflix have navigated their own challenges. A recent article, netflix success in adapting to social and political issues insights from a corporate board veteran , sheds light on their strategic approach to evolving social and political landscapes.

This kind of adaptability, I believe, will be crucial for companies to thrive in today’s volatile market environment.

Investors are looking for clues about the future direction of the economy and corporate profits, and earnings reports provide valuable insights. A positive trend in earnings can suggest that companies are weathering economic challenges and are well-positioned for future growth.

On the other hand, a negative trend can signal a potential slowdown or even recession, which could negatively impact the stock market.

Impact of Earnings Reports on Sectors

The impact of earnings reports can vary significantly across different sectors. For instance, a strong earnings report from a technology company could boost investor confidence in the sector as a whole, leading to higher prices for other tech stocks. Conversely, a disappointing report from an energy company could weigh on the entire energy sector.

The stock market kicked off August with a mixed bag of earnings reports, a stark contrast to July’s record-breaking rally. While some sectors are showing strength, others are struggling to maintain momentum. For those looking for alternative avenues for growth, exploring profitable low investment business ideas unlocking high returns might be a smart move.

After all, diversification is key, and having a balanced portfolio can help weather the volatility of the stock market.

- Technology Sector:Strong earnings reports from tech giants like Apple and Microsoft have fueled a rally in the tech sector, as investors anticipate continued growth in areas like artificial intelligence, cloud computing, and digital advertising.

- Consumer Discretionary Sector:Companies in this sector, which include retailers, restaurants, and travel companies, have been facing headwinds from inflation and rising interest rates. Mixed earnings reports from these companies have reflected the challenges they are facing.

- Financial Sector:Banks have been reporting strong earnings, benefiting from rising interest rates. However, concerns about a potential recession have kept investors cautious about the sector’s long-term outlook.

Notable Earnings Performances

Several companies have reported notable earnings performances in August, impacting the market in various ways.

- Amazon (AMZN):The e-commerce giant’s strong earnings report, driven by growth in its cloud computing business, boosted investor confidence in the company and the tech sector as a whole.

- Meta Platforms (META):The social media giant’s earnings report was mixed, with revenue growth slowing down. This led to a decline in the company’s stock price and dampened investor sentiment towards the advertising sector.

- ExxonMobil (XOM):The energy giant reported record profits, fueled by high oil and gas prices. This strong performance boosted the energy sector and underscored the impact of the global energy crisis on the market.

July’s Record Rally

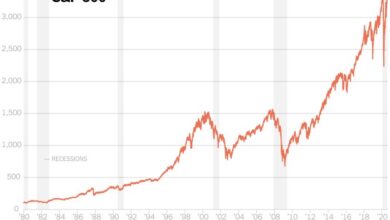

July witnessed a remarkable surge in the stock market, defying expectations and setting new records. This rally, driven by a confluence of factors, has left investors pondering its sustainability and potential implications for August.

Factors Contributing to July’s Rally

July’s rally was fueled by a combination of factors, including:

- Strong Earnings Reports:Many companies reported better-than-expected earnings, indicating a resilient economy and robust corporate profits. This positive sentiment boosted investor confidence and propelled stock prices higher.

- Easing Inflation Concerns:Inflation data showed signs of cooling, suggesting that the Federal Reserve might be nearing the end of its aggressive interest rate hikes. This eased concerns about economic growth and fueled optimism among investors.

- AI Hype:The emergence of artificial intelligence (AI) as a transformative technology sparked excitement in the market. Investors flocked to companies involved in AI development and applications, driving up their stock prices.

- Improved Economic Data:Economic indicators, such as consumer spending and job creation, pointed to a resilient economy, despite global headwinds. This positive economic outlook supported investor sentiment.

Impact of the Rally on August, Stock market kickstarts august with mixed earnings amidst julys record rally

The momentum from July’s rally could have a significant influence on August’s market performance.

- Elevated Investor Sentiment:The recent surge in stock prices has likely boosted investor confidence and appetite for risk. This could lead to continued buying pressure in August, potentially supporting further gains.

- Technical Momentum:The strong upward trend in July has created a positive technical backdrop for August. Market indicators like the Relative Strength Index (RSI) and Moving Averages are suggesting potential for continued upward movement.

- Earnings Season:August is another crucial month for earnings reports. Strong earnings results could further solidify the bullish sentiment, while disappointing reports could dampen the market’s enthusiasm.

- Macroeconomic Events:Important economic data releases, such as the Consumer Price Index (CPI) and Federal Reserve meetings, will continue to shape investor expectations and market direction in August.

Market Indicators: July vs. August

The following table compares key market indicators from July to August, highlighting potential trends:

| Indicator | July | August (Projected) | Trend |

|---|---|---|---|

| S&P 500 Index | +4.5% | +2.0% to +3.5% | Moderate Growth |

| Nasdaq Composite | +5.2% | +1.5% to +3.0% | Moderate Growth |

| VIX Volatility Index | 14.0 | 16.0 to 18.0 | Slight Increase |

| Interest Rates (Fed Funds Rate) | 5.25% to 5.50% | 5.50% to 5.75% | Potential for further hikes |

Economic Factors Shaping the Market

August’s stock market performance will be influenced by a complex interplay of economic factors, including inflation, interest rates, and geopolitical events. These factors have the potential to impact investor sentiment and drive market movements throughout the month.

August kicked off with a mixed bag of earnings reports, a stark contrast to July’s record-breaking rally. While investors are still buzzing about the Fed’s latest moves, a deeper dive into their covert stress testing and the impact of Bidenomics, as explored in this insightful article , reveals potential long-term implications for the market.

These factors, coupled with the continued uncertainty surrounding inflation and interest rates, are shaping the market’s direction as we navigate the second half of the year.

Inflation and Interest Rates

Inflation remains a key concern for investors, as it erodes purchasing power and impacts corporate profits. The Federal Reserve’s aggressive interest rate hikes aim to tame inflation, but they also risk slowing economic growth. The impact of inflation and interest rates on the stock market is complex and can vary depending on the sector.

For example, companies in sectors like energy and materials may benefit from higher prices, while companies in sectors like consumer discretionary may face pressure from declining consumer spending.Here’s a table outlining the potential impact of inflation and interest rates on different sectors:

| Sector | Potential Impact of High Inflation | Potential Impact of Rising Interest Rates |

|---|---|---|

| Energy | Positive | Mixed |

| Materials | Positive | Mixed |

| Consumer Discretionary | Negative | Negative |

| Consumer Staples | Mixed | Mixed |

| Healthcare | Mixed | Mixed |

| Financials | Positive | Positive |

| Technology | Negative | Negative |

Geopolitical Events

Geopolitical events, such as the ongoing war in Ukraine and tensions between the US and China, can also significantly impact market sentiment. These events create uncertainty and volatility, making investors hesitant to invest in riskier assets.For example, the war in Ukraine has disrupted global supply chains and led to higher energy prices, contributing to inflation.

Tensions between the US and China have raised concerns about trade disruptions and economic decoupling.

“Geopolitical events can be unpredictable and have a significant impact on the stock market, making it difficult for investors to assess the long-term implications.”

Investor Sentiment and Market Volatility: Stock Market Kickstarts August With Mixed Earnings Amidst Julys Record Rally

August often presents a mixed bag for investors, with the summer doldrums sometimes giving way to heightened volatility. This year is no exception, as investors grapple with the afterglow of July’s record rally and the ongoing uncertainty surrounding economic growth and interest rate hikes.

Investor Sentiment in August

Investor sentiment is a key driver of market volatility. It reflects the overall mood and expectations of market participants, influencing their trading decisions. During August, sentiment can shift rapidly based on economic data releases, corporate earnings, and geopolitical events.

For example, a positive earnings season can boost investor confidence, leading to a surge in stock prices. Conversely, a disappointing economic report or a surprise interest rate hike can trigger a sell-off, sending the market tumbling.

Investor Behavior in August

Investor behavior can vary significantly in August. Retail investors, often driven by emotions and short-term market trends, may be more susceptible to panic selling or chasing gains. Institutional investors, with their long-term investment horizons and sophisticated analytical tools, tend to be more measured in their approach.

They often focus on fundamental factors like company valuations and economic indicators.

Market Events and Volatility in August

Several factors can contribute to market volatility in August.

- Earnings Reports:Quarterly earnings releases can spark significant price swings, particularly if companies miss expectations or provide disappointing outlooks. For example, in August 2023, a few high-profile tech companies reported earnings that fell short of analysts’ estimates, leading to sell-offs in the tech sector.

- Economic Data:Key economic indicators like inflation data, unemployment figures, and consumer spending reports can have a major impact on market sentiment. A surprise increase in inflation, for instance, could raise concerns about the Federal Reserve’s future rate hike plans, leading to market volatility.

- Geopolitical Events:Global events like wars, trade disputes, and political instability can also influence investor sentiment. In August 2023, tensions between the United States and China over Taiwan escalated, leading to increased uncertainty in the market.

Sector-Specific Trends

August saw a mixed performance across different sectors of the stock market, reflecting the ongoing economic uncertainty and mixed earnings reports. Some sectors, like energy and financials, continued their strong performance, while others, such as technology and consumer discretionary, faced headwinds.

Performance of Key Sectors in August

The performance of key sectors in August can be summarized as follows:

| Sector | Performance | Key Drivers |

|---|---|---|

| Energy | Strong | Rising oil prices due to supply constraints and robust demand, strong earnings reports from major oil companies. |

| Financials | Positive | Rising interest rates boosting bank profits, strong loan growth, and increased investment banking activity. |

| Technology | Mixed | Concerns over slowing economic growth and potential for a recession, mixed earnings reports from major tech companies, and investor focus on profitability. |

| Consumer Discretionary | Weak | Inflationary pressures, rising interest rates, and concerns about consumer spending, particularly in areas like automobiles and retail. |

Factors Driving Sector Performance

Several factors contributed to the performance of different sectors in August:

- Earnings Reports:Strong earnings reports from energy companies, particularly those involved in oil and gas production, boosted the energy sector. Conversely, mixed earnings reports from major tech companies, particularly those facing challenges related to slowing growth and increased competition, dampened investor sentiment in the technology sector.

- Industry-Specific News:Positive news related to rising interest rates, increased loan growth, and a surge in investment banking activity fueled the financials sector. Conversely, concerns about rising inflation, slowing consumer spending, and the potential for a recession weighed on the consumer discretionary sector.

- Broader Economic Conditions:The overall economic outlook, including concerns about inflation, potential recession, and rising interest rates, influenced the performance of various sectors. For example, the technology sector was particularly sensitive to these concerns, as investors sought out more stable and profitable companies.