S&P 500 Bull Market: Stocks Fluctuate Amid Anxiety

Sp 500 enters bull market stocks fluctuate amid investor anxiety – The S&P 500 enters bull market stocks fluctuate amid investor anxiety takes center stage, a compelling narrative of growth and uncertainty unfolds. This journey into the world of finance reveals the delicate dance between market optimism and investor apprehension, as the S&P 500, a bellwether of the US stock market, embarks on a new bull run.

While the prospect of a bull market excites investors, concerns linger about inflation, interest rates, and geopolitical tensions, creating a backdrop of volatility.

This period of market dynamism presents both opportunities and challenges for investors. Understanding the forces driving stock fluctuations, navigating investor psychology, and adopting effective strategies are crucial for making informed decisions. We’ll explore the historical context of bull markets, the factors influencing current market volatility, and the potential growth drivers and risks associated with the bull market’s trajectory.

S&P 500 Enters Bull Market

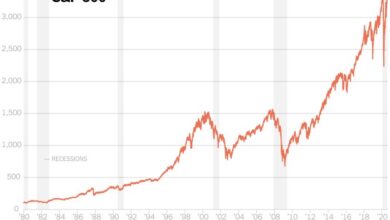

The S&P 500, a benchmark index representing the performance of 500 large-cap U.S. companies, has officially entered a bull market. This milestone marks a significant shift in market sentiment, signaling a period of sustained growth and optimism.

Definition of a Bull Market

A bull market is generally defined as a period where the stock market experiences a sustained increase of at least 20% from a recent low. This definition is widely accepted by financial analysts and investors, providing a clear benchmark for identifying market trends.

The current bull market is characterized by a surge in stock prices following a period of decline.

Historical Examples of Bull Markets

Bull markets have played a crucial role in shaping economic growth throughout history.

- The “Roaring Twenties” bull market (1920s): This period saw unprecedented economic prosperity, fueled by technological advancements, consumerism, and easy access to credit. However, it culminated in the devastating stock market crash of 1929, marking the beginning of the Great Depression.

- The post-World War II bull market (1949-1966): Following the devastation of World War II, the U.S. economy experienced a period of sustained growth driven by technological innovation, increased consumer spending, and a booming manufacturing sector. This bull market laid the foundation for the economic dominance of the United States in the decades to come.

- The “dot-com bubble” bull market (1995-2000): Fueled by the rapid growth of the internet and e-commerce, this bull market saw a surge in valuations for technology companies. However, the bubble burst in 2000, leading to a significant market correction.

Stock Fluctuations Amid Investor Anxiety: Sp 500 Enters Bull Market Stocks Fluctuate Amid Investor Anxiety

The recent entry of the S&P 500 into a bull market has been met with both excitement and trepidation. While the prospect of rising stock prices is appealing, investors are grappling with a multitude of factors that could influence market direction.

The current economic landscape is characterized by uncertainty, with inflation, interest rate hikes, and geopolitical tensions weighing heavily on investor sentiment. This cocktail of anxieties has created a volatile market, where stocks experience frequent fluctuations, leaving investors wondering about the best course of action.

Factors Contributing to Stock Fluctuations

The recent stock market volatility is driven by a confluence of economic and geopolitical factors that are impacting investor sentiment and causing uncertainty. Here are some of the key contributors:

- Inflation:Persistent inflation, particularly in the United States, has eroded purchasing power and forced the Federal Reserve to raise interest rates. Higher interest rates increase borrowing costs for businesses and consumers, potentially dampening economic growth and corporate earnings. This uncertainty about future economic growth and the impact of inflation on corporate profitability is a significant driver of market volatility.

- Interest Rates:The Federal Reserve’s aggressive interest rate hikes are intended to curb inflation but have also increased borrowing costs for businesses and consumers. Higher interest rates can slow economic growth and impact corporate earnings, leading to increased market volatility. The Fed’s commitment to fighting inflation and the potential for further interest rate hikes remain key factors influencing market sentiment.

- Geopolitical Events:The ongoing war in Ukraine, tensions between the United States and China, and other geopolitical events create uncertainty and volatility in the global economy. These events can disrupt supply chains, increase energy prices, and lead to economic sanctions, all of which can negatively impact corporate earnings and market sentiment.

The Psychology of Investor Anxiety

Investor anxiety is a natural response to market uncertainty. When faced with economic challenges, geopolitical tensions, and fluctuating stock prices, investors often experience a range of emotions, including fear, uncertainty, and a desire to protect their investments. This anxiety can lead to impulsive decisions, such as selling stocks during market downturns, which can exacerbate volatility.

- Fear of Missing Out (FOMO):The fear of missing out on potential gains can drive investors to buy stocks even when market conditions are uncertain. This can create a “bubble” effect, where prices are driven up by excessive demand, only to collapse when investors realize the market is overvalued.

- Herding Behavior:Investors often follow the crowd, buying or selling stocks based on the actions of others. This can lead to a self-reinforcing cycle of market volatility, as investors react to each other’s actions, rather than making independent decisions based on fundamental analysis.

The S&P 500 entering a bull market is exciting news, but it’s hard to ignore the stock market fluctuations that are giving investors the jitters. In times of uncertainty, it’s natural to look for safe havens. Gold, often seen as a hedge against inflation and economic turmoil, might be a good consideration for those seeking to diversify their portfolios.

Learn more about the role of gold as a safe investment to see if it aligns with your investment strategy. Whether you’re bullish on the stock market or seeking stability, it’s always a good idea to understand your risk tolerance and explore different investment options.

- Loss Aversion:Investors are generally more averse to losses than they are attracted to gains. This can lead to investors holding onto losing investments for too long, hoping for a recovery, while selling winning investments too early to avoid potential losses.

The S&P 500 entering a bull market is great news, but the market’s recent volatility is making investors nervous. It’s a reminder that even in bullish times, there are risks. Take the recent case of a Massachusetts father and son who received prison sentences for a $20 million lottery scam, as reported on The Venom Blog.

This kind of fraud shows how even seemingly secure investments can be vulnerable, so it’s important to be aware of potential pitfalls and diversify your portfolio.

This behavior can exacerbate market volatility, as investors sell stocks during downturns, further driving prices down.

Comparing Current Volatility to Previous Periods of Uncertainty

While the current market volatility is significant, it is important to compare it to previous periods of uncertainty. For example, the 2008 financial crisis, the dot-com bubble burst, and the 1970s oil crisis all resulted in significant market declines.

The current situation is unique in that it involves a confluence of factors, including inflation, interest rate hikes, and geopolitical tensions, all of which are impacting investor sentiment and driving volatility.

- The 2008 Financial Crisis:The 2008 financial crisis was triggered by a collapse in the housing market and a subsequent credit crunch. The S&P 500 fell by nearly 50% during this period, and it took several years for the market to recover.

The current situation is different in that it is not driven by a single event, but rather by a combination of factors, including inflation and geopolitical tensions.

- The Dot-Com Bubble:The dot-com bubble of the late 1990s was fueled by excessive investment in internet companies. When the bubble burst in 2000, the Nasdaq Composite Index fell by over 78%. The current situation is different in that it is not driven by speculation in a particular sector, but rather by broader economic and geopolitical factors.

- The 1970s Oil Crisis:The 1970s oil crisis was triggered by a sharp increase in oil prices due to the Arab oil embargo. The S&P 500 fell by nearly 50% during this period, and it took several years for the market to recover.

The S&P 500 entering a bull market is exciting news, but the fluctuating stock prices amidst investor anxiety reflect a complex landscape. It’s a reminder that even in a bullish market, individual stocks can move independently. This is where the concept of strategic mergers and acquisitions in the blockchain space comes into play, as seen in the recent activities of Gavin Wood.

Gavin Wood’s chain mergers and acquisitions highlight the potential for consolidation and growth in this rapidly evolving sector, offering a potential hedge against market volatility for savvy investors.

The current situation is different in that it is not driven by a single commodity price shock, but rather by a combination of factors, including inflation and geopolitical tensions.

Bull Market Prospects and Challenges

The recent entry of the S&P 500 into bull market territory has sparked optimism among investors, but it’s essential to consider the potential growth drivers and challenges that could shape the market’s trajectory. While the bull market presents opportunities for growth, it’s crucial to acknowledge the risks that could dampen investor enthusiasm.

Growth Drivers

Several factors could fuel the bull market’s ascent.

- Economic Resilience:Despite global economic headwinds, the U.S. economy has shown resilience, with a robust labor market and consumer spending. The Federal Reserve’s recent pause in interest rate hikes indicates a potential shift towards a more accommodative monetary policy, which could further support economic growth.

- Technological Advancements:Continued innovation in artificial intelligence (AI), cloud computing, and other emerging technologies is driving productivity gains and creating new investment opportunities. The adoption of these technologies is expected to reshape industries and drive economic growth.

- Industry Trends:The growth of sectors like renewable energy, electric vehicles, and healthcare is expected to continue, driven by long-term trends such as climate change, aging demographics, and increasing healthcare spending.

Challenges and Risks

While the bull market presents opportunities, several challenges and risks could hinder its progress.

- Inflation:Persistent inflation remains a key concern. Although inflation has shown signs of cooling, it remains above the Federal Reserve’s target, and further rate hikes could dampen economic growth and impact corporate earnings.

- Supply Chain Disruptions:Ongoing supply chain disruptions caused by geopolitical tensions and global events could lead to higher prices and limit economic growth.

- Geopolitical Tensions:Escalating geopolitical tensions, particularly the ongoing conflict in Ukraine, could create uncertainty and volatility in global markets.

Upside and Downside Scenarios

Here’s a table comparing potential upside and downside scenarios for the bull market:

| Scenario | S&P 500 Performance | Key Metrics | Data Points |

|---|---|---|---|

| Upside | 10-15% annualized return | Economic growth, corporate earnings, interest rates | GDP growth above 2%, S&P 500 earnings growth above 10%, Fed funds rate below 4% |

| Downside | 5-10% annualized return | Inflation, interest rates, geopolitical risks | Inflation above 4%, Fed funds rate above 5%, significant escalation of geopolitical tensions |

Investor Strategies in a Volatile Market

Navigating a volatile market requires a thoughtful approach to investing, balancing the potential for growth with the need to manage risk. While a bull market often brings optimism and the promise of strong returns, fluctuations are inevitable, and it’s crucial to have a strategy in place to weather the ups and downs.

Diversification: Spreading Risk Across Asset Classes

Diversification is a fundamental principle of investing that aims to reduce risk by spreading investments across various asset classes. By holding a mix of stocks, bonds, real estate, and other assets, investors can mitigate the impact of any single asset class performing poorly.

For example, during periods of economic uncertainty, stocks may decline in value, while bonds, considered a safer haven asset, might hold their value or even appreciate. Diversification helps to cushion the blow of market downturns and ensures that a portfolio’s overall performance isn’t overly reliant on any one asset class.

Risk Management: Defining and Controlling Risk Exposure

Risk management is the process of identifying, assessing, and controlling potential risks associated with investments. It involves understanding your risk tolerance, which is your capacity to handle potential losses, and setting appropriate risk limits for your portfolio.Risk management techniques include:

- Setting Stop-Loss Orders:These orders automatically sell a security when it reaches a predetermined price, limiting potential losses.

- Rebalancing Your Portfolio:Periodically adjusting your asset allocation to maintain your desired risk level, ensuring that no single asset class becomes overly concentrated.

- Using Derivatives:Financial instruments like options and futures can be used to hedge against market risk, providing a way to offset potential losses.

Asset Allocation: Strategically Dividing Investments

Asset allocation is the process of dividing your investment portfolio among different asset classes based on your investment goals, risk tolerance, and time horizon. It’s a key element of long-term investing, as it helps to optimize returns while managing risk.Here are some examples of asset allocation strategies:

- Growth-Oriented Portfolio:A portfolio with a higher allocation to stocks, aiming for long-term capital appreciation. This strategy is suitable for investors with a higher risk tolerance and a longer time horizon.

- Conservative Portfolio:A portfolio with a larger allocation to bonds, emphasizing income and preserving capital. This strategy is more appropriate for investors with a lower risk tolerance and a shorter time horizon.

- Balanced Portfolio:A portfolio that combines both stocks and bonds, seeking a balance between growth and stability. This strategy is a popular choice for investors with a moderate risk tolerance and a medium-term investment horizon.

Investment Strategies for Bull Markets

Bull markets are characterized by rising stock prices and economic growth, presenting opportunities for investors to potentially generate strong returns. However, it’s essential to remember that bull markets are not immune to volatility, and some strategies can be more effective than others.Examples of investment strategies that have historically performed well in bull markets include:

- Growth Stocks:Companies with high growth potential, often in emerging industries or sectors, can experience significant price appreciation during bull markets.

- Value Stocks:Companies that are undervalued by the market, offering potential for significant returns as the market recognizes their true value.

- Sector Rotation:Shifting investments between different sectors of the economy based on economic trends and industry performance. For example, during a bull market, investors may rotate towards sectors that are expected to benefit from economic growth.

Key Considerations for Investors, Sp 500 enters bull market stocks fluctuate amid investor anxiety

Making informed investment decisions during a bull market requires careful consideration of various factors, including:

- Economic Outlook:Understanding the overall economic climate and its impact on various sectors and industries.

- Interest Rates:Monitoring interest rate changes and their potential impact on asset valuations, especially bonds.

- Inflation:Assessing inflation’s impact on purchasing power and investment returns.

- Market Sentiment:Gauging investor confidence and potential shifts in market sentiment, which can influence stock prices.

- Valuation:Evaluating the intrinsic value of companies and comparing it to their current market prices to identify potential investment opportunities.

- Company Fundamentals:Analyzing a company’s financial performance, management quality, and competitive position.