Small Stocks Surge: Attractive Valuations Fuel Market Rally

Resurgence of small stocks joining the market rally with attractive valuations – Small stocks joining the market rally with attractive valuations is a trend gaining momentum, captivating investors and sparking lively discussions. This resurgence is driven by a confluence of factors, including economic conditions, investor sentiment, and market trends. Small-cap companies, often overlooked in favor of their larger counterparts, are now attracting attention due to their potential for significant growth and attractive valuations.

The recent economic recovery has played a key role in this shift. With businesses rebounding and consumer confidence rising, small companies are well-positioned to capitalize on the growth opportunities. This, coupled with a favorable investment climate, has led to increased investor interest in small-cap stocks.

The Rise of Small Stocks

The recent market rally has seen a resurgence of interest in small-cap stocks, a phenomenon driven by a confluence of factors, including economic conditions, investor sentiment, and market trends. As investors seek out opportunities for growth and diversification, small-cap stocks have emerged as a compelling investment proposition.

Factors Contributing to the Resurgence

Several factors have contributed to the recent surge in small-cap stock performance.

- Economic Growth and Inflation:The ongoing economic recovery, coupled with rising inflation, has created a favorable environment for small businesses. As the economy expands, small companies often benefit from increased demand and higher prices for their goods and services.

- Low Interest Rates:Low interest rates have made it cheaper for companies to borrow money, which can stimulate investment and growth. This environment has been particularly beneficial for smaller companies with limited access to capital.

- Shifting Investor Sentiment:Investors are increasingly looking for growth opportunities beyond the large-cap tech giants that have dominated the market in recent years. Small-cap stocks, with their potential for high growth, have become attractive alternatives.

- Market Rotation:As the market cycles through different sectors, investors often shift their focus to areas that are expected to outperform. This rotation can lead to a surge in demand for small-cap stocks, particularly in sectors that are benefiting from the current economic environment.

Small-Cap Sectors Experiencing Growth

Several small-cap sectors are experiencing significant growth, driven by the factors mentioned above.

While small stocks are enjoying a resurgence, fueled by their attractive valuations, the broader market seems to be taking a breather. The Dow futures are dipping this morning, likely due to Disney’s disappointing earnings report and the anticipation of today’s inflation data, as you can see in this live updates article.

Despite this short-term wobble, the overall bullish sentiment remains, especially for those smaller companies poised for growth.

- Healthcare:The aging population and rising healthcare costs are driving demand for innovative medical technologies and services, creating opportunities for small-cap healthcare companies.

- Technology:The rapid pace of technological innovation continues to create opportunities for small-cap technology companies, particularly in areas such as artificial intelligence, cybersecurity, and cloud computing.

- Consumer Discretionary:As consumer spending rebounds, small-cap companies in the consumer discretionary sector, such as restaurants, retail, and travel, are benefiting from increased demand.

- Energy:Rising energy prices and increased demand for oil and gas are creating opportunities for small-cap energy companies, particularly those involved in exploration and production.

Attractive Valuations

Small-cap stocks, representing companies with relatively small market capitalizations, are often characterized by their attractive valuations. These valuations can be significantly lower compared to larger companies, making them a potentially compelling investment opportunity for investors seeking growth and value.

Valuation Differences Between Small-Cap and Large-Cap Companies

The valuation of a company is determined by various factors, including its earnings, growth potential, and risk profile. Small-cap companies, due to their smaller size and often higher growth potential, tend to have higher price-to-earnings (P/E) ratios than larger companies.

However, they also tend to have lower price-to-book (P/B) ratios, indicating a lower price relative to their assets.

- P/E Ratio:The P/E ratio measures the price of a company’s stock relative to its earnings per share. Small-cap companies often have higher P/E ratios because investors are willing to pay a premium for their expected future growth. For example, a small-cap company with a P/E ratio of 25 indicates that investors are willing to pay $25 for every $1 of earnings.

- P/B Ratio:The P/B ratio measures the price of a company’s stock relative to its book value per share. Book value represents the company’s assets minus its liabilities. Small-cap companies often have lower P/B ratios because they may have fewer tangible assets compared to larger companies.

A lower P/B ratio suggests that investors are paying less for each dollar of the company’s assets.

Potential Risks and Rewards of Investing in Small-Cap Stocks

Investing in small-cap stocks can offer both significant rewards and risks.

- Rewards:

- Higher Growth Potential:Small-cap companies often operate in rapidly growing industries or niche markets, giving them the potential to generate substantial returns for investors. For example, a small-cap company in the renewable energy sector could experience significant growth as the demand for clean energy solutions increases.

The resurgence of small stocks joining the market rally is a welcome sight, especially with attractive valuations. This positive momentum could be further fueled by the recent breaking news of gasoline, natural gas, and other energy sources witnessing significant price declines.

Lower energy costs can translate into increased profitability for smaller companies, making them even more appealing to investors seeking growth potential.

- Lower Competition:Smaller companies may face less competition in their respective markets, allowing them to capture a larger market share and potentially achieve higher profitability.

- Higher Growth Potential:Small-cap companies often operate in rapidly growing industries or niche markets, giving them the potential to generate substantial returns for investors. For example, a small-cap company in the renewable energy sector could experience significant growth as the demand for clean energy solutions increases.

- Risks:

- Higher Volatility:Small-cap stocks tend to be more volatile than larger companies due to their smaller size and lower liquidity. This means that their prices can fluctuate more significantly in response to market events or company-specific news.

- Financial Risk:Small-cap companies may have weaker financial positions than larger companies, making them more susceptible to economic downturns or industry-specific challenges.

- Limited Information:Information about small-cap companies may be less readily available compared to larger companies, making it more difficult for investors to assess their financial health and growth prospects.

Market Performance

Small-cap stocks have been a bright spot in the market recently, outperforming their larger counterparts. This resurgence can be attributed to a confluence of factors, including attractive valuations, improving economic conditions, and a shift in investor sentiment.

The resurgence of small stocks joining the market rally with attractive valuations is a hot topic right now, but before diving into the details, it’s important to understand the fundamentals of data protection. A privacy policy, like the one outlined in this article what is a privacy policy and why is it important , defines how companies collect, use, and share your personal information.

Understanding this crucial aspect is key to making informed decisions about your investments, especially when considering the potential risks and rewards of small-cap stocks.

Recent Performance

The Russell 2000 Index, a benchmark for small-cap stocks, has outpaced the S&P 500 in recent months. The index has gained over 10% in the past three months, compared to a 5% gain for the S&P 500. This strong performance suggests that investors are increasingly optimistic about the prospects for small-cap companies.

Comparison to Broader Market, Resurgence of small stocks joining the market rally with attractive valuations

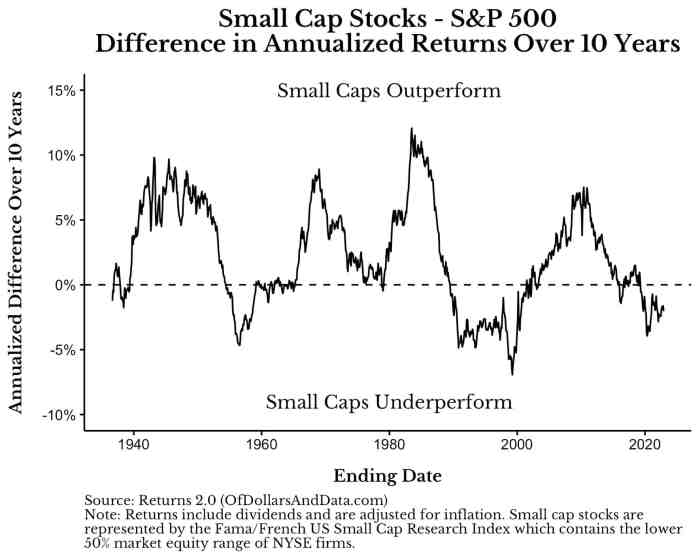

- Small-cap stocks have historically been more volatile than large-cap stocks, but they also tend to offer higher growth potential. This is because they are often in industries that are growing rapidly and have more room to expand. In recent years, small-cap stocks have been lagging behind large-cap stocks, but this trend appears to be reversing.

- The recent outperformance of small-cap stocks can be attributed to several factors, including a strong economic outlook, lower interest rates, and a shift in investor sentiment. As the economy continues to grow, small-cap companies are likely to benefit from increased demand for their products and services.

Macroeconomic Factors

- Interest rates are a key factor that can influence the performance of small-cap stocks. When interest rates are low, it is cheaper for companies to borrow money, which can boost their growth. However, when interest rates rise, it can make it more expensive for companies to borrow money, which can slow their growth.

- The economic outlook is also a major factor that can affect the performance of small-cap stocks. When the economy is growing, small-cap companies tend to benefit from increased demand for their products and services. However, when the economy is slowing, small-cap companies can be more vulnerable to a downturn.

- Inflation is another important factor to consider. When inflation is high, it can erode the value of a company’s profits. This can be particularly problematic for small-cap companies, which often have less pricing power than larger companies.

Investment Opportunities

The resurgence of small stocks presents a compelling opportunity for investors seeking growth and diversification in their portfolios. Small-cap companies, often characterized by their high growth potential and innovative business models, are poised to benefit from the current economic environment and market trends.

Identifying specific sectors and industries within the small-cap market that offer promising investment opportunities can help investors capitalize on this resurgence.

Identifying Promising Sectors

Small-cap companies are typically concentrated in specific sectors, offering investors a chance to gain exposure to industries experiencing rapid growth or undergoing significant transformation. Identifying these sectors can help investors focus their investment efforts and increase the likelihood of success.

- Technology:The technology sector remains a hotbed for innovation and growth, particularly in areas like artificial intelligence, cloud computing, cybersecurity, and e-commerce. Small-cap companies in this sector are often developing disruptive technologies and products that have the potential to reshape industries.

For example, a small-cap company specializing in AI-powered customer service solutions could benefit from the growing demand for personalized and efficient customer interactions.

- Healthcare:The healthcare sector is driven by factors such as an aging population, rising healthcare costs, and advancements in medical technology. Small-cap companies in this sector are often developing innovative drugs, medical devices, and healthcare services that address unmet medical needs.

For instance, a small-cap company developing a new treatment for a rare disease could see significant growth potential due to the high unmet need and limited competition.

- Consumer Discretionary:The consumer discretionary sector encompasses industries like retail, restaurants, travel, and entertainment. Small-cap companies in this sector are often catering to specific consumer trends or offering niche products and services. For example, a small-cap company specializing in sustainable and ethical fashion could benefit from the growing consumer demand for eco-conscious products.

Hypothetical Portfolio

Building a diversified portfolio of small-cap stocks can help investors mitigate risk and enhance returns. A hypothetical portfolio could include a mix of companies from different sectors, representing a range of growth potential and risk profiles.

For example, a hypothetical small-cap portfolio could include:

- Technology:A company developing AI-powered software for healthcare providers.

- Healthcare:A company developing a new treatment for a chronic disease.

- Consumer Discretionary:A company specializing in personalized online shopping experiences.

Strategies for Capitalizing on Small-Cap Resurgence

Investors can employ various strategies to capitalize on the resurgence of small stocks, ensuring they align with their investment goals and risk tolerance.

- Focus on Growth Potential:Investing in small-cap companies with strong growth potential, such as those operating in rapidly expanding industries or developing innovative products and services, can lead to significant returns. For example, investing in a small-cap company specializing in renewable energy solutions could benefit from the increasing global demand for sustainable energy sources.

- Diversify Across Sectors:Diversifying investments across different sectors within the small-cap market can help mitigate risk and increase the likelihood of positive returns. For instance, investing in small-cap companies in both the technology and healthcare sectors can provide exposure to different growth drivers and market trends.

- Utilize Long-Term Perspective:Investing in small-cap stocks often requires a long-term perspective, as these companies may experience periods of volatility and growth. Investors should focus on the long-term growth potential of the companies and avoid making short-term trading decisions based on market fluctuations.

Risks and Considerations: Resurgence Of Small Stocks Joining The Market Rally With Attractive Valuations

While the resurgence of small-cap stocks presents an exciting opportunity for investors, it’s crucial to acknowledge the inherent risks associated with this asset class. Small-cap stocks, due to their size and often nascent nature, carry a higher degree of volatility and liquidity challenges compared to their larger counterparts.

Volatility and Liquidity

Small-cap stocks are known for their price fluctuations, which can be more pronounced than those of larger companies. This volatility arises from several factors, including:

- Limited Market Capitalization:Smaller companies have a smaller market capitalization, meaning their stock prices can be more easily influenced by a smaller volume of trades or news events. This can lead to significant price swings, both positive and negative.

- Limited Financial Resources:Small-cap companies often have fewer financial resources and may be more vulnerable to economic downturns or industry-specific challenges. This can impact their profitability and ultimately affect their stock prices.

- Less Analyst Coverage:Smaller companies often receive less attention from analysts, leading to less research and information available to investors. This can make it more challenging to assess their financial health and future prospects.

In addition to volatility, small-cap stocks can also face liquidity challenges. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. Small-cap stocks often have lower trading volumes, making it more difficult to buy or sell large quantities of shares without impacting the price.

Company-Specific Factors

Beyond market-wide risks, small-cap stocks also face company-specific risks that can significantly impact their performance. These risks include:

- Higher Risk of Failure:Small companies are more likely to fail than larger companies due to their limited resources and exposure to competition. This risk can lead to significant losses for investors.

- Management Quality:The success of a small-cap company often hinges on the quality of its management team. A lack of experience or poor decision-making can significantly hinder a company’s growth and profitability.

- Competition:Small-cap companies often operate in highly competitive markets, facing pressure from larger, more established players. This competition can make it challenging for them to gain market share and achieve profitability.

Due Diligence and Risk Management

Given the inherent risks associated with small-cap stocks, it’s crucial for investors to conduct thorough due diligence before investing in these companies. This involves:

- Researching the Company’s Business Model:Understanding the company’s core business, its competitive landscape, and its growth potential is essential.

- Analyzing the Company’s Financials:Examining the company’s financial statements, including its revenue, profitability, and cash flow, can help investors assess its financial health and growth prospects.

- Assessing Management Quality:Evaluating the experience, track record, and integrity of the company’s management team is crucial, as it can significantly impact the company’s performance.

Managing risk in a small-cap stock portfolio requires a disciplined approach. Investors can consider the following strategies:

- Diversification:Investing in a diversified portfolio of small-cap stocks across different sectors and industries can help reduce overall risk.

- Dollar-Cost Averaging:Investing a fixed amount of money at regular intervals can help mitigate the impact of short-term price fluctuations.

- Setting Realistic Expectations:Small-cap stocks can be volatile, and investors should set realistic expectations for potential returns and losses.

- Monitoring Investments Regularly:Regularly reviewing the performance of small-cap investments and adjusting the portfolio as needed is essential for managing risk and maximizing returns.