S&P 500 Milestone: Market Volatility Persists

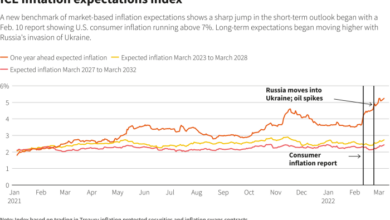

Market volatility persists as sp 500 approaches milestone – As market volatility persists as the S&P 500 approaches a milestone, investors are understandably on edge. The index has been on a tear in recent years, but the recent surge in inflation, rising interest rates, and geopolitical uncertainty have cast a shadow over the market’s future.

This volatility has many wondering if the S&P 500’s climb is sustainable, or if we’re headed for a correction.

This volatility is not unprecedented. Historically, the S&P 500 has often experienced turbulence around major milestones, as investors grapple with uncertainty about the future. In the coming weeks, we’ll delve into the factors driving this volatility, examine the potential impact on the S&P 500, and offer insights into how investors can navigate this challenging market environment.

Market Volatility and the S&P 500 Milestone

The stock market has been experiencing significant volatility in recent months, with the S&P 500 index approaching a major milestone. This volatility raises questions about the potential impact on the index’s performance and the overall market outlook.

The market’s roller coaster ride continues as the S&P 500 inches closer to a significant milestone, but amidst the volatility, some investors are looking ahead. A recent report suggests that ark invest anticipates tesla cybertruck to achieve mainstream success comparable to model y , which could provide a much-needed boost to Tesla’s stock and potentially influence the broader market.

Whether this prediction comes true remains to be seen, but it’s a reminder that even in turbulent times, innovation and future prospects can drive investor sentiment and shape the market’s direction.

Historical Examples of Market Volatility Near Significant Milestones

Market volatility often intensifies around significant milestones for the S&P 500. Historical examples demonstrate this pattern. For instance, during the 2000 dot-com bubble, the index reached an all-time high before experiencing a sharp correction. Similarly, in the lead-up to the 2008 financial crisis, the index experienced heightened volatility as it approached a new high.

These examples highlight the potential for market corrections near milestones, driven by factors such as investor sentiment, economic conditions, and geopolitical events.

Key Factors Contributing to Current Volatility

Several factors are contributing to the current market volatility.

- Inflation and Interest Rates:The Federal Reserve’s aggressive interest rate hikes to combat inflation have increased borrowing costs for businesses and consumers, leading to concerns about economic growth. This uncertainty contributes to market volatility.

- Geopolitical Tensions:The ongoing war in Ukraine and heightened tensions between the US and China have introduced geopolitical risks that investors are factoring into their decisions. This uncertainty further amplifies market volatility.

- Supply Chain Disruptions:Ongoing supply chain disruptions, stemming from the pandemic and geopolitical events, have led to higher prices and reduced production, impacting businesses and consumers. This uncertainty also contributes to market volatility.

Potential Scenarios for the S&P 500 in the Near Term

Given the current market volatility, there are multiple potential scenarios for the S&P 500 in the near term.

- Positive Scenario:If inflation starts to moderate, the Federal Reserve eases its monetary policy, and geopolitical tensions ease, the S&P 500 could continue its upward trend. This scenario would be supported by strong corporate earnings and a robust economy.

- Negative Scenario:If inflation remains stubbornly high, the Federal Reserve continues to raise interest rates, and geopolitical tensions escalate, the S&P 500 could experience a correction. This scenario would be driven by concerns about economic growth, corporate earnings, and investor sentiment.

Economic Indicators and Market Sentiment

The relationship between economic indicators and market volatility is complex and dynamic. Economic data releases can significantly impact investor sentiment, driving stock prices up or down. Understanding this interplay is crucial for navigating the often-unpredictable world of financial markets.

Recent Economic Data and Investor Sentiment

Recent economic data releases have provided mixed signals, influencing investor sentiment and market volatility. For example, strong employment numbers suggest a robust economy, boosting investor confidence. However, rising inflation figures, coupled with interest rate hikes, raise concerns about economic growth and potentially trigger market sell-offs.

This interplay of positive and negative economic data creates a volatile environment for investors.

Investor Sentiment and Market Direction

Investor sentiment plays a crucial role in shaping market direction. When sentiment is optimistic, investors are more likely to buy stocks, driving prices higher. Conversely, pessimistic sentiment can lead to selling pressure, pushing prices down. This dynamic is often amplified by herd behavior, where investors tend to follow the crowd, leading to further volatility.

Key Economic Indicators and Their Impact on the S&P 500, Market volatility persists as sp 500 approaches milestone

| Indicator | Potential Impact on S&P 500 |

|---|---|

| Gross Domestic Product (GDP) Growth | Strong GDP growth generally supports stock prices, as it indicates a healthy economy. Conversely, weak GDP growth can signal economic slowdown, leading to market decline. |

| Inflation Rate | High inflation erodes purchasing power and can lead to higher interest rates, which can negatively impact corporate earnings and stock prices. Conversely, low inflation is generally positive for stocks. |

| Unemployment Rate | Low unemployment suggests a strong economy, which is positive for stocks. Conversely, high unemployment can indicate economic weakness and potentially lead to market decline. |

| Consumer Confidence Index | High consumer confidence indicates a strong economy and willingness to spend, which can boost stock prices. Conversely, low consumer confidence suggests economic uncertainty and potentially lower spending, which can negatively impact stocks. |

| Interest Rates | Rising interest rates can increase borrowing costs for businesses and reduce corporate earnings, potentially leading to stock market decline. Conversely, low interest rates can encourage investment and economic growth, supporting stock prices. |

Investor Behavior and Market Psychology: Market Volatility Persists As Sp 500 Approaches Milestone

The way investors react to market fluctuations significantly influences the overall market trend. Understanding investor behavior and the psychological factors that drive their decisions is crucial for navigating market volatility.

The market’s rollercoaster ride continues as the S&P 500 inches closer to a major milestone, but there’s a glimmer of optimism from the east. The IMF has just predicted resilient economic growth for India in FY23 , which could provide a much-needed boost to global sentiment.

While the S&P 500’s journey remains uncertain, this positive news from India might just be the catalyst for a more stable market in the near future.

Common Psychological Biases

Psychological biases can lead investors to make irrational decisions, especially during periods of market uncertainty. These biases often stem from our innate desire to simplify complex information and maintain a sense of control.

The market’s recent volatility is a reminder that even with the S&P 500 approaching a milestone, nothing is guaranteed. While some see Bitcoin as a safe haven, others are looking to Ethereum for its unique features, like smart contracts and decentralized applications.

To understand why, it’s important to grasp the fundamental differences between the two cryptocurrencies, which you can explore further in this article: how ethereum is different from bitcoin. Ultimately, the future of the market remains uncertain, but understanding these distinctions can help investors navigate the ever-changing landscape.

- Confirmation Bias: This bias leads investors to seek out information that confirms their existing beliefs, even if it’s inaccurate or incomplete. This can cause them to ignore warning signs and hold onto investments longer than they should.

- Herding Behavior: This bias occurs when investors follow the actions of the crowd, often without conducting their own research. This can lead to market bubbles and crashes as investors blindly follow the herd, amplifying price movements.

- Loss Aversion: This bias describes our tendency to feel the pain of a loss more intensely than the pleasure of an equal gain. This can lead investors to hold onto losing investments longer than they should, hoping for a recovery, rather than cutting their losses and moving on.

- Overconfidence Bias: This bias causes investors to overestimate their ability to predict market movements, leading them to take on more risk than they can handle. This can lead to significant losses, especially during market downturns.

Strategic Considerations for Investors

Navigating market volatility requires a thoughtful approach that balances risk and reward. Investors need to consider their individual circumstances, investment goals, and risk tolerance to make informed decisions.

Risk Management Strategies

Effective risk management is crucial during periods of market uncertainty. Here are some strategies investors can employ:

- Diversify your portfolio: Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help reduce the impact of any single asset’s volatility. A diversified portfolio can mitigate losses by ensuring that not all your investments are affected by the same market fluctuations.

- Rebalance your portfolio regularly: Rebalancing involves adjusting your asset allocation to bring it back in line with your original target. This helps ensure that you don’t become overly exposed to any particular asset class. For example, if your stock holdings have significantly outperformed your bond holdings, you might consider selling some stocks and buying more bonds to rebalance your portfolio.

- Consider using stop-loss orders: Stop-loss orders are designed to limit potential losses on investments. When the price of a security falls to a predetermined level, the order automatically sells the security, preventing further losses. This strategy can be helpful for investors who are concerned about market downturns.

Potential Investment Opportunities

While market volatility can be daunting, it also presents opportunities for investors who are willing to take calculated risks. Some potential investment opportunities during periods of uncertainty include:

- Value stocks: These are stocks that are considered undervalued by the market. When the market is volatile, investors may overlook the long-term value of these companies, creating opportunities for those willing to take a longer-term perspective. A well-known example is Warren Buffett, who has often invested in value stocks during market downturns.

- Defensive sectors: These are industries that are less affected by economic downturns, such as healthcare, consumer staples, and utilities. During periods of uncertainty, investors may seek the relative stability of these sectors.

- Fixed income securities: Bonds, which offer a fixed rate of return, can provide a safe haven for investors during volatile markets. While bond yields may decline during periods of economic uncertainty, they can still offer a stable source of income.

Key Considerations for Investors

In the current market environment, investors should consider the following factors:

- Interest rate hikes: The Federal Reserve’s interest rate hikes are designed to combat inflation, but they can also impact stock valuations and make it more expensive for companies to borrow money. Investors need to consider how these hikes might affect their investments.

- Inflation: High inflation can erode the purchasing power of investments and make it more difficult for companies to maintain profitability. Investors need to be aware of the potential impact of inflation on their portfolios.

- Geopolitical risks: The ongoing conflict in Ukraine and other geopolitical tensions can create market volatility. Investors should be aware of these risks and their potential impact on their investments.

Impact on Different Sectors and Industries

Market volatility can have a significant impact on different sectors and industries, affecting their performance and growth prospects. Understanding how specific sectors are affected by market fluctuations is crucial for investors to make informed decisions.

Vulnerability and Resilience to Market Fluctuations

Market volatility can create both opportunities and risks for different sectors. Some sectors are more vulnerable to market downturns, while others tend to be more resilient.

- Vulnerable Sectors:Sectors like consumer discretionary, technology, and financials are often considered more vulnerable to market volatility. These sectors are typically cyclical, meaning their performance is closely tied to the overall economic cycle. During periods of economic uncertainty or recession, consumer spending tends to decline, impacting discretionary goods and services.

Similarly, technology companies may experience slower growth or even decline in revenue due to reduced investment in new technologies. Financial institutions can also be affected by market volatility, as it can lead to increased loan defaults and reduced profitability.

- Resilient Sectors:On the other hand, sectors like healthcare, utilities, and consumer staples are often considered more resilient to market fluctuations. These sectors provide essential goods and services that are less sensitive to economic downturns. For example, healthcare demand remains relatively stable regardless of economic conditions, while utilities are essential for daily life and continue to operate even during recessions.

Consumer staples, such as food and beverages, are also considered relatively resilient as they are essential goods that people continue to purchase even during difficult economic times.

Impact on Specific Industry Trends

Market volatility can influence industry trends in various ways.

- Increased Volatility in Technology:The technology sector has historically been associated with high growth and innovation. However, market volatility can lead to increased volatility in this sector. Investors may become more cautious about investing in technology companies during periods of uncertainty, leading to fluctuations in stock prices and valuations.

- Shifting Consumer Preferences:Market volatility can impact consumer preferences and spending habits. For example, during economic downturns, consumers may shift towards more value-oriented products and services. This can benefit sectors like discount retailers and budget airlines, while potentially impacting luxury goods and premium brands.

- Accelerated Digital Transformation:Market volatility can accelerate digital transformation across industries. Companies may seek to reduce costs and increase efficiency by adopting new technologies and digital solutions. This trend can benefit technology companies that provide cloud computing, data analytics, and other digital services.

Sector Performance During Market Volatility

The following table provides a simplified comparison of how different sectors may perform during periods of market volatility. This is a general overview and actual performance may vary based on specific market conditions and individual company characteristics.

| Sector | Performance During Market Volatility | Example |

|---|---|---|

| Consumer Discretionary | May experience significant decline due to reduced consumer spending. | Automobiles, restaurants, travel |

| Technology | Can be volatile, with some companies benefiting from increased digital adoption while others face challenges. | Software, hardware, e-commerce |

| Financials | May be impacted by increased loan defaults and reduced profitability. | Banks, insurance companies, investment firms |

| Healthcare | Tends to be more resilient due to consistent demand for essential healthcare services. | Pharmaceuticals, medical devices, hospitals |

| Utilities | Often considered a safe haven during market volatility as they provide essential services. | Electricity, gas, water |

| Consumer Staples | Relatively resilient as consumers continue to purchase essential goods. | Food, beverages, personal care products |

Global Economic Factors and Market Outlook

The S&P 500, a benchmark index for the U.S. stock market, is intricately linked to global economic conditions. Understanding these connections is crucial for investors seeking to navigate market volatility and make informed decisions.

Global Economic Indicators and Market Volatility

Global economic indicators, such as GDP growth, inflation, and interest rates, exert significant influence on the S&P 500. For example, a robust global economy often translates into increased corporate earnings, boosting investor confidence and driving stock prices higher. Conversely, economic downturns can lead to reduced corporate profits, investor pessimism, and market declines.