Oil Prices Slide to Three-Week Low Due to Economic Worries

Oil prices slide to three week low due to economic worries – Oil prices slide to three-week low due to economic worries, painting a picture of uncertainty in the global energy market. The recent decline, driven by concerns about slowing economic growth and potential recessions, has sent ripples through the industry and sparked discussions about the future of oil demand.

The current price drop stands in stark contrast to the record highs seen earlier this year, highlighting the volatility and sensitivity of oil prices to economic sentiment.

As investors grapple with the implications of a potential economic downturn, the focus shifts to the impact on oil production and supply. The interplay between global demand, economic anxieties, and OPEC+ decisions will shape the trajectory of oil prices in the coming months.

This situation underscores the interconnectedness of the global economy and the energy sector, with far-reaching consequences for consumers, businesses, and governments alike.

Current Market Conditions

The recent decline in oil prices, marking a three-week low, is a reflection of several interconnected factors, primarily stemming from concerns about global economic growth and demand for crude oil. This downward trend underscores the intricate relationship between economic health and the energy market, a dynamic that has historically shaped oil prices.

Oil prices have tumbled to a three-week low, driven by anxieties about global economic growth. The slowdown in China, a major oil consumer, is a key factor. If you’re wondering how China’s economic challenges could impact your investments, check out this article chinas economic challenges impact markets how it could affect your investments.

The uncertainty surrounding China’s economic recovery is adding to the downward pressure on oil prices, making it a volatile market to watch closely.

Economic Worries Weighing on Oil Prices

Economic anxieties are the primary driver behind the recent oil price slide. The global economy faces a confluence of challenges, including:

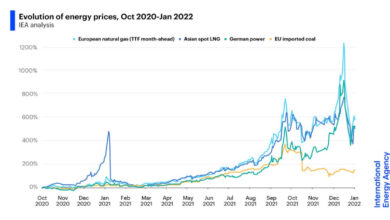

- Rising Inflation:Persistent high inflation across major economies, fueled by supply chain disruptions and robust consumer demand, is eroding purchasing power and dampening consumer spending, impacting overall economic activity.

- Central Bank Rate Hikes:Central banks around the world are aggressively raising interest rates to combat inflation, but these measures could slow economic growth and potentially trigger a recession, further impacting demand for energy.

- Geopolitical Tensions:Ongoing geopolitical conflicts, such as the war in Ukraine, have created uncertainty in energy markets, impacting supply chains and raising concerns about potential disruptions to oil production and exports.

Comparison with Recent Highs and Lows

The current oil price is significantly lower than its recent highs, reflecting the mounting economic concerns. For example, Brent crude, a global benchmark, reached a peak of over $130 per barrel in March 2022, driven by the Russia-Ukraine conflict and fears of supply disruptions.

However, the price has since retreated, currently trading below $80 per barrel. This decline highlights the sensitivity of oil prices to economic sentiment and the volatility inherent in the energy market.

Historical Perspective on Oil Price Fluctuations

Historically, oil prices have exhibited a strong correlation with economic conditions. During periods of strong economic growth and robust demand, oil prices tend to rise. Conversely, during economic downturns or recessions, demand for oil weakens, leading to price declines. For instance, during the 2008 financial crisis, oil prices plummeted from over $140 per barrel to below $40 per barrel as global economic activity contracted sharply.

This illustrates the profound impact of economic conditions on the energy market.

The oil market is in a bit of a funk right now, with prices sliding to a three-week low as economic concerns weigh on demand. It seems like everyone’s worried about a recession, and that’s definitely affecting how people feel about investing in oil.

Meanwhile, over in the crypto world, Coinbase is fighting back against the SEC lawsuit, drawing parallels between digital assets and baseball cards. It’s a pretty interesting argument , but it remains to be seen if it’ll sway the regulators. All this uncertainty is definitely adding to the jitters in the markets, so it’s going to be interesting to see how things play out in the coming weeks.

Impact on Global Economy

Lower oil prices can have a significant impact on the global economy, affecting various sectors and industries. The magnitude and direction of these impacts depend on factors such as the duration of the price decline, the underlying reasons for the price drop, and the response of governments and businesses.

Impact on Energy-Consuming Industries and Sectors

Lower oil prices directly benefit energy-consuming industries and sectors, such as transportation, manufacturing, and agriculture. Reduced fuel costs translate into lower production expenses, potentially leading to increased profits and economic activity. For example, airlines and trucking companies can pass on savings to consumers through lower ticket prices and shipping rates, stimulating travel and trade.

Impact on Inflation and Consumer Spending

Lower oil prices can help curb inflation, as energy costs constitute a significant portion of consumer spending. Reduced energy prices free up disposable income for consumers, potentially boosting demand for other goods and services, leading to economic growth. This effect is particularly pronounced in countries with high energy consumption and dependence on imported oil.

Potential Benefits and Drawbacks for Different Countries

Lower oil prices can have both positive and negative implications for different countries.

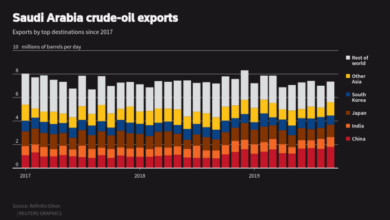

- Oil-exporting countries: These countries experience reduced revenue from oil exports, potentially leading to budget deficits, currency depreciation, and slower economic growth. For example, countries like Saudi Arabia and Russia rely heavily on oil exports, and lower prices can significantly impact their economies.

- Oil-importing countries: These countries benefit from lower energy costs, leading to reduced inflation, increased disposable income, and potentially higher economic growth. For instance, China and India, with their large populations and energy demands, could see significant economic gains from lower oil prices.

It’s a mixed bag out there today. Oil prices have slid to a three-week low due to concerns about global economic growth, but Wall Street is anticipating a positive start to the week thanks to the upcoming Jackson Hole symposium and the release of Nvidia’s earnings, which you can read more about here.

Whether the tech sector can buoy the market amidst broader economic anxieties remains to be seen, but the oil price dip certainly doesn’t paint a rosy picture for the immediate future.

Oil Production and Supply: Oil Prices Slide To Three Week Low Due To Economic Worries

The recent slide in oil prices to a three-week low is fueled by a combination of factors, including economic concerns, and the complex interplay of global oil production and supply. The current state of global oil production and its relationship to demand is a crucial factor driving oil price fluctuations.

Impact of Economic Worries on Oil Production Decisions

Economic worries are significantly impacting oil production decisions by major producers. The global economic outlook is uncertain, with fears of a recession looming. This uncertainty makes oil producers hesitant to increase production, as they worry about falling demand and lower prices.

- For instance, the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) have been cautious about increasing production targets, despite calls from consuming nations to boost supply. They are wary of a potential economic slowdown that could reduce demand for oil, leading to a surplus and further price declines.

- Major oil-producing nations like the United States, which are not part of OPEC+, are also facing challenges. U.S. shale oil producers, who are more responsive to price changes, are adjusting their production levels in response to the fluctuating market. They are likely to cut back on investment and production if oil prices remain low, further impacting global supply.

OPEC+’s Role in Managing Oil Supply, Oil prices slide to three week low due to economic worries

OPEC+ plays a significant role in managing global oil supply and influencing prices. The group, which includes OPEC members and several non-OPEC producers, has been coordinating production cuts to support oil prices and maintain market stability.

- However, the recent slide in oil prices suggests that OPEC+ may need to re-evaluate its strategy. While the group has indicated a willingness to adjust production levels as needed, it remains to be seen how it will respond to the current economic uncertainties and the pressure to increase supply.

- The group’s ability to effectively manage oil supply and influence prices will depend on its ability to reach a consensus among its members and navigate the complex geopolitical landscape.

Potential Disruptions to Oil Production and Supply Chains

Oil production and supply chains are vulnerable to various disruptions, including geopolitical instability, natural disasters, and unexpected events. These disruptions can significantly impact global oil supply and prices.

- For example, the ongoing conflict in Ukraine has already disrupted global energy markets, leading to concerns about supply shortages and price volatility. The conflict has also highlighted the fragility of global energy supply chains and the potential for unexpected events to cause significant disruptions.

- Other potential disruptions include:

- Political instability in key oil-producing regions, such as the Middle East, can lead to production disruptions and supply chain disruptions.

- Natural disasters, such as hurricanes or earthquakes, can damage oil infrastructure and disrupt production.

- Cyberattacks targeting critical energy infrastructure can also cause significant disruptions.

Investor Sentiment and Market Volatility

Oil investors and traders are currently exhibiting a cautious sentiment, with concerns about global economic growth weighing heavily on their minds. The recent slide in oil prices reflects this apprehension, as investors anticipate potential demand disruptions stemming from weakening economies.

Market Volatility and Its Impact on Oil Prices

Market volatility is a defining characteristic of the oil market, and it is driven by a confluence of factors.

- Geopolitical events, such as conflicts or sanctions, can significantly disrupt oil production and supply chains, leading to price spikes.

- Economic uncertainties, including inflation, interest rate hikes, and recessionary fears, can impact energy demand, influencing price fluctuations.

- Changes in government policies, such as fuel taxes or subsidies, can directly affect oil consumption and prices.

- Unexpected events, like natural disasters or technological advancements, can also introduce volatility into the market.

This volatility creates both opportunities and risks for investors. While it can lead to significant gains for those who correctly anticipate price movements, it can also result in substantial losses for those who misjudge market trends.

The Role of Speculation and Hedging

Speculation and hedging play crucial roles in shaping oil price movements.

- Speculators, who aim to profit from price fluctuations, can drive prices higher or lower based on their perceived market outlook. This can amplify market volatility, particularly in periods of uncertainty.

- Hedgers, who seek to protect themselves from price risks, often buy or sell oil futures contracts to lock in prices. This can influence market sentiment and dampen price volatility.

The interplay between speculators and hedgers can create complex market dynamics, making it challenging to predict price movements with certainty.

Potential Risks and Opportunities for Investors

Investors in the oil market face a range of risks and opportunities.

- One major risk is the potential for price volatility, which can lead to significant losses if market trends are misjudged. This risk is particularly pronounced during periods of economic uncertainty or geopolitical instability.

- Another risk is the potential for supply disruptions, which can drive prices sharply higher. This risk is heightened in regions prone to conflicts or natural disasters.

- However, investors also have the opportunity to capitalize on price movements, particularly during periods of market volatility. This can be achieved through various investment strategies, such as buying or selling oil futures contracts or investing in oil-related stocks.

The key to success in the oil market is to carefully assess risks, understand market dynamics, and develop a well-defined investment strategy.