Oil Prices Surge Amidst Red Sea Tensions

Oil prices surge amidst Red Sea tensions sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Red Sea, a vital waterway for global oil transportation, is currently experiencing a surge in geopolitical tensions.

These tensions, fueled by regional conflicts and political maneuvering, have the potential to significantly disrupt oil supply chains, impacting global economies and energy markets.

The Red Sea’s strategic importance lies in its role as a critical passage for oil tankers traveling from the Middle East to Europe and Asia. The Suez Canal, a vital artery connecting the Mediterranean Sea to the Red Sea, and the Bab el-Mandeb strait, connecting the Red Sea to the Indian Ocean, are crucial chokepoints for global oil trade.

Any disruption to these routes could lead to a significant reduction in oil supply, driving up prices and creating economic instability.

Red Sea Tensions and Their Impact on Oil Prices

The Red Sea, a vital waterway for global oil trade, has become a focal point of geopolitical tensions. Recent events in the region have raised concerns about potential disruptions to oil transportation routes, leading to a surge in oil prices.

The recent surge in oil prices, fueled by tensions in the Red Sea, has added another layer of complexity to the already challenging economic landscape. Rising energy costs are impacting everything from transportation to manufacturing, and this ripple effect is particularly felt by homebuilders in a tight spot as high mortgage rates impact new construction.

As construction costs climb, the affordability of new homes is further strained, potentially leading to a slowdown in the housing market. This, in turn, could impact demand for oil, creating a feedback loop that could exacerbate the current price volatility.

This blog post explores the current tensions in the Red Sea and their potential impact on the global oil market.

The Red Sea: A Critical Oil Transportation Route

The Red Sea serves as a crucial link for transporting oil from the Middle East to global markets. The Suez Canal, a man-made waterway connecting the Mediterranean Sea to the Red Sea, is a vital passage for oil tankers, handling approximately 10% of global seaborne oil trade.

Additionally, the Bab el-Mandeb strait, a narrow waterway connecting the Red Sea to the Gulf of Aden, is another critical route for oil shipments.

The Potential Impact of Red Sea Tensions on Oil Prices

Geopolitical tensions in the Red Sea could significantly disrupt oil transportation routes, leading to supply disruptions and price volatility.

The recent surge in oil prices, fueled by tensions in the Red Sea, has sent shockwaves through the global economy. While many investors are seeking safe havens, Gen Z investors, known for their bullish outlook, are looking for growth opportunities.

According to a recent study, gen z investors seek growth nvidia tesla and lennar emerge as top stock picks , with Nvidia, Tesla, and Lennar topping the list. It remains to be seen how these young investors will navigate the volatile market conditions, but their appetite for growth stocks is sure to have a significant impact on the future of the market.

- Suez Canal Blockage:Any disruption to the Suez Canal, such as a blockage or closure, would have a significant impact on global oil supply. The canal’s closure in 2021 due to the grounding of a container ship highlighted the vulnerability of this critical route.

A prolonged blockage could lead to a surge in oil prices as alternative routes become congested and shipping costs increase.

- Bab el-Mandeb Strait Security Concerns:The Bab el-Mandeb strait is another critical route for oil shipments, and its security has been a concern for several years. The strait is a narrow passageway with high maritime traffic, making it susceptible to piracy and other security threats.

Any disruption to the strait’s operations could significantly impact oil transportation and lead to price volatility.

Economic Consequences of Oil Supply Disruptions

Disruptions to oil supply due to Red Sea tensions could have significant economic consequences.

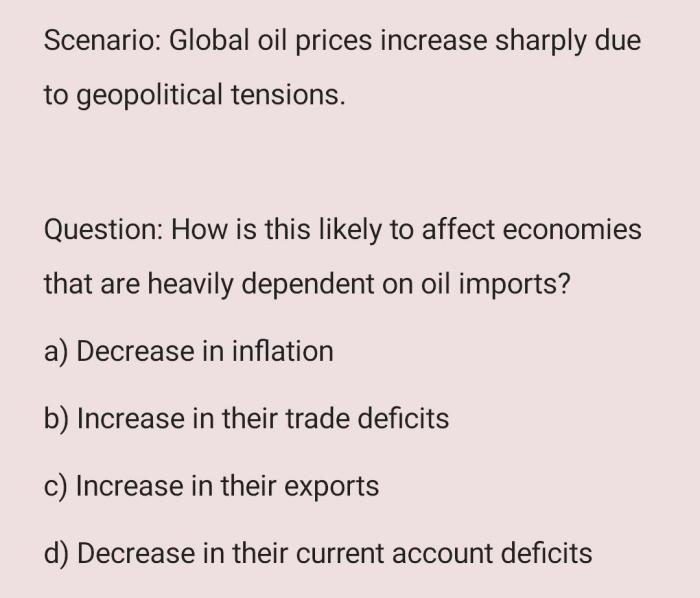

- Higher Oil Prices:A disruption in oil transportation routes would likely lead to a surge in oil prices, impacting consumers and businesses worldwide. Higher oil prices could fuel inflation, increase the cost of transportation, and dampen economic growth.

- Energy Security Concerns:Disruptions to oil supply could raise concerns about energy security, particularly for countries heavily reliant on oil imports. This could lead to increased dependence on alternative energy sources and fuel diversification strategies.

- Geopolitical Instability:Tensions in the Red Sea could further escalate regional conflicts and instability, potentially impacting global security and economic stability.

Historical Parallels

The current tensions in the Red Sea echo past instances of disruptions in the region.

- 1973 Oil Crisis:The 1973 oil crisis, triggered by the Arab-Israeli War, led to an oil embargo by Arab oil-producing countries, resulting in a sharp increase in oil prices and global economic turmoil.

- Iran-Iraq War:The Iran-Iraq War (1980-1988) disrupted oil production and transportation in the Persian Gulf region, leading to significant price fluctuations.

- First Gulf War:The First Gulf War (1990-1991) resulted in a temporary disruption of oil exports from Kuwait, impacting global oil markets.

Global Oil Market Dynamics

The global oil market is a complex and interconnected system influenced by a multitude of factors, including supply, demand, geopolitical events, and economic conditions. Understanding these dynamics is crucial for comprehending the impact of Red Sea tensions on oil prices.

Current State of the Global Oil Market

The global oil market is currently characterized by a delicate balance between supply and demand. While global oil demand is projected to grow in the coming years, driven by factors such as economic growth and increasing population, supply constraints remain a significant concern.

This delicate balance is further impacted by geopolitical tensions, such as those in the Red Sea region, which can lead to disruptions in production and supply chains.

The Role of OPEC+ in Influencing Oil Prices and Production Levels

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, play a crucial role in shaping global oil prices and production levels. OPEC+ members account for a significant portion of global oil production, and their decisions on production quotas and output adjustments can have a significant impact on market dynamics.

Impact of Economic Sanctions on Oil Producers, Oil prices surge amidst red sea tensions

Economic sanctions, often imposed as a response to geopolitical events or human rights concerns, can significantly impact oil producers. Sanctions can restrict access to financial markets, limit trade opportunities, and disrupt supply chains. In the context of Red Sea tensions, sanctions imposed on oil-producing countries in the region could potentially disrupt oil production and exports, leading to price volatility and supply shortages.

Major Oil-Producing and Consuming Countries in the Red Sea Region

The Red Sea region is home to several major oil-producing and consuming countries, making it a critical area for global energy markets.

The Red Sea tensions are definitely driving up oil prices, and it’s making me wonder if this will impact Tesla’s plans in India. It’s pretty exciting that Elon Musk announced Tesla’s interest in investing in India after meeting with PM Modi , but with rising oil prices, I wonder if that will influence their timeline or investment strategy.

We’ll have to wait and see how this all unfolds, but one thing’s for sure: the global energy landscape is getting more complex by the day.

- Saudi Arabia:The world’s largest oil exporter, Saudi Arabia plays a dominant role in global oil markets. Its production and export levels significantly influence global oil prices.

- United Arab Emirates (UAE):The UAE is another major oil producer and exporter in the region, contributing significantly to global oil supply.

- Yemen:While Yemen’s oil production has been significantly impacted by ongoing conflicts, it remains a key oil producer in the region.

- Egypt:Egypt is a major oil importer in the region, relying on imports to meet its domestic energy needs.

- Sudan:Sudan is an oil producer and exporter in the region, with its production levels impacting regional and global oil markets.

Potential Responses and Strategies: Oil Prices Surge Amidst Red Sea Tensions

The recent surge in oil prices due to Red Sea tensions has prompted discussions about potential responses and strategies to mitigate the impact. International organizations and governments are exploring various options to ensure stability in the region and minimize disruptions to the global oil market.

International Responses and Diplomatic Efforts

The international community has a vital role to play in de-escalating tensions and promoting dialogue. International organizations and governments can employ a range of diplomatic strategies to address the root causes of the conflict and encourage peaceful resolutions.

- Mediation and Dialogue:International organizations, such as the United Nations, can facilitate dialogue between the parties involved, encouraging them to find common ground and negotiate a peaceful resolution. The involvement of neutral third parties can help build trust and foster communication. For example, the UN’s successful mediation in the 2015 Iranian nuclear deal demonstrates the potential of diplomatic efforts in resolving complex international disputes.

- Sanctions and Pressure:Governments can impose targeted sanctions on individuals or entities deemed responsible for escalating tensions or undermining peace efforts. These sanctions can include travel bans, asset freezes, and trade restrictions. The effectiveness of sanctions depends on international cooperation and the willingness of all stakeholders to enforce them.

The US’s sanctions against Iran in the 1980s, aimed at deterring Iranian support for terrorism, exemplify the use of economic pressure as a diplomatic tool.

- Increased Military Presence:In some cases, increased military presence in the region might be necessary to deter aggression and maintain stability. However, this strategy must be carefully considered to avoid escalating tensions and potentially provoking conflict. The deployment of naval forces by the US and its allies in the Persian Gulf during the Iran-Iraq War demonstrates how military presence can act as a deterrent.

Strategies for Mitigating Oil Supply Disruptions

The potential for disruptions to oil supply from the Red Sea region necessitates proactive strategies to mitigate the impact on global markets.

- Diversification of Supply Sources:Reducing reliance on a single region for oil imports is crucial. Governments and energy companies can diversify their supply sources by exploring new partnerships with oil-producing nations outside the Red Sea region. The recent shift by some European countries to increase their reliance on US shale gas demonstrates the potential for diversification.

- Strategic Oil Reserves:Maintaining adequate strategic oil reserves can provide a buffer against supply disruptions. Countries can draw upon these reserves to meet short-term demand and stabilize prices during periods of crisis. The US Strategic Petroleum Reserve, established in 1975 after the Arab oil embargo, is a prime example of a successful strategic reserve program.

- Energy Efficiency and Conservation:Promoting energy efficiency and conservation measures can reduce overall demand for oil, mitigating the impact of supply disruptions. This includes encouraging the adoption of fuel-efficient vehicles, investing in energy-efficient buildings, and promoting sustainable practices. The “Energy Star” program in the US, which certifies energy-efficient appliances, showcases the potential for government initiatives to drive energy conservation.

Role of Alternative Energy Sources

Transitioning to alternative energy sources, such as renewable energy and nuclear power, can reduce dependence on oil from the Red Sea region.

- Renewable Energy:Solar, wind, and hydropower offer clean and sustainable alternatives to fossil fuels. Investing in renewable energy infrastructure can reduce reliance on oil imports and contribute to a more sustainable energy future. The rapid growth of solar and wind power in countries like China and Germany highlights the potential of renewable energy to displace fossil fuels.

- Nuclear Power:Nuclear power is a low-carbon energy source that can provide a stable and reliable baseload of electricity. Expanding nuclear power capacity can reduce dependence on oil for electricity generation. However, concerns about nuclear safety and radioactive waste management require careful consideration and robust regulatory frameworks.

The continued operation of nuclear power plants in countries like France and Japan demonstrates the viability of nuclear energy as a low-carbon alternative.

Hypothetical Scenario: Prolonged Conflict

A prolonged conflict in the Red Sea could have significant and far-reaching consequences, including:

A prolonged conflict in the Red Sea could lead to a substantial reduction in oil production and exports, further driving up oil prices. This could trigger a global economic recession, with ripple effects across industries and economies. The increased demand for alternative energy sources could accelerate the transition to a cleaner energy future, but this transition would likely be uneven and could lead to social and economic disruptions.

Economic and Financial Implications

The surge in oil prices due to Red Sea tensions has far-reaching economic and financial implications, impacting global economies, financial markets, and individuals alike. The ripple effects of this price increase are felt across various sectors, influencing consumer spending, business operations, and investment strategies.

Impact on Global Economies and Financial Markets

The rising cost of oil acts as a significant inflationary pressure, affecting overall economic growth. Higher energy prices translate into increased production costs for businesses, leading to higher prices for goods and services, ultimately eroding consumer purchasing power. This can trigger a cycle of inflation, potentially leading to economic instability.

Furthermore, volatile oil prices create uncertainty in financial markets, affecting investor confidence and investment decisions.

Implications for Consumers and Businesses

Consumers directly experience the impact of oil price surges through increased fuel costs, impacting transportation expenses and potentially affecting discretionary spending. Businesses face increased operational costs, as higher fuel prices affect transportation, logistics, and energy consumption. These cost increases can lead to reduced profit margins, potentially forcing businesses to raise prices or cut back on operations, further contributing to inflation.

Strategies for Investors to Mitigate Risks

Investors can adopt various strategies to mitigate the risks associated with volatile oil prices. Diversifying investment portfolios across different asset classes, such as real estate, precious metals, or stocks in sectors less affected by oil price fluctuations, can help mitigate risk.

Investing in companies that are hedged against oil price volatility or benefit from rising energy prices can provide potential returns. Additionally, investors can consider hedging strategies, such as using futures contracts or options, to manage their exposure to oil price fluctuations.

Economic and Financial Implications of a Prolonged Disruption to Oil Supply

A prolonged disruption to oil supply, driven by geopolitical tensions or other unforeseen events, would have severe economic and financial consequences. The global economy heavily relies on oil for transportation, energy production, and various industrial processes. A prolonged disruption would lead to significant supply shortages, driving oil prices to unprecedented levels.

This would have a devastating impact on global economies, leading to widespread inflation, recessionary pressures, and potential social unrest.