Oracle Cloud Concerns Shake Markets, Shares Plunge 9%

Oracle cloud growth concerns shake markets shares plunge 9 percent – Oracle Cloud Growth Concerns Shake Markets, Shares Plunge 9% – this headline paints a stark picture of the current state of Oracle’s cloud ambitions. The tech giant, once a dominant force, is now facing a turbulent landscape, struggling to keep pace with the rapid evolution of the cloud computing industry.

Concerns over Oracle’s cloud growth have triggered a significant market reaction, sending its stock plummeting by 9% and raising serious questions about its future in this fiercely competitive space.

At the heart of these concerns lie a series of challenges that Oracle is grappling with. The company has been criticized for its pricing models, which are seen as less flexible and competitive compared to its rivals. Furthermore, Oracle’s cloud platform has been perceived as less innovative and feature-rich, particularly when compared to the likes of Amazon Web Services (AWS) and Microsoft Azure.

These factors, coupled with Oracle’s sluggish adoption of emerging technologies like artificial intelligence (AI) and machine learning (ML), have contributed to a slowdown in its cloud growth, leading to a decline in market share.

Oracle Cloud Growth Concerns

Oracle’s cloud growth has slowed, raising concerns among investors and analysts. While Oracle remains a significant player in the enterprise software market, its cloud business has faced challenges in keeping pace with competitors like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

Factors Contributing to Oracle’s Cloud Growth Slowdown

The slowdown in Oracle’s cloud growth can be attributed to several factors.

- Competition from AWS, Azure, and Google Cloud:These cloud providers have established a strong foothold in the market, offering a wider range of services and a more mature ecosystem. This intense competition has made it challenging for Oracle to gain market share.

- Oracle’s Legacy Infrastructure:Oracle’s traditional on-premises software business has been a major source of revenue for the company. However, this legacy infrastructure has become a barrier to cloud adoption, as customers are hesitant to migrate their existing applications to Oracle’s cloud platform.

- Pricing Concerns:Oracle’s cloud pricing has been criticized for being more expensive than its competitors. This has made it difficult for Oracle to attract new customers and retain existing ones.

Impact on Oracle’s Market Share, Oracle cloud growth concerns shake markets shares plunge 9 percent

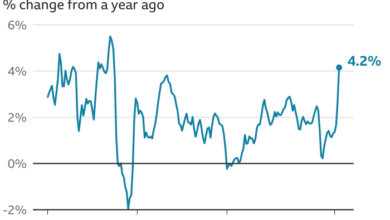

Oracle’s cloud growth slowdown has had a significant impact on its market share. According to Gartner, Oracle’s share of the global IaaS market declined from 2.9% in 2021 to 2.4% in 2022. This decline can be attributed to the increasing popularity of AWS, Azure, and Google Cloud, which have captured a larger portion of the market.

Oracle’s cloud growth concerns have sent shockwaves through the market, leading to a 9% plunge in its shares. This comes at a time when investors are closely watching the federal reserves september rate decision significance and market outlook , which could have a significant impact on the tech sector’s performance.

The combination of these factors paints a challenging picture for Oracle in the coming months, highlighting the need for the company to demonstrate strong cloud growth to regain investor confidence.

Impact on Oracle’s Financial Performance

Oracle’s cloud growth slowdown has also affected its financial performance. In the fourth quarter of fiscal year 2022, Oracle’s cloud revenue grew by 22%, a significant slowdown from the 35% growth rate it achieved in the previous quarter. This slowdown in cloud revenue growth has contributed to a decline in Oracle’s overall revenue and earnings.

Market Share Plunge

The recent 9% decline in Oracle’s market share is a significant setback for the company, highlighting the growing competitive pressure in the cloud computing market. This drop signifies a shift in customer preference, favoring alternative cloud providers and raising concerns about Oracle’s future growth trajectory.

Oracle’s Market Position Compared to Competitors

The decline in Oracle’s market share underscores the fierce competition in the cloud space. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) remain the dominant players, consistently gaining market share. Oracle faces an uphill battle to regain its footing, especially against these established giants with their extensive infrastructure, global reach, and comprehensive suite of cloud services.

Oracle’s cloud growth concerns have sent shockwaves through the market, with shares plummeting 9 percent. While this news dominated headlines, a more subtle shift occurred in the futures market, fueled by the market watch jobs report sparks interest as futures experience a minor dip.

This report, while seemingly minor, could signal a change in investor sentiment, potentially influencing the broader market and, in turn, further impacting Oracle’s stock performance.

Factors Contributing to Market Share Decline

Several factors have contributed to Oracle’s market share decline.

- Price Competitiveness:Oracle’s pricing strategies have been criticized for being less competitive compared to its rivals, particularly AWS. The company’s pricing model often appears more expensive, potentially driving customers towards more affordable options.

- Innovation and Feature Set:Oracle’s cloud offerings have been perceived as less innovative and feature-rich compared to those offered by competitors. This perception stems from a perceived lack of cutting-edge technologies, advanced analytics capabilities, and the breadth of services available. For example, AWS offers a wider range of services, including machine learning, data analytics, and serverless computing, which have become increasingly important for businesses.

- Customer Experience and Support:Customer feedback has highlighted concerns about Oracle’s customer experience and support. Some customers have reported challenges with service responsiveness, documentation, and overall ease of use. These issues can impact customer satisfaction and loyalty, ultimately affecting market share.

- Legacy Systems and Migrations:Oracle’s strong presence in traditional on-premises solutions has created a challenge in attracting new customers and migrating existing ones to the cloud. Many businesses are hesitant to transition away from their established Oracle systems due to concerns about compatibility, cost, and disruption.

Oracle’s cloud growth concerns sent shockwaves through the market, causing shares to plunge by 9 percent. This comes at a time when investors are closely watching the upcoming US inflation data, with hopes for a positive report to fuel further market optimism.

As we await the inflation data insights analysis, market optimism builds ahead of us inflation data insights analysis , the Oracle situation adds another layer of complexity to the market’s overall sentiment, highlighting the delicate balance between growth prospects and economic uncertainties.

This reluctance to embrace the cloud has limited Oracle’s growth potential.

Investor Reactions and Sentiment

The news of Oracle’s declining market share sent shockwaves through the investment community, triggering a wave of reactions and raising concerns about the company’s future prospects. Investors, analysts, and industry experts alike are scrutinizing the situation, trying to decipher the implications of this development for Oracle’s long-term growth trajectory.

Investor Sentiment and Impact on Stock Price

The market’s reaction to Oracle’s declining market share was immediate and severe, with the company’s stock price plummeting by 9%. This significant drop reflects the investors’ concerns about the company’s ability to maintain its competitive edge in the rapidly evolving cloud computing landscape.

The share price decline also highlights the importance of market share in the tech sector, as investors often view it as a proxy for future growth potential.

Oracle’s Response and Strategies: Oracle Cloud Growth Concerns Shake Markets Shares Plunge 9 Percent

Oracle, faced with declining cloud market share and investor concerns, has implemented a series of strategies to address the challenges and regain its position in the cloud market. These strategies aim to enhance its cloud offerings, strengthen its competitive edge, and attract new customers.

Oracle’s Strategies to Enhance Cloud Offerings

Oracle has taken significant steps to improve its cloud offerings, focusing on innovation, customer experience, and competitive pricing.

- Investment in Cloud Infrastructure and Services:Oracle has significantly invested in expanding its cloud infrastructure, including data centers, network capacity, and compute resources. This expansion aims to provide customers with reliable, scalable, and secure cloud services.

- Innovation in Cloud Technologies:Oracle continues to invest in research and development to introduce new cloud technologies and features. This includes advancements in artificial intelligence (AI), machine learning (ML), and database management.

- Enhanced Customer Experience:Oracle has focused on improving its customer experience by streamlining onboarding processes, providing comprehensive support, and offering tailored solutions. This includes personalized support, proactive monitoring, and customized training programs.

- Competitive Pricing and Bundling:Oracle has adjusted its pricing models to offer more competitive options, including flexible subscription plans and bundled packages. This aims to attract new customers and retain existing ones by providing cost-effective cloud solutions.

Effectiveness of Oracle’s Current Strategies

The effectiveness of Oracle’s current strategies in the cloud market is a complex issue, with both positive and negative aspects.

- Increased Investment in Cloud Infrastructure:Oracle’s investment in cloud infrastructure has helped improve the reliability and scalability of its cloud services, which has been positively received by some customers.

- Innovation in Cloud Technologies:Oracle’s investments in AI, ML, and database management have resulted in innovative cloud solutions, which have attracted some new customers.

- Enhanced Customer Experience:While Oracle has made efforts to improve its customer experience, it still faces challenges in areas like customer support and onboarding processes.

- Competitive Pricing and Bundling:Oracle’s pricing strategies have been effective in attracting some new customers, but they have also been criticized by some for being complex and less transparent compared to competitors.

Potential Future Strategies

Oracle may consider additional strategies to further enhance its cloud offerings and address the challenges it faces in the cloud market.

- Strategic Partnerships:Oracle could explore strategic partnerships with other technology companies to expand its reach and offer more comprehensive cloud solutions.

- Focus on Niche Markets:Oracle could focus on specific niche markets where it can leverage its existing strengths and expertise, such as industries like finance, healthcare, and manufacturing.

- Strengthening its Security Posture:Oracle could invest in strengthening its security posture to address concerns regarding data privacy and security, which is a critical aspect for many organizations considering cloud services.

- Investing in Open Source Technologies:Oracle could invest in open-source technologies and contribute to open-source communities to gain broader adoption and foster collaboration with developers and other technology providers.

Impact on the Cloud Computing Industry

Oracle’s recent struggles have sent shockwaves through the cloud computing industry, raising concerns about the future of this rapidly evolving sector. The decline in Oracle’s cloud growth and market share has prompted questions about the overall health of the cloud market and the competitive landscape.

Implications for the Cloud Computing Market

Oracle’s performance serves as a reminder of the intense competition and rapid innovation within the cloud computing industry. The cloud market is characterized by its dynamic nature, with new technologies and players constantly emerging. Oracle’s struggles highlight the challenges faced by established players in adapting to the changing market dynamics.

Impact on Other Cloud Providers

Oracle’s struggles could have significant implications for other cloud providers. Some potential impacts include:* Increased Competition:Oracle’s decline could open up opportunities for other cloud providers to gain market share. Competitors might capitalize on Oracle’s struggles by aggressively pursuing customers who are seeking alternatives.

Shifting Strategies Other cloud providers might re-evaluate their strategies in light of Oracle’s performance. They may focus on specific areas where Oracle is perceived as weak, or they may accelerate their own innovation efforts to maintain a competitive edge.

Investor Sentiment The impact on Oracle’s stock price could affect investor sentiment towards other cloud providers. Investors might become more cautious about investing in cloud companies, particularly those that are facing similar challenges to Oracle.

Future Landscape of the Cloud Computing Industry

Oracle’s challenges are likely to accelerate the evolution of the cloud computing industry. This could lead to:* Increased Focus on Innovation:Cloud providers will need to invest heavily in research and development to stay ahead of the curve and differentiate themselves from competitors.

New Business Models The cloud computing industry could see the emergence of new business models, such as hybrid cloud solutions or specialized cloud services tailored to specific industries.

Consolidation The cloud computing market could see further consolidation as larger players acquire smaller companies to gain access to new technologies and talent.