NASDAQ 100 Index: Rebalancing for Diversification

Nasdaq 100 index to undergo rebalancing for a more diversified composition – The NASDAQ 100 Index is undergoing a rebalancing process to create a more diversified composition, a move that promises to bring greater stability and resilience to this influential market benchmark. This shift is a direct response to the current composition of the index, which has become heavily concentrated in certain sectors, creating potential vulnerabilities and limiting opportunities for growth.

By expanding the representation of various industries and companies, the rebalancing aims to reduce risk and unlock new avenues for investors.

The rebalancing process involves a careful selection of index components, taking into account factors like market capitalization, sector representation, and overall market performance. The goal is to ensure a more balanced representation of various industries, creating a more robust and diversified portfolio.

This move is expected to benefit investors by reducing their exposure to specific sectors and offering them a broader range of opportunities for growth.

The NASDAQ 100 Index Rebalancing: A Move Towards Diversification

The NASDAQ 100 Index is a market-capitalization-weighted index that tracks the performance of 100 of the largest non-financial companies listed on the NASDAQ Stock Market. It serves as a benchmark for the technology sector and is widely used by investors to track the overall performance of the tech industry.

Recently, the NASDAQ 100 Index has undergone a rebalancing process, aiming to create a more diversified composition. This move is driven by the need to reflect the evolving landscape of the technology sector and mitigate risks associated with overconcentration in specific sub-sectors.

Benefits of Rebalancing

Rebalancing the NASDAQ 100 Index offers several potential benefits:* Reduced Concentration Risk:By diversifying the index’s composition, the rebalancing process aims to mitigate concentration risk. Overreliance on a few companies or sectors can make the index more susceptible to volatility and sudden downturns.

The Nasdaq 100 index is getting a makeover, with a rebalancing aimed at creating a more diversified composition. This move comes at a time when the tech sector is facing increasing scrutiny, and the index is looking to broaden its horizons.

Meanwhile, Elon Musk, ever the innovator, is reportedly developing a Twitter video app specifically for smart TVs, a move that could potentially disrupt the streaming landscape. exclusive elon musk confirms upcoming twitter video app for smart tvs The rebalancing of the Nasdaq 100 index, however, suggests a shift in focus away from the tech giants and towards a more diverse portfolio, reflecting the evolving dynamics of the global economy.

A broader range of companies and sectors can help spread risk and enhance resilience.* Increased Representation of Emerging Technologies:The rebalancing process allows for the inclusion of companies representing emerging technologies and sectors. This ensures that the index reflects the latest innovations and growth opportunities within the technology landscape.

For example, the inclusion of companies specializing in artificial intelligence, cloud computing, and renewable energy could enhance the index’s relevance and investment potential.* Enhanced Investment Opportunities:By diversifying the index’s composition, investors are presented with a wider range of investment opportunities. This allows them to access a more diverse pool of companies and sectors, potentially leading to better returns and reduced portfolio volatility.

Reasons for Rebalancing

The NASDAQ 100 Index, a widely-tracked benchmark for growth stocks, is undergoing a significant rebalancing to enhance its diversification and mitigate potential risks. This move is driven by the recognition that the current composition of the index has become concentrated in certain sectors, leading to potential vulnerabilities and a lack of representation for other promising industries.

Current Composition and Areas for Improvement

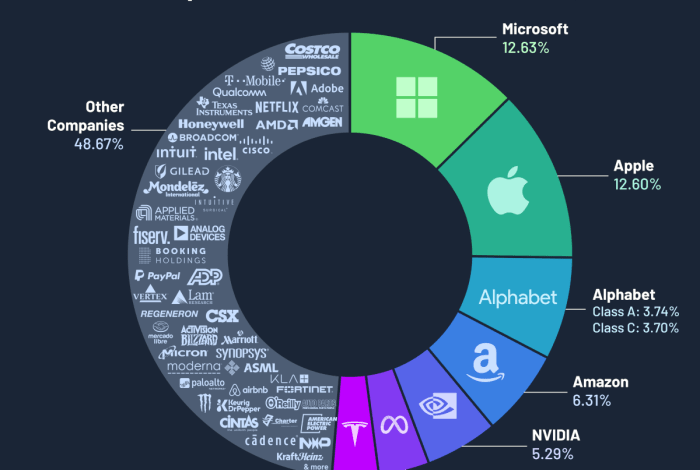

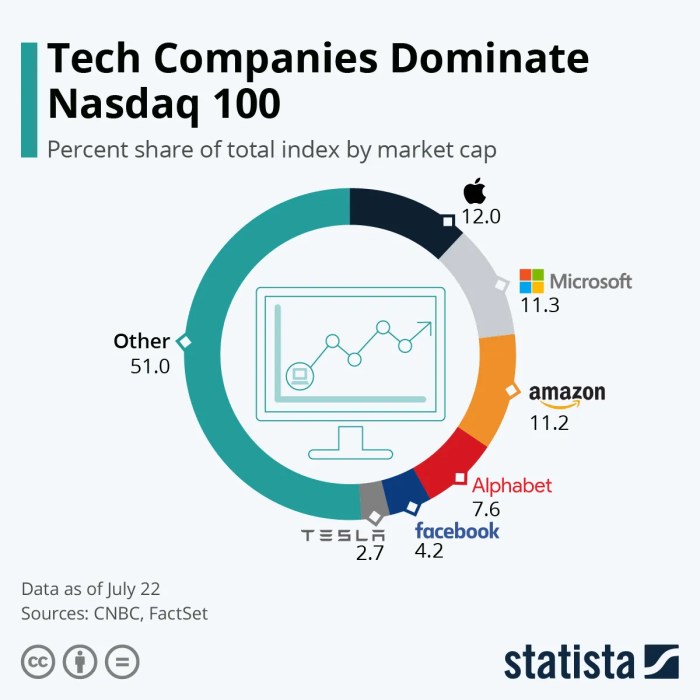

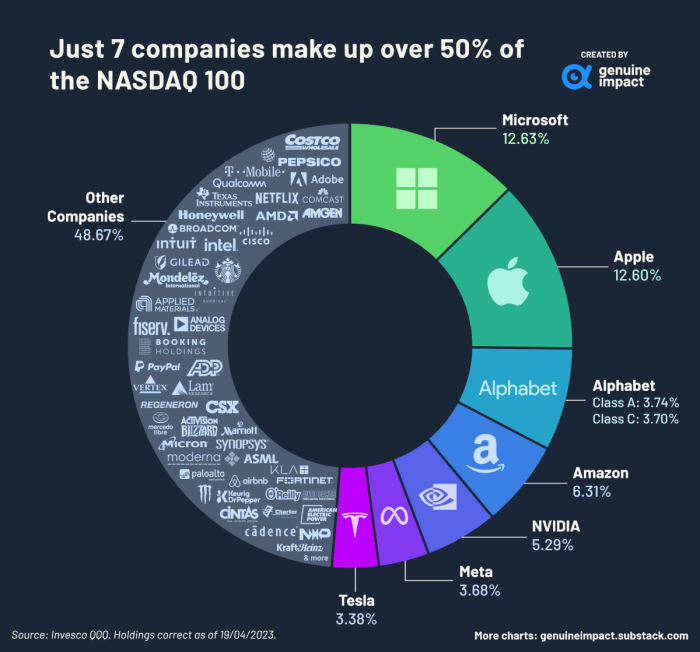

The NASDAQ 100 Index currently comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market. While this selection has historically reflected the dynamism and growth potential of the technology sector, it has also resulted in a significant concentration in certain areas.

For instance, the technology sector, particularly software and internet-related companies, accounts for a substantial portion of the index’s weight. This concentration can lead to heightened volatility and potential biases, making the index susceptible to sector-specific shocks.

Impact of Sector Concentration and Potential Risks

The concentration of the NASDAQ 100 Index in a few sectors can amplify the impact of industry-specific events. For example, a decline in the performance of the technology sector could disproportionately affect the overall index value. This concentration can also limit the potential for investors to diversify their portfolios, as they are exposed to the same set of companies and industries.

Additionally, it can create a bias towards certain sectors, potentially neglecting other industries with strong growth potential.

Need for Broader Representation of Industries and Companies

To address these concerns and enhance the index’s overall resilience, the rebalancing aims to broaden the representation of industries and companies within the NASDAQ 100 Index. By including a more diverse range of sectors, the index will become less susceptible to the volatility of specific industries and provide investors with a more comprehensive representation of the broader market.

This diversification will also offer greater opportunities for investors to gain exposure to a wider range of companies and industries, potentially leading to better risk-adjusted returns.

Rebalancing Process: Nasdaq 100 Index To Undergo Rebalancing For A More Diversified Composition

The NASDAQ 100 Index rebalancing is a complex process that involves a combination of factors and criteria to ensure the index remains representative of the technology sector and maintains its diversification. The rebalancing process aims to ensure that the index remains relevant to the evolving technology landscape and reflects the changing dynamics of the sector.

The Nasdaq 100 index is set to undergo a significant rebalancing, aiming for a more diversified composition. This move comes amidst news of the passing of renowned actor Ray Stevenson, known for his roles in films like “Punisher: War Zone,” “RRR,” and the “Thor” franchise.

Ray Stevenson’s passing is a sad reminder of the fragility of life, and his contributions to the world of cinema will be greatly missed. Meanwhile, the Nasdaq 100 index rebalancing aims to create a more robust and resilient market, ensuring a wider range of sectors and companies are represented.

The rebalancing process involves a series of steps to ensure a smooth and transparent transition of index constituents.

Selection Criteria and Weighting Methodology

The selection criteria and weighting methodology are key components of the NASDAQ 100 Index rebalancing process. The index aims to represent the 100 largest non-financial companies listed on the NASDAQ Stock Market. The rebalancing process involves a careful selection of companies based on specific criteria.The index uses a free-float market capitalization weighting methodology.

This means that the weight of each company in the index is determined by its market capitalization, adjusted for the number of shares available for public trading. This ensures that companies with larger market capitalizations have a greater influence on the index’s overall performance.

The Nasdaq 100 index is getting a makeover, aiming for a more diversified composition. This rebalancing could have a ripple effect on the market, especially as we navigate a period of rising inflation. To better understand how to manage your finances in this environment, check out the inflation guide tips to understand and manage rising prices.

The Nasdaq 100’s rebalancing is a move to adapt to the changing economic landscape, and understanding inflation is key to making informed financial decisions during this time.

Factors Considered During Rebalancing

The NASDAQ 100 Index rebalancing considers several factors to ensure a comprehensive and balanced representation of the technology sector.

- Company Performance:The rebalancing process considers the financial performance of companies, including revenue growth, profitability, and market share. Companies with strong financial performance and growth potential are more likely to be included or maintain their positions in the index.

- Industry Trends:The rebalancing process also considers industry trends and emerging technologies. Companies operating in rapidly growing sectors or developing innovative technologies are more likely to be included or receive higher weighting.

- Market Liquidity:The rebalancing process prioritizes companies with sufficient market liquidity. This ensures that the index is actively traded and reflects the overall market sentiment.

- Corporate Governance:The rebalancing process also considers corporate governance factors, such as board composition, executive compensation, and shareholder rights. Companies with strong corporate governance practices are preferred to maintain the integrity of the index.

Impact on Index Performance

The rebalancing process is expected to have a positive impact on the overall index performance. By ensuring a diversified composition and including companies with strong growth potential, the index is expected to be more resilient to market fluctuations and better reflect the long-term growth of the technology sector.

The rebalancing process aims to enhance the index’s diversification, reduce concentration risk, and reflect the evolving dynamics of the technology sector.

Impact on Investors

The rebalancing of the NASDAQ 100 Index will have significant implications for investors holding ETFs or funds tracking the index. The changes in sector weights and the inclusion of new companies will likely impact portfolio diversification and potential performance adjustments.

Potential Implications for Investors, Nasdaq 100 index to undergo rebalancing for a more diversified composition

The rebalancing process can create opportunities and challenges for investors.

- Potential for Increased Diversification:The inclusion of companies from sectors previously underrepresented in the NASDAQ 100 can lead to increased diversification within portfolios, reducing overall risk. For example, the inclusion of more healthcare or consumer staples companies could help mitigate the impact of fluctuations in technology stocks.

- Impact on Sector Weights:Changes in sector weights can affect the overall performance of the index. For instance, if the index increases its weight in a particular sector that performs well, investors holding ETFs or funds tracking the index could benefit from higher returns.

Conversely, if the index reduces its weight in a sector that underperforms, investors might see a decline in returns.

- Potential Performance Adjustments:The rebalancing process can lead to short-term market volatility as investors adjust their positions to reflect the new index composition. However, over the long term, the rebalancing could result in improved index performance due to the increased diversification and the inclusion of high-growth companies.

Potential Changes in Sector Weights

The rebalancing could lead to significant changes in sector weights, impacting the composition of investor portfolios. For example, if the index increases its weight in the healthcare sector, investors holding NASDAQ 100 ETFs or funds might see a larger allocation to healthcare companies.

Conversely, if the index reduces its weight in the technology sector, investors might see a decrease in their exposure to technology stocks. These changes can influence the overall risk and return profile of portfolios.

Potential Performance Adjustments

The rebalancing process could lead to short-term performance adjustments. As investors adjust their portfolios to reflect the new index composition, market volatility might increase. However, over the long term, the rebalancing could improve index performance due to the increased diversification and the inclusion of high-growth companies.

For instance, the inclusion of companies from sectors like healthcare and consumer staples could provide a more balanced portfolio and potentially mitigate the impact of market downturns, leading to more stable returns over the long term.

Future Outlook

The rebalancing of the NASDAQ 100 Index marks a significant shift towards a more diversified portfolio. This move has far-reaching implications for the index’s performance and the broader market dynamics.

Long-Term Implications

The rebalancing aims to create a more resilient index by reducing the concentration risk associated with a heavy reliance on a few large-cap technology companies. This will likely lead to a more stable index performance over the long term, reducing volatility and mitigating the impact of potential sector-specific downturns.

Potential for Further Diversification

The rebalancing is a step in the right direction, but there is always room for further diversification. The NASDAQ 100 could explore adding sectors currently underrepresented, such as healthcare, energy, and financials, to create a more balanced and comprehensive index.

This would enhance its ability to capture growth opportunities across various sectors and reduce its vulnerability to sector-specific shocks.

Impact on Market Dynamics

The rebalancing could have a significant impact on the overall market dynamics. By reducing the dominance of technology giants, it could create opportunities for other sectors to emerge and grow. This could lead to a more balanced market, with a wider range of investment opportunities and a more diversified growth landscape.

The rebalancing could lead to a “rotation” of capital, where investors shift their focus from tech-heavy portfolios to sectors that are now more prominently featured in the NASDAQ 100.

For instance, the inclusion of more healthcare companies could attract investors seeking exposure to a sector with a strong track record of growth and stability. This could lead to increased investment in healthcare companies, driving innovation and growth within the sector.