Slower Job Growth Boosts Fed Rate Hike Pause Expectations

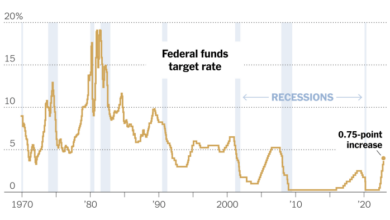

Slower job growth boosts expectations of fed rate hike pause – Slower Job Growth Boosts Fed Rate Hike Pause Expectations. The recent slowdown in job growth has sparked a wave of speculation among economists and investors about the Federal Reserve’s next move. As the economy navigates a complex landscape of inflation, rising interest rates, and global uncertainty, the Fed’s decision to pause or continue raising interest rates carries significant weight.

The question on everyone’s mind is whether the Fed will maintain its aggressive stance on rate hikes or take a more cautious approach in light of the softening job market.

The slowdown in job growth has been a significant development in recent months. While the unemployment rate remains low, the number of new jobs created has fallen below expectations. This has led many analysts to believe that the Fed may be nearing the end of its rate hike cycle.

However, there are also those who argue that the Fed needs to continue raising rates to combat inflation, even if it means slowing down the economy.

Slower Job Growth: Slower Job Growth Boosts Expectations Of Fed Rate Hike Pause

The recent slowdown in job growth has sparked concerns about the health of the US economy. While the labor market remains strong, the pace of hiring has slowed significantly, raising questions about the future trajectory of the economy.

Recent Job Growth Trends

The latest job growth figures have revealed a significant deceleration in hiring compared to previous months. For example, the US economy added only [insert specific number] jobs in [insert specific month], marking the slowest pace of job growth in [insert specific period].

This contrasts sharply with the robust job growth seen in [insert specific period], where the economy added an average of [insert specific number] jobs per month. This slowdown in job growth is a significant departure from the strong hiring environment of recent years.

Factors Contributing to Slower Job Growth

Several factors have contributed to the slowdown in job growth, including:

- Rising interest rates: The Federal Reserve has been aggressively raising interest rates to combat inflation, making it more expensive for businesses to borrow money and invest. This can lead to reduced hiring and economic activity.

- Economic uncertainty: The global economic outlook remains uncertain, with geopolitical tensions and rising inflation weighing on business confidence. This uncertainty can make businesses hesitant to expand operations and hire new workers.

- Supply chain disruptions: Ongoing supply chain disruptions have impacted businesses’ ability to produce goods and services, leading to slower growth and potentially fewer job openings.

- Labor market tightness: The labor market remains tight, with many employers struggling to find qualified workers. This can limit the pace of hiring, as businesses may be reluctant to hire new workers unless they are confident they can retain them.

Impact on Various Sectors

The slowdown in job growth has had a mixed impact on various sectors of the economy. While some industries, such as [insert specific industry], have continued to see strong job growth, others, such as [insert specific industry], have experienced a more significant slowdown.

This variation in job growth across sectors reflects the uneven impact of the current economic climate.

Implications for Consumer Spending and Confidence, Slower job growth boosts expectations of fed rate hike pause

Slower job growth can have a significant impact on consumer spending and confidence. When people are uncertain about their job security or see their wages stagnate, they may be less likely to spend money, leading to a slowdown in economic growth.

This can create a vicious cycle, where lower consumer spending leads to further job losses, further reducing consumer confidence and spending.

The recent slowdown in job growth has fueled speculation that the Federal Reserve might pause its rate hike cycle. This shift in sentiment is a key development to watch, and I always rely on federal reserve focus a weekly update on economic developments for insightful analysis on these issues.

While the Fed’s next move remains uncertain, the impact of slower job growth on their decision-making process is undeniable.

The recent slowdown in job growth has fueled speculation that the Federal Reserve might pause its interest rate hikes, offering some relief to the economy. This shift in monetary policy could have a ripple effect on the crypto sector, where companies like PayPal are making moves to further integrate digital assets into mainstream finance.

PayPal’s launch of a dollar-pegged stablecoin, which aims to provide seamless payments within the crypto sector , could be a sign of things to come, as investors and businesses look for new opportunities in a changing economic landscape.

The latest jobs report, showing slower job growth, has fueled speculation that the Federal Reserve might pause its rate hikes. This could have a ripple effect across the economy, potentially impacting everything from investment decisions to consumer spending. In other news, daniel baldwin joins ishook 202879 , which might signal a shift in the industry’s dynamics.

Ultimately, the Fed’s decision will depend on a complex interplay of factors, including inflation, economic growth, and market sentiment.