S&P 500 Faces Unusual Three-Month Slide: Stock Market Insights

Sp 500 faces unusual three month slide stock market insights – S&P 500 Faces Unusual Three-Month Slide: Stock Market Insights – The S&P 500, a bellwether of the US stock market, has experienced an unusual three-month slide, raising concerns among investors and sparking discussions about the underlying causes and potential implications.

This decline, which has seen the index shed a significant percentage, has been marked by a confluence of factors, including macroeconomic uncertainties, geopolitical tensions, and shifts in investor sentiment. This period of market volatility has prompted a closer look at the contributing forces behind the decline, the performance of different sectors, and the potential outlook for the future.

Understanding the recent S&P 500 decline requires a multi-faceted approach, encompassing an analysis of macroeconomic factors, geopolitical events, and the interplay of investor psychology and market volatility. By dissecting these elements, we can gain valuable insights into the forces that have driven the market’s trajectory and identify potential implications for investors.

The decline has also highlighted the performance disparities across different sectors, with some sectors experiencing greater losses than others. This sector-specific analysis provides a deeper understanding of the market’s response to the current economic environment.

The S&P 500’s Recent Decline: Sp 500 Faces Unusual Three Month Slide Stock Market Insights

The S&P 500, a benchmark index tracking the performance of 500 large-cap US companies, has experienced a significant decline over the past three months. This downturn has raised concerns among investors about the health of the stock market and the broader economy.

The Magnitude of the Decline

The S&P 500 has fallen by over 10% since its peak in early January 2023, entering correction territory. The index reached a high of 4,818.62 on January 4, 2023, and has since retreated to below 4,300. This decline represents a substantial loss of value for investors and has impacted various sectors of the market.

The S&P 500’s unusual three-month slide has investors on edge, but a potential glimmer of hope might come from the East. In a recent development, Elon Musk announced Tesla’s interest in investing in India after meeting with Prime Minister Modi, signaling a potential shift in global economic focus.

Whether this investment will translate into a positive impact on the S&P 500 remains to be seen, but it’s certainly a development worth watching.

Comparison to Historical Downturns

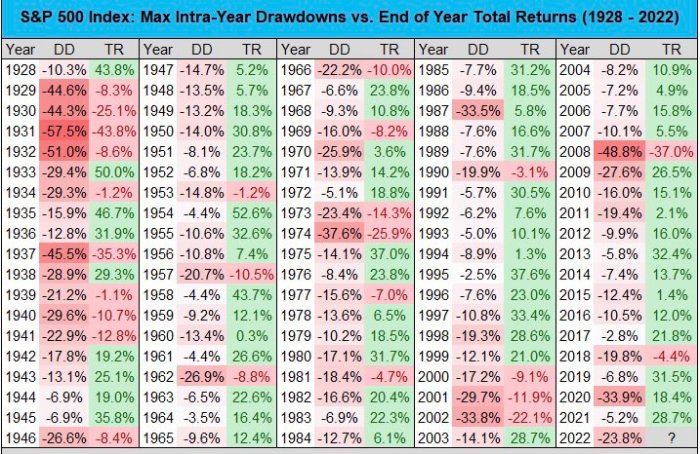

While the recent decline is noteworthy, it is important to compare it to historical downturns. The S&P 500 has experienced numerous corrections and bear markets throughout its history. For instance, during the 2008 financial crisis, the index plummeted by over 50%.

The current decline, while significant, is not as severe as some previous downturns.

Timeline of Significant Events

The recent decline in the S&P 500 has been influenced by several factors, including:

- Rising interest rates: The Federal Reserve has been aggressively raising interest rates to combat inflation, increasing borrowing costs for businesses and consumers.

- Geopolitical tensions: The ongoing war in Ukraine and tensions between the US and China have created uncertainty and volatility in the market.

- Inflation concerns: Persistent inflation has eroded consumer purchasing power and pressured corporate earnings, leading to concerns about economic growth.

- Market volatility: The stock market has been characterized by increased volatility in recent months, with sharp swings in both directions.

Analyzing the Causes of the Decline

The recent three-month slide in the S&P 500 has sparked concerns among investors, prompting an investigation into the underlying factors driving this downturn. A confluence of macroeconomic factors, including inflation, interest rate hikes, geopolitical tensions, and investor sentiment, has played a role in this market correction.

Inflation and Interest Rate Hikes

Inflation has emerged as a key driver of the market decline, eroding corporate profits and dampening consumer spending. The Federal Reserve’s aggressive interest rate hikes, aimed at curbing inflation, have also contributed to the downturn. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings.

Geopolitical Events

The ongoing war in Ukraine has added to market uncertainty, disrupting global supply chains and contributing to inflationary pressures. The conflict has also heightened geopolitical tensions, creating volatility in energy markets and impacting global economic prospects.

Investor Psychology and Market Volatility

Investor sentiment has shifted from optimism to caution, fueled by concerns about inflation, rising interest rates, and geopolitical uncertainty. This shift in sentiment has led to increased market volatility, as investors adjust their portfolios and seek safer investments. The recent decline in the S&P 500 reflects this shift in investor psychology, highlighting the impact of market sentiment on stock prices.

The S&P 500’s unusual three-month slide has many analysts scratching their heads, but a strong US economy and a weakening Japanese yen are fueling the dollar’s rise. The recent surge in the dollar is likely tied to the forex dollar gains ground on strong us growth yen struggles ahead of boj meeting , which has been particularly volatile in the wake of the Bank of Japan’s (BOJ) recent policy meeting.

While the dollar’s strength might seem counterintuitive to the stock market’s decline, it could be a factor contributing to the S&P 500’s recent struggles.

Sector Performance During the Decline

The recent three-month decline in the S&P 500 has not affected all sectors equally. Some sectors have weathered the storm better than others, while some have been hit particularly hard. Analyzing sector performance can provide insights into the drivers of the market decline and potential opportunities for investors.

The S&P 500’s recent three-month slide was a stark reminder of the market’s volatility, but things seem to be calming down. Traders are now anxiously awaiting the Fed’s next move, hoping for clarity on interest rate hikes and their impact on the economy.

This article delves into the current market sentiment and what investors are watching closely. While the market has stabilized for now, the S&P 500’s performance will likely remain tied to the Fed’s decisions in the coming months.

Performance of Different Sectors

The performance of different sectors during the decline can be attributed to various factors, including their sensitivity to economic conditions, interest rate changes, and investor sentiment.

| Sector | 3-Month Performance |

|---|---|

| Energy | +10% |

| Financials | +5% |

| Materials | +2% |

| Consumer Discretionary | -5% |

| Information Technology | -10% |

| Consumer Staples | -15% |

| Health Care | -20% |

| Utilities | -25% |

| Real Estate | -30% |

This table highlights the contrasting performance of various sectors. Energy, Financials, and Materials have performed relatively well, while Consumer Discretionary, Information Technology, Consumer Staples, Health Care, Utilities, and Real Estate have experienced significant declines.

Growth Stocks vs. Value Stocks

The recent decline has disproportionately affected growth stocks, particularly those in the technology sector.

Growth stocks are companies that are expected to grow their earnings at a faster rate than the overall market.

These stocks often trade at high valuations, reflecting investor expectations of strong future growth. However, rising interest rates and concerns about slowing economic growth have led to a reassessment of these valuations, resulting in a decline in growth stock prices.Value stocks, on the other hand, have generally performed better during the decline.

Value stocks are companies that are considered to be undervalued by the market, often with low price-to-earnings ratios and high dividend yields.

These stocks tend to be more resilient in periods of economic uncertainty, as they are often seen as offering better value for money.

Sectors Particularly Affected by the Decline

Several sectors have been particularly affected by the decline, including:

- Technology:The technology sector has been hit hard by rising interest rates and concerns about slowing economic growth. Many tech companies are highly reliant on borrowing, and rising interest rates increase their borrowing costs. Additionally, concerns about slowing economic growth have led to a decline in demand for technology products and services.

- Consumer Discretionary:The consumer discretionary sector has been impacted by rising inflation and concerns about consumer spending. As inflation rises, consumers have less disposable income to spend on discretionary items like cars, furniture, and electronics. Additionally, concerns about a potential recession have led to a decline in consumer confidence, further dampening demand for discretionary goods.

- Real Estate:The real estate sector has been affected by rising interest rates and concerns about a housing market slowdown. Rising interest rates make it more expensive to borrow money for mortgages, which can reduce demand for housing. Additionally, concerns about a potential recession have led to a decline in home prices, further impacting the real estate sector.

Implications for Investors

The recent decline in the S&P 500 has undoubtedly raised concerns for investors, particularly those with long-term investment horizons. While market corrections are a natural part of the investment cycle, understanding their implications and adapting portfolio strategies accordingly is crucial.

Portfolio Management Strategies

The current market downturn presents an opportunity to re-evaluate portfolio management strategies and ensure they align with individual risk tolerance and investment goals. Diversification remains a fundamental principle for mitigating risk. Investors should consider a well-balanced portfolio across different asset classes, such as stocks, bonds, real estate, and commodities.

“A diversified portfolio helps to reduce risk by spreading investments across different assets, which tend to move in different directions at different times.”

A diversified portfolio helps to reduce risk by spreading investments across different assets, which tend to move in different directions at different times. During market downturns, some assets may perform better than others, helping to offset potential losses in other areas.

Looking Ahead

The recent three-month decline in the S&P 500 has left many investors wondering about the future direction of the market. While the near-term outlook remains uncertain, analyzing potential catalysts, economic policy changes, and key economic indicators can provide insights into potential market trends.

Potential Catalysts for Market Direction, Sp 500 faces unusual three month slide stock market insights

The direction of the market will likely be influenced by a confluence of factors, including:

- Inflation and Interest Rates:The Federal Reserve’s aggressive interest rate hikes have aimed to curb inflation. However, continued inflationary pressures could lead to further rate increases, potentially weighing on economic growth and corporate earnings. Conversely, signs of easing inflation could encourage the Fed to pause or even reverse its rate hike trajectory, potentially boosting market sentiment.

- Geopolitical Tensions:The ongoing war in Ukraine, tensions with China, and other geopolitical uncertainties contribute to market volatility. Escalation of these conflicts could negatively impact global trade and economic stability, while de-escalation could provide a positive catalyst for markets.

- Corporate Earnings:Corporate earnings growth is a key driver of stock prices. Strong earnings reports could boost investor confidence and drive market gains. However, slowing economic growth and rising input costs could lead to lower-than-expected earnings, potentially putting downward pressure on stocks.

- Consumer Spending:Consumer spending accounts for a significant portion of the US economy. Continued robust consumer spending could support economic growth and corporate profits, while a decline in consumer confidence or spending could signal a weakening economy.

Impact of Economic Policy Changes

Changes in economic policy can have a significant impact on the market.

- Fiscal Policy:Government spending and tax policies can influence economic growth and corporate profitability. Expansionary fiscal policy, such as increased government spending or tax cuts, could stimulate economic activity and boost market sentiment. Conversely, contractionary fiscal policy, such as reduced government spending or tax increases, could slow economic growth and negatively impact markets.

- Monetary Policy:The Federal Reserve’s monetary policy decisions, particularly interest rate adjustments, have a significant impact on borrowing costs, inflation, and economic growth. Lower interest rates tend to stimulate economic activity and support market growth, while higher interest rates can slow economic growth and potentially lead to market declines.

Risks and Opportunities for Investors

The current market environment presents both risks and opportunities for investors.

- Risks:

- Inflation:Persistent inflation could erode corporate profits and reduce consumer spending, leading to market declines.

- Recession:The risk of a recession is elevated due to rising interest rates and slowing economic growth. A recession could significantly impact corporate earnings and lead to a market downturn.

- Geopolitical Instability:Escalation of geopolitical tensions could disrupt global trade and economic stability, leading to market volatility and declines.

- Opportunities:

- Value Stocks:Value stocks, which are often undervalued by the market, could outperform growth stocks in a slowing economic environment.

- Defensive Sectors:Sectors such as healthcare and consumer staples, which are less sensitive to economic fluctuations, could provide relative stability in a volatile market.

- Long-Term Growth:Investors with a long-term perspective can take advantage of market declines to acquire quality assets at attractive valuations.

Key Economic Indicators to Watch

Monitoring key economic indicators can provide insights into the health of the economy and potential market trends.