S&P 500 and Nasdaq React to Rate Cut Expectations

Sp 500 and nasdaq react to economic data shaping rate cut expectations – The S&P 500 and Nasdaq react to economic data shaping rate cut expectations, a dance between financial markets and the Federal Reserve. Every economic report, from inflation figures to GDP growth, carries the weight of influencing interest rate decisions.

This delicate interplay creates a captivating story for investors, as they navigate the potential for a rate cut and its impact on the stock market.

Understanding how these indices react to economic data is crucial for investors seeking to make informed decisions. Whether the latest numbers suggest a rate cut is imminent or delayed, the markets are quick to respond. This blog post delves into the intricacies of this relationship, exploring the recent performance of the S&P 500 and Nasdaq, the sentiment of investors, and the potential scenarios that lie ahead.

Economic Data Impact on Rate Cut Expectations

Recent economic data releases have been closely scrutinized by investors and economists alike, as they provide valuable insights into the health of the US economy and the potential trajectory of interest rates. These data points, particularly inflation, GDP growth, and unemployment figures, hold significant weight in shaping market expectations for future rate decisions by the Federal Reserve.

Impact of Economic Data on Rate Cut Expectations

The Federal Reserve’s monetary policy decisions are heavily influenced by economic indicators. The latest data releases have sparked debate among economists and analysts regarding the likelihood of a rate cut in the near future.

- Inflation: The latest inflation data has shown a slight moderation, indicating that price pressures may be easing. While this could be seen as a positive sign, the Fed remains cautious about the persistence of inflation and its impact on the broader economy.

If inflation continues to decline, it could bolster the case for rate cuts.

- GDP Growth: Recent GDP growth figures have painted a mixed picture. While the economy has shown resilience in the face of challenges, the growth rate has slowed. This suggests that the Fed may be less inclined to raise interest rates but could also be hesitant to cut rates if the economy shows signs of weakness.

The S&P 500 and Nasdaq are on edge as investors grapple with the latest economic data and its implications for interest rate cuts. While some analysts are predicting a potential easing of monetary policy, others are cautious, pointing to the recent ban on the Telegram app in Iraq, which was implemented due to concerns over data privacy and national security.

This incident highlights the growing tension between technological advancement and the need for robust security measures, which could further influence market sentiment and the Federal Reserve’s decision-making process.

- Unemployment: The unemployment rate has remained relatively low, indicating a strong labor market. However, some economists argue that the Fed may be more inclined to cut rates if unemployment starts to rise, signaling a weakening economy.

S&P 500 and Nasdaq Reactions to Economic Data

The recent performance of the S&P 500 and Nasdaq indices has been closely tied to the release of economic data, as investors try to gauge the health of the economy and anticipate the Federal Reserve’s future monetary policy moves. The latest economic data has sent mixed signals, with some indicators pointing to resilience while others suggest a slowdown.

This has resulted in significant price movements and volatility in both indices, as investors adjust their expectations for interest rate cuts.

S&P 500 and Nasdaq Reactions to Key Economic Indicators

The release of key economic indicators has had a noticeable impact on both the S&P 500 and Nasdaq indices. For example, following the release of the latest inflation data, the S&P 500 initially rose on hopes that the data would support a pause in interest rate hikes.

However, the index later retreated as investors remained concerned about the stickiness of inflation and the potential for further rate increases. The Nasdaq, which is more sensitive to interest rate changes, experienced a more pronounced decline, as higher interest rates typically weigh on the valuations of growth stocks.

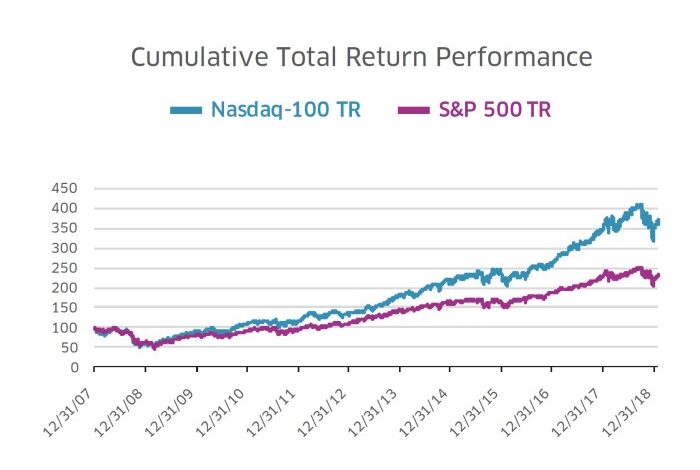

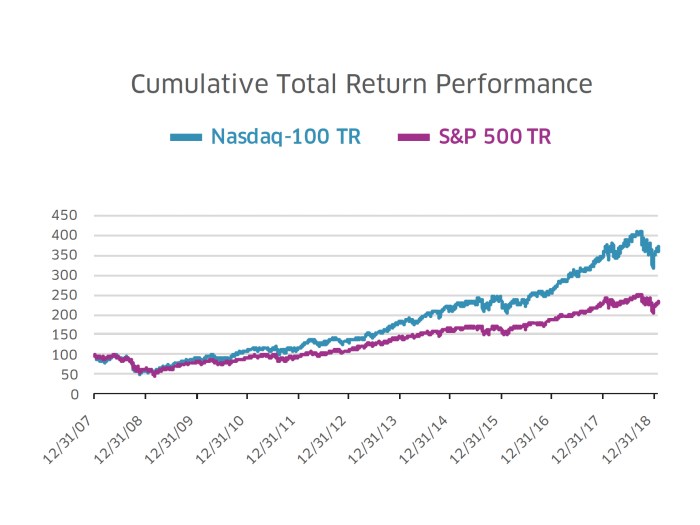

Comparison of S&P 500 and Nasdaq Reactions

While both the S&P 500 and Nasdaq have been affected by economic data releases, their reactions have often differed. The S&P 500, being a broader market index, tends to be more resilient to economic shocks. The Nasdaq, on the other hand, is more heavily weighted towards technology and growth stocks, which are more sensitive to changes in interest rates and economic sentiment.

For example, the Nasdaq has generally outperformed the S&P 500 during periods of economic growth, but it has also underperformed during periods of economic uncertainty or rising interest rates.

Examples of S&P 500 and Nasdaq Reactions to Economic Data

Here are some recent examples of how the S&P 500 and Nasdaq have reacted to economic data releases:

- Following the release of the latest jobs report, which showed strong employment growth, the S&P 500 rose, while the Nasdaq experienced a more muted reaction. This suggests that investors were encouraged by the positive employment data but remained cautious about the potential for continued interest rate hikes.

- After the release of the latest consumer confidence data, which showed a decline in consumer sentiment, both the S&P 500 and Nasdaq declined. However, the Nasdaq experienced a larger decline, reflecting the greater sensitivity of growth stocks to economic uncertainty.

Investor Sentiment and Market Volatility

Economic data releases significantly impact investor sentiment and market volatility. When economic data is positive, investors tend to be optimistic about the future, leading to increased confidence in the markets. This optimism translates into higher demand for stocks, driving prices upward and reducing market volatility.

Conversely, negative economic data can trigger pessimism, causing investors to sell their holdings, driving prices down, and increasing market volatility.

The S&P 500 and Nasdaq are in a tug-of-war, with recent economic data fueling expectations for a potential rate cut. This has caused some market volatility, and as the rally pauses, short sellers are capitalizing on the uncertainty. According to a recent report by Ortex, short sellers are profiting as the US stock rally pauses.

It remains to be seen how the Fed will react to these economic indicators, but the market’s reaction will likely shape the trajectory of the S&P 500 and Nasdaq in the coming weeks.

Investor Confidence and Economic Data

The relationship between investor confidence and economic data is strong and direct. Positive economic data releases, such as strong employment numbers, rising GDP growth, or declining inflation, bolster investor confidence. This confidence stems from the perception that the economy is healthy and growing, supporting business profitability and future earnings.

The S&P 500 and Nasdaq are reacting to economic data that’s shaping expectations for a potential rate cut. While positive US retail sales numbers are a bright spot, concerns about the Chinese economy are casting a shadow on global markets.

For a deeper dive into the latest stock market updates and economic trends, check out this article stock market updates and economic trends stocks open lower amid china economic concerns positive us retail sales. Ultimately, the direction of the S&P 500 and Nasdaq will likely hinge on how the Fed interprets these conflicting economic signals.

Conversely, negative economic data, such as high unemployment, weak GDP growth, or rising inflation, erodes investor confidence. This is because it suggests economic weakness and potential challenges for businesses, leading to concerns about future earnings and profitability.

Market Volatility and Interest Rate Expectations, Sp 500 and nasdaq react to economic data shaping rate cut expectations

Market volatility is closely tied to expectations for interest rate changes. When investors anticipate interest rate cuts, they often view it as a sign of economic weakness and a potential catalyst for market instability. This can lead to increased selling pressure and higher market volatility.

Conversely, expectations for interest rate hikes, often perceived as a sign of economic strength, can boost investor confidence and reduce market volatility. However, the relationship between interest rate expectations and market volatility is complex and can be influenced by various factors, including the overall economic outlook, inflation levels, and market sentiment.

Potential Market Scenarios: Sp 500 And Nasdaq React To Economic Data Shaping Rate Cut Expectations

The impact of economic data on rate cut expectations can lead to different market scenarios, with the S&P 500 and Nasdaq potentially reacting in various ways. Understanding these scenarios is crucial for investors to make informed decisions.

Rate Cut Scenario

This scenario explores the potential impact of a rate cut announcement on the S&P 500 and Nasdaq. A rate cut is often seen as a signal of easing monetary policy, which can stimulate economic growth and boost corporate earnings.

A rate cut could lead to a positive market reaction, with both the S&P 500 and Nasdaq potentially experiencing gains.

For example, in 2019, the Federal Reserve cut interest rates three times, and the S&P 500 and Nasdaq both rose significantly during that period.

Rate Cut Delay Scenario

This scenario explores the potential consequences of a rate cut delay or non-announcement on the indices. If the Federal Reserve holds off on cutting rates, it could signal that the economy is not as weak as some investors believe, or that the central bank is concerned about inflation.

A rate cut delay could lead to a negative market reaction, with both the S&P 500 and Nasdaq potentially experiencing losses.

For example, in 2018, the Federal Reserve raised interest rates four times, and the S&P 500 and Nasdaq both experienced significant declines during that period.

Market Volatility Scenario

This scenario explores the potential impact of increased market volatility on the S&P 500 and Nasdaq. Increased volatility can be caused by a variety of factors, including uncertainty about the economy, geopolitical tensions, or unexpected economic data releases.

Increased market volatility could lead to sharp swings in both the S&P 500 and Nasdaq, with investors potentially becoming more cautious and hesitant to invest.

For example, in 2020, the COVID-19 pandemic led to a sharp decline in the stock market, with both the S&P 500 and Nasdaq experiencing significant losses.

Historical Comparisons

Looking back at past market reactions to economic data and rate cut announcements can provide valuable insights into how the S&P 500 and Nasdaq might behave in the current situation. By examining historical trends, we can identify patterns and draw comparisons to understand the potential impact of current economic data on market expectations.

S&P 500 and Nasdaq Reactions to Rate Cuts

The impact of rate cuts on the S&P 500 and Nasdaq has varied historically, depending on the economic context and market sentiment.

- During the 2008 financial crisis, the Federal Reserve implemented aggressive rate cuts to stimulate the economy. The S&P 500 initially experienced a sharp decline but rebounded significantly in the following months as the rate cuts took effect. The Nasdaq, heavily reliant on technology and growth sectors, also saw a substantial recovery.

- In the aftermath of the 2020 COVID-19 pandemic, the Fed again slashed interest rates to support the economy. While the markets initially experienced a steep drop, they quickly rebounded, fueled by government stimulus measures and the expectation of a swift economic recovery.

The S&P 500 and Nasdaq both witnessed remarkable gains in the months following the rate cuts.

These historical examples highlight the potential for rate cuts to provide a boost to the stock market, especially when economic conditions are challenging. However, it is important to note that the effectiveness of rate cuts can be influenced by factors such as the severity of the economic downturn, the level of investor confidence, and the availability of other policy measures.