Morgan Stanley Warns of US Equity Setback as Earnings Drop 16%

Morgan stanley warns of potential setback in us equity rally as earnings projection drops 16 – Morgan Stanley Warns of US Equity Setback as Earnings Drop 16% – this headline sends shivers down the spines of investors who’ve enjoyed the recent market rally. The investment giant, known for its insightful market analysis, has issued a warning about a potential downturn in the US stock market, citing a significant drop in earnings projections as the primary driver.

This warning, backed by data and analysis, is a stark reminder that the market’s upward trajectory might not be as sustainable as it seems.

The warning stems from a confluence of factors, including rising inflation, aggressive interest rate hikes by the Federal Reserve, and a global economic slowdown. These factors have led to a significant decrease in corporate earnings projections, raising concerns about the future trajectory of the stock market.

The drop in earnings forecasts is particularly alarming, as it signals a potential decline in corporate profitability, which is a key driver of stock prices.

Morgan Stanley’s Warning: Morgan Stanley Warns Of Potential Setback In Us Equity Rally As Earnings Projection Drops 16

Morgan Stanley’s recent warning about a potential setback in the US equity rally has sent ripples through the financial markets. The investment bank’s outlook, which suggests a significant earnings decline, raises concerns about the sustainability of the current bull market.

Factors Contributing to the Warning

The warning stems from a confluence of factors that have begun to weigh on the US economy and corporate earnings.

- Rising Interest Rates:The Federal Reserve’s aggressive interest rate hikes have increased borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate profitability.

- Inflationary Pressures:Persistent inflation continues to erode consumer purchasing power, forcing businesses to raise prices and potentially impacting demand.

- Geopolitical Uncertainties:The ongoing war in Ukraine and heightened geopolitical tensions contribute to market volatility and uncertainty, making it difficult for businesses to plan for the future.

Details of the Warning

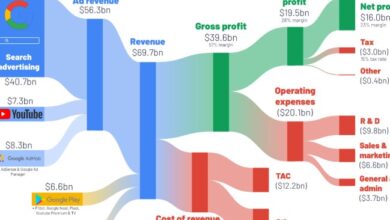

Morgan Stanley’s analysts project a 16% decline in earnings for S&P 500 companies in the coming quarters. This sharp drop in earnings could lead to a correction in the stock market, as investors reassess their valuations and adjust their expectations for future growth.

While Morgan Stanley’s warning about a potential setback in the US equity rally due to a 16% drop in earnings projections is a sobering reminder of the market’s volatility, it’s interesting to see how companies like Nvidia are defying the trend.

Nvidia’s recent unveiling of AI supercomputers and services, as detailed in this article nvidia unleashes ai supercomputers and services propelling stock surge to new heights , has propelled their stock to new heights, highlighting the potential for growth in specific sectors even amidst broader market uncertainty.

“We expect earnings to decline sharply in the coming quarters, as the impact of rising interest rates and inflation begins to bite. This could lead to a correction in the stock market, as investors adjust their expectations for future growth.”

Morgan Stanley Analyst

Earnings Projections and Market Sentiment

Earnings projections play a crucial role in shaping market sentiment and influencing investor behavior. They provide insights into the future profitability of companies and the overall health of the economy.

Earnings Projections and Market Sentiment

Earnings projections are forward-looking estimates of a company’s future profitability. They are based on various factors, including historical performance, economic conditions, industry trends, and management guidance. Analysts and investors closely monitor these projections, as they provide a gauge of a company’s growth potential and its ability to generate returns.When earnings projections are positive, it typically indicates a strong outlook for the company and the broader economy.

Morgan Stanley’s warning of a potential setback in the US equity rally, fueled by a 16% drop in earnings projections, highlights the fragility of the market. This volatility underscores the need to understand the broader economic landscape, including the impact of emerging technologies like cryptocurrencies.

To delve deeper into this complex interplay, check out this insightful article on bitcoins impact on the global economy dissecting the influence of cryptocurrency. Ultimately, navigating these uncertainties requires a comprehensive view of both traditional and emerging forces shaping the financial world, as Morgan Stanley’s warning clearly demonstrates.

This can lead to increased investor confidence, higher stock prices, and a more optimistic market sentiment. Conversely, negative earnings projections can signal concerns about a company’s future performance, leading to decreased investor confidence and potentially lower stock prices.

Recent Trends in Earnings Growth and Their Impact on Investor Confidence

Recent trends in earnings growth have been mixed, impacting investor confidence. While some sectors have shown strong earnings growth, others have faced challenges due to economic headwinds and supply chain disruptions.

- For example, the technology sector has witnessed robust earnings growth in recent quarters, driven by strong demand for cloud computing, software, and other digital services. This has fueled investor optimism and supported a strong rally in tech stocks.

- However, sectors like energy and consumer discretionary have experienced slower earnings growth due to rising inflation and higher interest rates. This has dampened investor enthusiasm and led to some market volatility.

Relationship Between Earnings Expectations and Stock Market Performance, Morgan stanley warns of potential setback in us equity rally as earnings projection drops 16

Earnings expectations play a significant role in driving stock market performance. When a company’s actual earnings meet or exceed expectations, it typically leads to positive stock price movements. However, if earnings fall short of expectations, it can result in negative price reactions.

The relationship between earnings expectations and stock market performance is often described by the “earnings surprise” concept. An earnings surprise occurs when a company’s actual earnings deviate from analysts’ expectations. Positive earnings surprises generally lead to stock price appreciation, while negative earnings surprises can result in price declines.

It’s important to note that earnings expectations are constantly evolving, and market sentiment can shift quickly based on new information and economic developments.

Potential Setbacks and Market Volatility

While the US equity market has enjoyed a remarkable rally in recent months, driven by optimism surrounding a potential economic rebound, it’s crucial to acknowledge that potential setbacks could lie ahead. Several factors could contribute to a correction, potentially leading to increased market volatility.

Factors Contributing to Potential Setbacks

Several factors could contribute to a potential setback in the US equity rally. These factors include:

- Inflation:Persistent inflation, although showing signs of moderation, remains a concern. The Federal Reserve’s aggressive interest rate hikes aim to curb inflation, but these actions could also slow economic growth and impact corporate earnings. If inflation remains elevated, it could lead to a reassessment of valuations, potentially triggering a market correction.

- Interest Rate Hikes:The Federal Reserve’s ongoing interest rate hikes, while aimed at controlling inflation, could also impact the economy’s growth trajectory. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic activity and impacting corporate earnings. This could lead to a re-evaluation of stock valuations and potentially trigger a market downturn.

Morgan Stanley’s warning of a potential setback in the US equity rally, fueled by a 16% drop in their earnings projection, is certainly giving investors pause. This news comes amidst a broader market uncertainty, as evidenced by the recent dip in Dow futures following Disney’s report of losses and the anticipation of inflation data.

You can find live updates on this situation here. With these factors in play, it’s clear that investors are closely watching for any signs of a shift in the market’s trajectory, and Morgan Stanley’s warning adds another layer of complexity to the current economic landscape.

- Geopolitical Tensions:Ongoing geopolitical tensions, such as the war in Ukraine, continue to create uncertainty and volatility in global markets. These tensions could disrupt supply chains, escalate inflation, and impact investor sentiment. A significant escalation of these tensions could trigger a market correction.

- Earnings Expectations:Recent corporate earnings reports have been mixed, and some analysts have lowered their earnings projections for the remainder of the year. If earnings growth fails to meet expectations, it could lead to a decline in investor confidence and a potential market correction.

Impact on Market Volatility

These factors can significantly impact market volatility. As investors grapple with concerns about inflation, interest rate hikes, geopolitical tensions, and earnings growth, they may become more cautious and hesitant to invest. This could lead to increased trading activity and price fluctuations, creating a more volatile market environment.

Historical Trends of Market Corrections

Market corrections are a normal part of the investment cycle. Historically, corrections have been triggered by various factors, including:

- Economic Slowdowns:Economic recessions or periods of slow economic growth often lead to market corrections. During these periods, corporate earnings tend to decline, and investors become more risk-averse, leading to stock price declines.

- Interest Rate Increases:As the Federal Reserve raises interest rates to combat inflation, it can lead to higher borrowing costs for businesses and consumers, slowing economic growth and impacting corporate earnings. This can trigger market corrections as investors re-evaluate valuations.

- Geopolitical Events:Major geopolitical events, such as wars or trade disputes, can create uncertainty and volatility in the market. These events can lead to investor anxiety and a sell-off, resulting in a market correction.

- Overvaluation:When asset prices become inflated and detached from fundamentals, a correction can occur. This is often driven by excessive optimism or speculation, leading to a rapid decline in prices when investor confidence wanes.

Investor Strategies and Risk Management

Morgan Stanley’s warning about a potential setback in the US equity rally underscores the importance of having a well-defined investment strategy and robust risk management practices. In light of this, investors need to carefully consider their investment goals, risk tolerance, and time horizon before making any decisions.

This section will explore various investment strategies that investors might consider and highlight some risk management techniques to mitigate potential losses.

Investment Strategies

In the face of potential market volatility, investors may consider adopting various strategies to navigate the market landscape. These strategies aim to balance risk and potential returns, catering to different investor profiles and market conditions.

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Value Investing | Focuses on identifying undervalued stocks with strong fundamentals and potential for growth. | Potential for higher returns, less susceptible to market sentiment fluctuations. | May require longer investment horizons, requires thorough research and analysis. |

| Growth Investing | Prioritizes companies with high growth potential, often in emerging industries. | Potential for significant returns, aligns with long-term economic growth. | Higher risk, more susceptible to market volatility, may require a longer time horizon. |

| Defensive Investing | Emphasizes investing in companies with stable earnings, low debt, and strong cash flow, often in sectors like utilities and consumer staples. | Provides stability and downside protection during market downturns. | Lower potential returns compared to growth or value strategies. |

| Index Investing | Investing in a basket of securities that track a specific market index, like the S&P 500. | Diversification, low cost, passive management, tracks market performance. | Limited potential for outperformance, no active management to capitalize on market opportunities. |

Risk Management Techniques

Risk management is crucial in mitigating potential losses and protecting capital. Here are some techniques investors can employ:

- Diversification:Spreading investments across different asset classes, sectors, and geographies reduces exposure to any single asset’s volatility.

- Rebalancing:Regularly adjusting portfolio allocations to maintain the desired risk profile and asset mix. This ensures that investments remain aligned with the investor’s risk tolerance and investment goals.

- Stop-Loss Orders:Pre-set orders to sell a security when it reaches a specific price level, limiting potential losses in case of a downturn.

- Dollar-Cost Averaging:Investing a fixed amount of money at regular intervals, regardless of market conditions. This helps reduce the impact of market volatility and averages out the purchase price.

Hypothetical Portfolio Allocation Strategy

A hypothetical portfolio allocation strategy should balance risk and potential returns, considering the investor’s risk tolerance and time horizon. For example, a young investor with a long time horizon might allocate a larger portion of their portfolio to growth stocks, while an older investor with a shorter time horizon might prefer a more conservative approach with a higher allocation to bonds and other fixed-income securities.

A balanced portfolio might consist of 60% stocks, 30% bonds, and 10% alternative investments like real estate or commodities.

This allocation would provide a blend of growth potential from stocks, stability from bonds, and diversification from alternative investments. However, this is just a hypothetical example, and investors should always consult with a financial advisor to create a personalized portfolio allocation strategy that aligns with their specific circumstances and goals.

Economic Outlook and Market Trends

The current economic outlook is characterized by a complex interplay of factors, including persistent inflation, rising interest rates, and geopolitical uncertainties, all of which are creating significant headwinds for the US equity market. Understanding these factors and their potential impact is crucial for investors navigating the current market landscape.

Major Economic Indicators

The major economic indicators that are influencing market trends include:

- Inflation:The persistent rise in inflation, fueled by supply chain disruptions, strong consumer demand, and the war in Ukraine, has eroded consumer purchasing power and forced the Federal Reserve to aggressively raise interest rates.

- Interest Rates:The Federal Reserve’s aggressive interest rate hikes are intended to curb inflation, but they also increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings.

- Gross Domestic Product (GDP):The US economy has shown resilience in recent quarters, but concerns remain about potential recessions due to the aggressive monetary tightening and the lingering effects of the pandemic.

- Consumer Spending:Consumer spending remains a significant driver of economic growth, but rising inflation and interest rates are putting pressure on household budgets, potentially impacting future spending.

- Labor Market:The labor market remains strong, with low unemployment and robust job growth. However, wage growth is not keeping pace with inflation, potentially eroding consumer confidence and spending.

Impact of Inflation, Interest Rates, and Geopolitical Events

Inflation, interest rates, and geopolitical events have a significant impact on the US equity market.

- Inflation:High inflation erodes corporate profits, reduces consumer spending, and increases borrowing costs, creating a challenging environment for businesses and investors.

- Interest Rates:Rising interest rates make it more expensive for companies to borrow money, potentially slowing investment and economic growth. Higher interest rates also make bonds more attractive to investors, potentially leading to a shift in capital away from stocks.

- Geopolitical Events:Geopolitical events, such as the war in Ukraine, can disrupt global supply chains, increase commodity prices, and create economic uncertainty, impacting market sentiment and investment decisions.

Market Volatility

The current economic climate is characterized by significant market volatility.

- Volatility:The combination of inflation, rising interest rates, and geopolitical uncertainty has created a volatile market environment, with stocks experiencing sharp fluctuations in price.

- Market Corrections:Market corrections, defined as a decline of 10% or more in the stock market, are a normal part of the market cycle, but they can be unsettling for investors. The current economic environment increases the risk of market corrections.

- Bear Market:A bear market is a decline of 20% or more in the stock market. While not imminent, the current economic conditions increase the risk of a bear market, especially if inflation remains high and interest rates continue to rise.