Oil Prices Drop Again Due to More Oil and Chinas Economic Problems

Oil prices drop again due to more oil and chinas economic problems – Oil prices drop again due to more oil and China’s economic problems, a trend that’s causing ripples across global energy markets. This recent decline is driven by a confluence of factors, including increased oil production from OPEC+ and other major producers, and the ongoing slowdown in China’s economy, which is impacting global oil demand.

This situation echoes previous oil price drops, but with unique nuances that warrant closer examination.

The increase in oil production, particularly from OPEC+, has flooded the market with more crude oil than is currently being consumed. This surplus, combined with China’s economic struggles, which have dampened its appetite for oil, is putting downward pressure on prices.

The situation is further complicated by technological advancements in oil extraction, which are making it more efficient and cost-effective to access new reserves.

Oil Price Drop: Oil Prices Drop Again Due To More Oil And Chinas Economic Problems

The price of oil has been on a downward trajectory in recent weeks, with Brent crude, the global benchmark, falling below $80 per barrel. This decline marks a significant shift from the highs seen earlier in the year, and it raises questions about the future direction of the oil market.

Oil prices are taking another tumble, and it’s a double whammy of increased supply and China’s economic woes. The slowdown in China is impacting global markets, and understanding how this could affect your investments is crucial. Head over to chinas economic challenges impact markets how it could affect your investments to get a better grasp on the situation.

With China’s economic uncertainty weighing heavily on demand, it’s no surprise that oil prices are feeling the pressure.

Factors Contributing to the Oil Price Drop

The recent drop in oil prices is primarily attributed to a combination of factors, including increased oil production and China’s economic challenges.

- Increased Oil Production:OPEC+, the alliance of oil-producing nations, has been gradually increasing production in recent months. This move aims to address the global energy shortage caused by the war in Ukraine and the subsequent sanctions on Russia, a major oil exporter.

However, the increased supply has put downward pressure on prices as demand remains relatively stable.

- China’s Economic Challenges:China, the world’s largest oil importer, is facing economic headwinds due to COVID-19 lockdowns and a struggling property market. These challenges have dampened oil demand from China, further contributing to the price decline. The country’s economic slowdown has also impacted global demand for other commodities, further contributing to the bearish sentiment in the market.

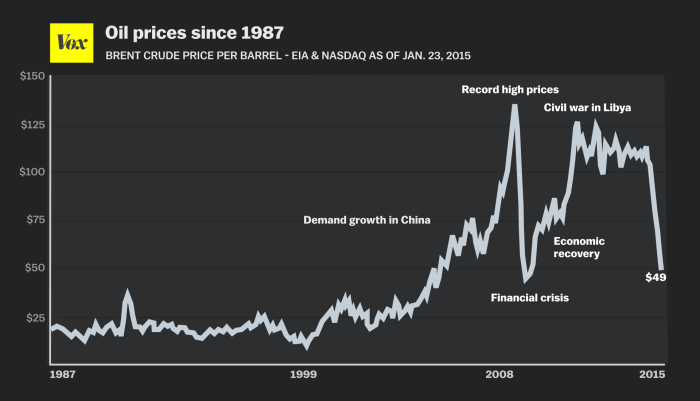

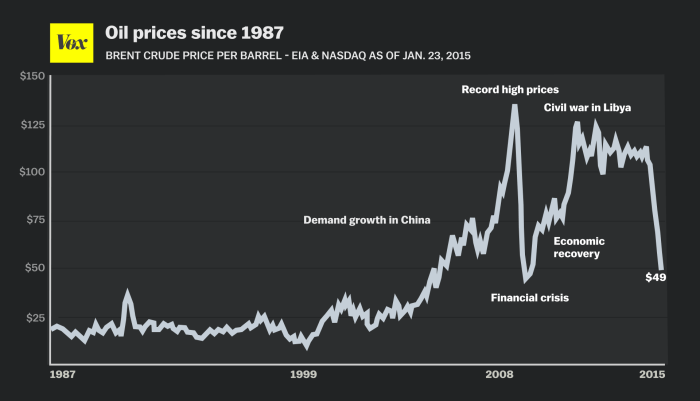

Comparison to Previous Oil Price Drops

The current oil price drop shares some similarities with previous declines. For instance, the 2014-2016 oil price crash was largely driven by increased US shale production and weak global demand. However, the current situation is distinct in several ways. The ongoing war in Ukraine has introduced a new element of uncertainty and volatility into the market.

Additionally, the global energy transition towards renewable sources is expected to have a long-term impact on oil demand, potentially contributing to a more sustained price decline in the future.

Impact on Global Oil Markets, Oil prices drop again due to more oil and chinas economic problems

The recent oil price drop has significant implications for global oil markets. Lower oil prices can benefit consumers by reducing fuel costs, but they also present challenges for oil producers, particularly those heavily reliant on oil revenue. The decline could also encourage increased investment in renewable energy sources, accelerating the transition away from fossil fuels.

Increased Oil Production

The recent drop in oil prices can be attributed, in part, to increased oil production. This has led to a greater supply of oil in the market, putting downward pressure on prices.

OPEC+ Decisions and Production Levels

OPEC+, a group of oil-producing nations including members of the Organization of the Petroleum Exporting Countries (OPEC) and their allies, has been playing a significant role in shaping global oil supply. Their decisions regarding production levels directly impact oil prices.

In recent months, OPEC+ has decided to increase production, adding to the existing oil supply and contributing to the price decline.

Impact of New Oil Discoveries and Technological Advancements

New oil discoveries and technological advancements in oil production have also contributed to the increased supply. The development of new oil fields and the use of advanced extraction techniques have enabled oil producers to access more oil reserves. For example, the discovery of new oil fields in the United States, particularly in shale formations, has significantly increased domestic oil production.

Global Oil Supply Chain Dynamics

The global oil supply chain is a complex network of producers, refiners, and consumers. The current dynamics within this network are influenced by several factors, including geopolitical events, economic conditions, and technological advancements. The recent drop in oil prices has been partly driven by changes in the global oil supply chain.

It’s a wild ride in the oil market right now! Prices are dropping again, fueled by increased supply and concerns about China’s economic recovery. Add to that the Fed’s aggressive interest rate hikes and the ongoing supply squeeze, and it’s clear that the market is facing a lot of uncertainty.

This recent article dives deeper into the complexities of the current situation, highlighting how these factors are creating a volatile environment for oil prices. Will prices continue to slide, or are we in for a rebound? Only time will tell, but one thing is for sure: the oil market is a rollercoaster right now!

Increased production from major oil-producing nations, combined with the impact of new oil discoveries and technological advancements, has led to a more balanced supply-demand equation.

China’s Economic Challenges

China’s economic growth has slowed in recent years, impacting global oil demand. The country’s transition from an export-driven to a consumption-driven economy, coupled with structural imbalances, has contributed to this slowdown.

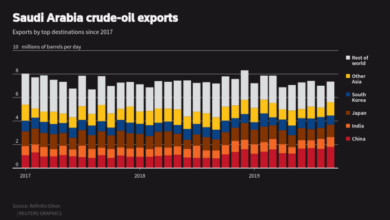

Impact on Global Oil Demand

China’s economic slowdown has directly impacted global oil demand. As the world’s second-largest oil consumer, China’s reduced economic activity translates into lower oil consumption. This trend is evident in the decline of oil imports in recent years. For example, in 2022, China’s crude oil imports fell by 2.5% compared to the previous year, according to the International Energy Agency (IEA).

This decline highlights the direct impact of China’s economic challenges on global oil demand.

Impact on Oil Consumption Patterns

China’s economic slowdown has altered oil consumption patterns. While the country’s overall oil demand has slowed, the composition of its oil consumption is also changing. As China transitions towards a more sustainable economic model, its reliance on fossil fuels is expected to decline.

This shift is reflected in the growing adoption of renewable energy sources and the increasing efficiency of energy consumption. The government’s efforts to promote electric vehicles and reduce reliance on coal are further contributing to this shift in oil consumption patterns.

Role of China’s Energy Policies and Infrastructure Development

China’s energy policies and infrastructure development play a crucial role in shaping oil demand. The government’s ambitious energy transition goals, including its commitment to achieving carbon neutrality by 2060, are driving investments in renewable energy sources and energy efficiency. These policies, combined with infrastructure development in areas such as electric vehicle charging stations and smart grids, are accelerating the shift away from fossil fuels.

This shift is expected to impact oil demand in the long term, as China’s energy mix evolves.

Potential Future Trends in China’s Energy Consumption

China’s energy consumption is expected to continue evolving in the coming years. While the country’s economic growth may moderate, its demand for energy is projected to remain robust, driven by factors such as population growth and urbanization. However, the composition of energy consumption is expected to shift significantly.

It’s a rough week for the markets. Oil prices are dropping again, thanks to a combination of increased supply and China’s economic woes. Meanwhile, even strong revenue couldn’t save Amazon’s stock price, which fell after the company reported slower-than-expected growth in its cloud computing business amazons stock falls despite strong revenue as cloud growth slows.

It seems investors are wary of the global economic outlook, and that’s impacting even companies with strong fundamentals. It’s a reminder that even in the face of positive news, market sentiment can be fickle, especially when oil prices are falling and economic headwinds are strong.

Impact on Global Energy Markets

The recent drop in oil prices, driven by increased oil production and China’s economic challenges, has significant implications for global energy markets. This price decline could lead to a shift in energy consumption patterns, influencing the adoption of renewable energy sources and impacting consumer energy costs.

Impact on Renewable Energy Development and Adoption

The decline in oil prices could potentially slow down the momentum of renewable energy development and adoption. This is because cheaper fossil fuels make renewable energy sources less competitive, particularly in regions heavily reliant on oil and gas. However, the long-term benefits of renewable energy, such as reduced greenhouse gas emissions and energy independence, remain significant.

Furthermore, the price volatility of oil and gas fuels may incentivize investments in renewable energy to mitigate price fluctuations.

Impact on Consumer Energy Costs and the Global Economy

The oil price drop generally translates to lower consumer energy costs, particularly for transportation and heating. This can stimulate economic activity by increasing disposable income and encouraging consumer spending. However, the impact on the global economy is complex and depends on factors such as the magnitude of the price drop, its duration, and the specific economic conditions of different countries.

For instance, oil-producing countries may experience reduced government revenue, leading to economic challenges.

Impact on Different Sectors

The impact of the oil price drop varies across different sectors:

| Sector | Impact | Example |

|---|---|---|

| Transportation | Lower fuel costs for airlines, trucking companies, and individual drivers, leading to increased travel and freight activity. | Airlines could offer lower ticket prices, boosting passenger demand. |

| Manufacturing | Lower energy costs for manufacturing processes, potentially leading to increased production and lower prices for goods. | Chemical manufacturers could see reduced input costs, leading to more competitive product pricing. |

| Energy Production | Reduced profitability for oil and gas producers, potentially leading to decreased investment in exploration and production. | Oil companies may scale back exploration activities or delay new projects due to lower profit margins. |

Future Outlook for Oil Prices

Predicting the future trajectory of oil prices is a complex task, influenced by a multitude of interconnected factors. While recent price drops reflect increased oil production and China’s economic challenges, several other factors will continue to shape the market in the coming months and years.

Key Factors Influencing Oil Prices

Several factors will significantly influence oil prices in the future. These include:

- Geopolitical Events:Geopolitical instability in key oil-producing regions, such as the Middle East, can disrupt supply chains and lead to price volatility. For instance, the ongoing conflict in Ukraine has already impacted global energy markets.

- Global Economic Conditions:Economic growth, particularly in major oil-consuming nations like China and the United States, directly impacts demand for oil. A recession in these countries could lead to lower oil prices, while strong economic growth could drive prices higher.

- Technological Advancements:Technological innovations, such as the development of renewable energy sources and electric vehicles, could potentially reduce demand for oil in the long term. However, the transition to a low-carbon economy is a gradual process and may not significantly impact oil prices in the short term.

- OPEC+ Production Decisions:The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) play a significant role in regulating global oil supply. Their decisions on production quotas can significantly influence oil prices.

- Investment in Oil and Gas Exploration:The level of investment in new oil and gas exploration and production projects can impact future supply. A decline in investment could lead to lower oil production in the future.

Scenario Analysis

A scenario analysis helps understand the potential range of outcomes for oil prices. Let’s consider three scenarios:

Scenario 1: Continued Economic Growth and Stable Geopolitics

In this scenario, global economic growth continues at a moderate pace, and geopolitical tensions remain relatively stable. Oil demand remains strong, while OPEC+ manages supply effectively. This could lead to a gradual increase in oil prices over the coming years, possibly reaching $80-$100 per barrel by 2025.

Scenario 2: Global Recession and Increased Geopolitical Risk

This scenario involves a global recession, potentially triggered by factors like rising interest rates or further geopolitical instability. Reduced economic activity would lead to lower oil demand, pushing prices down. In this scenario, oil prices could fall to $50-$60 per barrel by 2025.

Scenario 3: Accelerated Transition to Renewable Energy

This scenario assumes a rapid shift to renewable energy sources, driven by government policies and technological advancements. This could lead to a significant decline in oil demand, resulting in lower oil prices. In this scenario, oil prices could fall below $50 per barrel by 2025.

Long-Term Outlook

The long-term outlook for the oil market remains uncertain. While the transition to a low-carbon economy will likely reduce demand for oil over time, the pace and extent of this transition are still unclear. Several factors, including technological advancements, government policies, and consumer preferences, will influence the future of the oil market.The long-term outlook for oil prices will depend on the interplay of these factors.

It is possible that oil prices will stabilize at a lower level than in the past, but they are unlikely to completely disappear from the energy landscape in the foreseeable future.