Markets React as Investors Await Powells Speech, Asian Stocks Follow Wall Streets Lead

Markets react as investors await powells speech asian stocks follow wall streets lead – Markets React as Investors Await Powell’s Speech, Asian Stocks Follow Wall Street’s Lead – a headline that captures the current mood of global markets. With the Federal Reserve Chair Jerome Powell set to deliver a highly anticipated speech, investors are on edge, closely watching for any hints about the future direction of interest rates and monetary policy.

This speech holds significant weight, potentially shaping the trajectory of financial markets worldwide, and investors are particularly attuned to its implications for both the US and Asian economies.

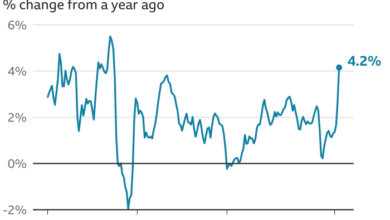

The global financial landscape is currently marked by a delicate balance of factors. Inflation remains a concern, but there are also signs of economic slowdown. This creates a complex environment where investors are trying to decipher the best course of action, making every word from Powell a valuable piece of the puzzle.

The interconnectedness of markets, particularly between the US and Asia, is further amplifying the impact of Powell’s speech. Asian markets have historically followed Wall Street’s lead, mirroring its movements, and this trend is likely to continue in the wake of Powell’s address.

Market Volatility and Investor Sentiment: Markets React As Investors Await Powells Speech Asian Stocks Follow Wall Streets Lead

Financial markets are in a state of flux, with investors closely watching the Federal Reserve’s upcoming interest rate decisions and the potential impact on economic growth. The upcoming speech by Federal Reserve Chair Jerome Powell is a key event for investors, as it could provide insights into the Fed’s future monetary policy stance and its impact on inflation and growth.

Investor Sentiment and Market Reactions

Investor sentiment plays a crucial role in shaping market reactions. When investors are optimistic about the economy and future prospects, they tend to buy stocks, driving prices higher. Conversely, when sentiment turns negative, investors may sell their holdings, leading to market declines.

Powell’s speech could significantly influence investor sentiment, depending on the tone and content of his remarks. If Powell signals a more hawkish stance on interest rates, investors might become concerned about the potential for slower economic growth, leading to a sell-off in stocks.

The markets are on edge, with investors anxiously awaiting Powell’s speech and Asian stocks mirroring Wall Street’s lead. This heightened anticipation is fueled by the upcoming Fed conference on interest rates, which will likely influence global market trends. For a deeper dive into how Asian markets are navigating this uncertain landscape, check out this insightful article on asian stock market trends amid anticipation of fed conference on interest rates.

Ultimately, Powell’s words will have a significant impact on investor sentiment, setting the tone for the coming weeks.

Conversely, a more dovish tone could boost investor confidence and lead to a rally in the market.

Key Factors Contributing to Market Volatility

Several factors contribute to market volatility, including:

- Economic Data:Economic indicators like inflation, unemployment, and GDP growth provide insights into the health of the economy and influence investor sentiment. Unexpectedly strong or weak data can trigger market reactions. For example, a higher-than-expected inflation reading could lead to concerns about aggressive interest rate hikes, causing stock prices to decline.

- Geopolitical Events:Global events, such as wars, political instability, and trade tensions, can create uncertainty and volatility in the markets. For example, the ongoing war in Ukraine has led to concerns about energy supplies and global economic growth, causing market fluctuations.

- Central Bank Policy:Central bank actions, such as interest rate decisions and quantitative easing programs, directly impact financial markets. When central banks raise interest rates, it can make borrowing more expensive for businesses and consumers, potentially slowing economic growth and leading to market declines.

Conversely, easing monetary policy can stimulate economic activity and support stock prices.

- Corporate Earnings:Company earnings reports provide insights into the financial health of businesses and their future prospects. Strong earnings can boost investor confidence and lead to stock price gains, while weak earnings can trigger sell-offs.

Powell’s Speech and its Implications

The markets are on edge, awaiting the highly anticipated speech by Federal Reserve Chair Jerome Powell. This address is expected to shed light on the Fed’s future monetary policy direction, particularly concerning interest rates and inflation. The speech’s implications could significantly impact investor sentiment and market movements in the coming weeks.

Markets are on edge as investors await Powell’s speech, with Asian stocks following Wall Street’s lead. Meanwhile, Warren Buffett’s Berkshire Hathaway has finalized the divestment of its TSMC holdings, as reported by The Venom Blog , adding another layer of uncertainty to the already volatile market.

Whether Powell’s speech will offer reassurance or further fuel market anxieties remains to be seen, but one thing is clear: investors are holding their breath.

Potential Content of Powell’s Speech

Powell’s speech is likely to address the current economic landscape, focusing on inflation, the labor market, and the Fed’s commitment to price stability. The Fed’s recent interest rate hikes, aimed at curbing inflation, have already had a noticeable impact on the economy.

- Powell might provide insights into the Fed’s assessment of inflation’s trajectory and its impact on the broader economy.

- He could also discuss the Fed’s outlook on the labor market, considering the recent slowdown in job growth and potential implications for future rate decisions.

- Powell’s speech is expected to provide clarity on the Fed’s intentions regarding future interest rate adjustments, whether a pause, a further increase, or a potential pivot towards a more accommodative stance.

Impact on Interest Rates and Monetary Policy

The market eagerly anticipates Powell’s stance on future interest rate movements. A hawkish tone, suggesting continued rate hikes, could send shockwaves through the markets, potentially leading to increased volatility and a decline in asset prices. Conversely, a more dovish stance, signaling a potential pause or even a rate cut, could boost investor confidence and trigger a rally in equities and other assets.

Influence on Investor Expectations and Market Direction

Powell’s statements will likely influence investor expectations regarding the Fed’s future actions. A hawkish tone could lead to a risk-off sentiment, as investors may become more cautious about investing in risky assets like stocks. Conversely, a dovish tone could foster a risk-on environment, encouraging investors to seek higher returns in equities and other assets.

The market’s reaction to Powell’s speech will be closely monitored, as it will provide valuable insights into the Fed’s future course of action and its potential impact on the global economy.

The markets are on edge as investors anxiously await Powell’s speech, with Asian stocks mirroring Wall Street’s cautious lead. Amidst this global uncertainty, it’s a good time to explore the potential of soft commodities trading, particularly in coffee, cocoa, cotton, and sugar.

These markets can offer diversification and potentially strong returns, even in volatile times. The global economy is a complex web, and understanding these diverse markets is crucial to navigating the current landscape.

Asian Markets Following Wall Street’s Lead

The global financial markets are interconnected, and the relationship between Asian and US markets is a prime example of this interdependence. Asian markets often mirror the performance of Wall Street, reflecting a strong correlation between these two regions. This phenomenon is driven by a complex interplay of factors, which we will explore in detail.

Factors Influencing the Correlation

The correlation between Asian and US markets is influenced by several key factors:

- Global Economic Sentiment:When the US economy performs well, it often translates into positive sentiment globally, boosting investor confidence in Asian markets. Conversely, negative news from the US can dampen investor appetite in Asia. For instance, during the 2008 financial crisis, the US market’s downturn had a significant ripple effect on Asian markets.

- Investor Flows:Institutional investors often allocate funds to various markets based on their perceived risk and return profiles. A positive outlook on the US market can lead to increased investment in Asian markets, as investors seek to diversify their portfolios. This flow of capital can drive up prices in Asian markets, creating a correlation with the US market.

- Currency Fluctuations:The US dollar is a dominant currency in global trade and finance. When the US dollar strengthens, it can make Asian currencies less competitive, potentially impacting exports and economic growth in the region. This, in turn, can influence investor sentiment and stock prices in Asian markets.

- Trade and Investment Ties:Asian economies are heavily reliant on trade with the US, both in terms of exports and imports. Strong US economic growth can stimulate demand for Asian goods, boosting their economies and stock markets. Conversely, any trade tensions or policy changes affecting US-Asia trade can impact Asian markets.

Impact on Global Markets

Powell’s speech, carrying significant weight in the global financial landscape, is likely to reverberate across various markets, influencing investment decisions and potentially reshaping market trends. The implications extend beyond the US, reaching global economies and asset classes, creating a domino effect that investors need to carefully navigate.

Potential Ripple Effects on Global Markets

The potential impact of Powell’s speech on global markets is multifaceted. Investors will be closely watching for any indication of the Fed’s future monetary policy direction, particularly regarding interest rate hikes and the pace of quantitative tightening.

- Currency Markets:A hawkish stance from Powell could strengthen the US dollar against other major currencies, as investors seek a safe haven. This could put pressure on emerging market currencies, potentially leading to capital outflows.

- Bond Markets:Rising interest rates could lead to a decline in bond prices, particularly for longer-term bonds. This could negatively impact bond yields, making fixed-income investments less attractive.

- Equity Markets:Depending on the tone of Powell’s speech, equity markets could react with volatility. A hawkish message could lead to a sell-off in stocks, while a more dovish stance might trigger a rally.

Impact on Different Sectors and Asset Classes

The effects of Powell’s speech are likely to vary across different sectors and asset classes.

- Growth Stocks:Growth stocks, often characterized by high valuations and future earnings potential, could be particularly vulnerable to rising interest rates. As the cost of borrowing increases, investors might favor value stocks, which tend to be more stable and less reliant on future growth.

- Technology Sector:The technology sector, known for its high growth potential and often associated with higher valuations, could be particularly sensitive to interest rate changes. A hawkish Fed could lead to a decline in technology stocks, as investors become more risk-averse.

- Commodities:Commodities, such as oil and gold, could also be affected. A strong US dollar could put downward pressure on commodity prices, while concerns about inflation might lead to a rise in gold prices as investors seek a safe haven.

Key Regions and Markets to Watch

Several key regions and markets are likely to be particularly sensitive to Powell’s speech.

- Emerging Markets:Emerging markets are often highly dependent on foreign capital flows. A hawkish Fed could lead to capital outflows from emerging markets, putting pressure on their currencies and economies.

- Eurozone:The Eurozone is facing its own economic challenges, including high inflation and energy dependence on Russia. Powell’s speech could have significant implications for the euro’s value and the Eurozone’s economic outlook.

- China:China’s economic growth is closely tied to global demand. A slowdown in the US economy could negatively impact Chinese exports and its overall growth prospects.

Investor Strategies and Considerations

Powell’s speech has injected a dose of uncertainty into the market, leaving investors to navigate a landscape of potential opportunities and risks. Understanding the implications of his comments and the broader economic context is crucial for making informed investment decisions.

Potential Investment Strategies

Investors can adopt a variety of strategies to navigate the current market environment. These strategies depend on individual risk tolerance, investment goals, and time horizon.

- Defensive Positioning:For investors seeking to minimize downside risk, a defensive strategy might involve increasing allocations to bonds, high-quality dividend-paying stocks, and defensive sectors like healthcare and consumer staples. This approach aims to preserve capital while generating a steady stream of income.

- Selective Stock Picking:Investors with a higher risk appetite might focus on identifying undervalued companies with strong fundamentals and growth potential. This strategy requires careful research and analysis to uncover opportunities in sectors that are expected to benefit from the economic environment.

- Tactical Asset Allocation:This strategy involves adjusting portfolio allocations based on market conditions. For example, investors might reduce equity exposure during periods of heightened uncertainty and increase it during periods of growth. This requires constant monitoring and adjustments to capitalize on market shifts.

Risks and Opportunities, Markets react as investors await powells speech asian stocks follow wall streets lead

The current market environment presents both risks and opportunities.

- Inflation:Persistent inflation remains a significant concern, potentially eroding returns and impacting corporate profitability. Investors should consider companies with pricing power and the ability to manage rising costs.

- Interest Rate Hikes:The Federal Reserve’s aggressive rate hikes could slow economic growth and impact corporate borrowing costs. Investors should monitor the pace of rate hikes and their potential impact on different sectors and companies.

- Geopolitical Uncertainty:The ongoing conflict in Ukraine and heightened geopolitical tensions create uncertainty and volatility in global markets. Investors should consider diversifying across different asset classes and geographies to mitigate geopolitical risks.

Navigating Market Uncertainty

Navigating market uncertainty requires a disciplined approach and a long-term perspective.

- Diversification:Diversifying across asset classes, sectors, and geographies helps reduce overall portfolio risk and mitigate the impact of any single event. This strategy is essential for managing market volatility and protecting capital.

- Long-Term Perspective:Short-term market fluctuations are inevitable. Focusing on long-term investment goals and avoiding emotional decision-making is crucial for success. Market downturns can present buying opportunities for long-term investors.

- Professional Guidance:Consulting with a financial advisor can provide valuable insights and guidance for navigating complex market conditions. Financial advisors can help investors develop a personalized investment strategy that aligns with their risk tolerance, financial goals, and time horizon.