Saudi Arabias Crude Oil Exports Dip Amid OPEC Production Cuts

Saudi arabias crude oil exports dip amid opec production cuts – Saudi Arabia’s crude oil exports dip amid OPEC production cuts, a move that has sent ripples throughout the global energy market. The decision to reduce production, a collaborative effort by OPEC member nations, has been driven by a complex interplay of factors, including the desire to stabilize prices and address concerns about oversupply.

This strategic shift has not only impacted the volume of oil available for export but has also significantly influenced global oil prices, creating a new landscape for both producers and consumers alike.

The reduction in Saudi Arabia’s oil production has had a tangible impact on its export figures. The volume of crude oil exported from the kingdom has declined since the production cuts were implemented, impacting global supply chains and potentially influencing economic growth in both Saudi Arabia and other oil-dependent nations.

This shift in production strategy has also had a ripple effect on the global oil market, prompting a reassessment of supply and demand dynamics and raising questions about the future of energy dependence on oil.

Saudi Arabia’s Oil Production Cuts

Saudi Arabia, the world’s largest oil exporter, has recently announced significant cuts to its oil production. This decision has sparked global attention, raising concerns about the future of oil supply and its potential impact on the global economy.

Reasons for Production Cuts

The decision to reduce oil production is primarily driven by a desire to stabilize oil prices and ensure a healthy market for OPEC+ members. Saudi Arabia, as the de facto leader of OPEC+, has been instrumental in coordinating production cuts to maintain price stability.

Saudi Arabia’s recent decision to cut crude oil exports amidst OPEC production cuts has sent ripples through the global energy market. While the focus remains on oil prices and supply, it’s interesting to consider the broader technological shifts happening simultaneously.

HP’s CEO, for example, forecasts an AI-driven revolution in computers within two years , which could potentially impact how we manage energy resources in the future. These technological advancements, coupled with the changing dynamics in the oil market, are shaping a complex and uncertain landscape for the energy industry.

Impact on Global Oil Supply and Prices

The production cuts have already had a noticeable impact on global oil supply. The reduced output has contributed to a tightening of the oil market, pushing prices higher. This has implications for consumers, who are likely to face higher fuel costs, and businesses, which may see increased operational expenses.

Economic Consequences for Saudi Arabia

While the production cuts may be beneficial for Saudi Arabia in the short term, they also carry potential economic consequences. Reduced oil production translates to lower oil revenue, which could impact government finances and economic growth.

Impact on Crude Oil Exports

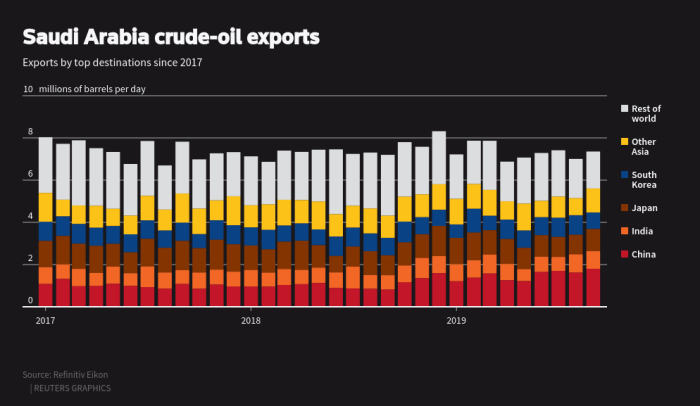

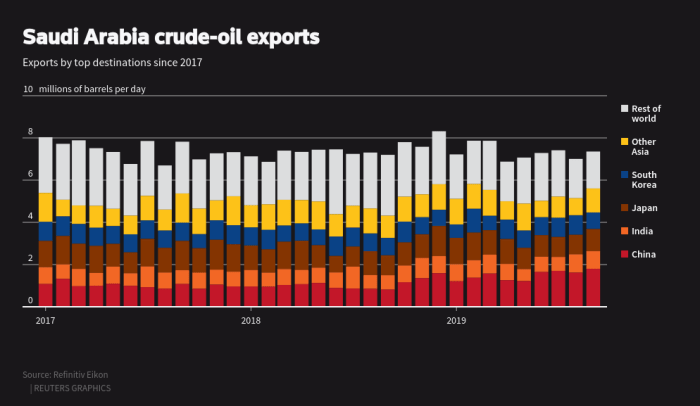

Saudi Arabia’s decision to cut oil production has had a significant impact on its crude oil exports. The reduction in production has directly led to a decrease in the volume of oil available for export. This section will delve into the specific details of this decline, providing data on export volumes before and after the cuts and comparing current export figures to historical trends.

Export Volumes Before and After Production Cuts

The production cuts have resulted in a notable decrease in Saudi Arabia’s crude oil exports. Prior to the cuts, Saudi Arabia was exporting an average of 7.5 million barrels per day (bpd) of crude oil. However, following the implementation of the production cuts, export volumes have declined to an average of 6.5 million bpd.

This represents a decrease of approximately 1 million bpd, highlighting the significant impact of the production cuts on Saudi Arabia’s export capacity.

Comparison to Historical Trends

To further understand the impact of the recent production cuts, it’s essential to compare current export figures to historical trends. Historically, Saudi Arabia has been a major oil exporter, consistently ranking among the top producers and exporters globally. However, the recent production cuts have resulted in a significant deviation from this historical trend.

The current export volume of 6.5 million bpd is significantly lower than the average export volumes observed in previous years. For instance, in 2022, Saudi Arabia’s average crude oil exports reached 8.5 million bpd, demonstrating a substantial decline in recent months.

OPEC’s Role in Production Cuts: Saudi Arabias Crude Oil Exports Dip Amid Opec Production Cuts

OPEC, the Organization of the Petroleum Exporting Countries, plays a pivotal role in coordinating production cuts among its member nations. This collective effort aims to influence global oil prices and maintain market stability.The decision to reduce production stems from OPEC’s desire to manage the delicate balance between supply and demand in the global oil market.

By limiting production, OPEC aims to increase oil prices, benefiting its member countries’ economies.

Rationale for Production Cuts, Saudi arabias crude oil exports dip amid opec production cuts

OPEC’s decision to reduce production is driven by several factors, including:* Maintaining Oil Prices:OPEC seeks to maintain oil prices at a level that is beneficial to its member countries. By reducing production, OPEC creates a scarcity in the market, leading to higher prices.

Market Stability OPEC aims to stabilize the global oil market by preventing excessive price fluctuations. Production cuts can help to dampen volatility and create a more predictable market environment.

Saudi Arabia’s recent dip in crude oil exports, driven by OPEC’s production cuts, is a reminder of the volatile nature of the global energy market. Meanwhile, across the Atlantic, Lufthansa’s CEO has downplayed speculation about a potential takeover of Portugal’s TAP airline, stating that any discussion is premature.

This statement comes as TAP continues to struggle financially, highlighting the complex interplay between global economic forces and individual industry challenges. Saudi Arabia’s export adjustments are likely to continue influencing the oil market, with global energy dynamics remaining intertwined with a host of other economic factors.

Balancing Supply and Demand By adjusting production levels, OPEC seeks to align supply with global demand, preventing shortages or surpluses. This ensures a more sustainable and balanced market.

Economic Considerations OPEC member countries rely heavily on oil revenue. Production cuts can help to boost oil prices and generate higher income for these nations.

Geopolitical Factors OPEC’s decisions are often influenced by geopolitical factors, such as global political tensions or economic sanctions.

Potential Implications of OPEC’s Actions

OPEC’s production cuts can have significant implications for the global oil market, including:* Higher Oil Prices:Reduced supply typically leads to higher oil prices, impacting consumers and businesses.

Increased Volatility While OPEC aims to stabilize the market, production cuts can create volatility as market participants adjust to the new supply dynamics.

Economic Impact Higher oil prices can impact economic growth, inflation, and energy costs.

Competition Non-OPEC producers may increase their production to fill the gap created by OPEC’s cuts, potentially leading to competition and market share adjustments.

Saudi Arabia’s recent dip in crude oil exports, a consequence of OPEC production cuts, highlights the shifting landscape of global energy markets. While oil prices fluctuate, a savvy investor might consider diversifying their portfolio with opportunities in the soft commodities market, like those detailed in this insightful article on soft commodities trading, exploring the potential of coffee, cocoa, cotton, and sugar.

As the world grapples with energy challenges, understanding the dynamics of these essential commodities could offer a strategic advantage in navigating the ever-evolving market landscape.

Strategic Considerations OPEC’s actions can influence global energy security and strategic relationships between countries.

Global Oil Market Dynamics

The global oil market is a complex interplay of supply, demand, and geopolitical factors. These factors constantly influence oil prices, which in turn impact global economies. The recent production cuts by OPEC+ have significantly impacted this dynamic, adding another layer of complexity to the market.

Impact of Production Cuts on Supply and Demand

The production cuts have created a tighter supply-demand balance, leading to higher oil prices. This is because the cuts reduce the amount of oil available in the market, while demand remains relatively stable. The impact of the production cuts is evident in the recent rise in oil prices.

For instance, Brent crude, a global benchmark, has risen by over 10% since the announcement of the production cuts.

Key Factors Influencing Global Oil Prices

- Demand:Global economic growth is a key driver of oil demand. As economies grow, demand for energy, including oil, tends to increase. For example, the robust economic growth in China and India has significantly boosted global oil demand in recent years.

- Supply:Oil production is influenced by factors such as technological advancements, geopolitical stability, and investment in new oil fields. For instance, the shale oil revolution in the United States significantly increased global oil supply. However, geopolitical tensions in oil-producing regions, such as the Middle East, can disrupt supply and lead to price volatility.

- Geopolitical Events:Geopolitical events, such as wars, sanctions, and political instability, can significantly impact oil prices. The 2003 invasion of Iraq, for example, led to a sharp rise in oil prices. Similarly, the ongoing conflict in Ukraine has raised concerns about energy security and supply disruptions, contributing to higher oil prices.

Potential Long-Term Impact of Production Cuts

The long-term impact of the production cuts on the global oil market is still uncertain. Some analysts predict that the cuts will lead to a sustained period of higher oil prices, while others believe that the market will eventually adjust to the new supply dynamics.

The impact will depend on several factors, including the duration of the production cuts, the response of oil producers, and the pace of global economic growth.

“The recent production cuts by OPEC+ have created a tighter supply-demand balance, leading to higher oil prices. The long-term impact of these cuts is still uncertain, but it is likely to have a significant impact on the global oil market.”

Economic Implications

The decision by Saudi Arabia to reduce oil production, in alignment with OPEC+ agreements, carries significant economic implications, impacting both the kingdom itself and the global energy landscape. These cuts directly influence oil prices, government revenues, and economic growth, while also prompting adjustments in consumer behavior and encouraging the exploration of alternative energy sources.

Impact on Saudi Arabia’s Economy

Saudi Arabia, as the world’s largest oil exporter, relies heavily on oil revenue to fund its budget and drive economic growth. Reduced oil production translates to lower export earnings, potentially impacting the government’s ability to finance public services, infrastructure projects, and social welfare programs.

This could lead to fiscal constraints and potentially impact the pace of economic diversification efforts.

Impact on Global Consumers and Businesses

Higher oil prices, a direct consequence of reduced production, impact consumers and businesses worldwide. Increased fuel costs for transportation, manufacturing, and energy production translate to higher prices for goods and services, potentially leading to inflation and reduced consumer spending. Businesses may face higher operating costs, affecting profitability and investment decisions.

The Rise of Alternative Energy Sources

The economic consequences of reduced oil production and higher prices are accelerating the transition towards renewable energy sources. Governments and businesses are increasingly investing in solar, wind, and other sustainable energy technologies to reduce dependence on fossil fuels. This shift, driven by environmental concerns and energy security considerations, is likely to reshape the global energy landscape in the long term.