Middle East Tensions Drive Oil Prices Up, Second Week of Gains

Middle East tensions drive oil prices up second week of gains, and the world is watching closely. This recent spike in oil prices is the result of a perfect storm of geopolitical factors, market dynamics, and economic anxieties. The situation in the Middle East is always volatile, and the current tensions are adding to the uncertainty in the global oil market.

This week, we’ll delve into the complexities of this situation, exploring the causes, consequences, and potential solutions.

The rise in oil prices is a significant event with far-reaching consequences. It impacts everything from the cost of transportation to the price of goods and services. For individuals, it means higher fuel costs and potentially higher prices at the grocery store.

For businesses, it can mean increased operational costs and reduced profits. And for governments, it can mean economic instability and political challenges.

Geopolitical Factors

The recent surge in oil prices, marking the second consecutive week of gains, is largely driven by escalating geopolitical tensions in the Middle East. These tensions, primarily stemming from the ongoing conflict in Yemen and the volatile situation in Iran, have significantly impacted global oil supply and demand dynamics, contributing to the price increases.

The Middle East tensions continue to drive oil prices up, marking their second week of gains. This volatile situation is impacting global markets, and it’s interesting to see how companies are adapting. Binance, for instance, has ensured smooth operations for Belgian users by establishing a new Polish entity, as reported on The Venom Blog.

While these are separate issues, they highlight the need for flexibility and adaptability in today’s complex world, where geopolitical events can have far-reaching consequences.

Impact on Global Oil Supply and Demand, Middle east tensions drive oil prices up second week of gains

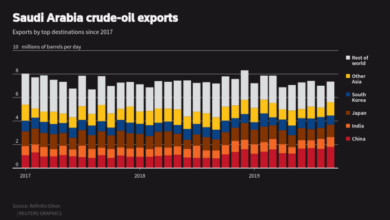

The ongoing conflict in Yemen, involving a Saudi-led coalition and Houthi rebels, has disrupted oil production and exports from the region. The Houthis have targeted oil infrastructure, including pipelines and refineries, leading to production cuts and supply disruptions. This has tightened global oil supply, pushing prices upwards.

Furthermore, the volatile situation in Iran, marked by US sanctions and tensions with neighboring countries, has also impacted global oil markets. Iran, a major oil producer, has faced limitations on its exports due to US sanctions. These sanctions have reduced Iran’s oil production and exports, further tightening global supply and contributing to the recent price surge.

Impact on Regional Stability

The current geopolitical tensions in the Middle East have significantly impacted regional stability. The conflict in Yemen has caused humanitarian crises, displacement, and economic instability. The ongoing tensions with Iran have also heightened concerns about regional security and stability. These tensions have fueled a cycle of escalation and instability, creating an environment of uncertainty and fear.

This instability has made it difficult to resolve regional conflicts and has hindered economic development and cooperation.

The Middle East tensions continue to drive oil prices higher, marking their second week of gains. This comes at a time when inflation is already surging, with annual consumer price hikes accelerating in July, reaching a record 32% rise, as reported by The Venom Blog.

This combination of rising energy costs and overall inflation is putting a significant strain on consumers and businesses, potentially leading to further economic uncertainty.

Comparison with Past Instances

The current situation bears similarities to past instances where Middle East tensions have driven oil prices higher. For example, the 1973 oil crisis, triggered by the Arab-Israeli War, saw oil prices skyrocket due to an oil embargo imposed by Arab oil-producing countries.

Similarly, the 1990-1991 Gulf War also led to significant oil price increases due to disruptions in supply from Kuwait. However, the current situation differs from past instances in some key aspects. While past tensions were primarily driven by political conflicts, the current situation is also influenced by economic factors, such as US sanctions on Iran and the global shift towards renewable energy sources.

Market Dynamics: Middle East Tensions Drive Oil Prices Up Second Week Of Gains

The second week of gains in oil prices reflects a confluence of factors, indicating a broader shift in market sentiment and underlying economic trends. The combination of geopolitical tensions, supply constraints, and growing demand has created a bullish environment, pushing prices higher.

Investor Sentiment and Speculation

Investor sentiment plays a significant role in driving oil price fluctuations. As geopolitical risks escalate, investors tend to seek safe haven assets, often turning to commodities like oil. This increased demand, fueled by speculation, pushes prices upwards. Additionally, concerns over potential supply disruptions due to sanctions or production cuts further exacerbate the situation.

The Middle East tensions continue to drive oil prices higher, marking their second week of gains. This is a significant development, as it impacts global markets and fuels inflation. While the situation remains volatile, the Indian stock market is showing resilience, with the Nifty index crossing 17,650.

For a detailed look at the live updates on the share market movement, including the performance of HCL Tech and Tata Motors, check out this insightful article: live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors.

The impact of rising oil prices is a key factor to watch, as it could influence the overall market sentiment in the coming weeks.

Perspectives of Major Oil Producers and Consumers

Major oil producers, particularly OPEC+, have been cautious in their response to the recent price surge. While acknowledging the geopolitical uncertainties, they have maintained their current production levels, indicating a desire to maintain market stability. However, some members have expressed concerns about potential supply shortages in the future.

Oil-consuming nations, on the other hand, are grappling with the rising cost of energy, which is impacting inflation and economic growth. Some countries are calling for increased production to alleviate price pressures, while others are exploring alternative energy sources to reduce their dependence on oil.

Key Market Indicators and Their Impact on Oil Prices

| Indicator | Impact on Oil Prices |

|---|---|

| Global Oil Demand | Increased demand leads to higher prices. |

| OPEC+ Production Levels | Lower production or output cuts push prices up. |

| US Dollar Index | A weaker dollar makes oil more affordable for foreign buyers, increasing demand and prices. |

| Inventory Levels | Low inventory levels indicate tight supply and potential for price increases. |

| Geopolitical Risks | Increased tensions or disruptions in oil-producing regions drive prices higher. |

Economic Implications

Rising oil prices can have a significant impact on global economic growth, particularly in energy-dependent industries and for consumers. The implications are complex and multifaceted, requiring careful analysis and potential policy responses to mitigate the negative effects.

Impact on Global Economic Growth

The relationship between oil prices and economic growth is intricate. High oil prices can act as a drag on economic growth by increasing production costs for businesses, leading to higher consumer prices, and reducing disposable income.

For example, the sharp rise in oil prices in the 1970s contributed to stagflation, a period of high inflation and low economic growth.

The impact of oil prices on economic growth can vary depending on factors such as the level of economic development, the reliance on oil imports, and the availability of alternative energy sources.

Implications for Energy-Dependent Industries and Consumers

Energy-dependent industries, such as transportation, manufacturing, and agriculture, are particularly vulnerable to rising oil prices. Increased fuel costs can lead to higher production costs, reduced profitability, and job losses. Consumers also face the brunt of high oil prices. Increased gasoline prices erode disposable income, leading to reduced spending on other goods and services.

This can have a ripple effect throughout the economy, slowing down overall economic activity.

For instance, the 2008 global financial crisis was partly attributed to high oil prices, which contributed to a decline in consumer spending and economic growth.

Policy Responses to Mitigate the Economic Impact of High Oil Prices

Governments can implement a range of policies to mitigate the economic impact of high oil prices.

- Fiscal Policies:Governments can use fiscal policies, such as tax cuts or subsidies, to reduce the burden of high oil prices on consumers and businesses.

- Monetary Policies:Central banks can adjust interest rates to stimulate economic activity and offset the negative effects of high oil prices.

- Energy Efficiency Measures:Governments can encourage energy efficiency measures, such as fuel-efficient vehicles and building insulation, to reduce demand for oil and mitigate the impact of price increases.

- Investment in Renewable Energy:Investing in renewable energy sources, such as solar and wind power, can help reduce reliance on oil and create new economic opportunities.

Economic Consequences of High Oil Prices in Different Regions

The economic consequences of high oil prices can vary significantly across different regions.

| Region | Economic Consequences |

|---|---|

| Developing Countries | Higher energy costs can exacerbate poverty, hinder economic development, and increase social unrest. |

| Developed Countries | High oil prices can lead to slower economic growth, inflation, and job losses, particularly in energy-intensive industries. |

| Oil-Exporting Countries | High oil prices can lead to increased government revenue, economic growth, and investment in infrastructure. |

Alternative Energy Sources

The recent surge in oil prices due to geopolitical tensions has highlighted the vulnerability of global economies to fossil fuel dependence. This has spurred renewed interest in alternative energy sources as a means to mitigate the impact of oil price volatility and transition towards a more sustainable energy future.

The Role of Alternative Energy Sources in Mitigating Oil Price Volatility

Alternative energy sources, such as solar, wind, hydro, and geothermal power, offer a significant opportunity to reduce reliance on fossil fuels and enhance energy security. These sources are less susceptible to geopolitical disruptions and price fluctuations that characterize the oil market.

By diversifying energy portfolios, countries can lessen their dependence on volatile oil prices and improve energy resilience.

The Potential of Renewable Energy Sources to Reduce Reliance on Fossil Fuels

Renewable energy sources have the potential to significantly reduce reliance on fossil fuels. For instance, solar energy is abundant and readily available in many parts of the world, while wind energy is a reliable source in areas with consistent wind patterns.

Hydropower, though geographically limited, provides a substantial source of clean energy. The continuous technological advancements in renewable energy technologies are further enhancing their efficiency and cost-effectiveness, making them increasingly competitive with fossil fuels.

Challenges and Opportunities Associated with Transitioning to a More Sustainable Energy Future

The transition to a more sustainable energy future presents both challenges and opportunities. One of the key challenges is the need for significant investments in infrastructure and technology to scale up renewable energy production. Additionally, integrating renewable energy sources into existing grids requires overcoming technical hurdles and ensuring grid stability.

However, the transition also presents numerous opportunities, including job creation in the renewable energy sector, reduced greenhouse gas emissions, and improved air quality.

Timeline of Key Developments in Alternative Energy Technologies

- Early 20th Century:The first hydroelectric power plants were built, marking the beginning of large-scale renewable energy utilization.

- 1970s:The oil crisis sparked renewed interest in alternative energy sources, leading to significant research and development in solar and wind energy technologies.

- 1990s:Advancements in photovoltaic technology made solar energy more efficient and cost-effective, leading to increased adoption.

- 2000s:Wind energy experienced rapid growth, driven by technological improvements and government incentives.

- Present:Continued technological advancements are making renewable energy sources increasingly competitive with fossil fuels, with a growing number of countries setting ambitious targets for renewable energy deployment.