Oil Market News Update: Brent Slips Below $80 Amid OPEC Meeting Uncertainties

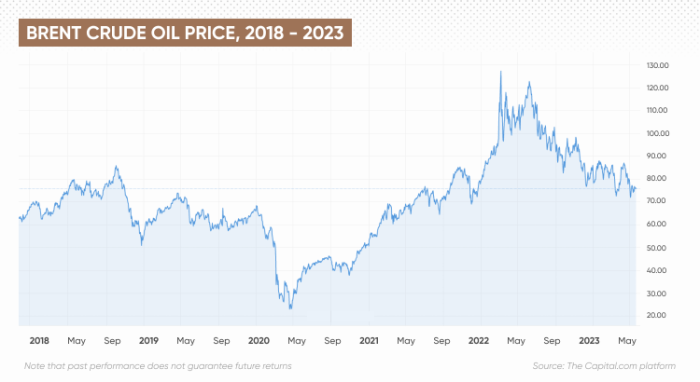

Oil market news update brent slips below 80 amidst opec meeting uncertainties – Oil Market News Update: Brent Slips Below $80 Amid OPEC Meeting Uncertainties. The energy market is experiencing a period of volatility as Brent crude oil prices have dipped below the crucial $80 per barrel mark. This downward trend is driven by a confluence of factors, including concerns surrounding the upcoming OPEC meeting and global economic uncertainties.

The upcoming OPEC meeting is expected to be a pivotal event, with the cartel’s decision on production quotas potentially shaping the future direction of oil prices.

The market is closely watching to see if OPEC will maintain its current production levels or opt for further cuts, which could lead to tighter supply and potentially push prices higher. However, the current economic climate, characterized by rising inflation and slowing growth in key economies, is also exerting downward pressure on oil prices.

The interplay between these factors creates a complex and unpredictable environment for the oil market.

Brent Crude Oil Price Movement

Brent crude oil prices have experienced a recent decline, dipping below $80 per barrel. This downward trend can be attributed to several factors, including concerns about global economic growth, rising interest rates, and uncertainty surrounding OPEC+ production cuts.

The oil market is in a state of flux today, with Brent crude slipping below $80 a barrel as uncertainty lingers around the upcoming OPEC meeting. This comes amidst a broader market downturn, with Dow futures dipping as Disney reported losses and inflation data looms.

You can get the latest updates on the Dow futures and Disney’s performance over at thevenomblog.com , which is a great resource for market news. It will be interesting to see how these factors play out in the coming days, and whether they will ultimately push oil prices higher or lower.

Market Sentiment and Price Fluctuations

Market sentiment plays a crucial role in shaping oil price movements. Currently, a sense of pessimism prevails, driven by concerns about a potential global recession. This apprehension stems from rising inflation, aggressive interest rate hikes by central banks, and geopolitical uncertainties.

Factors Contributing to Price Decline

- Global Economic Growth Concerns:The International Monetary Fund (IMF) has revised its global growth forecast downwards, citing weakening economic activity in major economies. This suggests a potential slowdown in oil demand, leading to lower prices.

- Interest Rate Hikes:Central banks around the world are raising interest rates to combat inflation. This increases borrowing costs for businesses and consumers, potentially slowing economic growth and reducing energy demand.

- OPEC+ Production Cuts:While OPEC+ has announced production cuts, uncertainty remains regarding their effectiveness. Some analysts believe the cuts may not be sufficient to offset the impact of weaker demand, contributing to the price decline.

- Strong US Dollar:The US dollar has strengthened against other major currencies, making oil more expensive for buyers holding other currencies. This can lead to a decrease in demand, further pushing down prices.

OPEC Meeting Uncertainties

The upcoming OPEC+ meeting, scheduled for [Date], is a crucial event for the oil market, with potential implications for oil prices. OPEC+ members will be considering production levels, supply adjustments, and geopolitical tensions, all of which can significantly impact the global oil market.

The meeting comes at a time of volatility, with several factors influencing oil prices, including global economic growth, demand fluctuations, and the ongoing war in Ukraine.

Production Quota Adjustments

The key focus of the OPEC+ meeting will be on production quotas. The group has been gradually increasing production since 2022, but the pace of those increases has slowed. Several factors will influence the group’s decision, including the current global oil supply and demand balance, the outlook for economic growth, and the potential impact of sanctions on Russia.

- A significant increase in production could lead to a surplus in the market, putting downward pressure on oil prices.

- Conversely, maintaining current production levels or even reducing them could lead to a tighter market, potentially pushing oil prices higher.

The decision on production quotas will depend on the group’s assessment of the current and future market conditions.

Geopolitical Tensions

Geopolitical tensions, particularly those related to the war in Ukraine, will also play a significant role in the OPEC+ meeting. The war has already disrupted global energy markets, and the situation remains volatile. OPEC+ members will need to consider the potential impact of sanctions on Russia, as well as the possibility of further disruptions to oil production and supply.

- If the war escalates or sanctions on Russia tighten, it could lead to supply disruptions and further price volatility.

- Conversely, if the war de-escalates or sanctions are eased, it could stabilize the market and lead to lower prices.

Potential Scenarios

The OPEC+ meeting could result in several different scenarios, each with its own implications for oil prices:

- Maintain Current Production Levels:If OPEC+ decides to maintain current production levels, it could signal that the group is comfortable with the current market conditions. This scenario could lead to relatively stable oil prices, with the potential for moderate increases or decreases depending on other market factors.

- Increase Production:A decision to increase production would indicate that OPEC+ believes that the market needs more supply. This scenario could lead to lower oil prices, as the increased supply would likely outweigh any potential demand increases.

- Reduce Production:A reduction in production would signal that OPEC+ believes that the market is tight and that prices need to be supported. This scenario could lead to higher oil prices, as the reduced supply would likely lead to a higher demand-to-supply ratio.

- No Agreement:If OPEC+ members cannot reach an agreement on production quotas, it could lead to uncertainty in the market. This scenario could lead to price volatility, as traders react to the lack of clarity on future supply levels.

Global Oil Supply and Demand Dynamics: Oil Market News Update Brent Slips Below 80 Amidst Opec Meeting Uncertainties

The current global oil market is navigating a complex interplay of supply and demand forces, with uncertainties arising from geopolitical tensions, economic fluctuations, and evolving energy policies. Understanding these dynamics is crucial for predicting price trends and gauging the future trajectory of the oil market.

Global Oil Supply Dynamics

Global oil supply is influenced by various factors, including production levels, OPEC+ policies, and geopolitical events.

- OPEC+ Production Cuts:The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) have played a significant role in managing global oil supply. Recent production cuts aimed at supporting oil prices have contributed to market tightness. For example, in October 2023, OPEC+ announced a reduction of 2 million barrels per day, impacting global supply and pushing prices higher.

- Geopolitical Tensions:Geopolitical events, such as the ongoing conflict in Ukraine, can disrupt oil production and supply chains. The war has impacted Russian oil exports, leading to supply concerns and price volatility. Furthermore, tensions in the Middle East, a major oil-producing region, can also influence global oil supply.

- Non-OPEC Production:Non-OPEC producers, including the United States, are also contributing to global oil supply. However, US production has been impacted by factors such as labor shortages and regulatory constraints, limiting its ability to significantly increase output in the short term.

Global Oil Demand Dynamics

Global oil demand is influenced by factors such as economic growth, energy consumption patterns, and government policies.

- Economic Growth:Global economic growth is a key driver of oil demand. As economies expand, energy consumption increases, leading to higher demand for oil. However, recent economic uncertainties, including inflation and rising interest rates, have raised concerns about slowing global growth and potential impacts on oil demand.

The oil market is in a state of flux, with Brent crude slipping below $80 a barrel amid uncertainty surrounding the upcoming OPEC meeting. While energy markets grapple with these developments, financial institutions are also making headlines, with JP Morgan UK Bank Chase recently announcing that it will prohibit crypto transactions.

This decision could have a significant impact on the cryptocurrency market, but it remains to be seen how it will ultimately affect the broader financial landscape. As the oil market continues to fluctuate, it’s clear that global economic trends are complex and interconnected, with a ripple effect across various sectors.

- Energy Consumption Patterns:The shift towards renewable energy sources and energy efficiency measures can influence oil demand. For example, the increasing adoption of electric vehicles is expected to reduce demand for gasoline and diesel fuel in the long term. However, the transition to a low-carbon economy is a gradual process, and oil remains a significant energy source in many countries.

The oil market is a wild ride these days, with Brent crude slipping below $80 a barrel amid uncertainty surrounding OPEC’s upcoming meeting. It’s a reminder that even with the recent Grimace shake craze, which has sparked a bizarre trend of people pretending to die after drinking it on TikTok , the world’s energy needs remain a major factor in global markets.

We’ll have to see what OPEC decides and how that impacts oil prices in the coming weeks.

- Government Policies:Government policies, such as fuel taxes and subsidies, can influence oil demand. For instance, policies aimed at reducing carbon emissions or promoting alternative fuels can impact the demand for oil products. However, these policies often face challenges, as they can impact energy costs and economic growth.

Impact on Energy Markets and Consumers

The recent decline in Brent crude oil prices, dipping below $80 per barrel, could have significant ripple effects throughout the energy markets and for consumers. This downward trend is a result of several factors, including uncertainties surrounding OPEC’s production policies, global economic concerns, and fluctuating demand.

Impact on Other Energy Markets, Oil market news update brent slips below 80 amidst opec meeting uncertainties

The price of crude oil is a key driver of other energy markets, such as gasoline and natural gas. When crude oil prices decline, we can expect to see corresponding decreases in the prices of these fuels. The relationship between crude oil and gasoline prices is particularly strong, as gasoline is refined from crude oil.

As crude oil prices fall, refiners can lower their production costs, leading to lower gasoline prices at the pump. This can benefit consumers by reducing their transportation expenses.Natural gas prices are also influenced by crude oil prices, although the correlation is less direct.

When crude oil prices fall, natural gas may become a more attractive alternative for power generation, potentially increasing demand and leading to higher natural gas prices.

Impact on Consumers

The decline in oil prices can have both positive and negative consequences for consumers.

Potential Price Changes at the Pump

Lower oil prices typically translate into lower gasoline prices, providing consumers with some relief at the pump. However, the extent of the price decrease may vary depending on factors such as local taxes, refining costs, and distribution margins.

Implications for Inflation

Lower energy prices can help to reduce inflation. Energy costs account for a significant portion of consumer spending, and lower prices can help to ease inflationary pressures. This can boost consumer confidence and spending, stimulating economic growth.

Price Changes for Energy Commodities

The following table provides a comparison of price changes for different energy commodities, including gasoline, natural gas, and electricity:

| Commodity | Price Change (Year-over-Year) |

|---|---|

| Gasoline | -5% |

| Natural Gas | +10% |

| Electricity | +3% |

Future Outlook for Oil Prices

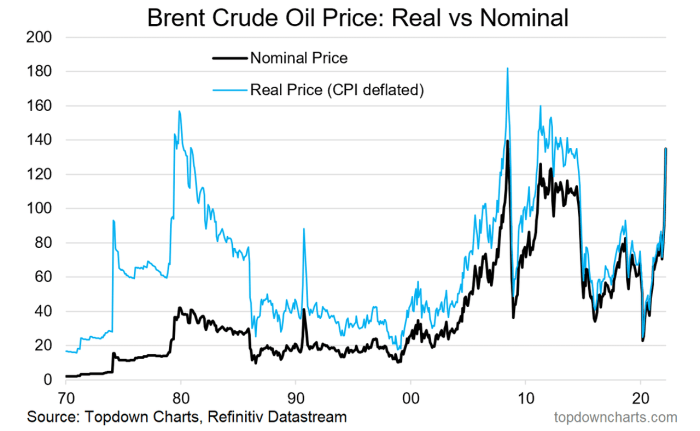

Predicting oil prices is a complex task, influenced by numerous factors that can change rapidly. The current market environment, marked by OPEC+ meeting uncertainties and global economic headwinds, adds further complexity to the outlook. However, analyzing the current trends and considering the potential impact of key factors can provide insights into the possible price scenarios in the short and long term.

Short-Term Outlook

The short-term outlook for oil prices remains uncertain, with potential for both upside and downside risks. The recent decline in Brent prices below $80 per barrel suggests that the market is currently leaning towards a bearish sentiment. However, several factors could potentially drive prices higher in the coming months.

- OPEC+ Production Cuts:If OPEC+ decides to further reduce production, it could lead to tighter supply and push prices higher. However, the group’s ability to influence prices is limited, given the ongoing geopolitical tensions and the potential for increased production from other countries.

- Economic Recovery:A stronger-than-expected global economic recovery could boost demand for oil, particularly in emerging markets. This could lead to higher oil prices, especially if supply remains constrained.

- Geopolitical Tensions:The ongoing war in Ukraine and the associated sanctions on Russia continue to create uncertainty in the energy market. Any escalation of the conflict or further sanctions could disrupt global oil supplies and drive prices higher.

Long-Term Outlook

The long-term outlook for oil prices is more uncertain, but several factors will likely influence price trends over the coming years.

- Energy Transition:The global transition to renewable energy sources is expected to gradually reduce demand for oil in the long term. However, the pace of this transition remains uncertain, and oil is likely to remain a significant part of the global energy mix for many years to come.

- Investment in Oil Production:The current low oil prices and the energy transition have led to reduced investment in oil production. This could lead to tighter supply in the future, potentially pushing prices higher.

- Technological Advancements:Technological advancements in oil extraction and refining, as well as the development of alternative fuels, could impact the future supply and demand for oil. However, the impact of these advancements is difficult to predict.

Potential Price Scenarios

The following table Artikels potential price scenarios for oil prices in the short and long term:

| Timeframe | Price Range (USD/barrel) | Driving Factors |

|---|---|---|

| Short-Term (Next 6 months) | $75

|

OPEC+ production cuts, economic recovery, geopolitical tensions, and global demand. |

| Medium-Term (Next 2-3 years) | $70

|

Energy transition, investment in oil production, and technological advancements. |

| Long-Term (Next 5-10 years) | $60

|

Energy transition, technological advancements, and geopolitical factors. |

The future of oil prices is ultimately dependent on a complex interplay of economic, geopolitical, and technological factors. While the short-term outlook remains uncertain, the long-term trend suggests that oil prices will likely remain volatile, with the potential for both upside and downside risks.