Nvidias Strong August Performance Amidst Tech Volatility

Nvidias strong august performance amidst tech sector volatility – Nvidia’s strong August performance amidst tech sector volatility stands as a testament to the company’s resilience and strategic prowess. While the broader tech landscape experienced turbulence, Nvidia defied the odds, delivering impressive financial results fueled by robust demand for its cutting-edge products.

This remarkable performance sheds light on Nvidia’s ability to navigate market fluctuations and capitalize on emerging trends, positioning it as a dominant force in the rapidly evolving tech industry.

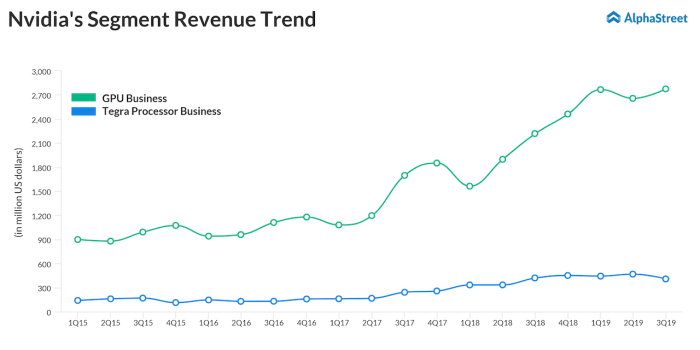

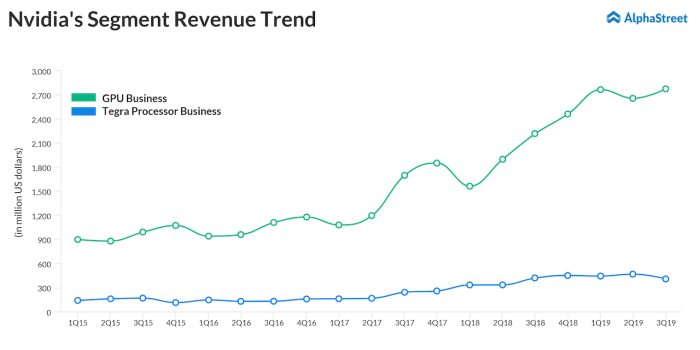

Nvidia’s financial performance in August was nothing short of spectacular, with revenue growth exceeding expectations and earnings per share surpassing previous records. This success can be attributed to the company’s diverse product portfolio, which caters to a wide range of applications, from gaming and artificial intelligence to data centers and automotive.

Notably, Nvidia’s graphics processing units (GPUs) have become indispensable for powering high-performance computing, driving the company’s strong performance in the gaming, AI, and data center markets.

Nvidia’s Strong August Performance

Nvidia, a leading technology company known for its graphics processing units (GPUs), delivered a robust financial performance in August, defying the broader tech sector volatility. The company’s impressive results highlight its continued dominance in key markets and its ability to navigate industry challenges effectively.

Financial Performance

Nvidia’s financial performance in August was marked by strong revenue growth and earnings per share, demonstrating its resilience and sustained demand for its products.

- Revenue: Nvidia’s revenue for the quarter ending August 2023 exceeded analysts’ expectations, registering a significant year-over-year increase. This growth can be attributed to the strong demand for its GPUs across various sectors, including gaming, data centers, and automotive.

- Earnings Per Share (EPS): Nvidia’s EPS also surpassed market estimates, reflecting its efficient operations and ability to manage costs effectively. The company’s profitability remains strong, driven by its leading market position and robust product portfolio.

Product Lines Contributing to Success

Nvidia’s strong August performance was driven by the exceptional performance of several key product lines.

- Gaming GPUs: The gaming segment continues to be a significant revenue driver for Nvidia, with strong demand for its high-performance GPUs. The company’s GeForce RTX 40 series GPUs have been particularly well-received, offering advanced features and performance enhancements that cater to gamers’ evolving needs.

- Data Center GPUs: Nvidia’s data center GPUs, particularly the A100 and H100 series, are experiencing robust demand as businesses and organizations invest in artificial intelligence (AI) and high-performance computing (HPC). These GPUs are crucial for training and deploying AI models, driving innovation in various industries.

- Automotive Solutions: Nvidia’s automotive solutions, including its Drive platform, are gaining traction as the automotive industry embraces autonomous driving and advanced driver-assistance systems (ADAS). The company’s technology is playing a key role in shaping the future of mobility.

Factors Driving Success

Nvidia’s success in August can be attributed to several key factors:

- Strong Market Demand: The global demand for GPUs remains robust, driven by the increasing adoption of AI, cloud computing, and gaming. Nvidia’s leadership position in these markets gives it a competitive advantage.

- Technological Advancements: Nvidia continues to invest heavily in research and development, delivering innovative products that meet the evolving needs of its customers. The company’s focus on AI, high-performance computing, and graphics technology has positioned it at the forefront of technological advancements.

Nvidia’s strong August performance amidst the tech sector volatility is a testament to their resilience and the growing demand for their AI-powered chips. However, it’s worth noting that even in robust sectors, safety concerns can arise. Just recently, Peloton recalled 2.2 million bikes over injury and fall concerns , highlighting the importance of rigorous testing and safety protocols across all industries, even those experiencing positive growth.

Nvidia’s commitment to innovation and quality control will likely continue to drive their success in the months ahead.

- Strategic Initiatives: Nvidia’s strategic acquisitions and partnerships have strengthened its market position and expanded its reach into new markets. The company’s focus on building an ecosystem of partners and developers has contributed to its success.

Tech Sector Volatility: Nvidias Strong August Performance Amidst Tech Sector Volatility

While Nvidia’s August performance was impressive, it’s important to remember that it occurred amidst a period of significant volatility in the broader tech sector. The tech sector, which has been a major driver of market growth in recent years, experienced a period of uncertainty and fluctuation in August.

Nvidia’s strong August performance amidst tech sector volatility is a testament to the company’s resilience and its focus on AI-driven growth. However, the financial landscape is not without its challenges, as evidenced by Moody’s recent signals of potential credit downgrades for six major US banks, which could have a ripple effect across the market.

While these developments are concerning, Nvidia’s robust performance suggests that its strong fundamentals and innovative solutions are positioned to weather potential economic headwinds.

Contrasting Nvidia’s Performance

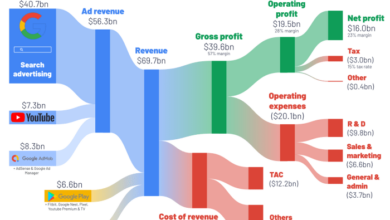

Nvidia’s strong performance stands in contrast to the mixed results seen in other major tech companies. While some companies, like Amazon and Alphabet, saw positive growth, others, like Meta and Microsoft, experienced declines in their stock prices. This disparity in performance highlights the sector’s current state of flux, where individual companies are experiencing varying degrees of success.

Factors Contributing to Volatility

Several factors contributed to the tech sector’s volatility in August.

- Macroeconomic Trends:Rising inflation, interest rate hikes, and concerns about a potential recession created a challenging environment for growth-oriented tech companies. These macroeconomic headwinds impacted investor sentiment and led to increased caution in the market.

- Investor Sentiment:Investor sentiment towards the tech sector shifted in August, with some investors becoming more risk-averse due to the uncertain economic outlook. This shift in sentiment led to increased selling pressure on tech stocks, contributing to the volatility.

- Specific Industry Challenges:The tech sector is facing specific challenges, including slowing growth in cloud computing, increased competition in the artificial intelligence (AI) market, and regulatory scrutiny. These industry-specific challenges are also contributing to the sector’s volatility.

Impact on Nvidia’s Future Performance

The tech sector’s volatility could have both positive and negative impacts on Nvidia’s future performance.

Nvidia’s strong position in the AI and gaming markets, coupled with its robust financial performance, could help it weather the current economic storm.

However, continued macroeconomic uncertainty and increased competition could also pose challenges for Nvidia. The company’s ability to navigate these challenges and maintain its strong growth trajectory will be crucial for its future success.

Nvidia’s Business Strategy

Nvidia’s success in August, despite the broader tech sector’s volatility, is a testament to its strategic focus on high-growth areas. The company’s current strategy centers on leveraging its expertise in artificial intelligence (AI), gaming, and data centers, positioning itself at the forefront of these rapidly evolving markets.

Nvidia’s Strategic Focus, Nvidias strong august performance amidst tech sector volatility

Nvidia’s strategy is characterized by its commitment to developing and delivering cutting-edge technologies that address the increasing demand for computing power in various sectors.

- Artificial Intelligence:Nvidia’s GPUs are the dominant force in AI training and inference, driving innovation in areas like natural language processing, computer vision, and autonomous driving. The company’s AI platform, NVIDIA AI, offers a comprehensive suite of tools and technologies for developers, researchers, and enterprises.

- Gaming:Nvidia is a leading provider of graphics processing units (GPUs) for gaming, with its GeForce brand dominating the market. The company’s focus on delivering high-performance gaming experiences, coupled with its commitment to innovative technologies like ray tracing and DLSS, has solidified its position in the gaming sector.

- Data Centers:Nvidia’s GPUs are increasingly being adopted in data centers for high-performance computing (HPC), cloud gaming, and AI workloads. The company’s DGX systems, designed for AI training and inference, are powering some of the world’s most advanced research and development initiatives.

Alignment with Industry Trends

Nvidia’s strategy is closely aligned with the prevailing trends and challenges in the tech sector. The increasing demand for AI, cloud computing, and high-performance computing, coupled with the growing need for data processing and analysis, creates a favorable environment for Nvidia’s products and services.

Implications for Future Growth

Nvidia’s strategic focus on AI, gaming, and data centers positions the company for continued growth and profitability in the years to come.

- AI Growth:The AI market is expected to experience substantial growth in the coming years, fueled by advancements in deep learning, machine learning, and other AI technologies. Nvidia’s leading position in AI hardware and software provides it with a significant competitive advantage in this rapidly expanding market.

Nvidia’s strong August performance amidst the tech sector volatility is a testament to the company’s strength and adaptability. It’s a reminder that even in turbulent times, businesses can thrive by focusing on innovation and meeting evolving customer needs. Of course, navigating these turbulent times requires a clear understanding of how to protect user data, which is why it’s crucial to understand what is a privacy policy and why is it important.

Nvidia’s commitment to transparency and user privacy likely plays a role in its continued success, showing that strong ethical practices can be a competitive advantage.

- Gaming Expansion:The gaming industry continues to grow, driven by the increasing popularity of mobile gaming, esports, and cloud gaming. Nvidia’s dominance in gaming GPUs, coupled with its investments in new technologies like ray tracing and DLSS, will likely drive further market share gains in this sector.

- Data Center Opportunities:The demand for data center infrastructure is expected to grow rapidly as businesses and organizations increasingly rely on cloud computing and AI. Nvidia’s GPUs are well-suited for the demanding workloads associated with these applications, creating significant opportunities for the company in the data center market.

Industry Analysis

Nvidia’s strong August performance comes amidst a volatile tech sector, highlighting the company’s resilience and strong market position. To understand the full picture, we need to analyze the broader industry landscape and its key players.

Nvidia’s Competitive Landscape

Nvidia faces competition from various companies in the GPU and semiconductor markets. In the GPU market, its primary competitors include:

- AMD:AMD is Nvidia’s main rival in the GPU market, offering competitive products in both the gaming and data center segments. AMD has been gaining market share in recent years, particularly in the gaming market, with its Radeon RX series GPUs.

- Intel:Intel is a major player in the semiconductor market, but its GPU offerings are still catching up to Nvidia and AMD. Intel’s Arc series GPUs are gaining traction in the gaming market, but they still need to improve performance and availability.

- Qualcomm:Qualcomm is a leading player in the mobile semiconductor market, and its Snapdragon processors are increasingly being used in PCs and laptops. Qualcomm is also developing its own GPU technology, which could become a significant competitor in the future.

In the semiconductor market, Nvidia faces competition from various companies, including:

- TSMC:TSMC is the world’s largest semiconductor foundry, manufacturing chips for Nvidia and other companies.

- Samsung:Samsung is another major semiconductor manufacturer, competing with TSMC and Nvidia in the fabrication of advanced chips.

- Intel:Intel is also a major player in the semiconductor market, but its manufacturing capabilities are lagging behind TSMC and Samsung.

Trends Shaping the GPU and Semiconductor Industries

The GPU and semiconductor industries are constantly evolving, driven by several key trends, including:

- Advancements in AI:AI is rapidly growing, driving demand for powerful GPUs to handle complex machine learning and deep learning tasks. Nvidia’s GPUs are highly sought after for AI applications, and the company is investing heavily in AI research and development.

- Cloud Computing:Cloud computing is another major trend driving GPU demand. Cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are using GPUs to power their cloud computing services, including machine learning, data analytics, and gaming.

- Edge Computing:Edge computing is gaining momentum, bringing computing power closer to users and devices. This trend is creating new opportunities for GPUs, as they can be used to process data at the edge, reducing latency and improving performance.

- Metaverse:The metaverse is an emerging concept that involves immersive digital experiences. This trend is expected to drive demand for high-performance GPUs for rendering complex graphics and simulations.

Impact of Trends on Nvidia’s Future Position

These trends are likely to have a significant impact on Nvidia’s future position within the industry.

- Increased Demand:Advancements in AI, cloud computing, and edge computing are driving increased demand for GPUs, benefiting Nvidia.

- New Opportunities:The metaverse and other emerging technologies are creating new opportunities for Nvidia to expand its product portfolio and market reach.

- Competition:The growing demand for GPUs is attracting new competitors, intensifying competition in the market. Nvidia needs to continue innovating and investing in research and development to maintain its competitive edge.

Investor Sentiment

Nvidia’s strong August performance, amidst a volatile tech sector, has undoubtedly caught the attention of investors. Understanding the factors driving investor sentiment towards Nvidia is crucial for assessing its future prospects and potential stock price movements.

Recent Stock Price Movements and Analyst Ratings

Recent stock price movements and analyst ratings provide valuable insights into investor sentiment. Nvidia’s stock price has experienced significant growth in recent months, reflecting strong investor confidence. This upward trajectory is supported by positive analyst ratings, with many analysts maintaining “buy” or “outperform” recommendations.

The strong performance can be attributed to several factors, including the company’s robust financial performance, its leading position in the AI chip market, and its expansion into new growth areas.

Factors Driving Investor Sentiment

Several factors contribute to the positive investor sentiment surrounding Nvidia:

- Strong Financial Performance:Nvidia has consistently delivered impressive financial results, exceeding analysts’ expectations in recent quarters. This strong performance has fueled investor confidence in the company’s ability to sustain growth and generate substantial profits.

- Dominance in the AI Chip Market:Nvidia holds a dominant position in the rapidly growing AI chip market, with its GPUs widely used in various applications, from data centers to gaming. This market leadership provides a strong foundation for future growth and revenue generation.

- Expansion into New Growth Areas:Nvidia is actively expanding into new growth areas, such as automotive and healthcare, which offer significant opportunities for future revenue streams. These strategic moves demonstrate the company’s commitment to innovation and long-term growth.

- Positive Industry Outlook:The overall industry outlook for semiconductors and AI is positive, with continued demand for high-performance computing and data processing capabilities. This favorable market environment supports Nvidia’s growth prospects and strengthens investor confidence.

Potential Implications for Nvidia’s Stock Price and Overall Valuation

The positive investor sentiment towards Nvidia is likely to have a significant impact on its stock price and overall valuation. As investors continue to view Nvidia as a growth leader in the AI chip market, the stock price is expected to remain elevated, potentially attracting further investment.

The company’s strong financial performance, market dominance, and expansion into new growth areas are all factors that could contribute to a higher valuation.

“Nvidia’s stock price is likely to continue its upward trajectory, driven by the company’s strong fundamentals and the growing demand for AI chips.”

However, it is important to note that investor sentiment can be volatile and subject to changes based on various factors, including economic conditions, competition, and technological advancements. Any negative developments in these areas could potentially impact investor sentiment and negatively affect Nvidia’s stock price.