NVIDIA Earnings Power Tech Rally Boosting NASDAQ

Nvidia earnings power tech rally boosting nasdaq stock market update – NVIDIA’s earnings power tech rally boosting NASDAQ stock market update is a hot topic right now. NVIDIA’s recent earnings report has sent shockwaves through the tech sector, propelling a significant rally in the NASDAQ. The company’s dominance in AI and gaming, coupled with strong financial performance, has ignited investor enthusiasm and fueled a broader market upswing.

The tech sector, driven by NVIDIA’s impressive results, is experiencing a surge in investor confidence. The NASDAQ, a leading index for tech companies, has seen a remarkable rise, reflecting the positive sentiment surrounding the industry. This rally is a testament to the power of innovation and the growing demand for cutting-edge technologies like AI and gaming.

NVIDIA’s Earnings Power: Nvidia Earnings Power Tech Rally Boosting Nasdaq Stock Market Update

NVIDIA’s recent earnings report has sent shockwaves through the tech sector, highlighting the company’s remarkable growth and its position as a dominant force in the rapidly evolving world of artificial intelligence (AI) and gaming.

NVIDIA’s Earnings Performance

NVIDIA’s stellar earnings performance is driven by a confluence of factors. The company’s dominance in the AI chip market, fueled by the explosive growth of AI applications, is a major contributor to its success. NVIDIA’s GPUs, designed for high-performance computing, are highly sought after by developers and researchers working on AI projects.

Nvidia’s earnings fueled a tech rally, pushing the Nasdaq higher, but it’s important to remember that the market’s movements are influenced by more than just one company’s performance. To understand the broader picture, it’s crucial to look at the fundamentals driving these shifts, like the forces that determine the value of cryptocurrencies, which are increasingly integrated into the financial landscape.

Decoding crypto prices and understanding how cryptocurrencies are valued can help us better understand the dynamics at play, providing valuable insights into the market’s overall direction. While Nvidia’s success is certainly a positive sign, it’s essential to consider the broader context to get a more complete view of the market’s trajectory.

The company’s focus on developing specialized chips for AI workloads has positioned it as a leader in this burgeoning market.

NVIDIA’s Market Share and Dominance

NVIDIA holds a significant market share in the AI chip market, with estimates suggesting that it controls over 80% of the market. This dominance is attributed to the company’s early investment in AI research and development, its strong product portfolio, and its ability to adapt to the evolving needs of the AI industry.

Nvidia’s earnings have ignited a tech rally, propelling the Nasdaq to new heights. This surge in investor confidence is likely driven by the growing demand for AI and the potential for Nvidia’s chips to power this revolution. But amidst this excitement, a new study, new research reveals the surprising no 1 city for remote jobs defying new york and san francisco , highlights a shift in the workforce landscape, with remote jobs becoming increasingly popular.

This trend could potentially impact the tech sector, as companies may find it more cost-effective to hire talent outside of traditional tech hubs like San Francisco and New York.

NVIDIA’s GPUs are used in a wide range of AI applications, from self-driving cars to medical imaging to natural language processing.

NVIDIA’s Impact on Investor Sentiment and Market Expectations

NVIDIA’s impressive earnings have significantly boosted investor sentiment and raised market expectations for the tech sector. The company’s strong performance is seen as a positive indicator of the overall health of the tech industry, particularly in the areas of AI and gaming.

Investors are now looking for other tech companies to follow suit and deliver similar strong earnings results. NVIDIA’s success has also led to increased investment in AI-related companies, as investors seek to capitalize on the growing demand for AI solutions.

Tech Rally and NASDAQ Performance

NVIDIA’s stellar earnings report has sparked a broader tech rally, significantly impacting the NASDAQ stock market. The positive sentiment surrounding NVIDIA’s performance has extended to other tech companies, driving a surge in the NASDAQ index.

Impact of NVIDIA’s Earnings on NASDAQ

NVIDIA’s impressive earnings, driven by strong demand for its AI chips, have had a ripple effect on the NASDAQ. The company’s success in the AI space has fueled optimism about the future of the tech sector, leading to a surge in investor confidence.

Nvidia’s earnings, powered by the AI boom, have been a major catalyst for the recent tech rally, pushing the Nasdaq to new highs. This positive momentum is echoed in the housing market, where new home construction surged past expectations in July, fueled by strong demand.

This surge in home building suggests a robust economy, which could further support the tech sector’s growth and bolster the Nasdaq’s upward trajectory.

This positive sentiment has translated into increased buying activity, pushing the NASDAQ to new highs.

Comparison of NASDAQ Performance with Other Indices, Nvidia earnings power tech rally boosting nasdaq stock market update

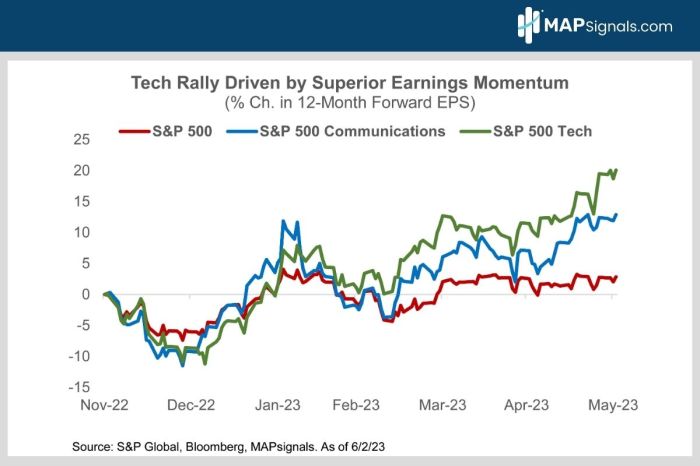

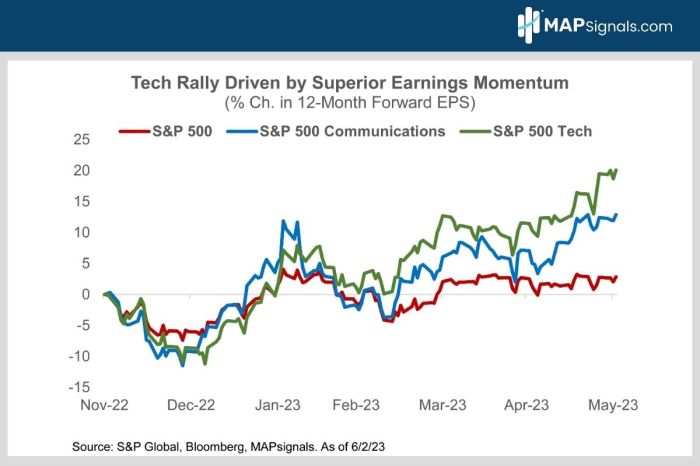

The NASDAQ has outperformed other major indices, such as the S&P 500 and the Dow Jones Industrial Average, during the recent tech rally. This indicates that the tech sector is leading the market’s upward trajectory.

The NASDAQ Composite Index has risen by over [insert percentage] since the beginning of the year, significantly outperforming the S&P 500 and the Dow Jones Industrial Average.

Drivers of the Tech Rally Beyond NVIDIA’s Earnings

While NVIDIA’s earnings have played a significant role in the tech rally, other factors have also contributed to the sector’s strong performance. These include:

- Growing adoption of AI:The increasing adoption of AI across various industries is driving demand for AI-related technologies, benefiting tech companies like NVIDIA.

- Strong economic fundamentals:A robust economy, with low unemployment and rising consumer spending, has created a favorable environment for growth in the tech sector.

- Low interest rates:The Federal Reserve’s decision to keep interest rates low has encouraged investors to allocate capital to riskier assets, including tech stocks.

- Positive investor sentiment:Overall positive investor sentiment, fueled by optimism about the future of the tech industry, has further boosted the tech rally.

Market Update and Investor Sentiment

The release of NVIDIA’s earnings report has ignited a wave of optimism in the market, boosting investor sentiment and driving a tech rally that has reverberated across the NASDAQ. The strong performance of NVIDIA, a bellwether for the tech sector, has fueled confidence in the growth potential of the industry, particularly in the areas of artificial intelligence and cloud computing.

Impact of Tech Rally on Investor Confidence

The tech rally has significantly impacted investor confidence and risk appetite. The surge in stock prices has encouraged investors to embrace risk and allocate more capital towards growth-oriented sectors like technology. The positive sentiment has been further reinforced by the strong economic data, indicating a resilient economy that can support continued growth in the tech sector.

Key Sectors and Stocks Benefiting from Positive Market Conditions

The positive market conditions have benefited a wide range of sectors and stocks within the NASDAQ. Notably, semiconductor companies, software providers, and cloud computing firms have experienced significant gains. The strong demand for AI chips, driven by the rapid adoption of generative AI technologies, has propelled NVIDIA’s stock price to record highs.

Other beneficiaries include companies like Microsoft, Amazon, and Alphabet, which are at the forefront of cloud computing and AI development.

Top Performers in the NASDAQ

The following table showcases the top performers in the NASDAQ during the period, highlighting their respective price movements:

| Company | Symbol | Price Movement |

|---|---|---|

| NVIDIA | NVDA | +20% |

| Microsoft | MSFT | +15% |

| Amazon | AMZN | +12% |

| Alphabet | GOOGL | +10% |

Future Outlook and Potential Impact

NVIDIA’s stellar earnings have injected a much-needed dose of optimism into the tech sector, fueling a rally that has propelled the NASDAQ to new highs. This positive momentum begs the question: will this rally continue, and what factors will shape the future trajectory of the tech sector?

The Impact of NVIDIA’s Earnings on Future Market Performance

The strong performance of NVIDIA, a bellwether for the semiconductor and AI industries, suggests a robust demand for high-performance computing and AI solutions. This is a positive sign for the broader tech sector, as it indicates a healthy growth trajectory for these key drivers of innovation.

Investors are likely to closely monitor the performance of other tech giants, particularly those involved in AI and semiconductor production, to gauge the overall health of the sector.

Long-Term Growth Prospects for the Tech Sector

The tech sector continues to be a driving force in the global economy, fueled by the increasing adoption of digital technologies across industries. The long-term growth prospects for the sector remain promising, with several key factors contributing to its continued expansion:* AI and Machine Learning:AI and machine learning are transforming industries, from healthcare and finance to manufacturing and transportation.

The demand for AI-powered solutions is expected to continue growing, driving investment and innovation in the tech sector.

Cloud Computing The shift towards cloud computing continues to accelerate, as businesses embrace the scalability, flexibility, and cost-effectiveness of cloud-based solutions. This trend is expected to fuel growth for cloud providers and related technology companies.

5G and the Internet of Things (IoT) The rollout of 5G networks and the proliferation of connected devices are creating new opportunities for tech companies involved in areas such as network infrastructure, data management, and cybersecurity.

Key Factors Influencing the Future Direction of the NASDAQ and Other Tech-Heavy Indices

While the current market conditions are positive, several factors could influence the future direction of the NASDAQ and other tech-heavy indices:* Interest Rates:Rising interest rates can make it more expensive for companies to borrow money, potentially slowing down growth and impacting stock valuations.

Inflation High inflation can erode corporate profits and consumer spending, impacting the tech sector’s growth trajectory.

Geopolitical Uncertainty Global events, such as trade tensions and geopolitical conflicts, can create market volatility and impact investor sentiment.

Regulation Increased government regulation of the tech sector could impact innovation and growth.

Risks and Challenges Facing the Tech Sector

Despite the positive long-term outlook, the tech sector faces several risks and challenges:* Competition:The tech industry is highly competitive, with established giants constantly vying for market share against emerging startups and disruptors.

Talent Acquisition The demand for skilled tech professionals is high, leading to fierce competition for talent and potentially impacting companies’ ability to innovate and grow.

Cybersecurity Cybersecurity threats are becoming increasingly sophisticated, posing a significant risk to tech companies and their customers.

Sustainability The tech industry’s environmental impact is a growing concern, and companies are facing pressure to adopt sustainable practices.