Middle East Conflict Sends Shockwaves Through Global Markets

Middle East Conflict Sends Shockwaves Through Global Markets, a headline that echoes through newsrooms and trading floors alike. The region, long a crucible of geopolitical tension, has once again become a focal point of global concern, with its simmering conflicts threatening to spill over and disrupt the delicate balance of the international order.

The recent escalation in violence has sent tremors through financial markets, as investors grapple with the economic and political ramifications of a potential regional conflagration.

From oil prices to currency fluctuations, the impact of the Middle East conflict is being felt far and wide. The conflict has the potential to disrupt global trade, energy markets, and investment flows, creating a ripple effect that could reach every corner of the world.

The question on everyone’s mind is: will the conflict escalate, and if so, what will be the consequences for the global economy?

Geopolitical Impact

The Middle East conflict has a long and complex history, deeply intertwined with global power dynamics and market fluctuations. Its roots can be traced back to the early 20th century, when the region was carved up by European powers following the decline of the Ottoman Empire.

This historical context has led to ongoing tensions, resource disputes, and political instability, with significant ramifications for global markets.

Impact on Global Markets

The Middle East conflict has a significant impact on global markets, primarily through its influence on oil prices, trade routes, and investment flows. The region holds vast oil reserves, making it a crucial player in the global energy market. Any disruption to oil production or transportation can have a ripple effect on energy prices, impacting economies worldwide.

The Middle East conflict is sending shockwaves through global markets, causing uncertainty and volatility. Meanwhile, in a seemingly unrelated development, KKR announces acquisition of PayPal buy now pay later loans valued at nearly 44 billion , a deal that could have significant implications for the financial sector.

This move highlights the ongoing trend of investors seeking opportunities amidst global instability, even as the Middle East conflict continues to cast a long shadow over the global economy.

The conflict also affects trade routes, as it often disrupts shipping lanes and transportation networks, impacting global supply chains. Moreover, political instability and security concerns deter foreign investment, hindering economic growth and development in the region.

Potential for Escalation and Regional Stability

The potential for escalation in the Middle East conflict is a constant concern, as it can lead to wider regional instability and geopolitical tensions. The conflict often involves multiple actors with competing interests, making it difficult to find a lasting solution.

Escalation can take various forms, including military confrontations, political instability, and humanitarian crises. This can further disrupt global markets, impact energy supplies, and create security risks for neighboring countries.

Key Players and Their Interests

The Middle East conflict involves a complex web of actors, each with their own interests and objectives. Key players include:

- Israel:Seeking security and recognition, with a focus on maintaining control over disputed territories.

- Palestine:Striving for self-determination and independence, with a desire to establish a sovereign state.

- United States:Seeking to maintain regional stability and protect its allies, while also pursuing its own strategic interests.

- Russia:Seeking to expand its influence in the region, particularly in Syria and the Mediterranean.

- Iran:Seeking to counter US influence and promote its regional interests, including supporting allies like Hezbollah in Lebanon.

- Saudi Arabia:Seeking to maintain regional dominance and counter Iranian influence, while also promoting its own economic interests.

Influence on Geopolitical Alliances and Power Dynamics

The Middle East conflict has significantly influenced geopolitical alliances and power dynamics in the region and beyond. It has led to the formation of alliances and rivalries, shaping the global political landscape. The conflict has also contributed to the rise of regional powers, such as Iran and Turkey, who have sought to fill the power vacuum created by the decline of traditional powers.

The conflict has become a focal point for international diplomacy, with major powers often taking sides and seeking to influence the outcome.

Economic Consequences

The Middle East conflict’s potential economic repercussions are far-reaching, impacting global trade, energy markets, investment, and financial stability. Disruptions to supply chains, increased commodity prices, and financial market volatility are among the key concerns.

Impact on Global Commodity Prices

The conflict’s impact on global commodity prices, particularly oil and gas, is a significant concern. The Middle East is a major oil producer, and any disruptions to production or exports can lead to supply shortages and price increases. The region also plays a crucial role in global gas markets.

The potential for increased energy prices could have a ripple effect throughout the global economy, impacting inflation, consumer spending, and economic growth.

The Middle East conflict has sent shockwaves through global markets, impacting everything from energy prices to investment strategies. It’s a reminder that geopolitical instability can have far-reaching consequences, even influencing the blockchain world. For instance, the recent activity in gavin wood chain mergers and acquisitions suggests that even in the face of global uncertainty, the blockchain space continues to evolve and innovate.

Ultimately, the Middle East conflict’s impact on global markets is likely to be complex and long-lasting, prompting businesses and individuals alike to reassess their strategies and risk tolerances.

For example, during the 2008 global financial crisis, oil prices surged to over $140 per barrel, driven partly by geopolitical tensions in the Middle East.

Disruptions to Trade and Investment

The conflict could disrupt global trade routes and supply chains, particularly for goods transported through the region. This could lead to delays, increased transportation costs, and shortages of essential commodities. Moreover, the conflict’s uncertainty could deter foreign investment in the region, hindering economic growth and development.

The Middle East conflict has sent shockwaves through global markets, with oil prices soaring and investors seeking safe havens. But amidst the turmoil, a new study reveals a surprising trend: new research reveals the surprising no 1 city for remote jobs defying new york and san francisco , suggesting that even in times of crisis, some sectors are thriving.

As the geopolitical landscape shifts, the global economy continues to evolve in unpredictable ways, with both challenges and opportunities emerging.

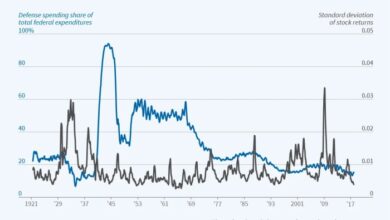

Financial Market Volatility and Currency Fluctuations

The conflict’s potential to destabilize financial markets is a major concern. Increased geopolitical risk can lead to investor flight, causing stock market declines and currency fluctuations. For instance, the 2011 Arab Spring uprisings triggered significant volatility in the stock markets of affected countries and the broader region.

The conflict could lead to a “risk-off” sentiment among investors, as they seek safer havens for their assets, potentially leading to capital outflows from the region.

Market Reactions

The Middle East conflict has sent shockwaves through global financial markets, triggering significant volatility and prompting investors to reassess their risk appetites. This section examines the specific reactions across various sectors and markets, analyzing how investors are navigating this turbulent landscape.

Impact on Global Stock Markets

The conflict’s impact on global stock markets has been swift and multifaceted. Major stock indices worldwide have experienced sharp fluctuations, with investors reacting to the escalating tensions and potential economic ramifications. For instance, the Dow Jones Industrial Average and the S&P 500 in the United States have shown significant volatility, reflecting concerns about the conflict’s potential to disrupt global energy supplies and trade.

Impact on Specific Industries

The conflict has had a profound impact on specific industries, particularly those closely linked to the region or dependent on global stability.

- Tourism:The tourism industry in the Middle East has suffered a significant blow, as travel advisories and security concerns discourage visitors. Destinations like Dubai, Abu Dhabi, and Istanbul have witnessed a sharp decline in tourist arrivals, impacting hotel bookings, airlines, and local businesses reliant on tourism revenue.

- Aviation:The conflict has led to disruptions in air travel, with airlines adjusting flight routes and schedules to avoid airspace deemed unsafe. This has resulted in increased operational costs and passenger inconvenience, impacting airlines’ profitability and overall travel demand.

- Shipping:The conflict has raised concerns about the safety of shipping lanes in the region, particularly through the Strait of Hormuz, a crucial waterway for oil and gas transportation. This has led to increased insurance premiums for vessels transiting the area, impacting shipping costs and potentially disrupting global supply chains.

Investor Portfolio Adjustments

In response to the conflict’s uncertainties, investors are adjusting their portfolios to mitigate potential risks.

- Risk-Off Sentiment:Investors are adopting a more risk-averse approach, shifting their investments away from volatile assets like stocks and towards safer havens like gold and US Treasury bonds. This trend is evident in the surge in gold prices, as investors seek to preserve capital during times of geopolitical uncertainty.

- Sector Rotation:Investors are actively rotating their portfolios, favoring sectors deemed less exposed to the conflict’s direct impact. This involves moving away from energy and defense-related sectors and towards sectors like consumer staples and healthcare, which are considered more resilient in uncertain times.

- Increased Volatility:The conflict has heightened market volatility, making it challenging for investors to predict future price movements. This has led to increased trading activity, as investors attempt to navigate the rapidly changing market conditions and capitalize on short-term opportunities.

Geopolitical Risk Premiums

The conflict has significantly increased geopolitical risk premiums in market valuations. This means that investors are demanding higher returns for holding assets exposed to the conflict’s uncertainties.

“Geopolitical risk premiums are the extra returns investors demand for holding assets that are exposed to geopolitical risks.”

The rise in geopolitical risk premiums reflects the market’s heightened awareness of the conflict’s potential to disrupt global economic activity, energy supplies, and financial markets.

Long-Term Implications: Middle East Conflict Sends Shockwaves Through Global Markets

The Middle East conflict, with its deep historical roots and complex geopolitical dynamics, has far-reaching implications that extend beyond the immediate region. The conflict’s potential to reshape global power dynamics, disrupt economic stability, and escalate tensions across the world demands careful consideration of its long-term consequences.

Potential Long-Term Economic and Political Consequences

The long-term economic and political consequences of the conflict are multifaceted and interconnected. The conflict can exacerbate existing economic challenges in the region, leading to further instability and hardship. Moreover, the conflict can also have a ripple effect on global markets and economies, impacting trade, investment, and energy prices.

| Economic Consequences | Political Consequences |

|---|---|

| Increased poverty and unemployment | Escalation of regional tensions and instability |

| Disruption of trade and investment | Heightened risk of regional conflicts and military interventions |

| Economic sanctions and financial instability | Increased political polarization and extremism |

| Rise in humanitarian crises and refugee flows | Weakening of regional institutions and governance |

Shifts in Global Power Dynamics and Regional Alliances

The conflict has the potential to reshape global power dynamics and regional alliances. As the conflict unfolds, existing alliances may be tested, and new alignments may emerge. The conflict could also lead to a realignment of regional power dynamics, as countries seek to secure their interests in the face of escalating tensions.

For example, the conflict could lead to a strengthening of alliances between countries that share common interests in the region, such as the United States and Israel, or between countries that are opposed to the conflict, such as Russia and Iran.

Impact on Global Security and Stability

The conflict poses a significant threat to global security and stability. The conflict could lead to an escalation of regional tensions, potentially spilling over into neighboring countries and regions. Moreover, the conflict could also create opportunities for terrorist organizations and other non-state actors to gain a foothold in the region, further destabilizing the area.

Increased Political and Economic Instability in the Region, Middle east conflict sends shockwaves through global markets

The conflict is likely to lead to increased political and economic instability in the region. The conflict can exacerbate existing social and political tensions, leading to protests, unrest, and even violence. The conflict can also disrupt economic activity, leading to job losses, poverty, and hardship.

The long-term consequences of the conflict could include a weakening of state institutions, a rise in corruption, and a decline in the rule of law.