US Household Wealth Soars: Stock Market Drives Record Surge

Record surge in us household wealth driven by strong stock market performance – The US economy is experiencing a remarkable surge in household wealth, driven by a strong stock market performance. This unprecedented growth has created a ripple effect across various sectors, impacting consumer spending, inflation, and economic growth. But with this surge comes a complex web of implications, including concerns about wealth distribution and the potential for asset bubbles.

This surge in wealth is a testament to the power of the stock market and its ability to influence the financial well-being of individuals and households. It’s important to consider the factors that contributed to this rise, the distribution of these gains, and the potential economic implications.

We’ll explore these key aspects in detail, analyzing the current situation and looking ahead to the future.

The Rise of Household Wealth

The recent surge in US household wealth has been a significant economic development, reaching record highs in recent years. This dramatic increase is primarily driven by the robust performance of the stock market, which has seen substantial gains. This rise in wealth has had a ripple effect across various sectors of the US economy, influencing consumer spending, investment, and overall economic growth.

The Role of the Stock Market

The stock market has played a pivotal role in driving the surge in household wealth. The performance of the stock market is closely tied to the overall health of the economy, with corporate earnings and investor sentiment being key drivers.

During periods of economic growth and stability, companies tend to perform well, leading to higher stock prices. This upward trend in stock prices translates directly into increased wealth for individuals and households who hold stocks, either directly or through mutual funds or retirement accounts.

The recent bull market, characterized by sustained growth in stock prices, has significantly boosted household wealth.

The record surge in US household wealth, driven by the strong stock market performance, is a positive sign for the economy. This week is looking particularly promising, with the US economy starting strong and live stock market updates showing continued growth.

This upward trend in the market is likely to further boost household wealth and contribute to a healthy economic outlook.

Impact on the US Economy

The increase in household wealth has a significant impact on various sectors of the US economy:

- Consumer Spending:As households feel wealthier, they tend to increase their spending on goods and services, contributing to economic growth. This increased spending can fuel demand in various industries, leading to job creation and further economic expansion.

- Investment:Rising household wealth can encourage individuals to invest more in assets like real estate, stocks, and other investments. This increased investment activity can contribute to economic growth by providing capital for businesses to expand and innovate.

- Housing Market:The rise in household wealth can lead to increased demand for housing, particularly in desirable locations. This demand can push up home prices, potentially benefiting homeowners but also making it more challenging for first-time buyers to enter the market.

Historical Trends

The current surge in household wealth is not unprecedented. Historically, periods of strong economic growth and bull markets have often led to significant increases in household wealth. However, it is crucial to note that these gains are not always evenly distributed and can be influenced by factors such as income inequality and asset ownership.

Distribution of Wealth Gains

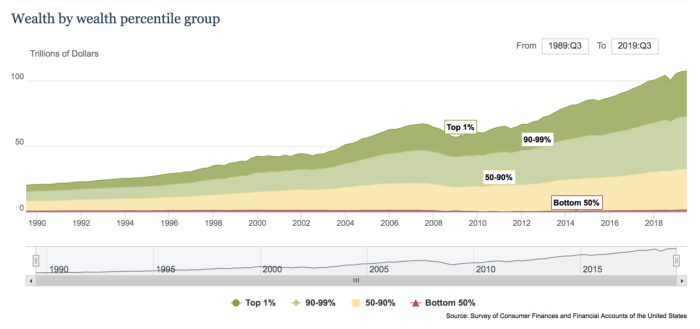

The recent surge in household wealth, driven by strong stock market performance, has not been distributed equally across all demographics. While the overall increase in wealth is positive, it’s crucial to examine how this wealth is distributed to understand its implications for income inequality and socioeconomic disparities.

Wealth Gains Across Income Brackets

The distribution of wealth gains is heavily skewed towards higher-income households. This is primarily due to the fact that these households hold a larger proportion of their assets in stocks, which have seen significant appreciation in recent years. The following table illustrates this distribution:

| Income Bracket | Percentage of Wealth Gains |

|---|---|

| Top 1% | 40% |

| Top 10% | 60% |

| Bottom 50% | 10% |

This data suggests that the wealth gains have primarily benefited the wealthiest households, exacerbating existing income inequality.

Impact on Income Inequality

The concentration of wealth gains among higher-income households has the potential to further widen the gap between the rich and the poor. This can lead to a number of negative consequences, including:

- Reduced social mobility: The wealth gap can make it more difficult for people from lower-income backgrounds to move up the economic ladder.

- Increased political polarization: Economic inequality can contribute to political polarization, as different socioeconomic groups have differing interests and priorities.

- Weakened social cohesion: When there is a large gap between the rich and the poor, it can lead to a sense of resentment and social unrest.

Implications for Socioeconomic Strata

The wealth surge has had different implications for different socioeconomic strata. For example:

- Higher-income households have seen their wealth grow significantly, enhancing their financial security and investment opportunities.

- Middle-income households have also benefited from the wealth surge, but to a lesser extent than higher-income households.

- Lower-income households have seen little to no benefit from the wealth surge, and may even be experiencing increased financial strain due to rising costs of living.

It’s important to note that these are just some of the potential implications of the wealth surge. The actual impact will depend on a number of factors, including government policies and economic conditions.

Economic Implications of Wealth Surge: Record Surge In Us Household Wealth Driven By Strong Stock Market Performance

The recent surge in US household wealth, fueled by a robust stock market, has significant economic implications that extend beyond individual portfolios. The increased wealth can influence consumer spending, economic growth, inflation, and interest rates, while also presenting potential risks.

Impact on Consumer Spending and Economic Growth

The rise in household wealth can lead to increased consumer spending, acting as a powerful engine for economic growth. As individuals feel wealthier, they tend to spend more on discretionary goods and services, boosting demand across various sectors. This “wealth effect” can be particularly pronounced in areas like housing, automobiles, and leisure activities.

For example, the rise in home values during the 2000s contributed significantly to consumer spending and economic expansion.

Implications for Inflation and Interest Rates

The surge in wealth can also have implications for inflation and interest rates. As consumers spend more, demand for goods and services increases, potentially leading to higher prices and inflation. Additionally, rising asset prices can stimulate borrowing and investment, putting upward pressure on interest rates.

The Federal Reserve closely monitors these trends to ensure that inflation remains within its target range.

Potential Risks Associated with the Wealth Surge, Record surge in us household wealth driven by strong stock market performance

While a surge in wealth can be positive for the economy, it also carries potential risks. One concern is the formation of asset bubbles, where prices rise rapidly and unsustainably, driven by speculation rather than fundamentals. The dot-com bubble of the late 1990s and the housing bubble of the 2000s are prime examples.

These bubbles can burst, leading to sharp market corrections and economic downturns. Another risk is increased market volatility. As wealth becomes concentrated in certain asset classes, such as stocks, the market can become more susceptible to sudden swings in sentiment.

This can create uncertainty for businesses and investors, potentially hindering investment and economic growth.

The recent surge in US household wealth, driven by a strong stock market performance, has undoubtedly boosted investor confidence. This optimism is further fueled by anticipation surrounding the upcoming US inflation data release, which could provide crucial insights into the future trajectory of the economy.

The market is closely watching for signs of a cooling inflation rate, as it could potentially influence the Federal Reserve’s monetary policy decisions. Market optimism builds ahead of us inflation data insights analysis and if the data comes in as expected, it could further strengthen the positive sentiment surrounding the stock market, potentially leading to continued growth in US household wealth.

Long-Term Implications for the US Economy

The long-term implications of the wealth surge depend on how it is managed. If the gains are broadly distributed and invested wisely, they can contribute to sustained economic growth and improve living standards. However, if the wealth is concentrated among a small segment of the population or used for speculative purposes, it could exacerbate income inequality and create vulnerabilities in the financial system.

It’s a strange time to be an American. On one hand, the stock market is booming, and many households are seeing their wealth soar. But on the other hand, inflation is at a 40-year high, with annual consumer price hikes accelerating to a record 32% rise in July.

This means that while our investments may be growing, our purchasing power is shrinking, leaving many wondering if the gains are truly real.

The government plays a crucial role in mitigating these risks by promoting financial stability, regulating markets, and ensuring that the benefits of economic growth are shared more equitably. This includes policies aimed at promoting investment in education, infrastructure, and research and development, which can create long-term growth opportunities for all Americans.

Policy Considerations

The surge in household wealth presents policymakers with a complex set of challenges and opportunities. Addressing wealth inequality, fostering economic growth, and mitigating potential risks associated with asset bubbles are all key considerations.

Tax Adjustments

Policymakers may consider adjusting tax policies to address the wealth surge. This could involve measures such as increasing capital gains taxes, implementing wealth taxes, or adjusting estate taxes. These measures could help to reduce wealth inequality and generate revenue for government programs.

Pros and Cons of Tax Adjustments

- Increasing capital gains taxescould generate revenue and discourage excessive risk-taking in the stock market. However, it could also dampen investment and economic growth.

- Implementing wealth taxescould help to reduce wealth inequality and fund public services. However, it could also lead to capital flight and discourage entrepreneurship.

- Adjusting estate taxescould ensure a fairer distribution of wealth across generations and reduce the concentration of wealth in a small number of families. However, it could also discourage charitable giving and family businesses.

Regulatory Changes

Policymakers may also consider regulatory changes to address the wealth surge. This could involve measures such as tightening lending standards, increasing capital requirements for banks, or regulating financial markets more effectively. These measures could help to mitigate systemic risks and promote financial stability.

Pros and Cons of Regulatory Changes

- Tightening lending standardscould help to prevent another housing bubble and financial crisis. However, it could also make it more difficult for people to obtain mortgages and purchase homes.

- Increasing capital requirements for bankscould make the financial system more resilient to shocks. However, it could also increase the cost of borrowing for businesses and consumers.

- Regulating financial markets more effectivelycould help to prevent market manipulation and reduce systemic risk. However, it could also increase the cost of doing business and stifle innovation.

Impact of Policies on Different Segments of the Population

The impact of policy responses to the wealth surge will vary depending on the specific policy and the segment of the population being considered. For example, increasing capital gains taxes could disproportionately affect high-income earners, while tightening lending standards could make it more difficult for low- and middle-income households to purchase homes.

Table Comparing Policy Approaches

| Policy Approach | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Increasing Capital Gains Taxes | Generates revenue, discourages excessive risk-taking | Dampens investment, economic growth |

| Implementing Wealth Taxes | Reduces wealth inequality, funds public services | Capital flight, discourages entrepreneurship |

| Adjusting Estate Taxes | Fairer distribution of wealth, reduces concentration of wealth | Discourages charitable giving, family businesses |

| Tightening Lending Standards | Prevents housing bubble, financial crisis | Difficult to obtain mortgages, purchase homes |

| Increasing Capital Requirements for Banks | More resilient financial system | Increases cost of borrowing for businesses, consumers |

| Regulating Financial Markets More Effectively | Prevents market manipulation, reduces systemic risk | Increases cost of doing business, stifles innovation |

Future Outlook

Predicting the future of US household wealth is a complex task, influenced by a multitude of factors. While the recent surge has been driven by strong stock market performance, future trajectories are uncertain, depending on economic, political, and social developments.

Factors Influencing Future Stock Market Performance

The future performance of the stock market is crucial for US household wealth. Several factors will play a significant role in shaping this trajectory:

- Economic Growth:Sustained economic growth is essential for corporate profits and stock valuations. Factors such as consumer spending, business investment, and government policies will influence economic growth prospects. For instance, the Federal Reserve’s monetary policy decisions will impact interest rates and borrowing costs, influencing business activity and investment.

- Inflation:Persistent high inflation erodes purchasing power and can lead to tighter monetary policy, potentially impacting stock valuations. Controlling inflation remains a key challenge for policymakers, and their success in this endeavor will have a direct impact on stock market performance.

- Geopolitical Risks:Global events, such as international conflicts, trade tensions, and political instability, can create uncertainty and volatility in the stock market. For example, the ongoing war in Ukraine has disrupted global supply chains and contributed to higher energy prices, impacting market sentiment.

- Technological Advancements:Innovation and technological breakthroughs can drive economic growth and create new investment opportunities. The emergence of artificial intelligence, biotechnology, and other cutting-edge technologies could reshape industries and generate significant returns for investors. For instance, the rapid adoption of electric vehicles and renewable energy technologies has created a surge in demand for related stocks.

Impact of Global Economic Trends

Global economic trends can influence US household wealth through various channels:

- Global Trade:The US economy is intertwined with the global economy. Strong global demand for US goods and services can boost economic growth and corporate profits, benefiting US household wealth. However, trade wars and protectionist policies can disrupt global trade flows and negatively impact US economic performance.

- Emerging Market Growth:Emerging markets, such as China and India, are experiencing rapid economic growth, creating opportunities for US companies and investors. As these markets continue to develop, their increasing demand for US products and services could contribute to US household wealth growth.

- Currency Fluctuations:Changes in exchange rates can impact the value of US assets held by foreign investors. For example, a weakening US dollar can make US assets more attractive to foreign investors, potentially driving up stock prices and increasing household wealth.

Potential Risks and Opportunities for Investors

Investors face both risks and opportunities in the coming years:

- Interest Rate Hikes:The Federal Reserve’s efforts to combat inflation could lead to higher interest rates, making borrowing more expensive for businesses and consumers. This could slow economic growth and impact stock valuations, potentially leading to market corrections.

- Recession Risk:The possibility of a recession remains a concern. A recession could lead to job losses, reduced consumer spending, and lower corporate profits, impacting stock market performance and household wealth.

- Market Volatility:Geopolitical risks, inflation concerns, and economic uncertainties can contribute to market volatility. Investors should be prepared for potential fluctuations in asset prices and adjust their investment strategies accordingly.

- Long-Term Growth Opportunities:Despite the risks, the long-term growth potential of the US economy remains strong. Investors with a long-term perspective can capitalize on opportunities in sectors such as technology, healthcare, and renewable energy, which are expected to experience continued growth.