Oil Prices Surge: IEA Warns of Supply Shortfall

Oil prices surge iea supply shortfall warning – a stark reminder of the precarious state of global energy markets. The recent surge in oil prices, driven by a confluence of factors, has sent shockwaves through the global economy. From geopolitical tensions to production constraints, the world is grappling with a potential energy crisis.

The International Energy Agency (IEA) has issued a warning about a looming supply shortfall, highlighting the urgent need for action.

The impact of this crisis is far-reaching, extending beyond the energy sector. Rising oil prices are fueling inflation, impacting consumer spending, and threatening to disrupt business operations. The implications for different sectors, including transportation, manufacturing, and agriculture, are significant.

Oil Price Surge

The global oil market is experiencing a significant surge in prices, with crude oil prices reaching their highest levels in years. This upward trend has been driven by a complex interplay of factors, including supply constraints, geopolitical tensions, and increased demand.

Oil Price Fluctuations

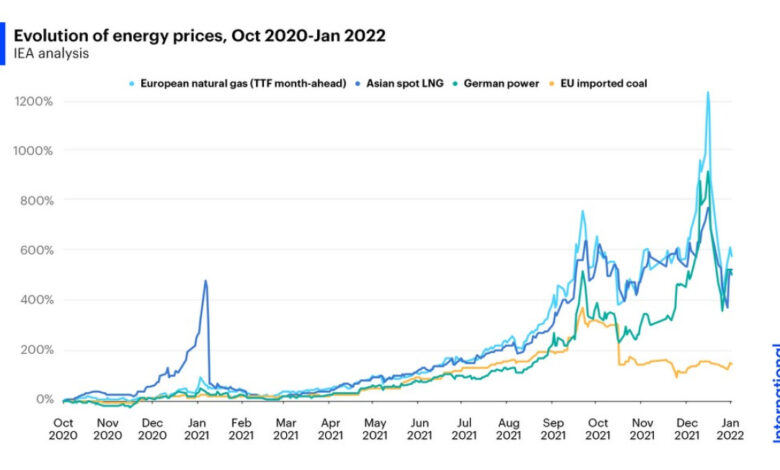

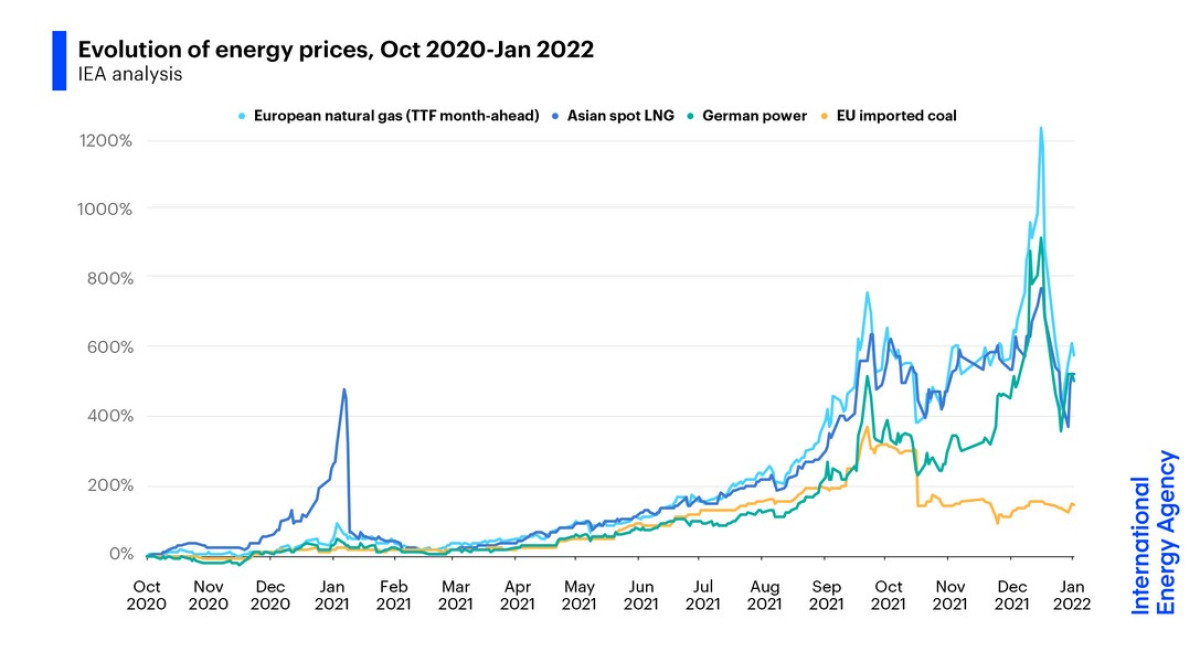

The past year has witnessed a rollercoaster ride in oil prices, with significant fluctuations driven by a combination of events.

- In early 2022, oil prices were already on an upward trajectory due to recovering demand following the COVID-19 pandemic. However, the Russia-Ukraine conflict in February 2022 triggered a sharp spike in prices, as concerns about supply disruptions from Russia, a major oil exporter, intensified.

The recent surge in oil prices, fueled by the IEA’s warning of a supply shortfall, has got everyone talking. But while the world grapples with energy concerns, there’s a fascinating trend emerging: the rise of remote work. New research reveals the surprising No.

1 city for remote jobs, defying the usual suspects like New York and San Francisco. Check out this article to discover the unexpected location that’s become a hotbed for remote workers, offering a glimpse into the future of work and the potential impact on oil demand.

- The subsequent imposition of sanctions on Russia by Western countries further exacerbated the situation, leading to a surge in oil prices to over $130 per barrel in March 2022.

- While prices have since retreated from their peak, they remain elevated, hovering around $80 per barrel in recent months, driven by factors such as ongoing geopolitical tensions, supply concerns, and the global economic recovery.

Oil Price Breakdown by Region

The oil price surge has impacted different regions and major oil-producing countries differently.

- In the United States, benchmark crude oil prices, such as West Texas Intermediate (WTI), have risen significantly, reflecting the impact of global supply constraints and the country’s dependence on imported oil.

- In Europe, Brent crude oil prices have also surged, with the continent facing a particularly challenging situation due to its reliance on Russian oil and gas imports. The ongoing energy crisis in Europe has contributed to the upward pressure on oil prices.

- In Asia, oil prices have also risen, but the impact has been somewhat less pronounced compared to Europe and the United States. However, countries such as China and India, with their growing economies and energy demands, are also facing challenges due to the high oil prices.

Major Oil-Producing Countries

The surge in oil prices has had a significant impact on major oil-producing countries, with some benefiting from the increased revenue while others face challenges.

The IEA’s warning of a supply shortfall in oil markets has sent prices surging, adding another layer of stress to an already volatile global economy. It’s a reminder that managing your finances and health is more crucial than ever, especially during times of uncertainty.

For some helpful tips on achieving both financial stability and well-being, check out this article on balancing your finances and health top tips for achieving both. Ultimately, taking control of your own well-being is key to navigating the challenges of rising oil prices and other economic headwinds.

- Saudi Arabia, the world’s largest oil exporter, has seen its revenue increase significantly due to the higher oil prices. The country has been able to maintain its production levels, benefiting from the current market conditions.

- Russia, another major oil producer, has also seen its revenue increase, despite the sanctions imposed by Western countries. However, the country has faced challenges in exporting its oil due to the sanctions and the difficulties in finding alternative buyers.

- The United States, while a major oil producer, has also been impacted by the higher oil prices, as it relies on imported oil to meet its domestic demand. The rising oil prices have contributed to inflation and increased consumer costs.

The IEA’s warning of a looming oil supply shortfall has sent prices skyrocketing, highlighting the need for financial institutions to be agile and adaptable. Bank of America’s recent expansion across four US states, aimed at bridging the gap with JP Morgan , suggests a proactive approach to capturing market share in an increasingly volatile economic landscape.

This strategic move could position them to weather the storm of rising oil prices and the potential economic fallout, showcasing their commitment to navigating the complex challenges ahead.

IEA’s Supply Shortfall Warning

The International Energy Agency (IEA) has issued a stark warning about a potential supply shortfall in the global oil market, raising concerns about energy security and price volatility. This warning highlights the growing challenges in balancing global oil supply and demand, particularly in the context of ongoing geopolitical tensions and the transition towards cleaner energy sources.

Factors Contributing to the Anticipated Shortfall

The IEA’s warning is based on a confluence of factors that are expected to exacerbate existing supply constraints and increase demand for oil in the coming years.

- Production Constraints:Several key oil-producing countries, including OPEC members, are facing production constraints due to aging infrastructure, limited investment in new projects, and a lack of spare capacity. These factors are hindering their ability to increase production to meet rising demand.

- Demand Trends:Global oil demand is projected to continue rising, driven by economic growth in developing countries and the increasing use of oil in transportation and other sectors. The IEA estimates that global oil demand will reach a record high in 2023, further straining already tight supply conditions.

- Geopolitical Tensions:Geopolitical tensions, particularly in regions like the Middle East and Russia, are creating uncertainty and volatility in oil markets. Sanctions and other restrictions on oil production and exports can significantly impact supply and prices.

Potential Consequences of a Supply Shortfall

A supply shortfall in the global oil market could have significant consequences for energy markets and the global economy.

- Higher Oil Prices:A supply shortfall would likely lead to higher oil prices, as demand outstrips supply. This could have a cascading effect on other energy prices, transportation costs, and consumer inflation.

- Energy Security Concerns:A supply shortfall could exacerbate energy security concerns, particularly for countries that are heavily reliant on oil imports. This could lead to increased competition for limited supplies and potentially destabilize regional and global energy markets.

- Economic Impacts:Higher energy prices could have a negative impact on economic growth, as businesses and consumers face higher costs. This could also lead to job losses and reduced investment in other sectors.

Impact on Global Economy

The surge in oil prices, fueled by the IEA’s supply shortfall warning, poses a significant threat to global economic growth. The ripple effects of this price hike can be felt across various sectors, impacting inflation, consumer spending, and business operations.

Inflation and Consumer Spending

Rising oil prices directly contribute to inflation, as they increase the cost of transportation, manufacturing, and other essential goods and services. This inflationary pressure erodes consumer purchasing power, forcing individuals to cut back on discretionary spending. For instance, in 2022, when oil prices surged, the United States experienced a significant spike in inflation, leading to a decline in consumer confidence and a reduction in spending on non-essential items.

Business Operations

Businesses across various sectors face substantial challenges due to rising oil prices. Transportation costs increase, impacting logistics and supply chains. Manufacturing companies, especially those heavily reliant on oil-based inputs, see their production costs rise, potentially leading to reduced output or price increases.

For example, the airline industry experienced significant financial strain during the 2022 oil price surge, as fuel costs represented a major portion of their operating expenses.

Impact on Different Sectors

- Transportation:The transportation sector is directly affected by oil price fluctuations. Higher fuel costs lead to increased transportation expenses for businesses and individuals, potentially impacting freight rates, airfares, and consumer travel. This can disrupt supply chains, leading to delays and higher prices for goods.

- Manufacturing:Manufacturing companies, especially those using oil-based inputs or relying heavily on transportation, face increased production costs. This can lead to price increases for finished goods, reduced profit margins, or even production cuts.

- Agriculture:The agricultural sector is also affected by rising oil prices, as they impact the cost of fertilizers, pesticides, and transportation. This can lead to higher food prices, impacting consumers and potentially leading to food insecurity in vulnerable populations.

Long-Term Implications: Oil Prices Surge Iea Supply Shortfall Warning

The current oil price surge and supply concerns have far-reaching implications that extend beyond the immediate economic impact. This crisis could fundamentally reshape the global energy landscape and accelerate the transition to a more sustainable future.

Impact on the Global Energy Landscape

The current situation underscores the vulnerabilities of the global energy system, heavily reliant on fossil fuels. This dependence creates significant risks, including price volatility, geopolitical instability, and environmental damage. The crisis may push countries to diversify their energy sources, reducing their reliance on oil and gas.

- Increased Investment in Renewable Energy:The high oil prices and supply uncertainty may incentivize governments and businesses to invest more heavily in renewable energy sources like solar, wind, and hydropower. This could lead to a faster transition to a cleaner energy future, reducing reliance on fossil fuels.

- Accelerated Development of Energy Storage Technologies:The intermittency of renewable energy sources like solar and wind power has been a challenge. However, the current crisis may accelerate the development and deployment of energy storage technologies, such as batteries, pumped hydro, and hydrogen, making renewable energy more reliable and dispatchable.

- Emphasis on Energy Efficiency:The high oil prices could also drive greater efforts to improve energy efficiency in buildings, transportation, and industrial processes. This would reduce energy consumption and lower dependence on fossil fuels.

Potential for New Energy Technologies and Policies, Oil prices surge iea supply shortfall warning

The current crisis could also be a catalyst for the development of new energy technologies and policies.

- Advancements in Biofuels and Synthetic Fuels:The demand for alternative fuels could accelerate the development of biofuels and synthetic fuels derived from renewable sources. These fuels could offer a more sustainable alternative to traditional fossil fuels.

- Nuclear Power Renaissance:Nuclear power, a low-carbon energy source, may experience a resurgence as countries seek to reduce their reliance on fossil fuels. The current crisis could lead to renewed investments in nuclear power, especially in countries with existing nuclear infrastructure.

- Carbon Capture and Storage (CCS) Technologies:CCS technologies, which capture and store carbon dioxide emissions from fossil fuel power plants, could play a more significant role in mitigating climate change. The high oil prices and supply concerns could lead to increased investments in CCS research and development.